Tariffs may only reveal the tip of the iceberg—what are the real challenges in the Chinese market?

TechFlow Selected TechFlow Selected

Tariffs may only reveal the tip of the iceberg—what are the real challenges in the Chinese market?

In terms of tariffs, China is an exception.

By Steven Sinofsky

Translated by zhouzhou, BlockBeats

Editor's note: This article explores the immense challenges U.S. tech companies face in China. While the Chinese market is alluring to foreign enterprises, issues such as weak intellectual property protection, heavy government intervention, and rampant piracy make doing business there exceptionally difficult. Companies like Microsoft have tried numerous approaches but continue to struggle against the complex barriers of the Chinese market. The piece emphasizes that while tariffs are visible, the real problems in China lie in soft restrictions, regulatory labyrinths, and cultural differences—calling for deeper understanding and discussion of these challenges.

Below is the original text (slightly edited for clarity and readability):

There’s been a lot of discussion about how American firms benefit from China’s powerful manufacturing base, with tariffs often at the center of international trade debates. But what’s frequently overlooked is just how hard it is for American companies to enter the Chinese market and build a sustainable business—especially in services and intellectual property-intensive industries.

Tariffs are merely the tip of the iceberg. Beneath the surface lies a vast, intricate network of “soft barriers,” regulatory hurdles, and cultural differences that make it nearly impossible for American firms to operate fairly and sustainably in the market.

I spent 15 years at Microsoft, including time living and working in China, where I experienced this firsthand. These experiences were far more challenging—and more revealing—than any tariff dispute.

Over the years, I attended many events in China focused on collaboration and piracy.

Microsoft’s first major push in Asia was entering Japan in the late 1980s. It wasn’t easy. We faced technical obstacles—such as the lack of a UNICODE standard—strong local preference for domestic products, and government policies that subtly favored Japanese companies. In many ways, this wasn’t so different from the “Buy American” policies we see at home.

But through persistence, respect for local customs, and massive investment in product localization, we eventually succeeded. Japan’s deep-rooted respect for intellectual property played a key role. By the mid-1990s, Microsoft Office in Japan had become one of the most profitable businesses globally, beloved by both enterprise and individual users, thanks to our tailored distribution models and localized software experience.

Windows 7 launch in Japan.

China, however, was a completely different story.

From the outset, we encountered a cascade of complex challenges. At one point, an early version of Windows was outright banned because part of the localization work had been done in Taiwan. And that was just the beginning. We repeatedly responded in good faith: building large local engineering teams, developing a popular Input Method Editor (IME), establishing advanced R&D centers, and strictly complying with all rules for operating in China—even hiring CCP representatives within our own offices.

Yet, we kept hitting walls.

