Bitcoin breaks $100,000 for the 7th time—can Ethereum keep up this time?

TechFlow Selected TechFlow Selected

Bitcoin breaks $100,000 for the 7th time—can Ethereum keep up this time?

Counterfeit goods see significant price increase.

Author: 1912212.eth, Foresight News

A long-awaited major rally has finally arrived. On the evening of May 8, BTC broke through the $100,000 mark and continued climbing, surpassing $102,000, achieving five consecutive weekly gains. However, the most remarkable performer was Ethereum, which has long faced criticism—ETH surged over 20% in 24 hours, breaking past $2,000 and rising to above $2,200. ETH/BTC reclaimed the 0.02 level, rebounding more than 14% from its recent low.

Ethereum's surge also led a broad rally across altcoins. In the past 24 hours, restaking token EUGEN rose over 40%, ETHFI climbed over 28%, while OP and ARB both gained more than 15%. Among layer-1 blockchains, SOL increased nearly 10%, while SUI and BERA each gained over 19%. In stablecoins, ENA rose over 28% and LQTY surged over 39%.

The crypto market has been quiet for several months since January this year. What factors are driving this latest rally, and what comes next?

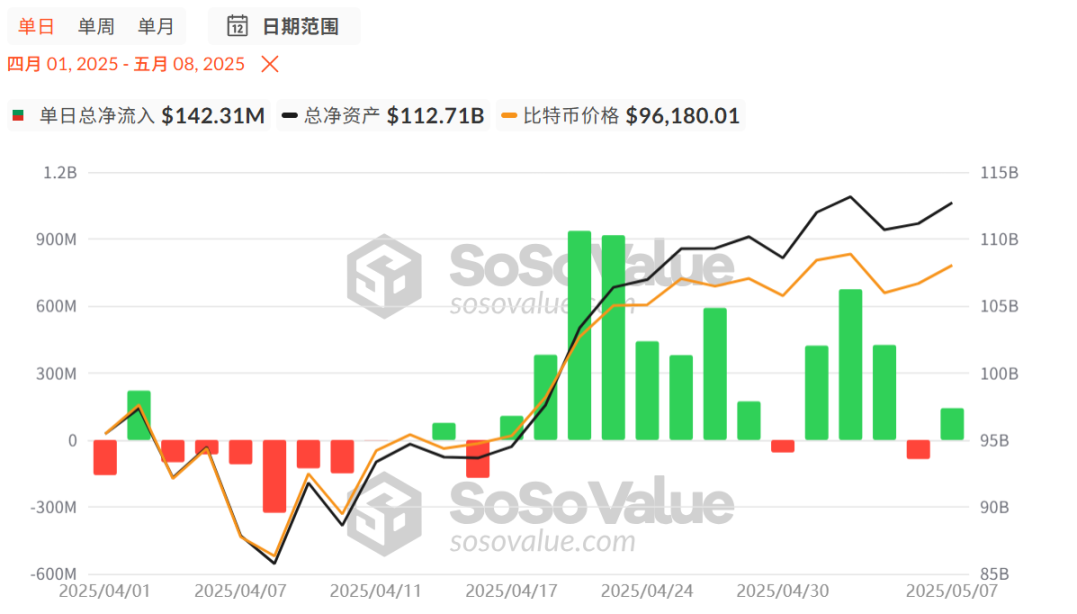

Bitcoin Spot ETFs Have Seen Continuous Net Inflows Since Mid-April

Data on ETFs, a key indicator of market capital flows, shows that Bitcoin spot ETFs have seen consistent net inflows since April 15.

The chart shows two-day net inflows exceeding $900 million, one-day inflows surpassing $600 million, and five-day inflows exceeding $300 million. There was only one day of net outflows, on the third day, and those outflows were far smaller than the inflows.

To date, cumulative net inflows into Bitcoin spot ETFs have reached $40.77 billion, providing a solid foundation for BTC’s price ascent.

Public Companies Like Strategy Continue Aggressive Buying

Data shows that Strategy spent $555.8 million to acquire 6,556 BTC between April 14 and 20 at an average price of $84,785 per BTC. It then added another 1,895 BTC for $180.3 million, averaging $95,167 per coin. Additionally, Strategy launched its bold "42/42 Plan," aiming to raise $84 billion over two years to purchase Bitcoin, following last year's $4.2 billion "21/21 Plan."

