Pharos: A high-performance modular L1 focused on RWA tokenization

TechFlow Selected TechFlow Selected

Pharos: A high-performance modular L1 focused on RWA tokenization

30,000 TPS, 1-second finality—will Pharos, founded by a core member from Ant Group, become the key hub linking real-world assets and the Web3 world?

Writing: KarenZ, Foresight News

On May 16, Pharos, an EVM-compatible Layer 1 project founded by former Ant Group executives, announced the official launch of its testnet.

Positioned as a high-performance modular blockchain focused on RWA onboarding, Pharos claims to achieve transaction performance of 30,000 TPS with 1-second finality. Additionally, its blockchain-based verifiable storage solution reportedly reduces storage costs by 80.3%, drawing market attention to next-generation Web3 infrastructure. This article provides an overview from multiple dimensions including team background, technical architecture, ecosystem development, and interaction methods.

Team Background

The core team of Pharos consists of former key personnel from Ant Group’s blockchain division and senior executives from leading Web3 projects:

-

Founder Alex Zhang (Zhang Hui): Former CTO of Ant Blockchain, former CEO of Ant Group's Web3 project ZAN, and head of Alibaba DAMO Academy's Blockchain Lab.

-

Co-founder and CTO Wish Wu: Former Chief Strategy Officer of Ant Group's Web3 project ZAN.

-

CMO Laura Serein: Previously worked at Solana, PayPal Crypto, and Visa.

-

Ecosystem Lead Wilguish: Formerly associated with Wormhole.

Pharos is currently hiring for positions including Senior Blockchain Engineer (C++), Social Media Lead, Web3 Research Intern, and Blockchain R&D Intern (C++).

In terms of funding, in November 2024, Pharos announced the completion of an $8 million seed round led by Lightspeed Faction and Hack VC, with participation from SNZ Capital, Reforge, Dispersion Capital, Hash Global, Generative Ventures, Legend Star (the early-stage investment and incubation arm of Lenovo Holdings), MH Ventures, Zion, and Chorus One. At the time, Pharos co-founder and CEO Alex Zhang told The Block that the round began fundraising in July and closed in September, structured via a Simple Agreement for Future Equity (SAFE) with attached token warrants.

In March 2025, Pharos also launched a $20 million ecosystem grant program, aiming to foster innovation and growth within its ecosystem by funding and supporting projects that advance Pharos technology and applications.

Additionally, according to researcher @WorldOfMercek, Pharos plans to launch its mainnet in Q3, during which time $300 million worth of renewable energy RWA assets will be deployed (@_FORAB has also learned through peer channels that Pharos has already secured commitments for $300 million in RWA assets). In Q4, SPN will go live and the RWA environment will be optimized, with expansion into new asset types and more institutional partners expected in 2026.

What Is Pharos’ Architecture?

Pharos is an EVM-compatible, modular, full-stack parallel L1 blockchain network focused on high throughput, low latency, scalability, and support for heterogeneous computing and cross-chain interoperability. Its core objective is to provide enterprise-grade infrastructure for Web3 applications while enabling the convergence of RWA and DeFi. According to Pharos documentation, the Pharos framework resembles Cosmos SDK, allowing the construction of L1s or L2s atop this infrastructure.

At a macro level, Pharos employs a three-layer architectural design:

1. L1-Base (Base Layer): Provides data availability and hardware acceleration capabilities.

2. L1-Core (Core Layer): A high-performance global distributed blockchain network driven by decentralized nodes.

3. L1-Extension (Extension Layer): A modular extension layer built on L1-Core, enabling network scalability across three dimensions:

-

Leveraging heterogeneous computing to create customized Special Processing Networks (SPNs): Supports running blockchain networks, sidechains, or non-blockchain applications (similar to subnets), such as HFT, ZKML, and AI models.

-

Native restaking: Validators can restake their mainnet staked tokens into SPNs, enabling shared security, reward distribution, and slashing mechanisms.

-

Cross-SPN interoperability: Enables seamless asset and data flow between different networks via a cross-SPN protocol, supporting collaboration among infrastructure-, middleware-, and application-type SPNs to build a highly modular and composable ecosystem.

From a functional module perspective, the Pharos modular blockchain stack is divided into consensus, execution, settlement and restaking, and data availability layers.

