KiloEx Hacked for $7.5 Million: Market Cap Not Enough to Cover Losses, Sparking Renewed Decentralized Trust Crisis?

TechFlow Selected TechFlow Selected

KiloEx Hacked for $7.5 Million: Market Cap Not Enough to Cover Losses, Sparking Renewed Decentralized Trust Crisis?

The actual loss from this attack is nearly equivalent to its current market capitalization.

By ChandlerZ, Foresight News

On April 15, perpetual contract DEX KiloEx announced that its treasury had been compromised. The team has contained the situation and temporarily suspended platform operations. They are now working with security partners to trace fund flows and plan to launch a bounty program. KiloEx is currently analyzing the attack vector and affected assets, while collaborating with ecosystem partners in efforts to recover funds. A full incident report will be released in the coming days.

On-chain data shows that the stolen funds from KiloEx’s address amount to approximately $7.4 million, including $3.3 million on Base, $3.1 million on opBNB, and $1 million on BNB Chain.

Market data indicates that KILO has dropped over 33% in the past 24 hours, hitting a low of 0.033 USDT, and is currently trading at 0.0346 USDT.

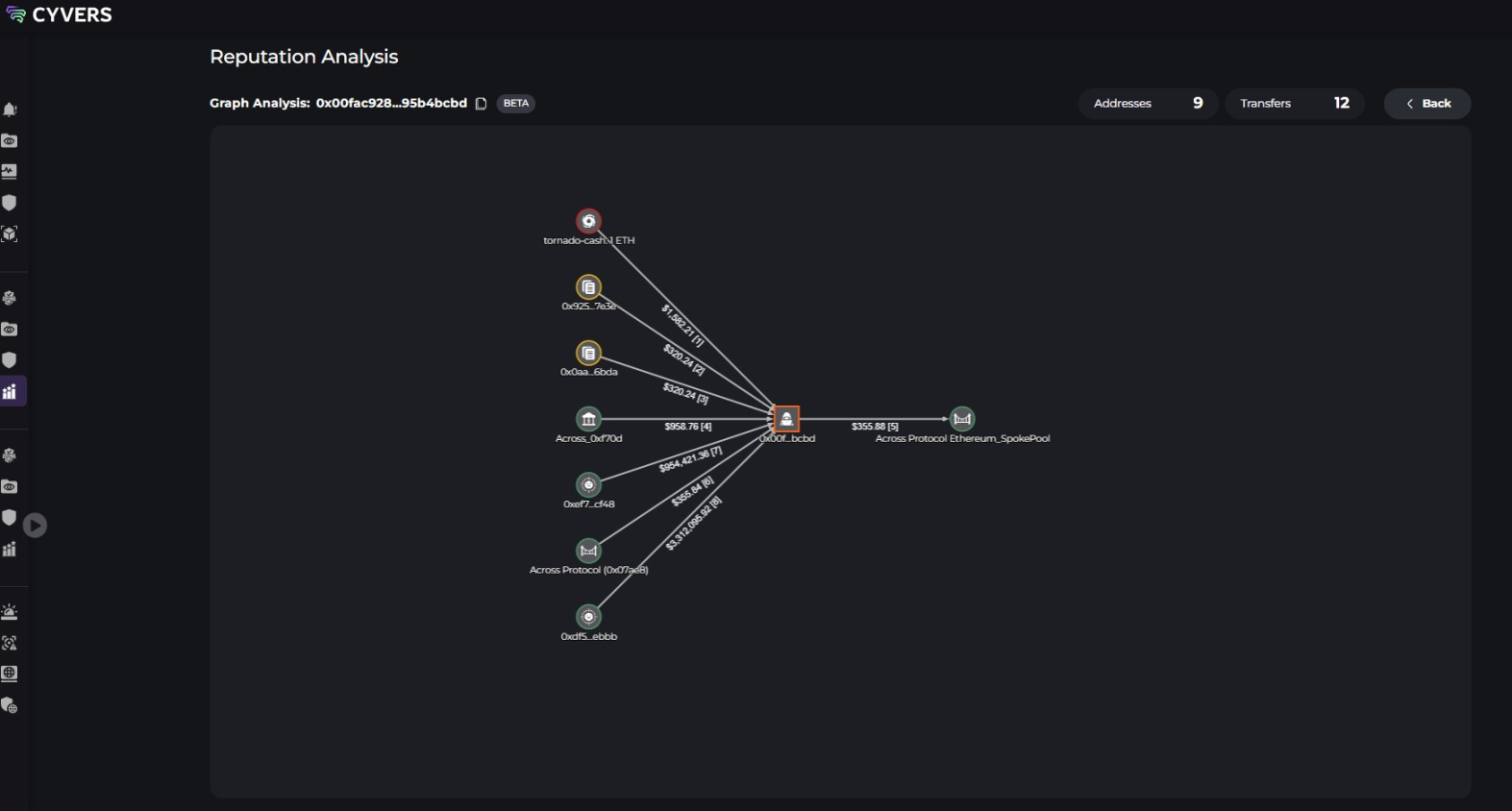

According to Cyvers Alerts, the root cause of this hack may have been an access control vulnerability in the price oracle.

In simple terms, oracles should only allow trusted roles to update price information. However, due to insufficient permission restrictions, attackers bypassed the validation mechanism and arbitrarily manipulated asset prices, thereby exploiting the contract logic.

