The world is a massive rat hole

TechFlow Selected TechFlow Selected

The world is a massive rat hole

You and I are both prey in the game.

By TechFlow

From Wall Street to blockchain, "rat trading" is nothing new.

In the past, such activities were at least somewhat concealed, with a trace of shame. Now, it’s all out in the open—no pretense left.

In early 2025, Trump launched a meme coin under the guise of a "crypto strategic reserve," manipulating markets. Today, he wields tariffs like a Sichuan opera performer changing masks, pushing this collusion of power and capital to historic heights.

When the president becomes a market manipulator and regulation turns into a fig leaf, the world becomes a colossal rat-trading arena—and each of us is prey within the game.

The White House Turns Into a Casino: Trump’s Art of the Flip-Flop

"Since over 75 countries have contacted the U.S. expressing willingness to negotiate, and upon my strong recommendation refrained from retaliating against the U.S. in any manner, form, or shape, I have authorized a 90-day suspension and will significantly reduce reciprocal tariffs on other nations to 10%, effective immediately."

Midway through trading, Trump’s social media post reversed the nervous sentiment across U.S. markets, sending all three major indices soaring.

The Dow surged over 2,900 points, up 7.87%—its largest gain since March 25, 2020. The S&P 500 jumped 9.52%, its best day since October 29, 2008. The Nasdaq skyrocketed 12.16%, marking the second-largest single-day rally in history.

All seven tech giants saw massive gains, collectively adding $1.85 trillion (roughly RMB 13.4 trillion) in market value—all within just hours.

Notably, shortly after the market opened, Trump posted on his social platform Truth Social: "Now is an excellent time to buy." He urged followers to "stay calm" and predicted everything would "work out fine."

At the time, the comment seemed merely encouraging. But in hindsight, it raises troubling questions.

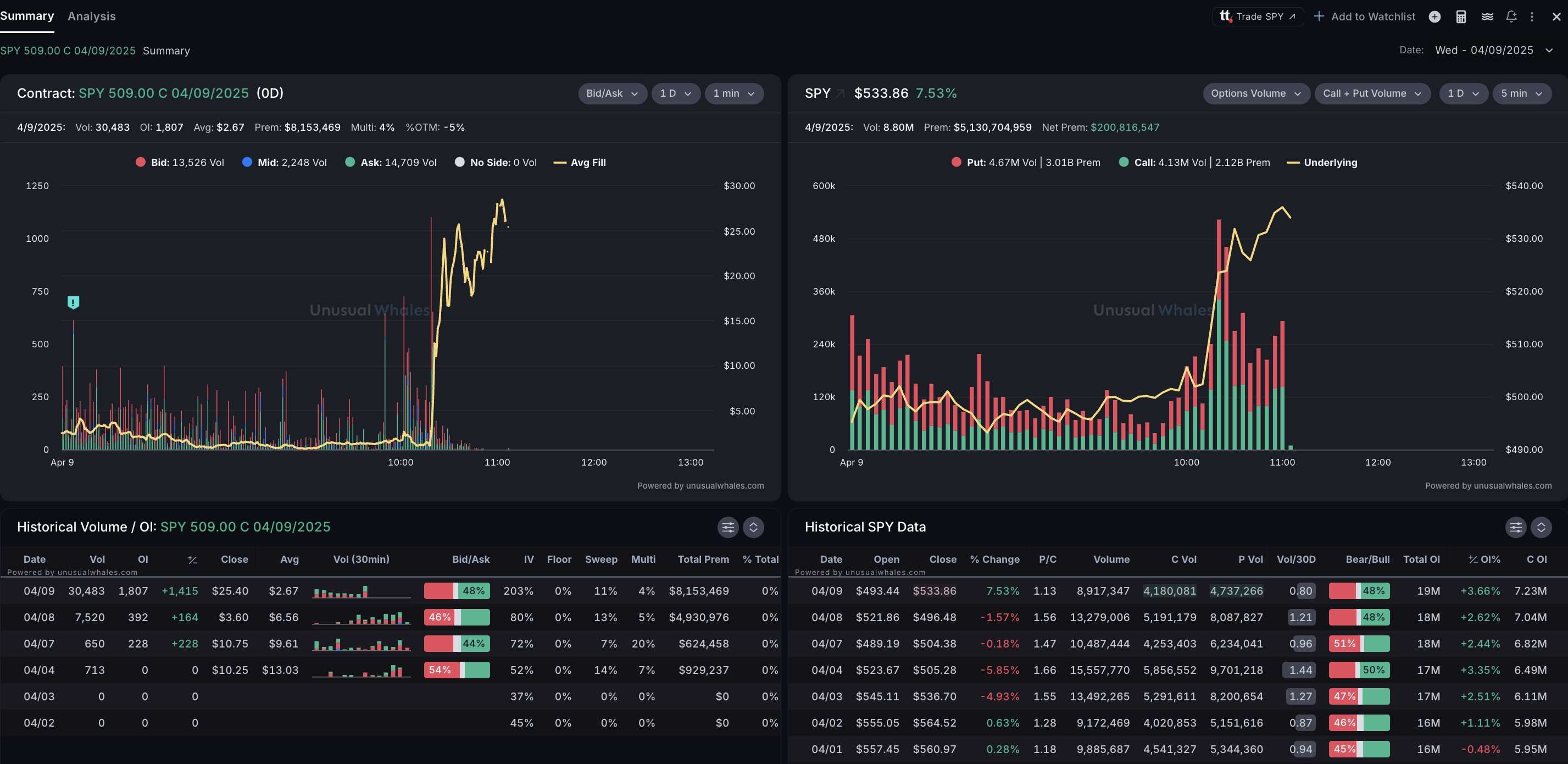

According to market data disclosed by Unusual Whales, large bullish options positions in $QQQ, $TQQQ, and $SPY had already been established before Trump issued his "buy" signal. More shockingly, right before the tariff suspension was announced, someone purchased same-day-expiring $SPY 509 call options, which surged an astonishing 2,100% within one hour.