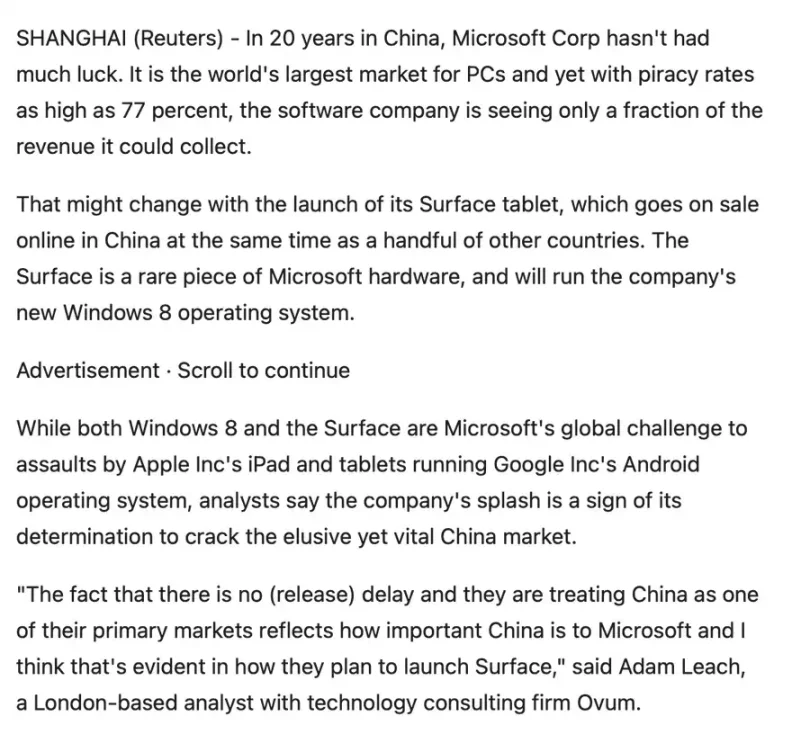

Piracy was the most obvious and frustrating challenge. While software piracy is a global issue, its scale in China was staggering. Around 90% of Microsoft products in China were pirated. Imagine a country with 200 million PCs generating roughly the same revenue as Italy—a country with only a quarter of the PC count and a "mere" 50% piracy rate.

We used to comfort ourselves with the idea that users would eventually pay once they grew fond of our products, and that revenue would rise once the government truly valued intellectual property.

A visit to any bustling computer market makes the problem visceral. Five or more floors packed with computers—from pre-built systems to DIY components. You pick your specs, and they assemble it on the spot.

Once built, they hand you a software menu. Pick what you want, and shortly after, you receive a custom CD loaded with every piece of software you selected—Windows, Office, Photoshop—along with serial numbers in a text file in the root directory, sometimes even bundled with pirated movies. The whole package? 100 RMB (about $12 at the time).

