The market crashed, but you haven't lost yet

TechFlow Selected TechFlow Selected

The market crashed, but you haven't lost yet

At critical moments, initiate cognitive upgrading.

Author: Tokyo

Translator: Asher

Growth and Evolution Amidst the Turbulence

Recently, Bitcoin plunged over 20%, Ethereum dropped nearly 30%, and many altcoins suffered declines of around 70%. Whether you're a seasoned market veteran or a newcomer just entering the space, such extreme volatility can feel overwhelming. One thing is certain: this market shakeout isn't an isolated experience—it's a collective pain shared across the entire crypto ecosystem.

Everyone Is Bleeding—It’s Not Just You

When prices spiral downward, anxiety and helplessness are natural reactions. I’ve taken significant losses too. Even with prior experience through bull and bear cycles, every downturn still hits hard. The decline isn’t just about shrinking numbers on a screen—it strikes at your beliefs and emotions. We’ve grown accustomed to the market’s relentless pace, where euphoria during rallies and panic during drops have become routine. But this latest wave of volatility has reminded everyone, regardless of strategy or position size, what it truly feels like to lose—and how heavy that burden can be.

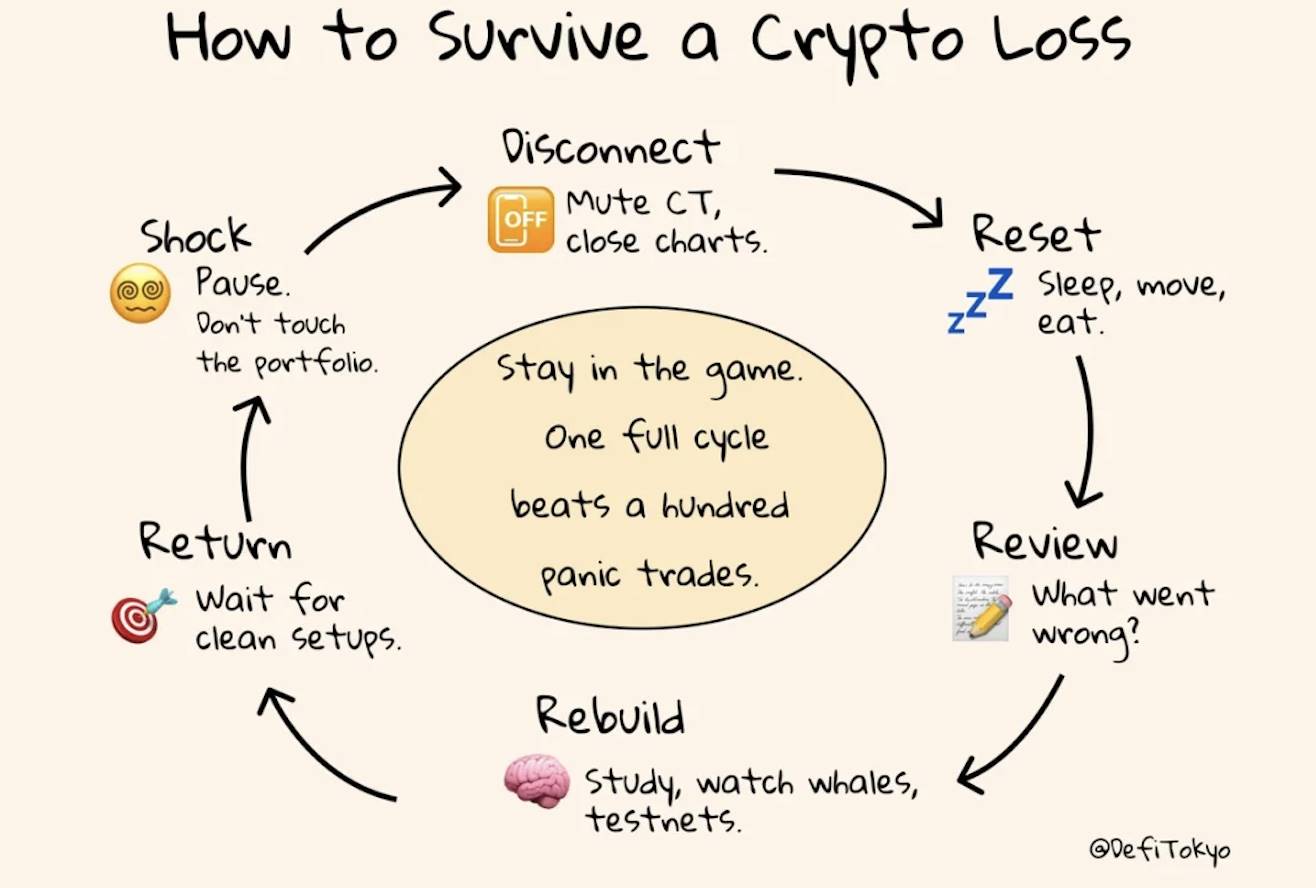

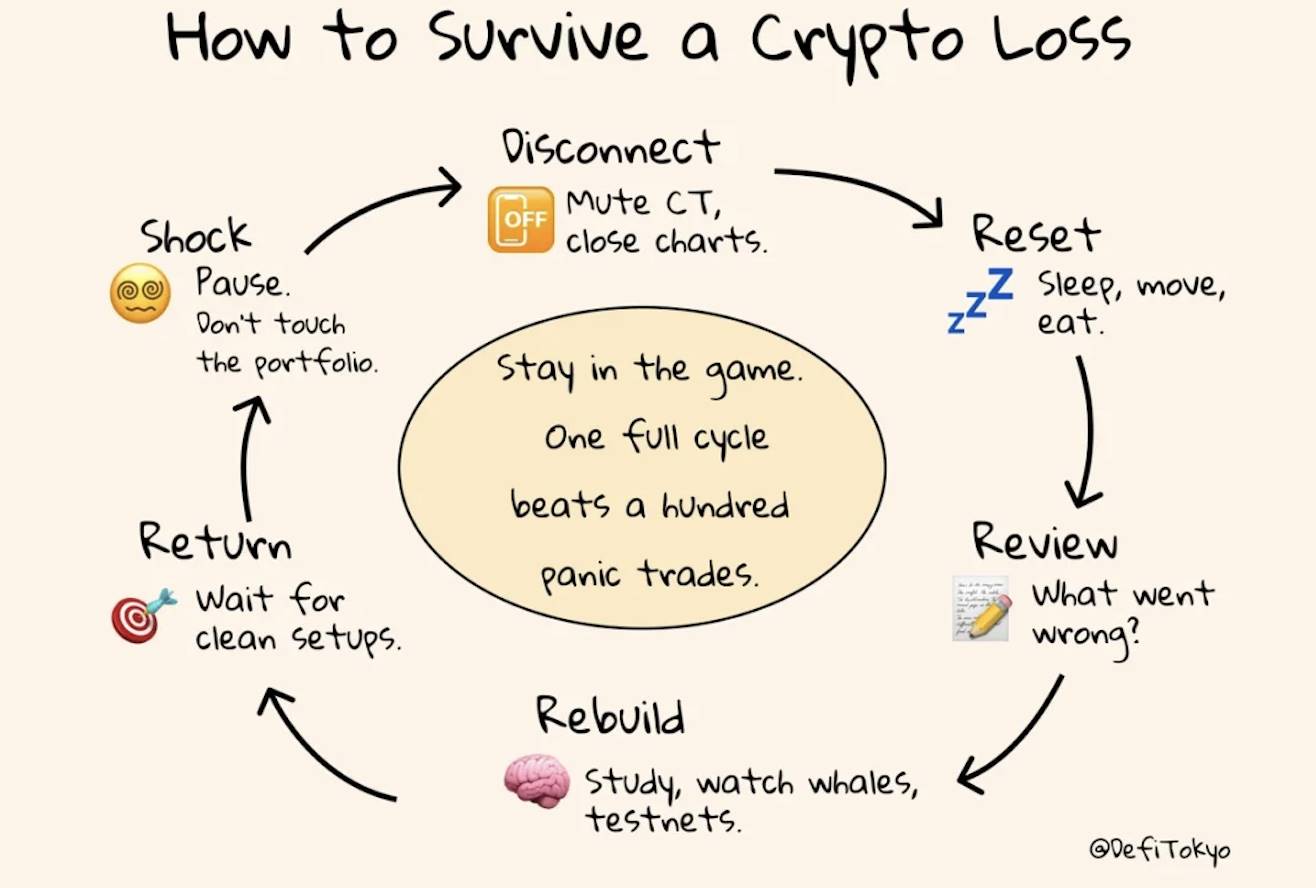

