From Whale to Ant: How Did James Wynn, the On-Chain Contract Legend, Fall?

TechFlow Selected TechFlow Selected

From Whale to Ant: How Did James Wynn, the On-Chain Contract Legend, Fall?

A one-month, $1 billion "crypto public class."

Original by Wenser, Odaily Planet Daily

No one expected that within just two weeks, James Wynn—the so-called "legendary trader" and crypto whale who once opened positions worth billions of dollars—would end up completely bankrupt, reduced to placing "ant-sized" trades worth only a few hundred dollars. Previously, he published a long self-confession detailing how he went from "earning $100 million" to losing everything, using his own story as a cautionary tale to reveal the terrifying power of greed.

This article by Odaily Planet Daily will analyze James Wynn’s recent activities and public statements, digging deep into his story and exploring the lingering questions surrounding whether “James Wynn is actually a white glove for the Hyperliquid platform.”

Outsmarting Himself with Greed, Only to Lose His “On-Chain Life”

In the early hours of June 6, James Wynn's long position was liquidated again, resulting in a loss of 155.38 BTC—approximately $16.14 million at market value. On-chain data shows this liquidation occurred during a sharp drop in the BTC-USDT contract price, with the liquidation price around $103,981. This forced liquidation may have been triggered by short-term market volatility.

Perhaps this final blow was truly the "straw that broke the camel’s back." That morning, James Wynn released a lengthy personal statement, publicly sharing his rise to fame and current downfall for the first time:

I started trading perpetual contracts seriously in March this year. Before that, I’d never done serious trading—just dabbled in meme coins (previously famous for discovering PEPE when it had a $600K market cap and making eight-figure profits). I grew my account from $3 million to $100 million in just one month, then lost it all within a week on HyperLiquid.

At first, I was just messing around, but since on-chain data is public, hundreds of thousands watched my account swing wildly. So I just let go and embraced the chaos.

Eventually, things spiraled out of control.

I knew deep down this was gambling. I wanted to recover my losses and feared being mocked for “not holding onto a $100 million profit,” so I dug myself deeper.

The numbers flashing on screen turned into a virtual game. Greed took complete control.

Reading this evokes profound regret. He had previously announced multiple times that he would leave the derivatives market, only to renege and return to the table. As market sentiment rose to new highs before correcting, and amid volatility caused by Trump’s inconsistent policies and statements, James Wynn became just another piece of meat on the chopping block in the grand theater of crypto trading.

And sure enough, this latest moment of “enlightenment” didn’t last long. Later that day, James posted that over the coming days, he would scavenge small assets from old wallets, see what usable funds he could find, and refused to walk away empty-handed. His words were filled with longing to make a comeback.

The Whale Returns—Now Reduced to Ant-Sized Positions

On June 7, James Wynn fully liquidated his on-chain holdings, transferring a total of $1.91 million to three centralized exchanges: $1.5 million to Kucoin, $335K to MEXC, and $75K to Gate.io.

When many thought this retirement might finally be real, his subsequent actions revealed his inability to let go—prompting the inevitable sigh: “You can take the man out of the game, but not the game out of the man.”

On June 8, James Wynn re-entered the market with a principal of $468.62, opening a 40x leveraged long position on Bitcoin at an entry price of $105,537.50 and a liquidation price of $104,190. The nominal value of his position was only $18,737.66. He claimed he had bet his entire remaining net worth.

