Who is directing James Wynn's reckoning?

TechFlow Selected TechFlow Selected

Who is directing James Wynn's reckoning?

"Overseas Coolness" is also getting anxious.

Author: shushu, BlockBeats

During the recent Dragon Boat Festival holiday, whale James Wynn delivered a vivid demonstration of "not treating money seriously" in the crypto world, even live-streaming on X the distance between Bitcoin’s price and his long position’s liquidation level—once getting as close as $20 from blowing up—sparking widespread online attention.

A Western Version of Liangxi: “Begging” to Top Up Margin

On May 30, James Wynn was first liquidated due to an extremely leveraged BTC long. His $100 million position was wiped out, generating approximately $530,000 in profit for Hyperliquidity Provider (HLP). He then repeatedly opened new 40x leveraged long positions, suffering partial or full liquidations again on May 30 and 31, with liquidation prices ranging between $102,000 and $103,400.

According to Lookonchain data, his PEPE and BTC longs were partially liquidated, accumulating losses of up to $9.36 million, with total losses reaching $17.72 million. Subsequently, Wynn closed all positions and withdrew the last ~460,000 USDC from his HyperLiquid account, completely emptying it.

But gamblers rarely leave the table easily. Just one day after going flat, he unstaked 126,116 HYPE tokens (worth about $4.12 million) and sold them at an average price of $32.7, realizing a $1.05 million profit. This move was seen as his "last hope"—yet immediately afterward, he returned to battle.

On June 2, James Wynn once again opened a 40x leveraged BTC long, holding 944.93 BTC at an entry price of $105,890.3, with a liquidation price at $104,580—leaving minimal downside buffer. As the market trended downward, he continuously added margin on-chain, pushing his liquidation price down step by step—from $104,360 to $104,150, eventually stabilizing around $103,610, just about $20 below the prevailing market price.

As leverage approached critical levels, Wynn launched a public fundraising appeal on social media, stating: "If you want to fight against market makers and support me, please send USDC to the designated address." He promised to repay crowdfunding contributors 1:1 if the trade succeeded. This sparked immediate controversy, with even Liangxi commenting angrily that such behavior amounted to "infringement."

Per chain analyst EJin’s monitoring, within just two hours, he received over $40,000 in donations, of which $30,000 was transferred into HyperLiquid to avoid liquidation. The liquidation price briefly dropped to $103,610. He later injected another 480,000 USDC as margin, pushing the liquidation threshold up to $103,637, temporarily avoiding total collapse.