Japanese listed company Metaplanet added 145 BTC on April 24 and then purchased another 555 BTC for $53.4 million on May 7. On the same day, it also issued $25 million worth of ordinary bonds to fund further Bitcoin purchases. The CEO of Metaplanet stated in a letter to shareholders that the company remains committed to its Bitcoin strategy, targeting a total holding of 10,000 BTC by year-end.

Other publicly traded firms such as Indian company Jetking, Nasdaq-listed Thumzup, and U.S.-listed medical tech firm Semler Scientific are either buying or planning to buy more Bitcoin.

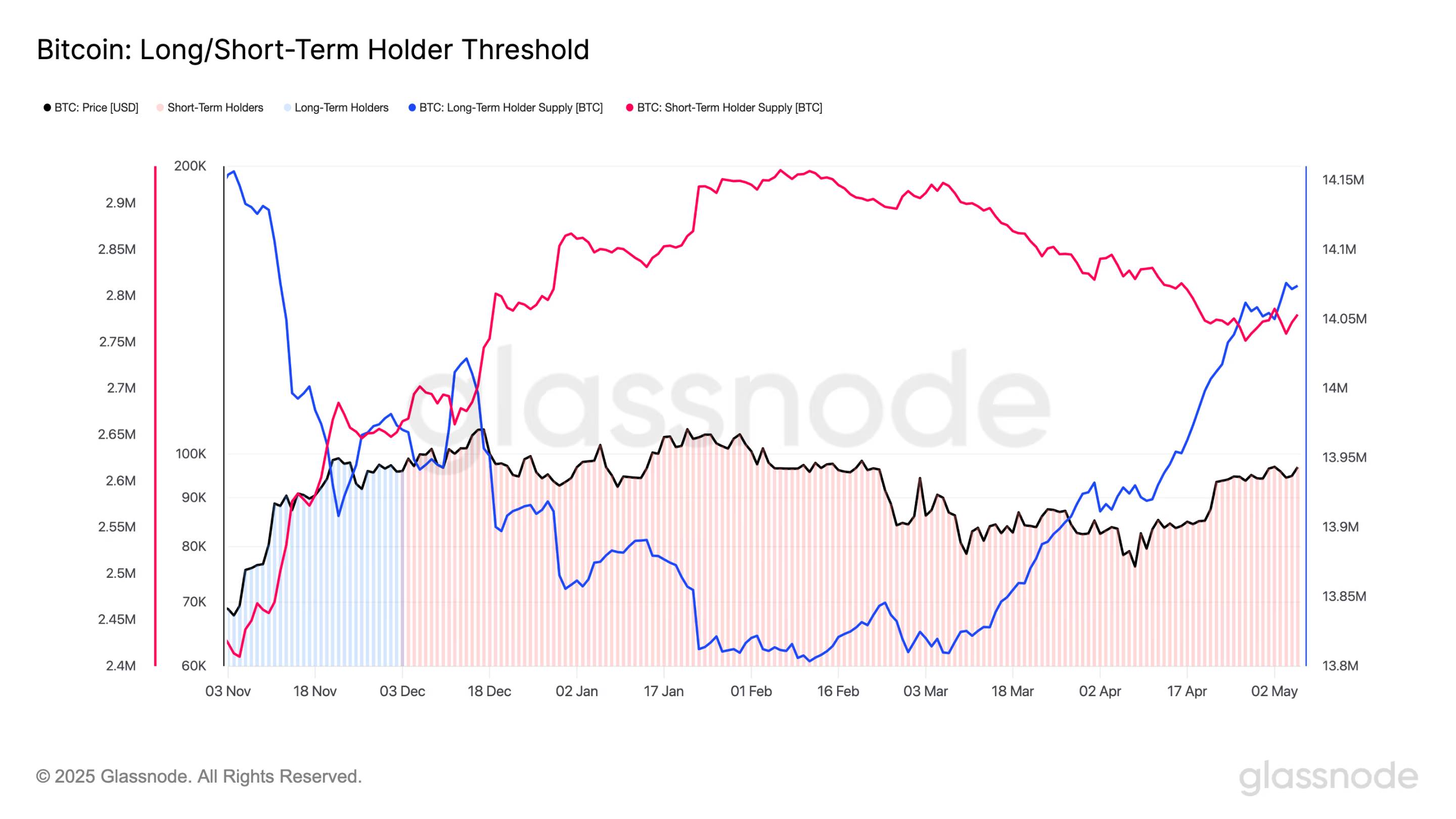

Both Long-Term and Short-Term BTC Holders Are Accumulating

Glassnode data indicates that both short-term holders (STH) and long-term holders (LTH) are accumulating Bitcoin. LTHs have been steadily accumulating since early March, while STHs began adding positions over the past week. Glassnode defines LTHs as investors who have held BTC for more than 155 days and STHs as those holding for less than 155 days. According to its latest weekly report, LTHs have acquired over 250,000 BTC since early March, pushing their total holdings above 14 million BTC.

This suggests growing market confidence, with accumulation momentum now outweighing profit-taking and risk-off behavior.

