Why Goldman Sachs' assessment of Ethereum is wrong?

TechFlow Selected TechFlow Selected

Why Goldman Sachs' assessment of Ethereum is wrong?

The approval of ETFs is significant, but merely the opening act.

Written by: Brendan on Blockchain

Translated by: Bihua Blockchain

A few years ago, Ethereum was Bitcoin’s little sibling—known for decentralized finance (DeFi), pixelated NFTs, and creative smart contract experiments, far from being a "serious" choice for investors. Yet by 2025, Ethereum has become Wall Street’s focal point.

In 2021, Goldman Sachs perfectly encapsulated traditional institutional thinking when it dismissed Ethereum as “too volatile and speculative,” calling it “a solution in search of a problem.” Their research team believed smart contract technology was overhyped, with limited real-world applications, and that institutional clients had “no legitimate use case” for programmable money. They weren’t alone—JPMorgan referred to it as a “pet rock,” while traditional asset managers avoided it altogether.

Yet that view is now as outdated as once calling the internet a passing fad. Today, Goldman is quietly building Ethereum-based trading infrastructure; JPMorgan uses its Ethereum-powered Onyx platform to process billions of dollars in transactions; and those same asset managers who once shunned Ethereum are now racing to launch Ethereum-related products.

The real turning point came in 2024, when the U.S. Securities and Exchange Commission (SEC) finally approved spot Ethereum ETFs. This may not sound like thrilling dinner-table conversation, but its implications are profound. Unlike Bitcoin, which regulators neatly categorized as “digital gold,” Ethereum posed a challenge: how do you regulate a programmable blockchain that powers everything from decentralized exchanges to digital art markets? The fact they resolved this and gave approval speaks volumes about where the industry is headed.

The ETF Floodgates Open

For years, there was skepticism around regulatory clarity for Ethereum, particularly the SEC’s ambiguous stance on whether Ethereum qualified as a security. But the ETF approval sent a clear signal: Ethereum has matured into an investable asset for pension funds, asset managers, and even conservative family offices.

BlackRock led the charge with its iShares Ethereum Trust—and frankly, watching this rollout felt like witnessing institutional FOMO unfold in real time. Fidelity quickly followed, Grayscale converted its existing product into an ETF, and suddenly every major asset manager launched an Ethereum offering. More notably, these aren’t just plain-vanilla ETFs tracking ETH price—some include staking rewards, meaning institutional investors can earn yield on their holdings just like DeFi participants.

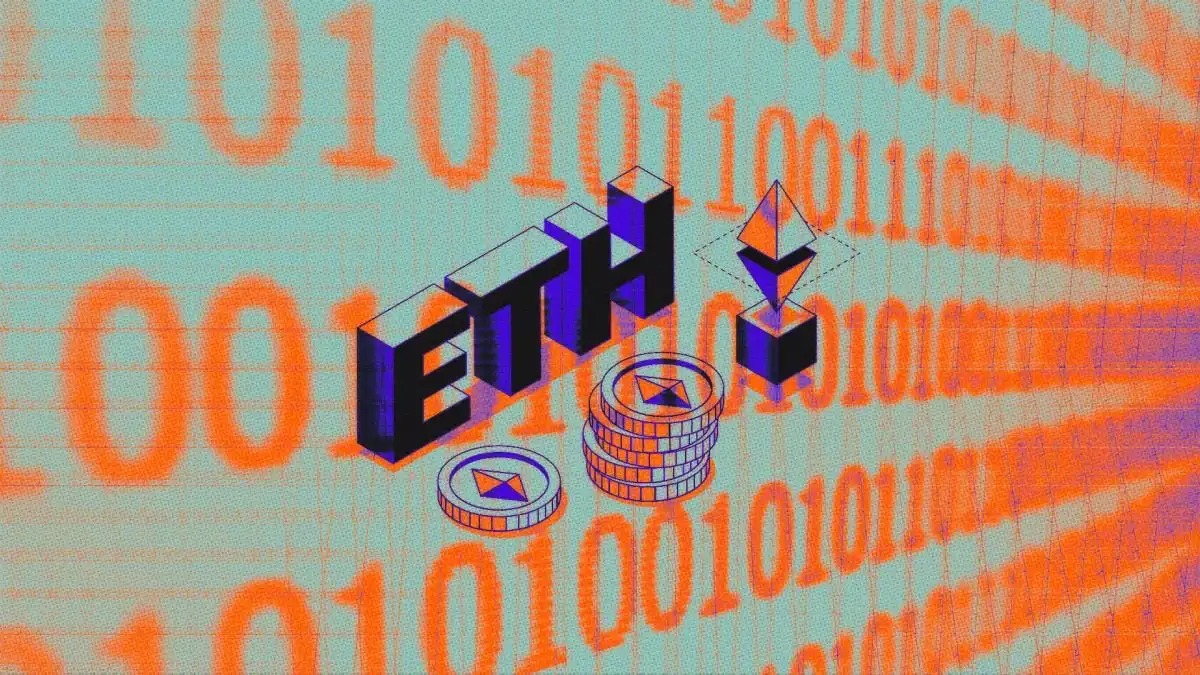

Visualizing Ethereum's price volatility before and after institutional adoption

Visualizing Ethereum's price volatility before and after institutional adoption

Visualizing Ethereum's price volatility before and after institutional adoption

Full Corporate Embrace

What’s truly compelling is how companies are integrating Ethereum into actual business operations—not just holding it speculatively like Bitcoin, but building digital infrastructure on Ethereum because it solves real problems.