Paidun's preliminary analysis of one attack transaction confirms an oracle-related issue. The attacker exploited this vulnerability by setting the initial ETHUSD price at 100 when opening a position, then immediately closing it at a manipulated price of 10,000, profiting around $3.12 million from a single transaction.

What is KiloEx?

KiloEx is a decentralized perpetual DEX focused on risk management, capital efficiency optimization, and LST token ecosystem integration. KiloEx participated in BNB Chain’s recent Airdrop Alliance initiative and the Renew Paradigm campaign on Manta Pacific, offering stablecoin yields through STONE staking. Additionally, KiloEx plans to introduce a hybrid vault and cross-margin trading features.

KiloEx itself is an oracle-based Perp DEX similar to GMX, with core innovations including:

-

Self-hedging, stablecoin-neutral LP

-

Copy Trading functionality

-

Tokenomics inspired by state-of-the-art mechanisms

In terms of funding, KiloEx received investment from Binance Labs and was incubated in its MVB Season VI program. It also secured backing from Foresight Ventures, Crescendo Ventures, Manta Network, 7UP DAO, Poolz Finance, GTS Ventures, and several angel investors.

KiloEx conducted an exclusive TGE via Binance Wallet on March 27, attracting over 70,000 users and seeing subscription demand exceed supply by 300 times.

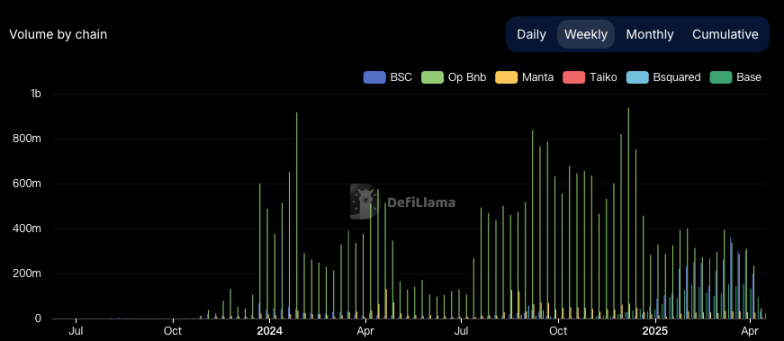

According to its official website, KiloEx has achieved a total trading volume of $3.764 billion, with a current TVL of $33.84 million. DefiLlama data shows that KiloEx averages around $100 million in daily trading volume, with a 7-day volume of approximately $500 million.

Trust Crisis and Community Backlash Exposed by Security Incident

Although the project team promptly suspended platform functions and partnered with security firms to track fund movements, the actual loss from this attack nearly equals KiloEx’s current market cap of $7.3 million, while its fully diluted valuation stands at only about $34.49 million. Such a significant theft occurring within a project of this scale has severely damaged user confidence. More concerning is that, as of now, the KiloEx team has not issued any detailed statement regarding user compensation, recovery plans, or how treasury funds will be managed, blurring the line between “hacker attack” and whether the project team will take responsibility.

On social media platforms, numerous community members have expressed strong dissatisfaction, criticizing KiloEx for lacking clear commitments to protect user interests during this critical moment. Some users have accused the team of “exiting in a bear market” and “raising funds loudly but handling aftermath quietly,” raising concerns about platform governance and financial transparency. The rapid shift in market sentiment led to a more than 30% drop in the KILO token in a short period.

While still in the early stages of incident response, the KiloEx incident highlights a central contradiction in the sustainability test facing a new generation of decentralized protocols: security is not a post-launch reactive measure, but a responsibility that must be embedded into architectural design from day one. Particularly given that KiloEx was incubated by Binance Labs and involved in high-profile airdrop initiatives, its core user base built trust based on perceived “official endorsement.” If the team fails to present a clear accountability framework, market confidence in its “security and controllability” will suffer fundamental damage—regardless of whether stolen funds are recovered—potentially impacting the reputation of its entire ecosystem network.

Structural Challenges Amid Frequent Security Incidents: Not Just a KiloEx Problem

Meanwhile, the Web3 space has recently seen a surge in security-related negative events, further deepening industry-wide trust issues. Shortly after the KiloEx breach, Bob Bodily, co-founder of Odin.fun, tweeted yesterday that his account may have been hacked, with the incident still under investigation. Earlier reports indicated that associated accounts were drained, suggesting possible theft. The fact that hacker attacks are now extending from smart contracts to founders’ personal assets indicates that attackers are no longer limited to technical vulnerabilities, but are instead launching systematic assaults across multiple vectors—including permissions, social engineering, and operational weaknesses—posing higher demands on project-level security governance.

Particularly alarming is that many small-to-medium-sized DEXs rely on on-chain oracles for pricing, yet still exhibit clear shortcomings in access control, permission verification, and anomaly detection. From a broader Web3 industry perspective, the absence of compensation mechanisms, imbalanced permission configurations, and vacant token governance structures are increasingly becoming red-line criteria in the community’s new investment evaluation frameworks. While markets previously prioritized product design and token return models, rising security incidents and tightening regulatory scrutiny mean that a project’s ability to establish an end-to-end framework—“prevention before, freezing during, compensation after”—will now be the key determinant of continued user and capital support.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News