Lens flagship project Phaver ceases operations—will the crypto market face a new wave of shutdowns?

TechFlow Selected TechFlow Selected

Lens flagship project Phaver ceases operations—will the crypto market face a new wave of shutdowns?

Garbage time is indeed the best opportunity to BUIDL. But a player's first priority is to survive and stay in the game.

By Nianqing, ChainCatcher

Recently, DeFi researcher Ignas revealed in a tweet that after communication with the team, it has been confirmed that the crypto social app Phaver will cease operations. Additionally, Phaver still needs to pay severance fees equivalent to 1–2 months’ salary for its employees. Some former team members are now developing SocialDAO, seeking new utilities for the SOCIAL token.

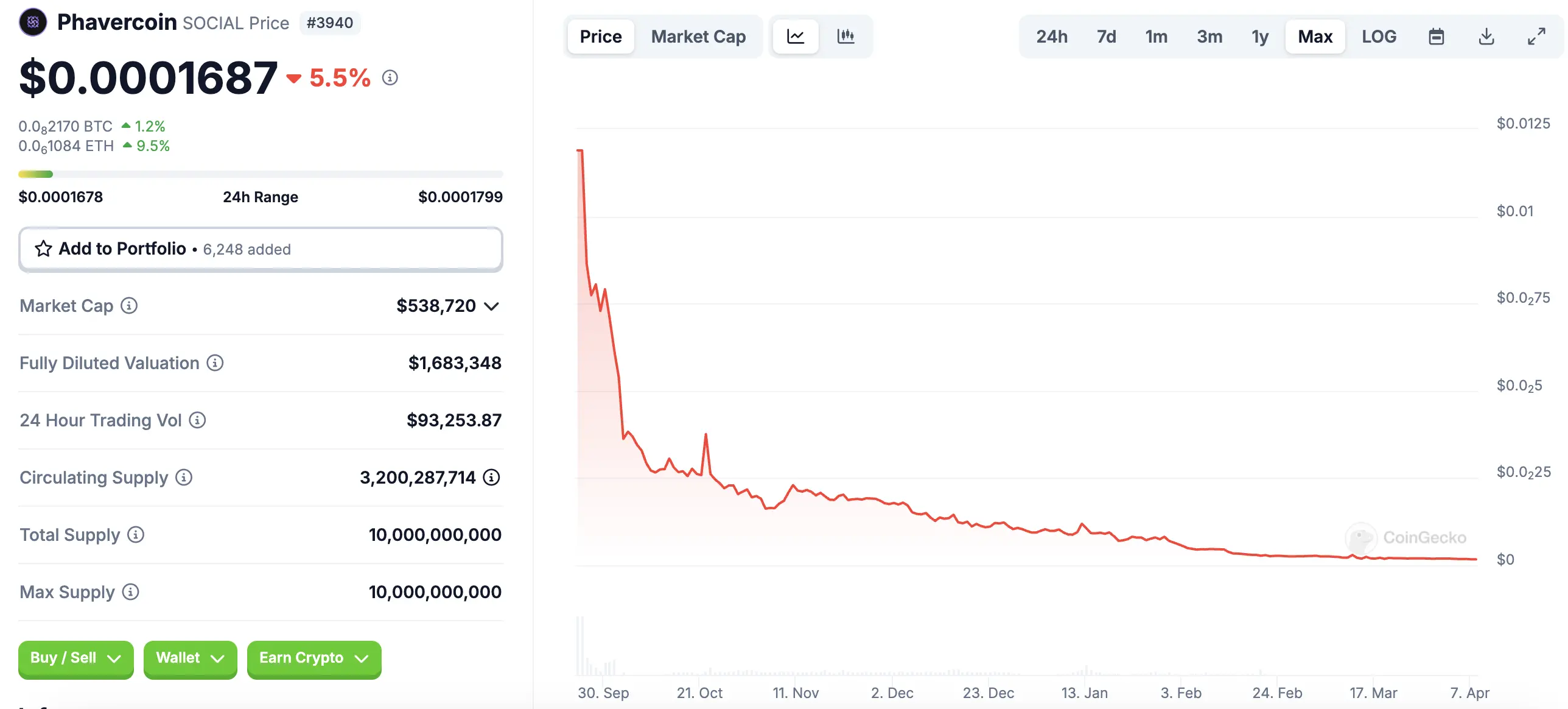

The price of Phaver's token SOCIAL has dropped 99% since its TGE in September 2024. At the time of writing, it trades at $0.000168, with 68% of the tokens still unclaimed.

In 2023, Phaver was once highly anticipated amid the SocialFi boom. It was the largest mobile application on the Lens protocol, with over 800,000 downloads and reaching a peak of 35,000 DAUs. At its height, it accounted for 50% of Lens traffic and 40% of external Farcaster app usage.

Clearly, Phaver—aiming to "break down barriers between Web2 and Web3 social through Web2.5"—was unable to overcome the persistent growth challenges within the SocialFi sector. After short-term incentives ended post-TGE and the SocialFi hype faded, the project became unsustainable.

Besides Phaver, TreasureDAO, which once aspired to become the “Web3 Nintendo,” recently announced a full halt to game development and publishing, pivoting toward AI instead.

