Web3 Project Foundation Myth: Essential Token Launch Guide for Founders

TechFlow Selected TechFlow Selected

Web3 Project Foundation Myth: Essential Token Launch Guide for Founders

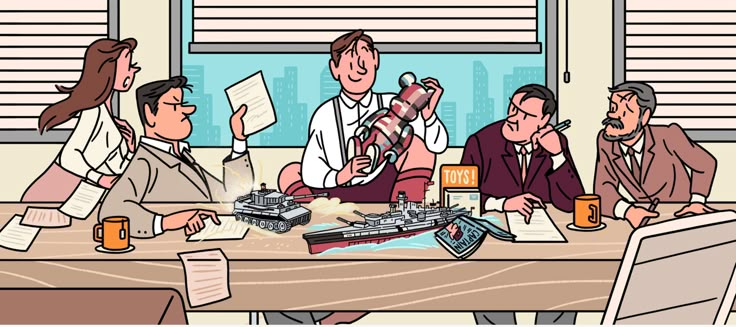

In the crypto world, a "foundation" is one of the most misunderstood and expensive products founders can purchase.

Author: wassielawyer

Translation: TechFlow

Foundations for Web3 Projects: What They Are, What They Aren’t, and Why You’d Use One

In the world of crypto, “foundations” are among the most misunderstood—and often most expensive—products founders buy. It often feels like most lawyers don’t fully understand them either.

First, why do foundations exist in Web3? What problem are we actually solving by setting one up?

The primary reason for establishing a foundation is to address the issue of token issuance. But to understand why that’s a problem, we first need a brief overview of how most Web3 projects are structured.

Currently, most Web3 projects typically incorporate what’s called a "LabsCo" or "DevCo" (development company) in jurisdictions like Delaware or Singapore.

These jurisdictions are well-suited for operating companies that develop technology. They offer Y-Combinator-style SAFE (Simple Agreement for Future Equity), accessible banking, efficient corporate services, strong legal infrastructure, and more.

Founders of Web3 projects usually become shareholders of this DevCo and raise funds via SAFEs (we can discuss SAFTs separately).

However, there’s one thing you absolutely cannot do: issue tokens from Delaware or Singapore. Issuing tokens from the U.S. is essentially impossible, and Singapore’s virtual asset laws are not particularly friendly toward token issuance.

Generally speaking, you shouldn't commit regulatory offenses on your home turf.

This presents a challenge for Web3 projects because their business model is essentially:

(a) Raise funds to develop technology (or host events),

(b) Spend those funds over several years, and ultimately

(c) Launch a token so investors can exit and the team can monetize.

Your development company rarely generates significant revenue—let alone profits—before launching a token.

Therefore, issuing a token is essential. So how do you do it without breaking securities laws or triggering tax issues? This is where the “foundation” structure comes in. It's designed as an offshore vehicle for token issuance and governance, theoretically shifting liability away from the founders.

The two most common forms are:

(a) Panama Foundation plus corporation, and

(b) Cayman Islands and British Virgin Islands (BVI) structures. The logic behind these is:

Issuing tokens directly from the DevCo isn’t appropriate because the founders are embedded within the DevCo. We need a separate entity—unconnected to the DevCo—to issue tokens.

Ideally, this token-issuing entity should be located in a jurisdiction that (a) permits token issuance, (b) is legally independent from the DevCo, and (c) has no direct link to the founders.

Panama and BVI are chosen because Panama lacks specific virtual asset regulations, while BVI’s laws are favorable toward token issuance.

This addresses point (a).

Solving (b)—ensuring independence from the DevCo—is manageable, though some lawyers still get this wrong. The key is to avoid issuing tokens from the DevCo or allowing the DevCo to control the token-issuing entity.

Point (c)—breaking ties with the founders—is where many lawyers make critical mistakes.

If the DevCo doesn’t own the token issuer, who does? This is where the concept of a “foundation” comes into play. A foundation is seen as a non-owned entity, making it ideal for holding the token-issuing structure.

Sounds great—just set up a non-owned foundation and you’re done, right? If only it were that simple.

Enter the concept of UBOs—Ultimate Beneficial Owners. UBOs refer to the natural persons who ultimately own the assets of a legal structure, or who exercise ultimate control when no clear owner exists.

UBOs matter because they may (a) influence the tax treatment of the structure or be taxed personally based on its activities, (b) bear personal liability for certain actions of the structure, (c) subject the structure to a particular country’s jurisdiction, and (d) must be disclosed to certain national registries and/or commercial partners (such as exchanges, banks, financial institutions) as part of KYC/AML (Know Your Customer / Anti-Money Laundering) procedures.

