US Suspends Tariff Collection for 90 Days, CPI and PPI Miss Expectations; Crypto Fear Eases | Hotcoin Research Market Insights

TechFlow Selected TechFlow Selected

US Suspends Tariff Collection for 90 Days, CPI and PPI Miss Expectations; Crypto Fear Eases | Hotcoin Research Market Insights

This week, market sentiment hit extreme fear due to the U.S. imposing excessive tariffs globally. On-chain stablecoins saw a slight decline, which is not an optimistic sign. U.S. spot Bitcoin ETFs experienced significant net outflows, and Ethereum ETFs also recorded net outflows.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total cryptocurrency market cap stands at $2.53 trillion, with BTC accounting for 62.35%, or $1.58 trillion. Stablecoin market cap is $233.5 billion, down 0.67% over the past seven days, with USDT representing 62.05% of that total.

This week, BTC has been trading in a range-bound manner, currently priced at $83,668; ETH has also fluctuated within a range, now at $1,580.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: XCN up 121.21% over 7 days, FARTCOIN up 82.36%, ORCA up 62.25%, and BABY up 58.74%.

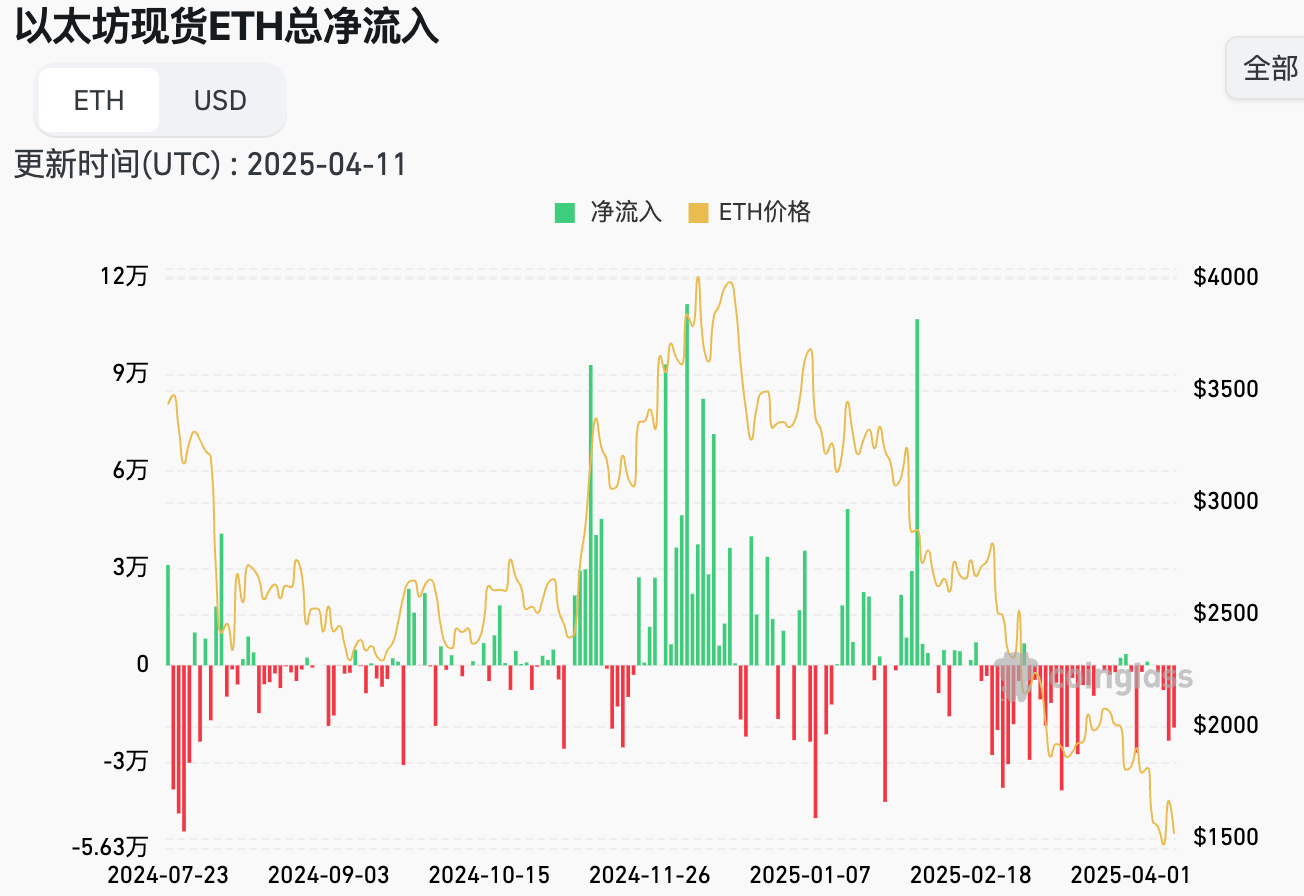

This week, U.S. spot Bitcoin ETFs saw net outflows of $708 million; U.S. spot Ethereum ETFs recorded net outflows of $82.5 million.

The "Fear & Greed Index" on April 12 was 43 (higher than last week), reflecting this week's sentiment: 1 day of extreme fear, 5 days of fear, and 1 day of neutrality.

Market Outlook: Earlier in the week, market sentiment briefly plunged into extreme fear due to the U.S. imposing excessive tariffs globally. Stablecoin holdings on-chain slightly decreased, indicating bearish pressure. Large outflows from U.S. spot Bitcoin ETFs and net outflows from Ethereum ETFs further added to concerns. However, later in the week, U.S. CPI and PPI data came in significantly below expectations. Combined with the announcement of a 90-day suspension of tariffs (excluding China), market sentiment improved. Cryptocurrency prices rebounded moderately in the second half of the week.

The probability of a 25-basis-point rate cut by the Fed in May is currently 16%, lower than last week. The overall market is expected to remain range-bound during April–May, with BTC likely to trade between $75K and $90K. For potential opportunities, focus on fundamentally strong projects such as Babylon, and monitor the “Hotcoin New Listings Radar” for additional wealth opportunities.

