After Spark, Sky Bets on Grove—A New RWA Contender Emerges?

TechFlow Selected TechFlow Selected

After Spark, Sky Bets on Grove—A New RWA Contender Emerges?

Will Grove's $1 billion investment from Sky bring a wealth effect similar to Spark?

By Alex Liu, Foresight News

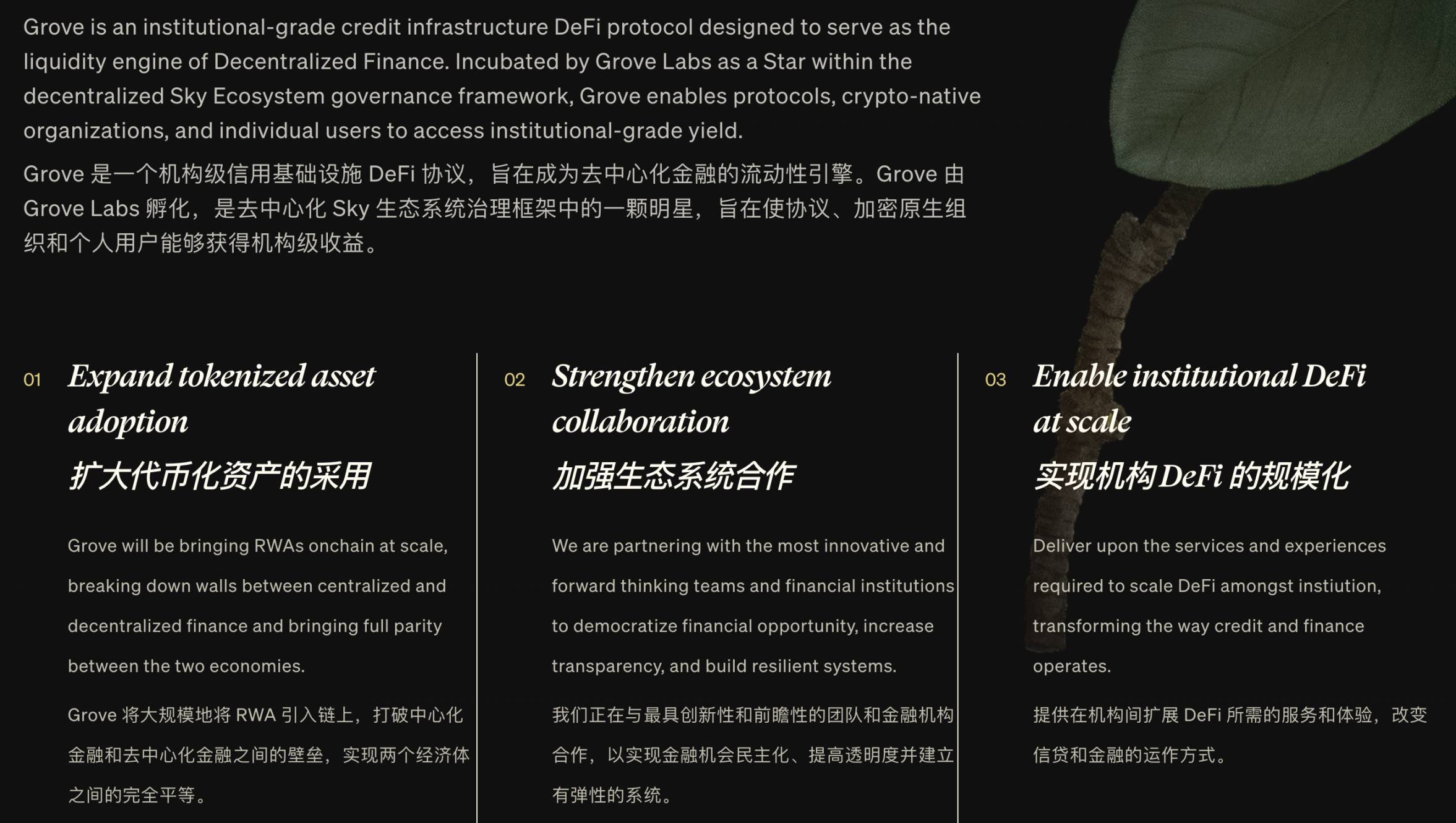

Sky Ecosystem (formerly MakerDAO) launched a new decentralized finance protocol, Grove Finance, on June 25, backed by an initial $1 billion funding commitment from the Sky Ecosystem to drive investment in tokenized credit assets—primarily collateralized loan obligations (CLOs).