Calling Out CZ, Sparking Open Competition Among Perp DEXs

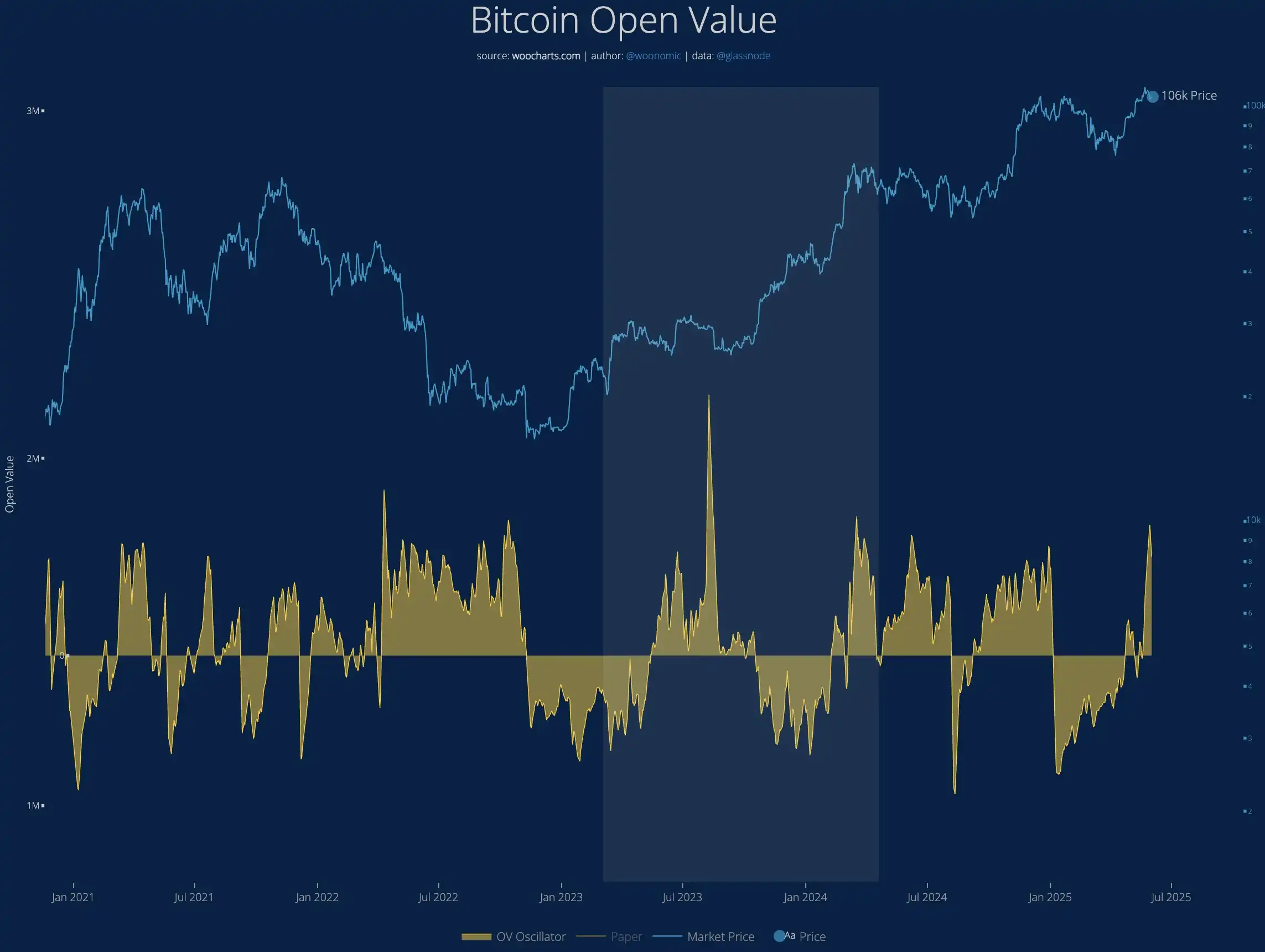

The current Bitcoin market is in a state of intense博弈, where excessive contract leverage has turned it into fertile ground for liquidation hunting. With weak buying pressure last week, low liquidity, and seasonal factors like summer weekends, large players can more easily manipulate prices under neutral conditions.

Crypto analyst Willy Woo believes that despite frequent appearances of buy walls, these may actually reflect repeated manipulation behind the scenes—such as targeting James Wynn’s liquidation levels.

During Wynn’s continuous margin top-ups, a minor incident occurred. As Bitcoin neared his liquidation price, he posted a screenshot addressing CZ, asking emotionally: "What do you think about this kind of market manipulation?"

Shortly after, James directly tagged CZ, urging him to DM. CZ jokingly replied that James no longer had 1 BNB left to use the messaging app—effectively advertising a native ecosystem application.

After the DM episode, CZ posted a thoughtful long thread suggesting: "Given recent market events, now might be a good time to launch a dark pool perpetual DEX. A dark pool perp DEX concept—hiding order books, delaying display of margin changes, even concealing trading addresses and funding paths—could technically be achieved via ZK and other cryptographic solutions."

He argued that DeFi’s current transparency paradoxically becomes a weakness for high-leverage traders. On-chain visibility of order books, liquidation prices, and margin flows makes any large position vulnerable to coordinated attacks. While CEX users can hide their identities, on-chain traders face opponents including market makers, bots, arbitrageurs, and copy-trading funds acting in concert.

This resonates strongly with James Wynn’s experience—his liquidation price was tracked in real-time, his social media became a spectator sport, and even his "1:1 crowdfunding" campaign was instantly decoded on-chain, turning him into a public experiment for markets and media alike.