Understanding the Present

Review of Weekly Major Events

1. On April 8, Galaxy Digital announced that its registration statement filed with the U.S. SEC has become effective, preparing for a Nasdaq listing;

2. On April 9, according to FOX BUSINESS, the White House press secretary stated that the additional 104% tariff on China took effect at noon Eastern Time. This extra tariff began levying on April 9;

3. On April 9, Ripple announced via Crowdfund Insider that it will acquire Hidden Road Partners for $1.25 billion, entering the multi-asset institutional brokerage space. This marks one of the largest transactions in the crypto industry to date, making Ripple the first crypto firm to operate a multi-asset prime brokerage service. The deal was facilitated by FT Partners;

4. On April 9, Bloomberg reported that the U.S.-announced so-called “reciprocal tariffs” severely impacted global financial markets. Since April 3, global equity market value has shrunk by $10 trillion—slightly more than half of the EU’s GDP;

5. On April 10, former President Trump announced he authorized a 90-day suspension of tariffs, applicable to both reciprocal tariffs and the 10% tariff. The pause took immediate effect;

6. On April 10, after Trump announced the suspension of tariffs on most trading partners, U.S. stocks surged within minutes, with the S&P 500 jumping over 9% and U.S. market capitalization increasing by $4 trillion in just 10 minutes;

7. On April 10, market news indicated that the U.S. Securities and Exchange Commission (SEC) has approved options trading for spot Ethereum ETFs;

8. On April 10, the U.S. Senate confirmed Paul Atkins, President Trump’s nominee, as Chairman of the Securities and Exchange Commission (SEC) by a vote of 52 to 44;

9. On April 11, spot gold briefly spiked to $3,218 per ounce, reaching a new all-time high, before pulling back to $3,207 per ounce;

10. On April 11, according to market data, the yield on U.S. 30-year Treasury bonds rose to 4.907%, gaining 1.22% on the day;

11. On April 11, President Trump signed legislation officially repealing the IRS DeFi crypto broker rules—the first cryptocurrency bill to be signed into law by a U.S. president.