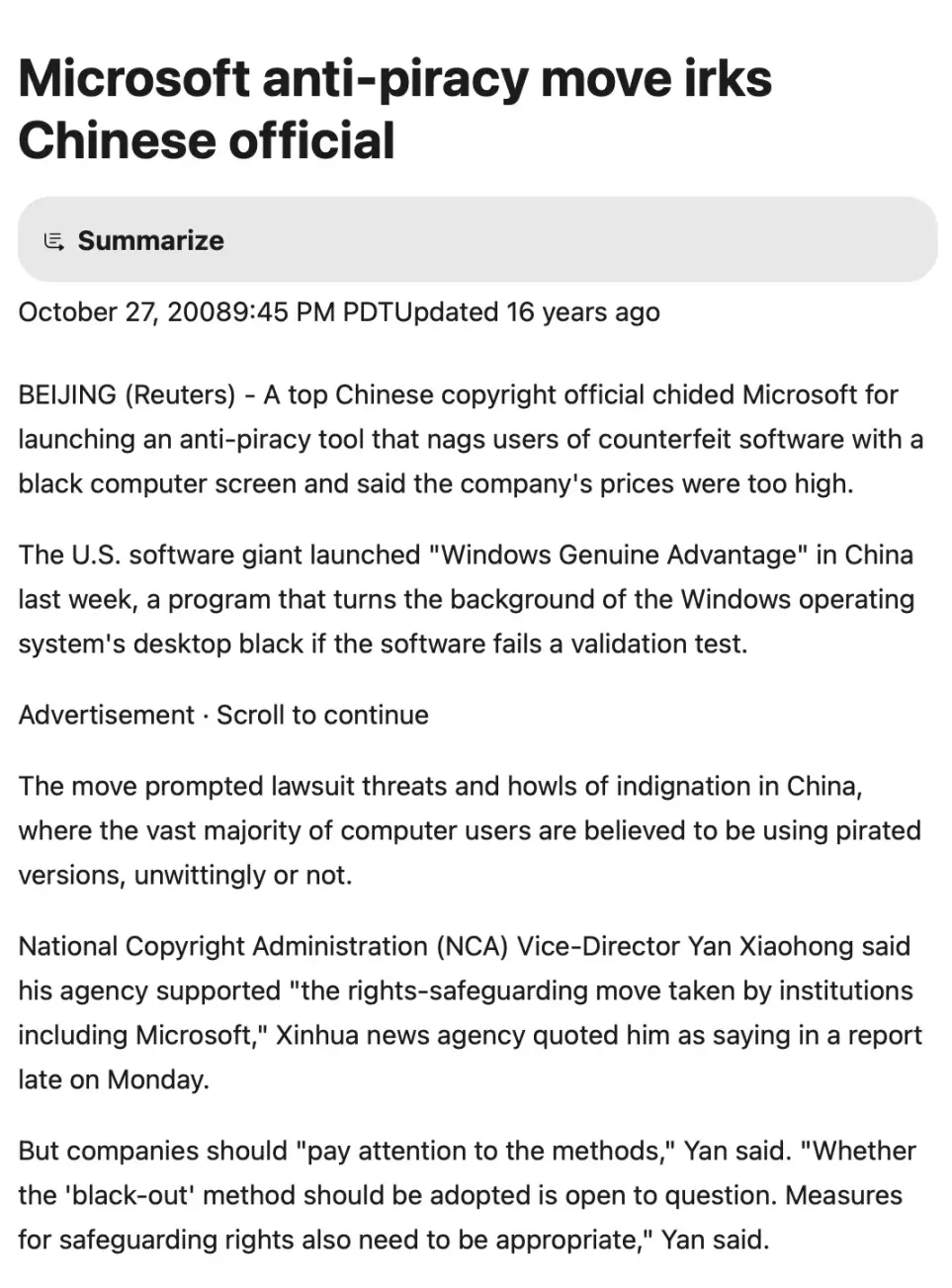

We pleaded our case repeatedly in meetings with government officials. Through endless banquets and countless glasses of baijiu, we talked about cooperation, innovation, and the value of intellectual property. But the response never changed: officials cited poverty, claiming people couldn't afford genuine software—all while arriving in black Mercedes and dining lavishly in upscale restaurants above luxury Ferrari showrooms.

Eventually, some officials became more candid: “We don’t agree with your concept of intellectual property,” they told us. “We believe knowledge should be shared and disseminated.”

In theory, that’s a noble idea—one echoed by open-source advocates—but in practice, it served as little more than justification for copying and reselling our work without compensation.

We gradually introduced stronger anti-piracy measures in Windows (and later Office), only to find users simply switching to older versions that were easier to crack—versions not only more vulnerable to piracy but also to hacking. We shared designs and plans with the government in advance, yet still faced strong resistance. They told us our “approach” didn’t meet market needs—like a simple registration wizard.

So you’d see airport flight information screens displaying “Unlicensed Windows” warnings. My supermarket checkout ran Windows XP ten years after its release, simply to avoid paying for upgrades. PC manufacturers stopped pre-installing Windows altogether, even openly claiming it was to comply with U.S. antitrust laws.

And it wasn’t just software. Companies across industries in the U.S. and Europe—pharmaceuticals, fashion, publishing—face similar struggles. I remember visiting a massive pharmaceutical plant on the outskirts of Shanghai. Tech circles know Foxconn and device makers, but pharma operations are even larger. Officials claimed these factories produced solely for Western companies, but everyone knew some output would quietly enter the local market—with no return to the innovators who developed the drugs.

Even consumer goods weren’t spared. Once, during a rainy hike with colleagues from Microsoft China, I noticed they were all wearing North Face jackets just like mine. But while my jacket stayed dry, theirs were soaked through—counterfeits made in the same factories, bearing identical logos, but using inferior materials.

I once believed we could find a path to success in China. I advocated for expanding local R&D, gave speeches everywhere, led team expansions, and held onto hope that, like in Japan, we could achieve hard-won but real success. But over time, I realized: compromise has no end, and a truly sustainable long-term business model simply doesn’t exist.

We’re not alone. Google exited China. Meta is almost entirely blocked. Even in eras of cloud computing and subscription software—where piracy is harder—Microsoft’s revenue from China still accounts for less than 1% of global total. Even Apple—one of the few American success stories in China—faces immense pressure from government intervention and local competition. Automakers like Ford have pulled out; BMW and Volkswagen’s market shares are now half what they once were.

When discussing fair trade, it’s easy to focus on tariffs. Tariffs are visible, quantifiable, and politically convenient. But in China, tariffs are far from the biggest obstacle. The real challenges are much harder to measure: soft restrictions, regulatory mazes, cultural divides, and shifting definitions of fairness and property rights.

Yes, every country has its forms of protectionism—including the U.S. Relations between EU and U.S. tech firms are also fraught. But over decades, we’ve found ways to navigate those regions. In China, after 25 years of effort, we’re still waiting for meaningful breakthroughs that would allow the tech industry to operate effectively.

So when we talk about international trade, let’s not stop at tariffs. The real story—especially in China—is far more complex, and far more important.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News