From "Standard Feature" to "Burden": The Foundation Model is Heading into Its Twilight

TechFlow Selected TechFlow Selected

From "Standard Feature" to "Burden": The Foundation Model is Heading into Its Twilight

The practical difficulties of this idealized structure are gradually emerging, and the foundation's halo is rapidly fading.

By Fairy, ChainCatcher

Eleven years ago, the Ethereum Foundation was registered in Switzerland, setting an early governance paradigm for crypto projects. In today’s era of “proliferation of chains,” foundations have become a standard feature for Layer 1 projects—decentralized, non-profit, community-serving—labels once hailed as the "gold standard" of blockchain governance.

However, a recent article by a16z titled *The End of the Crypto Foundation Era* has reignited scrutiny around foundations. The real-world challenges of this idealized structure are becoming increasingly apparent, and the foundation's luster is rapidly fading.

When Ideal Meets Reality: Cases of Foundation Governance Gone Awry

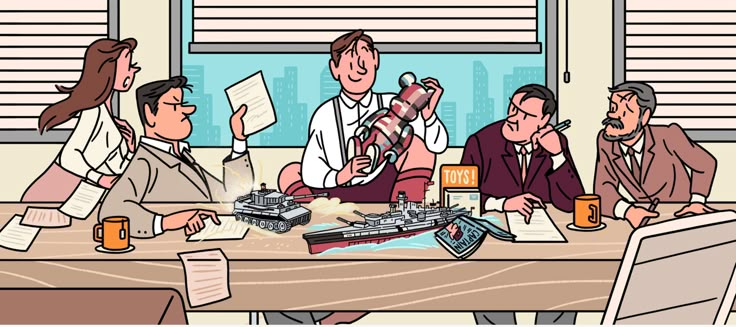

The ideal foundation carries strong moral overtones, seen as an essential bridge between a project’s early stage and self-governance. Yet as many projects mature and scale, this mechanism is showing structural fatigue. Internal conflicts, misallocated resources, weakening community engagement—more and more project foundations are experiencing governance imbalances, widening the gap between idealism and reality.

The Arbitrum Foundation transferred large amounts of ARB tokens without DAO approval, triggering strong community backlash; it later cited poor communication as the reason. The Kujira Foundation leveraged KUJI tokens in margin trading, leading to cascading liquidations and a sharp price drop, ultimately handing treasury control over to the DAO. The Ethereum Foundation has repeatedly faced criticism for selling ETH at high prices, inefficiency, and inaction—though it has recently begun reforms, skepticism persists.

In terms of power structures, the early Tezos project was mired in prolonged infighting between its foundation and founding team, delaying token issuance and sparking investor lawsuits. A similar situation occurred with the Cardano Foundation, which has been accused of marginalizing founder Charles Hoskinson and failing to act decisively on key matters like on-chain governance and charter drafting.

It is evident that some current foundations face issues including opaque governance processes, ambiguous power structures, weak fund management and risk controls, and inadequate community participation and feedback mechanisms. Amid increasingly accommodating regulations and rapid industry evolution, should the role and governance model of foundations be re-evaluated and upgraded?

Invisible Interest Networks and the Fate of Tokens

In actual crypto operations, a structural model has gradually emerged: foundations handle governance coordination, fund management, and ecosystem grants, while technical development is typically managed by independent Labs or dev companies. However, behind this division lies a growing complexity of intertwined interests.

According to crypto influencer "Crypto Fearless," in North American projects such as Movement, a professional "foundation architecture export group" composed of lawyers and traditional compliance consultants has formed. They offer standardized "Labs + Foundation" templates, helping projects launch compliant tokens, design governance frameworks, and deeply participate in critical decisions such as airdrop rules, ecosystem fund allocations, and market-making partnerships.

Yet these board members are often not native to the projects—they hold prominent foundation roles for six-figure annual salaries—exercising substantial "compliance veto power" and influencing key resource flows despite minimal involvement in product development.

We compiled a list of major public chain projects with active and highly involved foundations over the past year, analyzing their token performance over the last three months and one year:

Overall, most foundation-led project tokens have declined to varying degrees over the past three months, with weak annual performance as well. That said, this trend also reflects broader bearish altcoin market conditions.

According to "Crypto Fearless," two top-200 market cap projects plan to dissolve their foundation structures in the second half of this year, merging directly into their Labs. As two dominant organizational models in crypto, foundations emphasize non-profit operation, decentralization, and ecosystem governance, while corporate structures prioritize efficiency and growth, focusing on business expansion and market valuation.

Meanwhile, a16z argues in its article that development company models can more precisely mobilize resources, attract talent, and respond quickly to change. With the rising trend of U.S. stock listings and tighter crypto-traditional market linkages, company-led governance appears increasingly advantageous.

So—is the exit of some foundations already entering countdown mode?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News