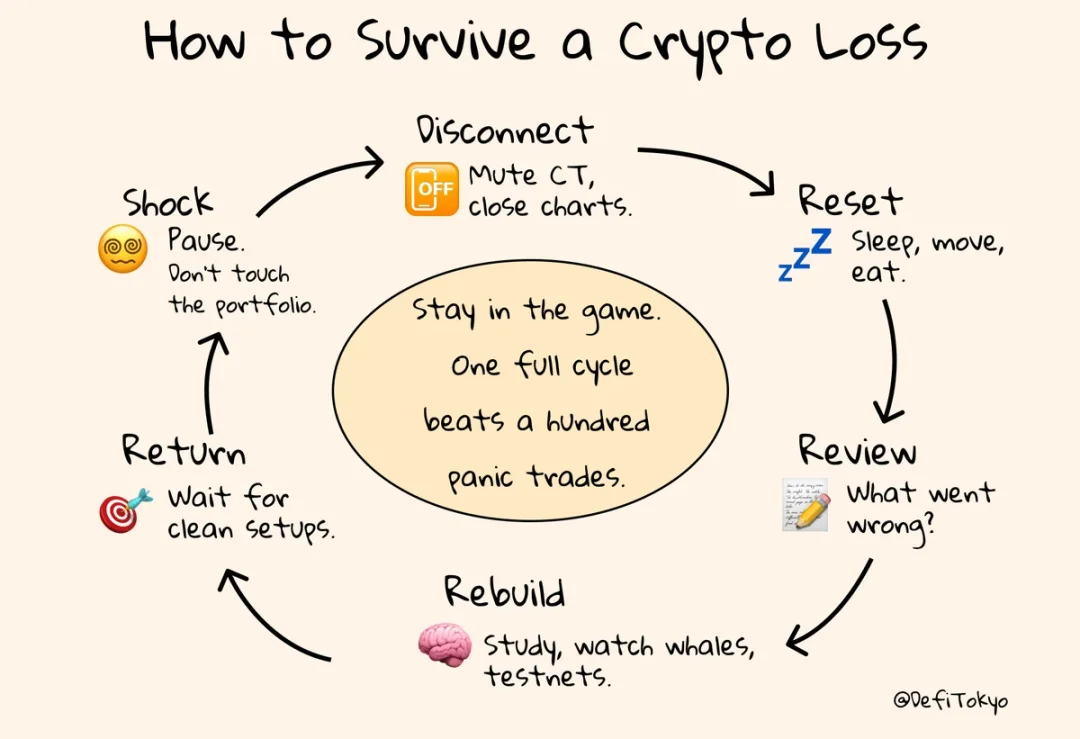

First, Stop—And Take Care of Yourself

Market swings can catch anyone off guard. In fear, many rush to act, desperate to recover losses quickly. But the most important step right now isn’t chasing gains—it’s learning to pause and reset your mindset. Close those constantly refreshing K-line charts. Step away from social media. Don’t let external noise and negativity further cloud your judgment. Give yourself time to rest. Enjoy a warm meal, get enough sleep, take a peaceful walk—allow your body and mind the recovery they need. Only when you’ve regained inner calm will you be able to think clearly and face the market again with clarity.