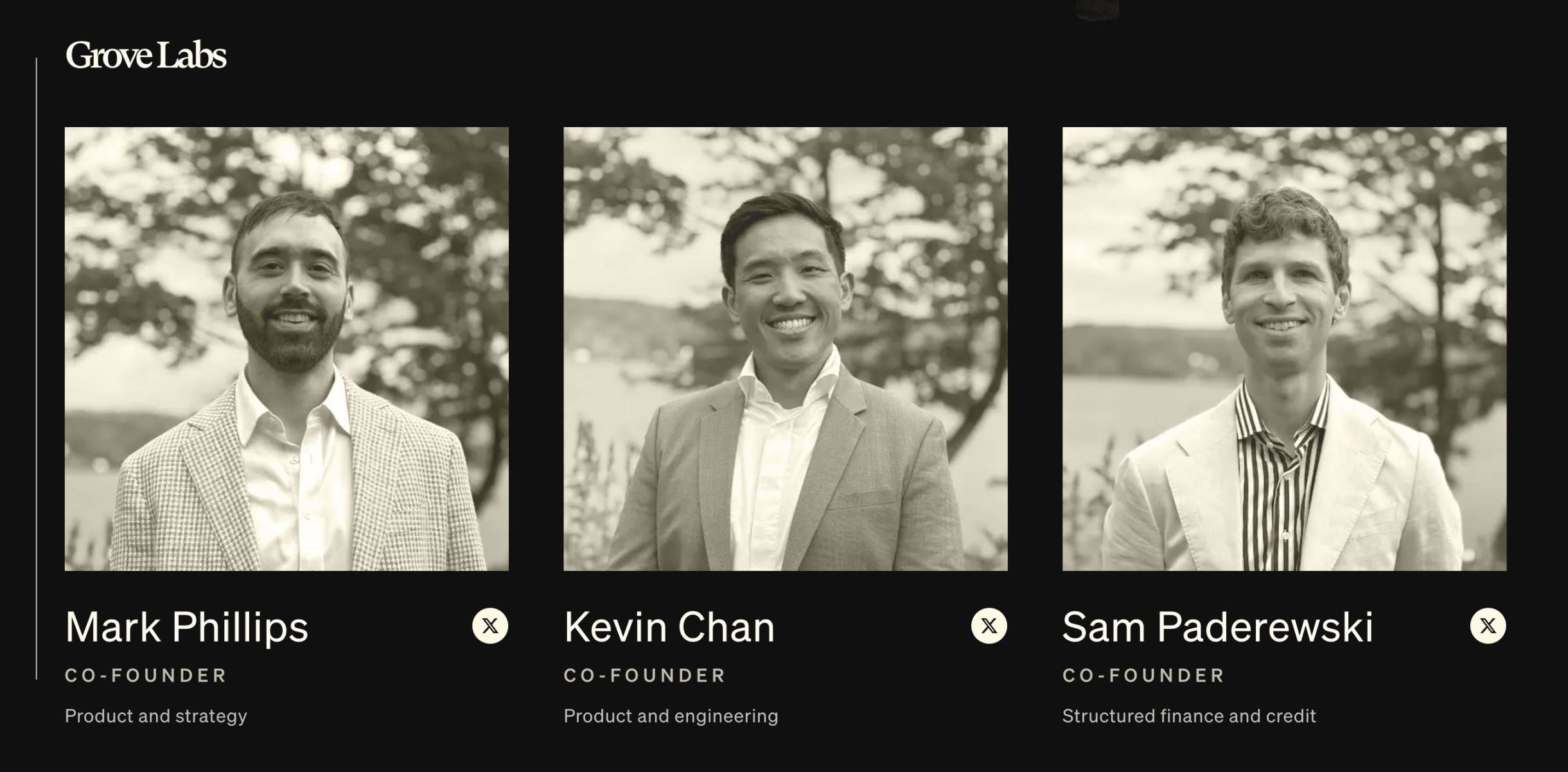

Grove was incubated by Grove Labs, part of blockchain firm Steakhouse Financial, with co-founders including Mark Phillips, Kevin Chan, and Sam Paderewski. The core team brings extensive experience from both traditional finance and DeFi, having previously worked at institutions such as Deloitte, Citigroup, BlockTower, and Hildene.

Steakhouse Financial previously played a key role in bringing real-world assets (RWA) into the Sky ecosystem, making Grove’s debut another significant step toward connecting traditional credit markets with DeFi.