Ethereum’s real institutional value lies in its role as infrastructural, programmable blockchain capable of handling tokenized currencies, digital contracts, and complex financial workflows.

Institutions are rapidly joining this wave:

Franklin Templeton, managing $1.5 trillion in assets, tokenized one of its mutual funds on Ethereum. Investors now hold digital shares on the blockchain, benefiting from transparency and 24/7 settlement.

JPMorgan, through its blockchain division Onyx, is testing tokenized deposits and asset swaps using Ethereum-compatible networks such as Polygon and its enterprise-grade Ethereum variant, Quorum.

Amazon AWS and Google Cloud now offer Ethereum node services, enabling enterprises to easily connect to the network without building infrastructure from scratch.

Microsoft is partnering with ConsenSys to explore enterprise use cases ranging from supply chain tracking to compliance-focused smart contracts.

This is no longer just the domain of crypto-native players. Traditional financial giants are waking up to the fast, secure, automated, and intermediary-free financial services Ethereum enables.

Conversations among Fortune 500 CFOs have completely shifted. They’re no longer debating whether blockchain makes sense—they’re asking how quickly they can deploy smart contract automation for vendor payments, supply chain financing, and internal processes. The efficiency gains are undeniable.

The gaming and entertainment industries are especially aggressive. Mainstream game studios are tokenizing in-game assets, music platforms are automating royalty distributions, and streaming services are experimenting with decentralized content monetization. Ethereum’s transparency and programmability have solved decades-old industry issues almost overnight.

Why Is Ethereum So Appealing to Institutions?

Ethereum allows assets—whether dollars, stocks, real estate, or carbon credits—to be digitized, tokenized, and programmed. Combined with major stablecoins like USDC or USDT that primarily run on Ethereum, you suddenly have the foundational building blocks for an entirely new financial operating system.

-

Need instant cross-border settlement?

-

Need programmable payments based on contractual milestones?

-

Need transparency without sacrificing control?

-

Ethereum delivers—all this and more.

Add to this Layer 2 networks like Arbitrum and Optimism, which scale Ethereum’s capacity, reduce fees, and dramatically increase speed. Many institutions choose to build on Layer 2s for greater efficiency while still leveraging Ethereum’s liquidity and security.