Power Down and Reboot—Start With Body and Mind

Sometimes, the simplest adjustments bring the biggest change. Cutting off anxiety-inducing information flows and returning to basic routines is the first crucial step out of emotional distress. Try spending a full day away from screens—give yourself a chance to go “offline.” Put down your phone, close your eyes, and simply focus on your breath. That sense of peace will gradually restore your inner strength. As we often say: only by healing yourself first can you begin to heal your portfolio. This is the true path forward.

Calmly Review—Face Losses with Rationality

Once your emotions have settled, take out a pen and paper and thoughtfully review your recent trading journey. This isn’t about self-blame or regret—it’s about identifying the root causes behind your losses. Ask yourself honestly: Was your position too large? Did you neglect stop-loss settings? Did you blindly chase momentum? Or trust unverified information? Write down each insight and lesson. This process isn’t just personal growth—it’s building a foundation to avoid repeating the same mistakes in future markets. Losses hurt, but only by learning from them can you gain an edge when the next opportunity arises.

Rebuild From the Ground Up—Step by Step

The priority now isn’t rushing to find new profit opportunities, but restoring stability and order in your daily life. Reset your sleep schedule, ensure nutritious meals, and maintain moderate exercise. These ordinary habits form the bedrock for rebuilding both mental resilience and your trading system. As your daily rhythm returns, inner restlessness and fear will naturally subside. Rebuilding yourself isn’t merely about re-entering the market—it starts with mastering the smallest details of everyday life, making you stronger and more composed.

Regroup—Focus on What You Can Control

You can’t control market movements, but you can absolutely control your learning and thinking. Dive deep into reviewing every past trade—analyze what led to success or failure. Use on-chain data tools like Nansen and DeBank to access real-time insights and data. Track the moves of major players and “whale addresses” to understand their strategies and logic. Through continuous study and accumulation, you’ll discover that rationality and data far outweigh fleeting emotions in shaping investment outcomes. True winners aren’t just those who seize opportunities amid chaos—they’re the ones who steadily elevate their understanding during calm periods.

Remember: Don’t Rush to Win It Back

After suffering losses, many feel compelled to quickly recover their funds. But this impulse often leads to self-destruction. Chasing losses increases the risk of falling into cycles of high leverage and overtrading—potentially wiping out your account entirely. What you need most now is calmness and patience, not impulsive actions. Wait for the market to stabilize. Wait for clear signals. Then—and only then—should you act decisively. Smart investors know that the key during volatile times is emotional stability, waiting patiently for the optimal moment to strike.

Growth Through Pain—Insight Makes You Stronger

After enduring this market trial, you’ll realize that pain eventually transforms into invaluable wisdom. Market lows expose your weaknesses and teach you the value of steady, disciplined progress. Perhaps you’re moving slower now, but your future decisions will be more thoughtful and rational. You’ll learn to recognize long-term opportunities instead of demanding profit from every single trade. It’s through overcoming such challenges that you emerge more resilient and insightful—gradually reclaiming your confidence and sense of purpose.

If You’re Still Holding On, You’re Already Ahead

If you’ve made it this far, it means you’ve chosen to stay in the game rather than walk away after a setback. Compared to the 90% who give up, you already possess greater courage and perseverance. Losses don’t define who you are—it’s how you respond and what you learn that matters. These experiences are precisely what will shape you into a mature, rational, and capable investor—one who can navigate market swings with strength.

Slow Down, Reset Yourself—The Future Holds Infinite Possibilities

Markets rise and fall, and with each cycle, you grow. Remember: a stable mindset and continuously improving understanding are the keys to long-term success. Look further ahead. Once you’ve completed your personal reset and upgraded your thinking, the next opportunity will arrive quietly. And when it does, you’ll stand at the forefront—calm, confident, and ready to embrace a brighter future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News