Product Positioning and Technical Architecture of Grove

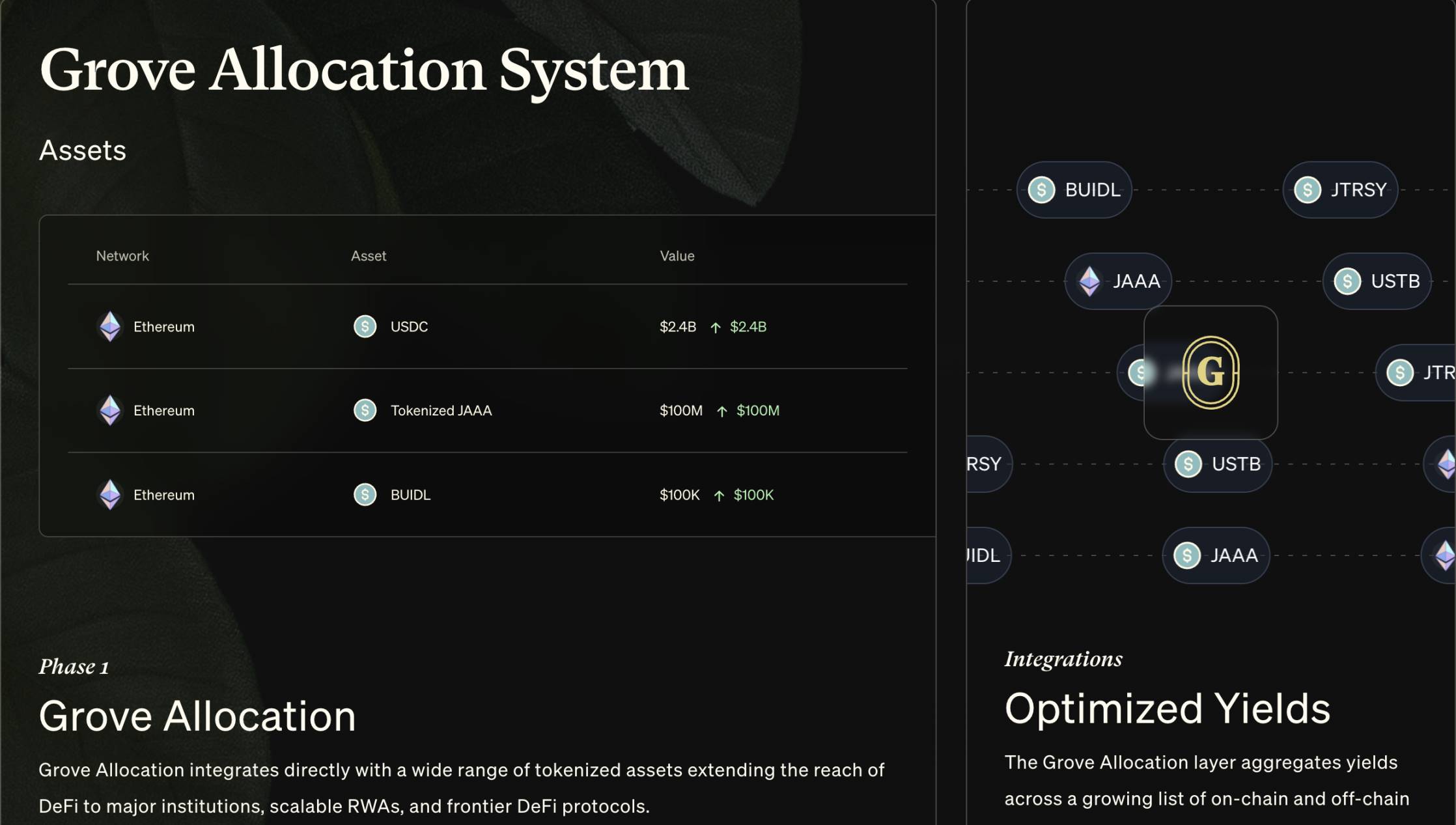

Grove aims to build "institutional-grade credit infrastructure," functionally bridging decentralized finance with regulated traditional credit markets. The protocol enables DeFi projects and asset management firms to route idle capital via on-chain governance into compliant credit products—initially focusing on AAA-rated CLO strategies—to generate returns decoupled from crypto market volatility.

It is reported that the Sky Ecosystem has deployed its initial capital into the Anemoy AAA-rated CLO strategy fund (JAAA), managed by Janus Henderson (Abrdn) and launched in partnership with the Centrifuge platform. This marks the first AAA-rated CLO strategy available for on-chain trading.

Operating as open-source and non-custodial, Grove seeks to establish a "DeFi–Traditional Finance capital channel," enhancing capital efficiency and reducing transaction friction while offering programmable and diversified capital allocation capabilities for asset managers and DeFi protocols. According to official materials, Grove can create new global distribution channels for asset management firms, provide high-end on-chain capital partnerships for protocols/DAOs, and enhance credibility and sustainability across the broader DeFi ecosystem.

In short, Grove's technical architecture centers on on-chain governance and automated capital routing, transforming stablecoins or other idle capital held by crypto protocols into investments in institutional-grade credit assets—optimizing returns and risk profiles.

Comparing Grove and Spark

Both Grove and the Spark protocol are autonomous sub-units (subDAOs, also known as "Stars") under MakerDAO (Sky)'s "Endgame" initiative, yet they differ significantly in positioning and mechanism.