When BTC approached its recent low near $74,000, over 5 million BTC were in loss-making positions. However, with the market recovery, this number has dropped to around 1.9 million BTC, indicating that more than 3 million BTC have returned to profitability.

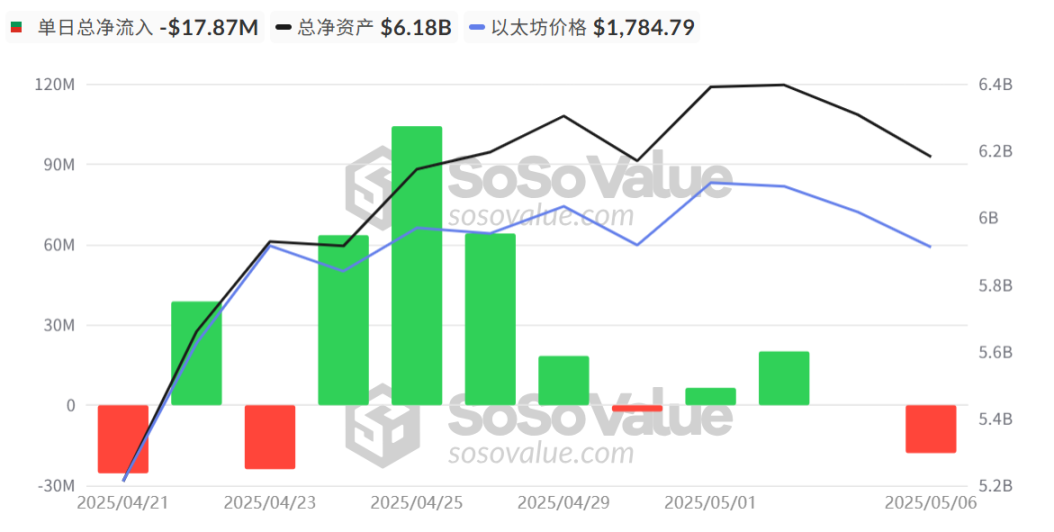

Ethereum Spot ETFs See Net Inflows Amid Pectra Upgrade Optimism

Data on Ethereum spot ETFs is also positive. Since the end of April, there have been seven days of net inflows, with three days exceeding $60 million in inflows. The largest single-day outflow remained under $30 million.

In addition, Ethereum has completed the Pectra upgrade—the first mainnet upgrade since the Cancun upgrade in March last year—comprising two coordinated updates: the Prague execution-layer hard fork and the Electra consensus-layer upgrade. The upgrade incorporates 11 Ethereum Improvement Proposals (EIPs). Key EIPs include EIP-7251 (increasing the maximum effective balance for validators), EIP-7691 (improving blob throughput), and EIP-7623 (raising call data fees).

This upgrade brings significant technical improvements to the Ethereum mainnet and its ecosystem projects, with market capital and sentiment directly reflected in ETH’s price and associated ecosystem tokens.