Although entertainment-focused applications like social platforms and games have carried the crypto industry’s hopes for mass adoption, aside from financial use cases such as stablecoins, DeFi, and RWAs, other sectors are now under pressure of being disproven. After the last bull market, spring has yet to arrive for social, NFTs, and blockchain gaming. Amid this prolonged winter, the crypto market may be heading into a new wave of shutdowns.

A Brief History of Phaver’s Rise and Fall

Founded in 2020, Phaver’s team consists of alumni from Google, Goldman Sachs, Alibaba, and other major companies. The founder brings extensive experience in Web2 social apps. Phaver aimed to offer a Web3 social experience powered by decentralized protocols like Lens and Farcaster, allowing users control over their social interactions. It branded itself as “Web 2.5,” supporting Web2 login methods to simplify user onboarding into Web3. Moreover, it was the only social app enabling cross-posting and integrating both Lens Protocol and Farcaster.

In October 2023, Phaver raised $7 million in a seed round led by Polygon Ventures, Nomad Capital, Symbolic Capital Partners, Foresight Ventures, dao5, f.actor, Superhero Capital, and Alphanonce, among others, with a valuation of approximately $80 million.

In May 2024, Phaver launched its SOCIAL token and initiated its first airdrop season, completing its TGE in September of the same year. After TGE, however, there were few significant updates from the official team.

By the end of 2024, Phaver officially announced a full transition into SOCIAL DAO—an “AI-first internet organization.” This meant only a small number of team members would continue contributing to the DAO, while daily operations adopted AI agents to reduce costs.

Phaver’s mobile app was discontinued in January this year. Currently, apart from staking functionality, the SOCIAL token is virtually indistinguishable from a memecoin.

A New Wave of Project Shutdowns Incoming?

On April 3, the gaming ecosystem TreasureDAO announced it would fully cease game development and publishing, shifting focus toward an AI transformation. Facing deteriorating finances and restructuring, TreasureDAO currently holds only $2.4 million in treasury while annual operating expenses reach $8.3 million—originally projected to last only until July this year. The DAO has laid off 15 staff members and decided to discontinue its gaming business and Treasure Chain, assisting partners in migrating to other blockchains.

The consensus that social and gaming serve as gateways to Web3 mass adoption is collapsing.

With the rise of concepts like NFTs, Web3 social, and GameFi, the crypto revolution around data ownership gradually became tied to Web3.0, strengthening crypto believers' faith. Yet in this market cycle, financial use cases such as Bitcoin ETFs, RWAs, and stablecoins remain dominant, while other sectors face increasing skepticism. Since the last bull market ended, the long-awaited spring for social, NFTs, and blockchain gaming remains absent. Web3 belief is beginning to waver—cryptocurrency appears more like a major innovation in fintech rather than a disruptive upgrade to the internet.

In this prolonged bear market, the crypto industry may soon face another wave of project shutdowns.

Bear Market Survival Rule: Staying Alive Is Priority One

The struggles of Phaver and TreasureDAO have sparked deeper discussions: when the market cools, how can projects survive?

According to Phaver team members, three main reasons led to the shutdown of the original social project:

-

TGE and airdrop issues: During TGE, the airdrop portal suffered hours of downtime, preventing users from claiming tokens immediately, triggering panic (FUD).

-

Excessively high CEX listing fees: Over $1 million was spent listing on five exchanges including Bybit, KuCoin, and Gate, draining resources.

-

Lack of operational funding: No tokens were sold during TGE to avoid further FUD, resulting in insufficient funds to sustain operations.

Phaver’s closure serves as a reminder that strong financial management is essential for any crypto project—if neglected, failure becomes highly likely. While the Phaver team did prioritize product development, they overlooked economics and token management. Notably, they didn’t sell any tokens at launch. As Phaver founder & CEO Joonatan Lintala previously told ChainCatcher: “Friend.tech’s rapid growth was interesting, but we’re fundamentally different. We place far greater emphasis on social aspects than tokenomics.”

Despite Farcaster raising a $150 million Series A at a $1 billion valuation last year, it too faces listing pressures. The social sector consistently struggles with balancing short-term incentives against sustainable long-term growth. Without a killer use case or compelling incentives, it remains difficult to lure users away from traditional platforms like X or Weibo.

Moreover, Phaver stands as a cautionary tale explaining why teams rush to list on top-tier exchanges. KOL @Chen Jian Jason believes many projects list on Binance despite the risk of immediate price drops—not primarily to raise money, but to avoid complete collapse. As long as you have a listing on Binance, even if your token falls more than 10x during a harsh bear market, there's still a good chance of revival in the next bull cycle. But without a major exchange listing, zero means truly zero.

@Ye Su argues that for mid-tier projects (with less than $10M in funding), spending heavily to list on second-tier exchanges accelerates death. The right approach is to avoid paid CEX listings altogether, opt for DEX listings instead, and save capital to refine the product. Projects progressing well today maintain valuations around $150M—the key is surviving the winter.

Even in garbage time, building remains the best opportunity. But the player’s first priority must always be survival—staying alive and staying in the game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News