All these trades were newly opened that day—an anomaly given the market's implied volatility ratio (IVR) of 82 and extremely high implied volatility (IV). Traders appeared certain of the direction, making bold directional bets.

Net premium tracking shows clearly that after these initial moves, more investors piled in, loading up on call options to bet on a reversal. This all points to one disturbing conclusion: certain parties knew about the policy shift in advance.

On X, many users expressed frustration mixed with resignation:

"Trump uses the presidency to make millions for his family and friends."

"The market is a casino for insiders. We’re just the suckers at the table."

Ironic too: days earlier, CNBC reported Trump was considering a 90-day tariff pause on some countries. At the time, White House press secretary Karoline Leavitt swiftly dismissed it as "fake news."

Just days later, that "rumor" became a "prophetic insight."

Trump Plays the Crypto Crowd

This isn’t the first time Trump has manipulated financial markets this year—he previously toyed with crypto twice.

On March 2, 2025, Trump announced the creation of a "Cryptocurrency Strategic Reserve" via social media, instantly spiking tokens like XRP, SOL, and ADA.

As people questioned why BTC and ETH weren’t mentioned, he quickly followed up: "Clearly, BTC and ETH, along with other valuable cryptocurrencies, will be at the core of the reserve. I am a fan of Bitcoin and Ethereum."

Ethereum promptly rose.

However, these moves appear more like the work of Trump’s son. His second son, Eric Trump, praised the move online:

I love the genius of announcing the strategic reserve on a Sunday when traditional markets are closed and Wall Street is asleep. For once, retail investors win. Traditional finance better catch up, or they’ll go extinct. The world no longer runs Monday to Friday, 9 to 5.

The crypto community largely reacted with skepticism, questioning whether Trump family members engaged in significant rat trading.

Back in January 2025, during the launch of Trump’s meme coin, extensive rat trading also occurred.

Data analytics platform Bubblemaps revealed that an address starting with 6QSc2 received funds four hours before the TRUMP token launch and spent $1 million to purchase 5.9 million TRUMP tokens in the first minute.

The address then transferred all TRUMP tokens to an ff.sol wallet, redistributing them across 10 addresses for staged sales, cashing out tens of millions of dollars.

This was only the "tip of the iceberg." The Trump family has publicly cashed out over $100 million via $TRUMP and other meme coins, operating with even greater impunity in the lightly regulated crypto space.

Those familiar with Trump aren’t surprised. During his previous term, he was similarly accused of profiting from self-generated insider information.

In 2019, Vanity Fair published an exposé claiming: within Trump’s seemingly chaotic statements on China-U.S. tariffs lay a highly profitable rat-trading scheme.

Take June 28: in the final 30 minutes of trading, massive long positions were taken on S&P futures contracts.

Shortly after, Trump announced in Osaka that China and the U.S. would resume negotiations. Markets surged on the positive news. That mysterious trade reaped nearly $1.8 billion in profits within a week.

It’s not just Trump—many White House officials are financial market wizards.

Democratic former Speaker Nancy Pelosi is famously dubbed the "Oracle of Capitol Hill," with an impressive track record:

January 2021: Before the Biden administration announced EV subsidies, Pelosi’s husband Paul bought Tesla shares worth millions;

March 2021: Before Microsoft secured a $22 billion Pentagon AR helmet contract, Paul bought Microsoft stock at a low price;

July 2021: Amid antitrust investigations into big tech, Paul went long on Google. With no adverse impact, Google’s stock soared, netting Paul huge profits;

July 2022: Weeks before Congress voted on a $52 billion chip manufacturing subsidy bill, Paul had already purchased Nvidia shares valued between $1 million and $5 million.

According to OpenSecrets, the Pelosis achieved a 56.15% investment return in 2021. In 2024, Pelosi’s portfolio gained 70.9%, far exceeding the S&P 500’s 25% rise—and outperforming legends like Warren Buffett (26%), David Shaw, and Jim Simons.

The Arrogance of Power: Financial Markets’ Ultimate Bullying

Why do we despise rat trading so much?

Because it’s bullying—the privileged exploiting ordinary people who play by the rules.

In financial markets, average investors painstakingly research and take risks, seeking one thing above all: fairness, fairness, and fairness.

When a head of state casually manipulates markets through policy announcements, enabling inner circles to profit in advance, it’s no longer just insider trading—it’s the complete distortion of market mechanisms by power.

Traditional rat trading relies on confidential information and operates covertly, at least acknowledging its disgrace.

But now, Trump doesn’t just generate insider information—he openly promotes it, unapologetically displaying an attitude of “what can you do about it?”

In this era where power and capital are deeply entangled, if basic market fairness cannot be guaranteed, then globalization and free-market economics become nothing but a solo performance by the elite.

Perhaps this is the ultimate form of modern capitalism—power directly controls markets, elites openly harvest global wealth, and the majority are left as ignorant pawns in a giant rat-trading game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News