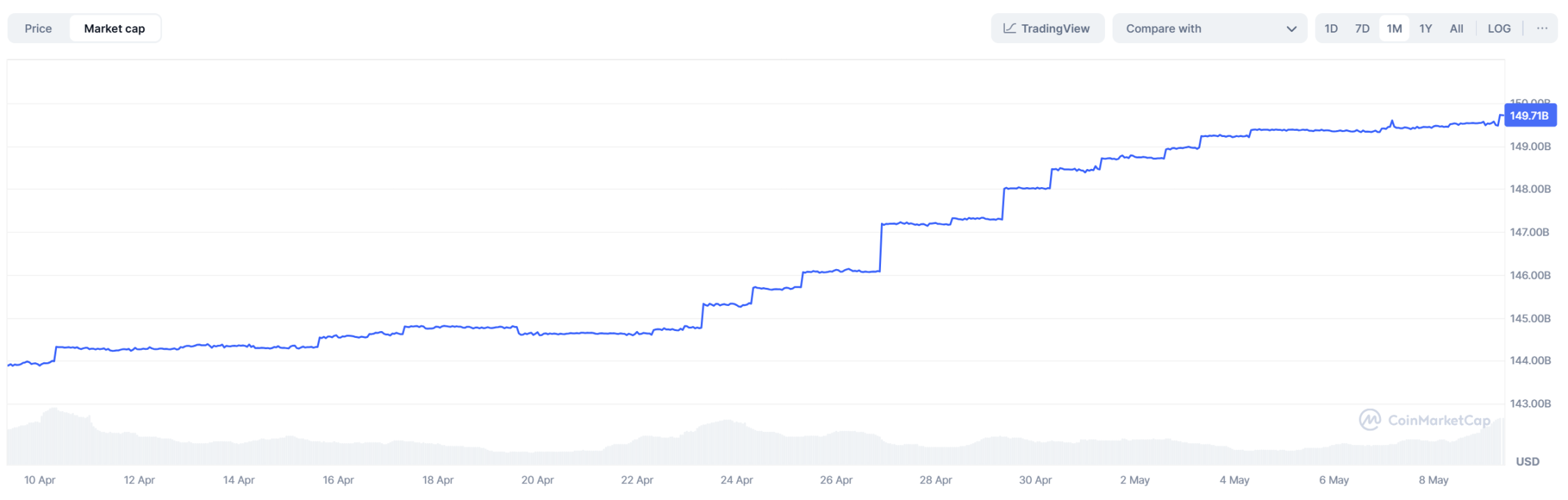

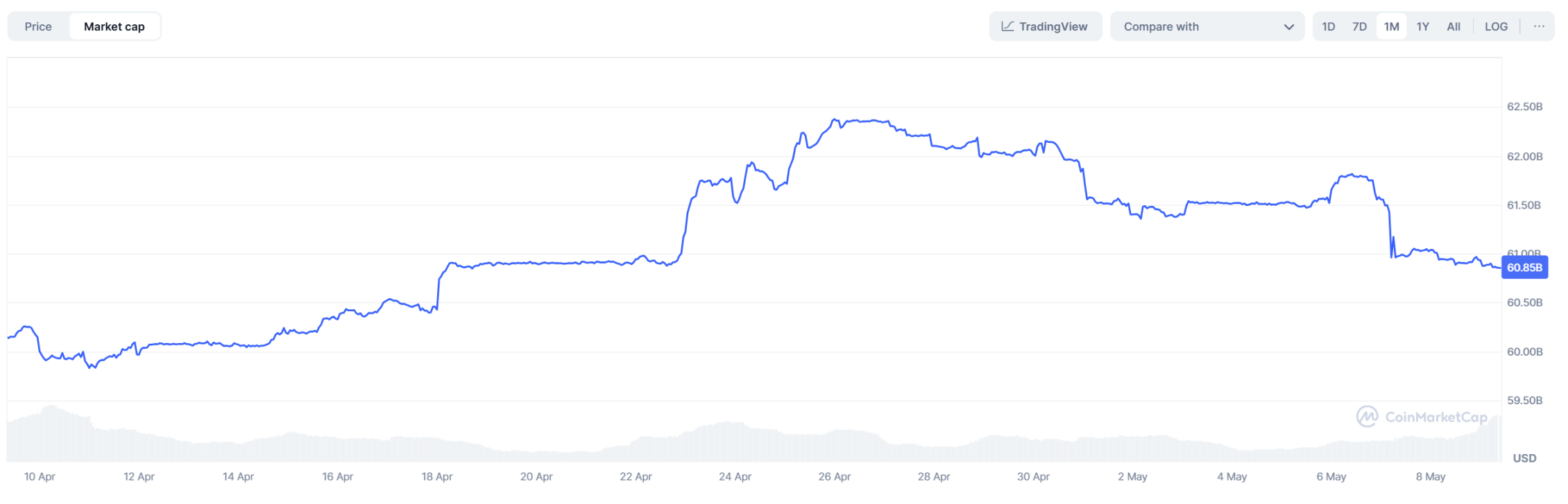

USDT and USDC Market Cap Combined Up Over 4% in One Month

Total stablecoin market cap continues to reach new highs. According to DefiLlama, the total stablecoin market cap now stands at $242.226 billion, up over $16.078 million in the past 7 days. USDT’s monthly gain is 3.75%, with a market cap of $150.179 billion. USDC gained 1.18% month-on-month, with a market cap of $60.904 billion, slightly down after reaching a peak at the end of April.

USDT Market Cap Chart

The combined market cap of the two major stablecoins continues to rise, signaling ongoing capital inflow into the crypto market.

USDC Market Cap Chart

Fed Rate Cuts Expected in June-July; U.S.-China Tariff War May Soon Ease

In the early hours of May 8, after concluding its two-day monetary policy meeting, the Federal Reserve decided to keep the federal funds rate unchanged in the range of 4.25% to 4.5%. This marks the third consecutive meeting since January and March this year where the Fed has chosen not to cut rates. Powell stated, “The monetary policy outlook could include lowering short-term interest rates.” At the press conference, he said the outlook “could include” either rate cuts or holding rates steady, depending on economic conditions. “Fluctuations in GDP data won’t really change our position.” This has further intensified tensions between the Fed and the White House. Trump has repeatedly criticized the Fed as “Jiangxi,” saying that talking to Powell is like playing music to a cow—Powell is always too late.

Markets currently assign a 30% probability of a 25-basis-point rate cut as early as June, slightly higher than the previous 27%. Futures pricing suggests about a 75% chance of a rate cut by July. Recently, the Bank of England and the People’s Bank of China both cut rates and reserve requirements, and global M2 liquidity continues to expand. Expectations of Fed rate cuts could boost capital inflows into crypto assets.