Macroeconomic Overview

1. On April 10, the U.S. unadjusted YoY CPI for March was 2.4%, below the expected 2.6%;

2. On April 11, the U.S. PPI YoY for March was 2.7%, lower than the forecasted 3.3% and prior 3.20%;

3. On April 10, according to CME's "FedWatch" tool, the probability of a 25-basis-point rate cut by the Fed in May is 16%, with an 84% chance of rates being held steady;

4. On April 9, the eurozone money markets are now fully pricing in a 25-basis-point ECB rate cut in April, compared to an 85% probability earlier in the week;

5. On April 9, Japan's 30-year bond yield hit a 21-year high amid market turmoil triggered by U.S. trade tariffs, as investors sold off the most liquid bonds to raise cash. With equities and oil prices plummeting, the 30-year JGB yield peaked at 2.785%, the highest since August 2004, rising 22 basis points on the day to close at 2.715%;

6. On April 9, Bank of Japan Governor Kazuo Ueda stated that if the economy improves as expected, the central bank will continue raising interest rates.

ETFs

Data shows that from April 7 to April 11, U.S. spot Bitcoin ETFs experienced net outflows of $708 million. As of April 11, GBTC (Grayscale) has seen cumulative outflows of $22.736 billion, currently holding $16.523 billion in assets, while IBIT (BlackRock) holds $47.899 billion. The total market cap of U.S. spot Bitcoin ETFs stands at $93.702 billion.

U.S. spot Ethereum ETFs recorded net outflows of $82.5 million.

Looking Ahead: Future Outlook

Upcoming Events

1. TOKEN2049 Dubai 2025 will take place in Dubai from April 30 to May 1, 2025;

2. Canada Crypto Week will be held in Toronto, Canada, from May 11 to 17, 2025.

Project Milestones

1. KerneIDAO will conduct its TGE on April 14, launching the KERNAL token;

2. Matchain, a decentralized and scalable AI blockchain, will begin Genesis license sales on April 14, offering 100,000 utility-focused licenses tied to its autonomous identity system MatchID;

3. 25% of the community airdrop tokens on Ethereum L2 network Mint will unlock on April 15;

4. Ripple Labs has requested to set April 16 as the deadline for filing court briefs in its case against the SEC.

Key Events

1. Trump has invited Salvadoran President Nayib Bukele to attend a White House meeting on April 14 to discuss bilateral cooperation and diplomatic relations;

2. A U.S. judge has postponed the trial of Tornado Cash developer Roman Storm, originally scheduled for December 2024, to April 14. The trial is expected to last two weeks.

Token Unlocks

1. Starknet (STRK) will unlock 127 million tokens on April 15, worth approximately $15.66 million, representing 4.37% of circulating supply;

2. Sei (SEI) will unlock 224 million tokens on April 15, valued at around $38.53 million, or 2.25% of circulating supply;

3. Zebec Network (ZBCN) will unlock 2.12 billion tokens on April 16, worth about $2.05 million, or 2.12% of circulating supply;

4. ApeCoin (APE) will unlock 15.38 million tokens on April 17, valued at approximately $6.59 million, or 1.54% of circulating supply;

5. Immutable (IMX) will unlock 24.52 million tokens on April 18, worth around $10.38 million, or 1.23% of circulating supply.

About Us

Hotcoin Research, the core investment research hub of the Hotcoin ecosystem, is dedicated to providing global digital asset investors with professional, in-depth analysis and forward-looking insights. We have built a three-pillar service framework—“trend analysis + value discovery + real-time tracking”—delivering deep sector analyses, multidimensional project evaluations, and round-the-clock market monitoring. Through our bi-weekly strategy livestreams “Top Coin Selection” and daily news digest “Blockchain Today,” we provide precise market interpretations and actionable strategies for investors at all levels. Leveraging cutting-edge data analytics models and an extensive industry network, we empower novice investors to build foundational knowledge and help institutional clients capture alpha, together seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and invest strictly within a sound risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News