Consensus Layer: Pharos supports multiple consensus models including PBFT, PoS, and PoA, ensuring effective communication and validation between SPNs and the main network. The Pharos network topology and consensus mechanism utilize three fundamental node types: validator nodes, full nodes, and relay nodes. Validator nodes operate under a Byzantine Fault Tolerant (BFT) Proof-of-Stake protocol, securing the network and efficiently processing user transactions. In addition to transaction fees and staking rewards, validators can earn additional income through restaking. Full nodes and relay nodes support blockchain data distribution and provide services such as state synchronization, parallel tip generation, indexing, queries, and APIs.

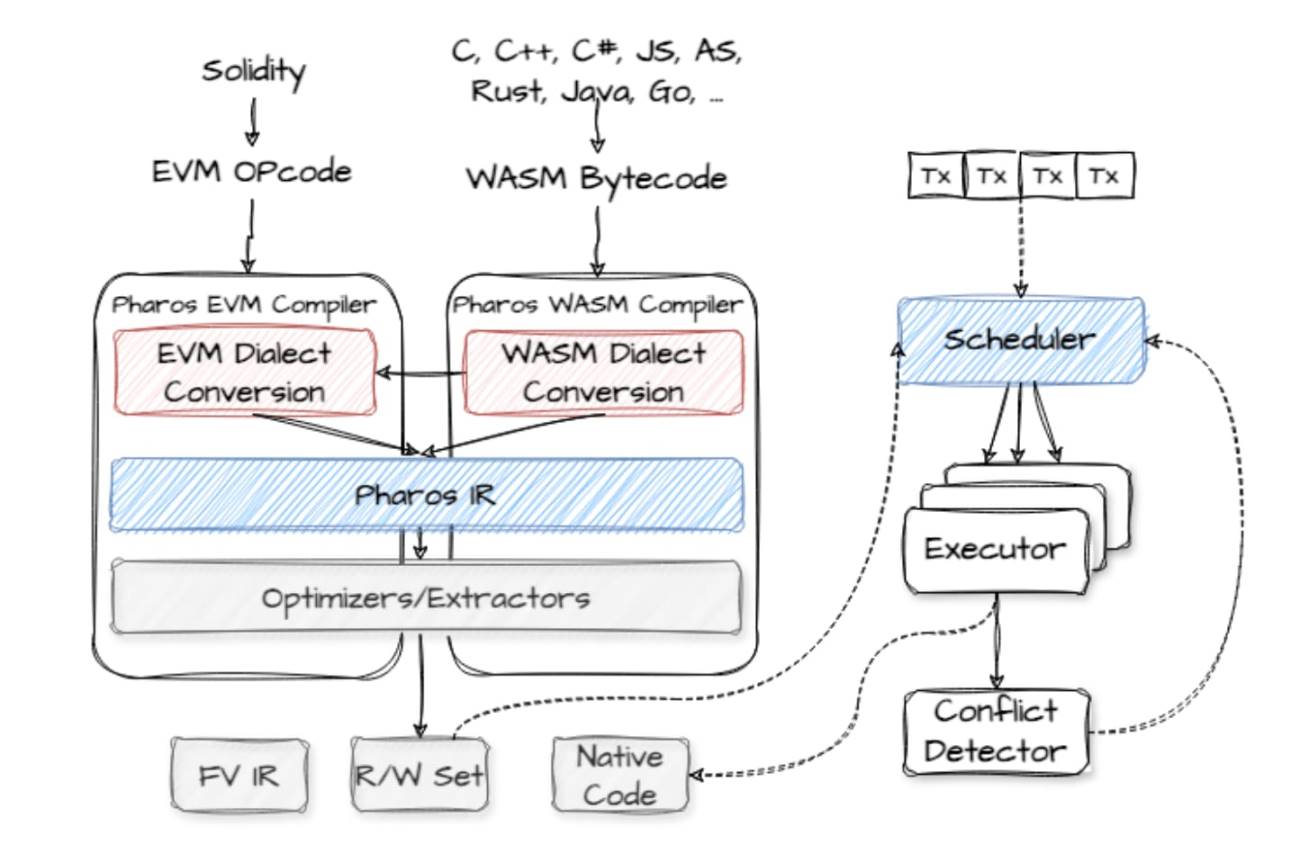

Execution Layer: Comprises two key components—scheduler and executor. The scheduler is the core component for parallel scheduling and execution of transactions, utilizing optimization algorithms to maximize parallelism and minimize conflicts. The executor uses a dual virtual machine engine (EVM and WASM), enabling fast and flexible smart contract execution. Pharos also leverages optimistic execution and the "Pipeline Finality" algorithm, allowing execution results to be rapidly aggregated and final states to be efficiently determined. With the Pipeline Finality algorithm, Pharos prioritizes transaction finality to enhance user experience and sets a maximum finalization time for each block.