Launched in 2023, Spark was the first Star within the Sky ecosystem and serves as a "stablecoin + RWAs" yield engine. Leveraging DAI/USDS stablecoin reserves issued by Sky, Spark introduced products such as SparkLend, Spark Savings, and the Spark Liquidity Layer (SLL). Users can deposit USDS, USDC, or DAI to participate in lending or yield farming, with funds allocated across DeFi lending, CeFi lending, and tokenized Treasury bills via a dynamic risk engine—generating relatively stable returns.

Deployed across multiple chains, Spark currently manages over $3.5 billion in stablecoin liquidity and has launched its native governance token SPK (distributed via community airdrop). Users earn additional rewards through staking SPK, participating in governance, and engaging in community incentives (Community Boost). Emphasizing transparency and auditability, Spark targets returns slightly above U.S. Treasury yields, catering to risk-adjusted return demands.

In contrast, Grove focuses more narrowly on large-scale institutional credit. Its initial $1 billion deployment into Abrdn’s AAA-rated CLO fund indicates that Grove targets users with larger capital pools and higher requirements for return stability—such as asset management firms and DeFi protocols. Grove has just gone live, and launching a governance token is premature at this stage. Its incentive model primarily lies in enabling DeFi projects to "activate idle reserves and earn returns from higher-quality assets."

In simple terms, Spark serves as a yield product within the Sky ecosystem targeting ordinary stablecoin holders, whereas Grove functions as infrastructure designed to build on-chain credit channels for large projects and institutions. Both are integral components of Sky’s "Endgame" strategy, aiming to bring real-world assets on-chain: Spark enhances stablecoin yields through Treasuries and other RWAs, while Grove diversifies DeFi asset portfolios through secured loans and other credit assets.

Thus, Grove represents a strategic move in the RWA space—specifically completing the institutional credit puzzle beyond what Spark offers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News