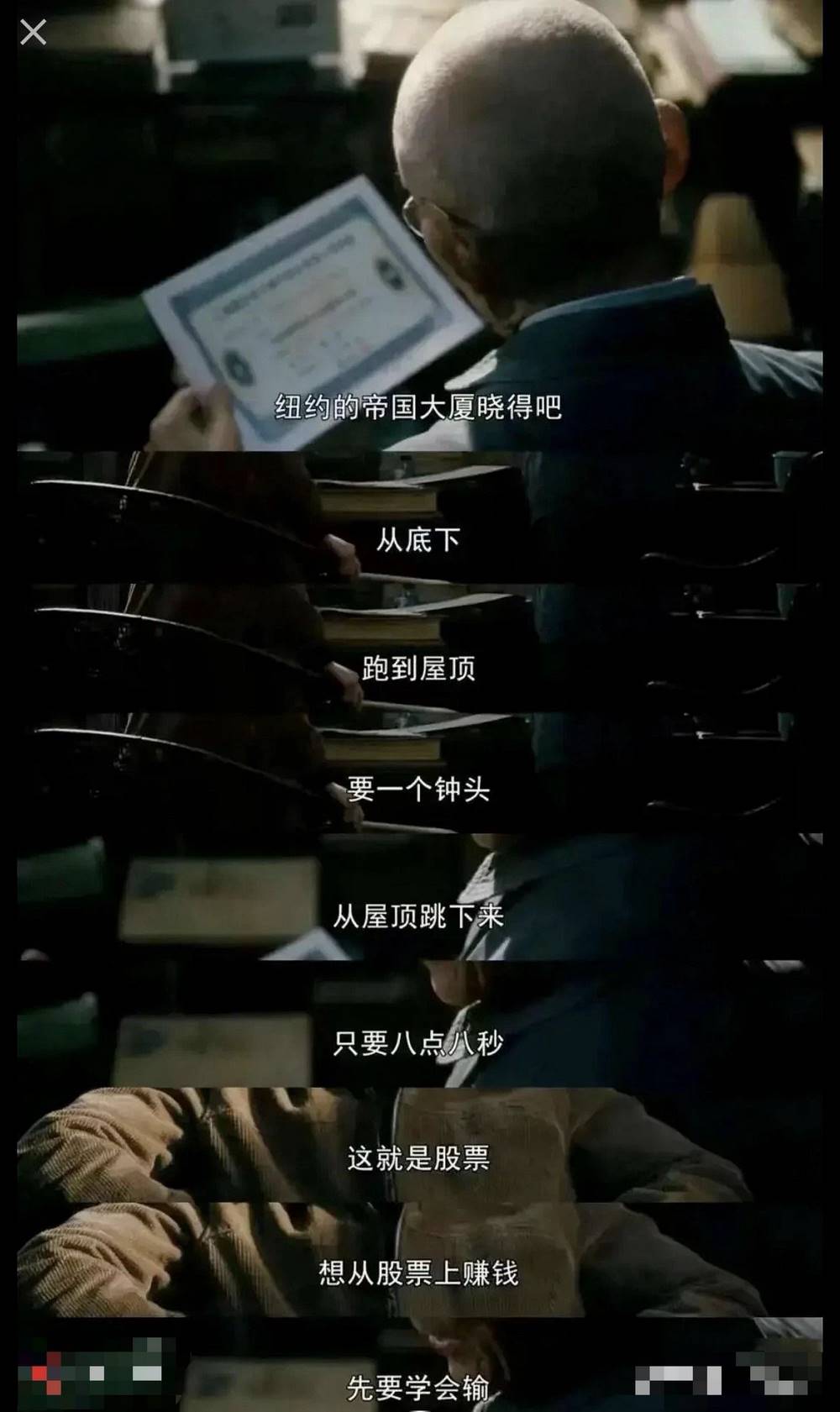

In the TV series *Blossoms*, the seasoned character Uncle Ye once told Bao Zong: "Do you know New York's Empire State Building? It takes an hour to run from the bottom to the top—but only 8.8 seconds to jump down. That’s the stock market. If you want to profit from stocks, learn how to lose first."

Uncle Ye’s Warning

Compared to traditional markets, crypto is even more brutal.If someone asks: 'How long does it take for an eight-figure-earning crypto whale to become a broke trader with nothing left?'

Maybe James Wynn has the answer—from opening billion-dollar BTC longs to betting his entire fortune on an “ant-sized” trade, exactly one month passed between May 8 and June 8.

On the afternoon of June 8, according to Onchain Lens monitoring, James Wynn closed his 40x Bitcoin long, suffering a loss of about $70.71. Then, despite the small size of the trade, the loss continued to grow—Lookonchain reported that the loss increased to $113.55.

It's hard for most of us to imagine such a stark contrast: just a week ago, you were a dominant whale moving markets, with positions valued in tens or even hundreds of millions of dollars. You boldly declared, “$100 million isn't much money—it can’t even buy a superyacht.” And now, after scavenging through dozens of old wallets and adding referral rewards, you’re placing trades with just a few hundred dollars.

The price of greed is painfully clear—but the thrill of gambling goes far beyond that.