CZ’s high-profile discussion of dark pool perp DEXs was no spontaneous outburst—it read more like a deliberate signal. As the James Wynn saga unfolds on-chain, next-gen perp DEXs like HyperLiquid are gaining unprecedented attention and user activity, beginning to genuinely challenge centralized exchanges’ dominance.

In previous cycles, DeFi derivatives platforms were often viewed as illiquid, clunky experiments. But this time, the perp DEX model represented by HyperLiquid has matured—not only in trading experience and asset stability but also in its gambling-like design—creating intense drama and community buzz through aggressive liquidation mechanics and ultra-high leverage.

As these decentralized platforms begin to directly compete with CEXs in high-frequency futures trading, the once-clear boundary between them is blurring, forcing both sides to take each other seriously.

Hyperliquid’s Unofficial Spokesman?

The controversy surrounding James Wynn extends beyond his crowdfunding stunt. What has drawn broader community scrutiny is the apparent "scripted" nature of his extreme actions.

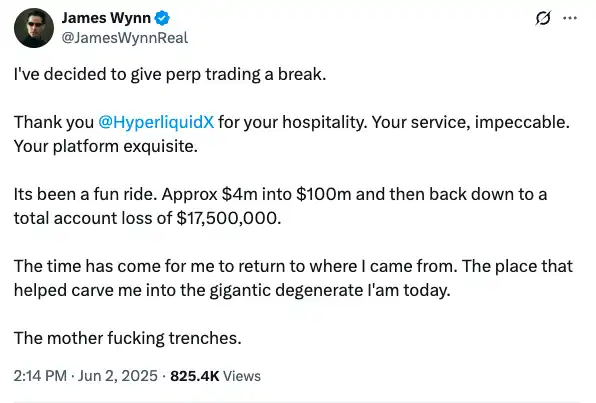

Just before redeeming HYPE for a $1.05 million profit and preparing to reopen positions, Wynn posted a ritualistic tweet announcing a temporary departure from futures trading. More strikingly, he lavishly praised Hyperliquid: "Thanks for the hospitality, Hyperliquid. Your service is impeccable, and the platform is outstanding."

This thank-you note quickly raised eyebrows, especially given it came right after multiple liquidations and massive losses. Many in the community suspect James functions more like a "storyline character" deployed by Hyperliquid—a highly visible, high-leverage actor generating unprecedented attention and discourse for the platform through relentless on-chain drama and social media engagement.

In fact, these suspicions aren’t baseless. For weeks, rumors have circulated that while James Wynn opens extreme leveraged positions on Hyperliquid, he may hedge in reverse on other exchanges—using on-chain narratives to boost influence, indirectly drive user activity on the platform, and attract broad attention to the HYPE token and its ecosystem.

As James revealed that several of his exchange accounts had been banned and funds restricted, outsiders began re-evaluating the plausibility of these rumors. In subsequent statements, he fired back aggressively:

"I stand for decentralization and oppose corruption. I support Hyperliquid and oppose market maker manipulation. You can't find a single flaw in my actions—my wallet is clean, my trades are clean. I’ve never taken promotional fees or pumped-and-dumped. I’m just a meme coin gambler who earned his place on-chain and a top-tier HL player."

This passionate self-defense, emotionally charged and defiant, seems aimed at branding himself as an authentic, transparent figure in the on-chain space. Yet to many in the community, this very contrast—so loud, so dramatic—feels less like authenticity and more like a carefully orchestrated marketing performance.

Arthur Hayes, co-founder of BitMEX, commented on social media: "This could become one of the most successful exchange marketing campaigns in crypto history. Also, there’s a good chance this guy is hedging on another anonymous address specifically to farm Hyperliquid’s next airdrop."

As of June 3, Bitcoin’s price dipped again, and James Wynn’s 40x long briefly turned profitable before slipping back into loss territory. Throughout this ongoing on-chain drama, Hyperliquid remains firmly at the center of public discourse.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News