On tariffs, Trump’s aggressive tariff threats had kept global capital markets on edge. Under mounting market and domestic public pressure, Trump has finally signaled willingness to negotiate. On May 7, China’s Foreign Ministry announced that Vice Premier He Lifeng will visit Switzerland from May 9 to 12 and hold formal talks with U.S. Treasury Secretary Bessent and Trade Representative Tai. This marks the first face-to-face high-level consultation on trade issues between China and the U.S. since the 2024 G20 summit, widely interpreted by markets as a clear signal that both sides are pausing tariff escalation.

Outlook for Future Price Movements

Raoul Pal, former Goldman Sachs executive and founder of Real Vision, tweeted: “I think BTC dominance has peaked today. We’re seeing DeMark top signals on daily, weekly, and monthly charts, with the top levels below the 2021 highs, which themselves were below the 2017 peaks. If this holds, it would signal the arrival of the next phase of the ‘Banana Zone’—an altseason. Let’s wait and see.”

Chris Burniske, partner at Placeholder, who has consistently argued the bull market isn’t over, tweeted again: “When the blockchain economy thrives, it has the fastest economic feedback loop of any trillion-dollar system globally: activity → on-chain capital inflows → price → activity. We always forget this when we’re in despair, then get surprised by how quickly wealth can shift.”

Jack Tan, co-founder of WOO X, said: “Bitcoin breaking $100,000 again is not just a restoration of price confidence—it’s a strong global vote of confidence in the future vision of decentralized finance. As the impact of trade war developments fades, gold markets are entering a wait-and-see phase, and risk appetite is regaining dominance.”

Arthur Hayes, BitMEX co-founder and the most bullish “call king,” predicted that Bitcoin will reach $150,000 by the end of May.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News