In a typical corporate structure, UBOs are usually shareholders.

When the company profits, they benefit both through equity appreciation and indirect control via shareholder rights—such as appointing or removing directors.

This is relatively straightforward.

But how does this work for a so-called “non-owned” foundation?

Let’s examine two common foundation models.

The Panamanian Private Interest Foundation (PIF) is a structure originally used for estate planning, now repurposed as a low-cost token issuance vehicle for Web3 projects. It is governed by a three-member foundation council, typically composed of randomly selected Panamanian nominees—sometimes including founders. Control lies with beneficiaries or enforcers who hold the assets, and these roles are often filled by the founders themselves.

In a PIF structure, the Ultimate Beneficial Owners (UBOs) are likely the beneficiaries or enforcers, since they have authority over the assets. In nearly every Panamanian structure I’ve seen, the UBOs are the founders themselves. Sometimes—interestingly—the founders even retain ownership of all DAO assets.

Next, the Cayman Foundation Company. A Cayman Foundation Company is established for a specific purpose and managed by at least one director. For Web3 projects, the stated purpose is typically “to support the growth and development of the XYZ ecosystem.” In the absence of members or shareholders, the power to appoint or remove directors rests with a “supervisor,” whose role is to ensure the directors act in accordance with the foundation’s objectives.

Legally, distributions of assets or income to directors or supervisors are prohibited. As a result, the UBO of a Cayman Foundation Company is typically the supervisor. Due to these restrictions, the supervisor is often a corporate service provider charging $5,000–$10,000 annually for this role.

It’s generally not advisable for founders to serve as directors or supervisors of the Cayman Foundation. For added robustness, Cayman Foundations are often paired with BVI companies, given BVI’s more favorable token issuance laws.

In any case, your main goal should be ensuring that the founders are not considered the Ultimate Beneficial Owners (UBOs). The Cayman model generally makes this easier to achieve, thanks to professional directors and third-party supervisors willing to assume managerial and UBO-related risks.

Panama structures often rely on nominee arrangements, which don’t fully resolve UBO concerns. Simply listing someone else as a member or enforcer doesn’t mean you’re not the UBO—especially if you retain de facto control through service agreements or other arrangements.

In other words, Panama structures often depend on opacity. They work because it’s hard to identify who’s behind them—but once discovered, that person will be treated as the UBO.

That said, Cayman structures aren’t perfect either. For them to work effectively, you need genuinely independent directors and actual third-party supervisors—not just figureheads. You can’t just appoint a friend and expect it to hold up under scrutiny.

So how do founders “control” the foundation? Does this mean directors can act arbitrarily?

Not at all. Directors must act within the foundation’s stated purpose (and its charter, if applicable). They cannot distribute assets to themselves, mitigating rug-pull risks.

Since founders are usually the ones most familiar with the project, directors can consult with them and accept recommendations or other advisory input. As long as such advice is reasonable, there’s little reason for directors to reject it.

This doesn’t mean Cayman structures are always superior to Panama ones—“superior” depends on context. Sometimes, due to virtual asset regulations, Panama is still used even alongside Cayman structures (another topic altogether). Often, founders choose Panama simply due to lower costs.

Properly executed, the cost is substantial. While perhaps not as high as you might think, running a proper Cayman-BVI structure with a professional director typically requires a budget of at least $50,000–$70,000. By contrast, setting up a Panama structure costs around $10,000–$15,000, sometimes even less.

Thus, some founders prioritize cost and accept temporary obscurity as a trade-off.

Another major misconception concerns timing—when to establish such a structure.

Ideally, it should be set up before your Token Generation Event (TGE). Although lawyers may try to sell you on this early, you shouldn’t establish a foundation during seed fundraising.

As a founder, your priority should be building the actual product—not spending heavily on legal structures. Only when you’ve made real progress and plan to launch within three months should you seriously consider setting up a foundation. I could go deeper (and I want to), but I realize this is already one of my longest threads, and covering everything thoroughly would take a full article—or over 100 tweets.

If you’ve read this far, the key takeaway is this: foundation structures primarily aim to solve the Ultimate Beneficial Owner (UBO) problem. You don’t want the founders to be viewed as UBOs.

But if avoiding UBO status seems too costly, you might decide it’s acceptable—as long as no one finds out or cares.

Still, ensure your lawyer clearly explains how the structure works so you can properly assess the risks. Also, remember this decision usually needs to be made before TGE—not during initial fundraising (though SAFTs deserve their own discussion). That’s all for now.

I’m sure I’ll get plenty of DMs, but if you’d like to discuss anything, feel free to reach out to @Vigil_eth to schedule a chat.

This is not legal or financial advice—just for entertainment and informational purposes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News