Now that James has seemingly reached a dead end, perhaps some of the wilder theories circulating about him—“Is James Wynn actually a frontman for Hyperliquid?” “Is he laundering money via Hyperliquid through matched trades?” “Was James Wynn invented by the Hyperliquid platform? Does he even exist?”—can finally be laid to rest.

James Wynn and Hyperliquid: Nothing More Than Casino and Gambler

Doubts About James Wynn’s Identity

Earlier, Wintermute founder wishful_cynic became a target after James Wynn directly accused him of targeting his trades and manipulating the market, calling on supporters to donate funds to fight against alleged “conspiracy market makers.” Later, he responded: “Overall, I believe ‘wynn’ is simply a well-executed HL (Hyperliquid) marketing campaign—well done. He’s brilliant. His tweets are excellent.” Tagging @JamesWynnReal, he added: “In fact, James Wynn mentions Hyperliquid roughly once every three tweets, constantly promoting decentralization, anti-corruption, anti-manipulation, while vaguely referencing unverified ‘account bans’ on other centralized exchanges. From a PR perspective, James Wynn has achieved the biggest success in crypto this year.”

However, James Wynn quickly shattered this “conspiracy theory” with his own words.

James Clarifies: Reached Out Twice to HyperLiquid for Partnership, Hopes CZ’s Dark Pool Beats HP

James later stated: "I proactively contacted HyperLiquid twice, hoping to establish some form of partnership agreement given the attention I brought them. While they expressed gratitude, they declined any such arrangements. It makes sense—they operate a decentralized platform unlike traditional exchanges. I earned only $34,000 in referral commissions through their program. Given the number of sign-ups and trading volume I generated, this amount is very low. Their referral system is terrible—other platforms offer much better incentives." His tone clearly doesn’t match that of a paid shill for Hyperliquid—even though the platform benefited greatly from the surge in attention, with its HYPE token briefly surpassing the popular SUI and climbing to 11th place on the cryptocurrency rankings.

Moreover, James openly praised CZ, saying: "In my view, when CZ launches a dark pool-style perpetual DEX, HyperLiquid will be finished. CZ has the capital, resources, and team to build something unprecedented. Just look at what he accomplished with Binance. I hope this pushes HyperLiquid to improve, otherwise they’ll soon be overtaken by stronger competitors." For more on CZ’s dark pool concept, see our article "Decoding CZ’s Vision for the Future of Derivatives: The Dark Pool Solution".

Notably, Wintermute founder wishful_cynic offered a sarcastic take on dark pools, commenting: “Ironically, we learned from FTX + Alameda that internal market maker black boxes are bad—that on-chain DEXs are the future. Yet now, many believe the most successful DEXs are essentially running… internal market maker black boxes.”

Another Controversy: Is Hyperliquid a Money Laundering Platform? No Official Conclusion Yet

Meanwhile, as noted by Wintermute’s founder, concerns about whether “Hyperliquid enables hedging or matched trades for money laundering” have also drawn widespread attention.

Mirror Tang, founder of Web3 security firm Salus, previously pointed out that since March this year, Chinese law enforcement has cracked three cases involving cryptocurrency money laundering via Hyperliquid. The primary method involved exploiting Hyperliquid’s high-leverage liquidation mechanism: criminals deliberately trigger liquidations on Hyperliquid while simultaneously establishing offsetting positions on centralized exchanges to hedge and launder illicit funds. He emphasized that these strategies closely resemble James Wynn’s known trading patterns.

To date, there has been no official conclusion on these allegations. Odaily Planet Daily will continue to monitor developments.

Conclusion: One Thought Leads to Heaven, Another to Hell—Withdraw Profits Early, Avoid High-Frequency Trading

Looking back at James Wynn’s turbulent month—from obscurity, to pumping the meme coin Moonpig past a $100M market cap, to massive gains on large long positions, to chasing momentum and ultimately losing everything—it truly feels like a mini crypto drama. Going forward, his chances of recovery appear extremely slim.

Amid James’s personal rollercoaster of heaven and hell, Bitcoin first surged to new highs before falling back toward $100,000 in recent days.

Perhaps James Wynn is teaching us, through painful firsthand experience, an unshakable truth of the crypto market: Withdraw your principal after profits, and avoid high-frequency trading at all costs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News