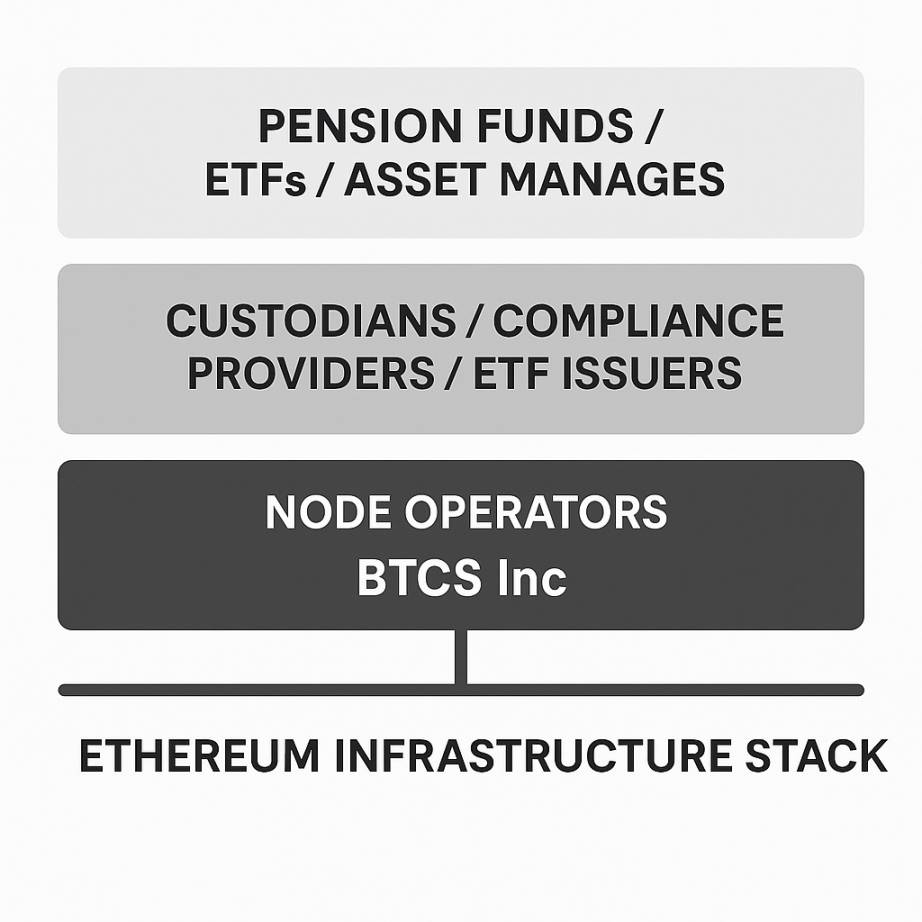

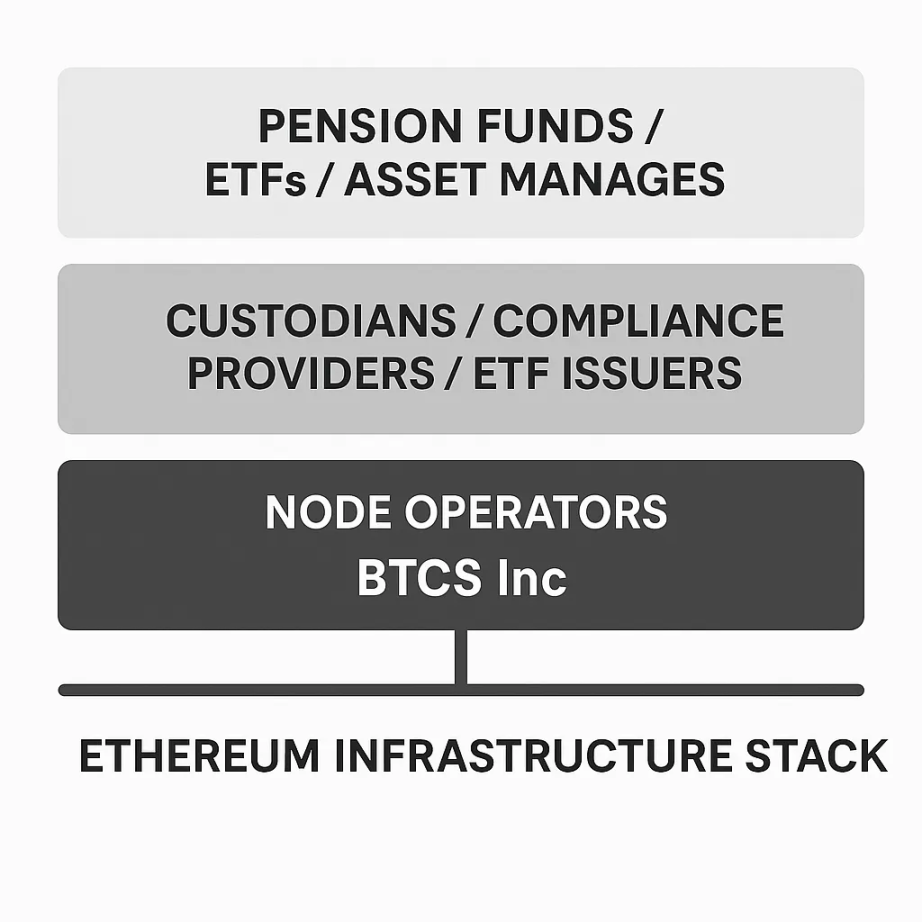

All this institutional adoption rests on an infrastructure layer most people overlook. Companies like BTCS Inc are increasingly providing the essential infrastructure that enables traditional financial institutions to participate in Ethereum and products like ETH ETFs. BTCS focuses on operating secure, enterprise-grade Ethereum validator nodes, maintaining network integrity and allowing institutions to participate in staking without dealing with technical complexity. While they are neither custodians nor ETF issuers, their validator operations support Ethereum’s functionality and credibility, enhancing the network resilience and transparency that institutional investors demand.

Looking Ahead

Where is this heading? I believe the direction is crystal clear. Ethereum is becoming the infrastructure layer for programmable finance. We’re no longer just talking about cryptocurrency trading—we’re discussing automated lending and borrowing, programmable insurance, tokenized real estate, and round-the-clock supply chain financing.

Integration with central bank digital currencies (CBDCs) presents another massive opportunity. As countries develop digital currency strategies, many are exploring Ethereum-compatible solutions to enable seamless interaction between government-issued digital currencies and the broader DeFi ecosystem.

More importantly, this institutional embrace is driving the long-awaited regulatory clarity the entire industry has been waiting for. When major financial institutions build products around Ethereum, regulators have strong incentives to establish workable frameworks rather than impose blanket restrictions.

We are witnessing a technology evolve—from experimental platform to critical financial infrastructure. The ETF approval was significant, but merely the opening act. The real story lies in how Ethereum is fundamentally transforming how financial services operate, how businesses manage their operations, and how value flows across the global economy.

Honestly, I believe we’re still in the early stages of this transformation. Current institutional adoption is just the beginning of a large-scale convergence between programmable money and traditional finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News