Source: Pharos

Settlement and Restaking Layer: Validators on the main network can participate in SPN restaking, thereby earning dual rewards from both SPNs and the main network. Using the Pharos restaking protocol allows rapid deployment of SPNs, ensuring shared security, pooled resources, and incentives for validators.

Beyond this, Pharos supports multi-asset protocols and seamlessly integrates with restaking protocols like Babylon and Eigenlayer, expanding the network's overall interoperability and security.

Data Availability Layer: Utilizes authenticated data structures (ADS) to enable high-throughput, low-latency storage. Pharos claims its blockchain-based verifiable storage solution increases throughput by up to 15.8x and reduces storage costs by 80.3%. For SPNs, combining the cross-SPN protocol with native restaking enables second-level finality, according to official statements.

Additionally, the Pharos gas model follows Ethereum's gas mechanism and is compatible with EIP-1559 (base fee + priority fee). The base fee is dynamic and recalculated every epoch.

Pharos’ Ecosystem Potential and Use Cases

Alex Zhang, co-founder and CEO of Pharos, previously told The Block that real-time payments and RWA are two primary use cases prioritized by Pharos. Pharos has also established a strategic partnership with ZAN, the Web3 brand under Ant Digital Technologies (a subsidiary of Ant Group), aiming to jointly develop Web3 infrastructure focusing on node services, security, and hardware. Alex Zhang emphasized that the collaboration with ZAN will focus on RWA use cases, while another partnership with the World Stablecoin Payment Network (WSPN) will concentrate on stablecoin payment use cases.

According to Pharos' official website, the following use cases are supported:

-

Institutional-grade RWA tokenization: Supports onboarding of renewable energy, real estate, supply chain finance, and other assets using zkDID authentication and on-chain/off-chain credit systems. The Pharos CTO stated that Pharos’ RWA applications aim to price assets using trusted data and blockchain technology rather than relying on centralized financial institutions.

-

Unified order book contracts or spot DEXs across chains: Supports advanced order types such as take-profit, stop-loss, and time-weighted average price (TWAP).

-

Real-time payments: Leverages 1-second finality and ultra-low transaction costs to enable seamless hybrid payment systems.

-

Scalable DePIN

-

Unified liquidity under multiple virtual machines: Enables cross-VM interoperability between EVM and WASM smart contracts, allowing developers to build cross-chain applications under a unified account system and reduce multi-chain deployment costs.

How to Interact?

Given that Pharos raised its seed round last year via SAFE with attached token warrants, and that the testnet has deployed the native token PHRS for network fees, it is reasonable to expect that Pharos will launch its native token. Pharos’ official X account reported over 110,000 real users within the first 24 hours of the testnet launch.

Pharos’ specific interaction steps are as follows:

1. Connect wallet: https://testnet.pharosnetwork.xyz/

2. Faucet test token claims:

-

Scroll down the page to claim 0.2 PHRS every 24 hours (requires CAPTCHA verification).

-

Claim 0.2 PHRS every 24 hours at ZAN (https://zan.top/faucet/pharos) (registration required).

-

Claim USDC or USDT at https://testnet.zenithswap.xyz/faucet (author failed to claim).

3. Complete on-chain and social tasks. (https://testnet.pharosnetwork.xyz/experience)

On-chain tasks include:

-

Swap tokens (https://testnet.zenithswap.xyz/swap) and provide liquidity on Zenith;

-

Transfer PHRS tokens to another address;

-

Invite friends.

4. Explore other Pharos ecosystem projects afterward. (https://testnet.pharosnetwork.xyz/ecosystem)

Challenges and Opportunities for Pharos

Leveraging the technical expertise and resource integration capabilities of its founding members from the Ant Group ecosystem, Pharos may demonstrate differentiated competitiveness in areas such as RWA onboarding and high-performance DeFi. Its modular architecture and SPN design offer flexible customization options for enterprise applications, while EVM compatibility lowers the barrier for developer adoption. However, key challenges post-mainnet launch will include balancing performance with decentralization, meeting regulatory compliance requirements—especially in the RWA space—and building a sustainable token economy model.

As the testnet opens fully, whether Pharos can secure a position in the Web3 infrastructure race will depend on the speed of technological implementation, efficiency in expanding ecosystem partnerships, and acceptance by traditional financial institutions. If it delivers on its performance promises and successfully bridges RWA and DeFi into a closed-loop value system, Pharos could emerge as a pivotal hub linking real-world assets with the blockchain world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News