Who Will Influence the World’s Most Important Interest Rate? Betts “Takes Power” from Powell

TechFlow Selected TechFlow Selected

Who Will Influence the World’s Most Important Interest Rate? Betts “Takes Power” from Powell

The U.S. Treasury's preference for increasing short-term bond issuance is materially undermining the independence of the Federal Reserve.

Author: Bao Yilong, Wall Street Insights

The U.S. Treasury's growing preference for issuing short-term debt is materially undermining the Federal Reserve's independence, potentially shifting monetary policy authority in practice to the fiscal authorities.

This week, Treasury Secretary Bessent clearly expressed a preference for relying more on short-term debt financing—a stance that contrasts with his earlier criticism of the previous administration’s overreliance on short-term Treasuries. This strategy effectively functions as a fiscal version of quantitative easing.

In the short term, the Treasury’s pivot toward issuing more short-term Treasury securities will further inflate risk asset prices beyond their long-term fair value and structurally push inflation higher.

More profoundly, this shift severely constrains the Fed’s ability to freely implement anti-inflationary monetary policies, paving the way for fiscal dominance. The central bank’s actual independence has eroded in recent years, and the surge in short-term debt issuance will further deprive the Fed of space to conduct independent monetary policy.

Why Short-Term Debt Fuels Inflation

In the coming years, rising inflation appears unavoidable, and the U.S. Treasury’s decision to increase short-term debt issuance is likely to become a structural driver of higher inflation.

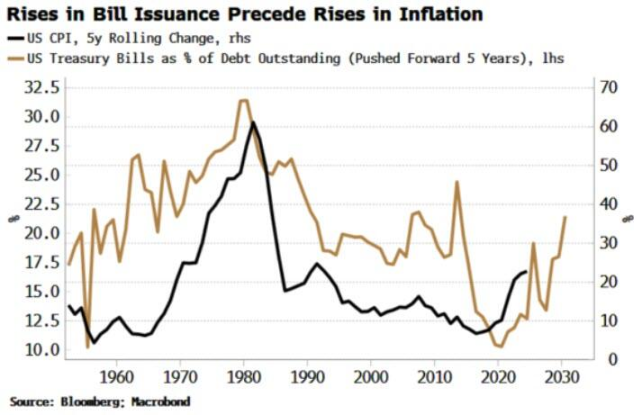

Treasury bills, as debt instruments with maturities under one year, are more "monetary" in nature than long-term bonds. Historical data shows that changes in the share of T-bills in total outstanding debt often precede long-term movements in inflation—suggesting a causal relationship rather than mere correlation.

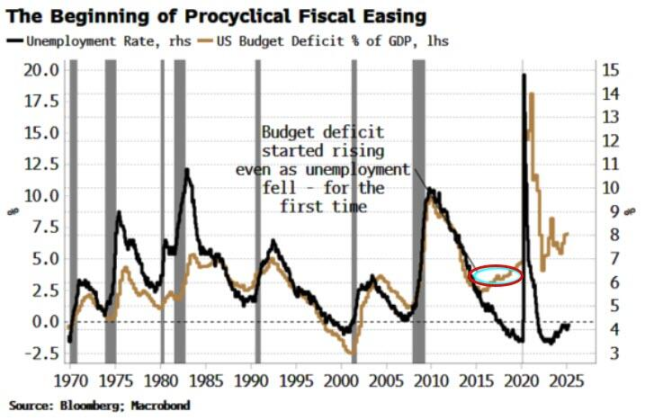

The early signs of the current inflation cycle emerged in the mid-2010s with a rebound in T-bill issuance, coinciding with the first pro-cyclical expansion of the U.S. fiscal deficit.

In addition, the explosive growth of the repo market in recent years has amplified the impact of short-term debt. Thanks to improved clearing mechanisms and deeper liquidity, repo transactions themselves have become more money-like.

Treasury bills typically receive zero haircuts in repo transactions, enabling higher leverage. These repo-activated government bonds are no longer dormant assets on balance sheets but are transformed into "quasi-money" capable of inflating asset prices.

Moreover, different debt issuance strategies have sharply divergent impacts on market liquidity.

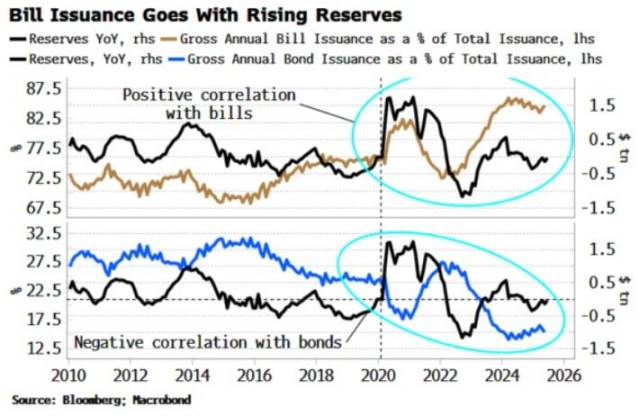

A clear example is that when annual net bond issuance is disproportionately high relative to the fiscal deficit, equities tend to suffer. The 2022 stock market bear run exemplified this. In response, then-Treasury Secretary Yellen released a large volume of Treasury bills in 2023. This move successfully prompted money market funds to use the Fed’s reverse repo facility (RRP) to purchase these short-dated securities, injecting liquidity into the financial system and helping drive an equity market recovery.

Observations also show that short-term Treasury issuance is typically positively correlated with growth in Federal Reserve reserves—especially since the pandemic—while long-term bond issuance tends to be negatively correlated with reserve levels. In simple terms, issuing more long-term debt drains liquidity, whereas issuing more short-term debt adds liquidity.

Short-term debt provides a “sweet stimulus” to markets, but when equities are already at record highs, investor positioning is crowded, and valuations are stretched, the effectiveness of such stimulus may prove unsustainable.

The Age of Fiscal Dominance Arrives: The Fed Is Trapped

For the Federal Reserve, the combination of irrational asset price exuberance, elevated consumer inflation, and a large volume of outstanding short-term debt creates a thorny policy dilemma.

Conventionally, the central bank would respond by tightening monetary policy.

However, in an economy piled high with short-term debt, rate hikes would almost immediately translate into fiscal tightening, as the government’s borrowing costs would spike accordingly.

Under such circumstances, both the Fed and the Treasury would face intense pressure to ease policy to offset the impact. Either way, inflation ultimately wins.

As outstanding short-term Treasury balances climb, the Fed will become increasingly constrained in its ability to raise rates, gradually losing the capacity to fulfill its full mandate. Instead, the government’s massive deficits and issuance plans will de facto dominate monetary policy, ushering in an era of fiscal dominance.

The monetary policy independence that markets have grown accustomed to will be significantly diminished—and this is even before the next Fed chair takes office, who is likely to hold an ultra-dovish stance aligned with the White House.

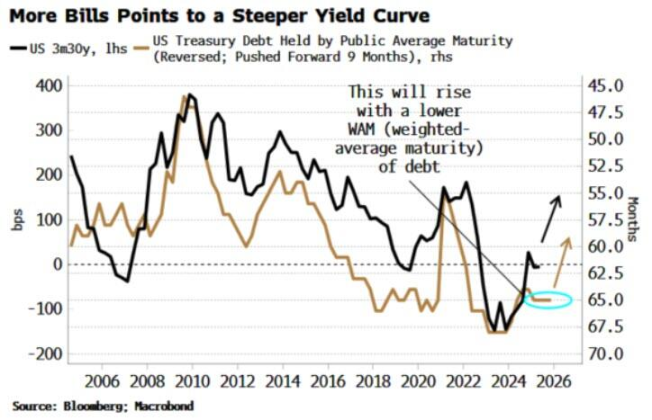

Notably, this shift will have profound long-term implications for markets. First, the U.S. dollar will become the main casualty. Second, as the average maturity of government debt shortens, the yield curve will steepen, meaning long-term financing costs will become more expensive.

The likelihood of reviving policy tools such as quantitative easing, yield curve control (YCC), and financial repression to artificially suppress long-term yields will rise substantially. Ultimately, this could mark a “victory” for the Treasury.

If inflation runs high enough, and if the government manages to bring its primary budget deficit under control, the debt-to-GDP ratio could indeed decline. But for the Federal Reserve, this would be a painful loss—the hard-won independence it has maintained would be severely compromised.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News