Why are more and more people choosing to leave the Web3 industry recently?

TechFlow Selected TechFlow Selected

Why are more and more people choosing to leave the Web3 industry recently?

Setting aside superficial restlessness, we need to see more of what is changing or has yet to be changed across industries.

By Blockchain Knight

"Only when the tide goes out do you discover who's been swimming naked." This Warren Buffett quote perhaps best describes the current state of the crypto market. Over the past period, we've sporadically heard or seen news about yet another XXX "exiting the space." These messages are less about complaints and have instead become a reflection of the industry’s prevailing sentiment.

As to why these individuals are choosing to leave, I’ve roughly tracked several primary reasons.

The most common reason is the prolonged bearish market or personal setbacks caused by market conditions, forcing some people to temporarily step away in search of a "new beginning." Secondly, over the past one to two years, Web3 has been experiencing a kind of unappealing, unhealthy growth, leading some value creators to exit as they see little real value being generated. Additionally, a segment of participants has turned their attention to the rise of AI, believing Web3 has become outdated and that new blue oceans lie elsewhere.

Of course, these reasons vary significantly at the individual level. Yet none of these factors should be extrapolated from isolated cases into a broad narrative. The majority of market participants still remain观望or continue building, because this industry—over a decade in development—has faced such challenges before.

It's just that some of those leaving happen to be influential KOLs, which can impact public sentiment. However, I believe it's precisely at this stage that builders are truly tested. Beyond the surface-level noise, we need to focus on the deeper transformations—and what remains unchanged—in the industry. Here, I’ll briefly discuss three key aspects.

Has the Web3 Industry Moved from Blue Ocean to Red Ocean?

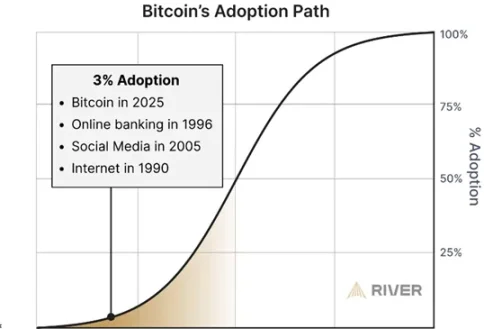

According to a March research report by BTC financial services firm River, only 4% of the global population currently holds BTC, with the U.S. having the highest adoption rate at around 14%. In terms of development stage, BTC adoption today is comparable to the internet in 1990 or mobile social in 2005.

This simple data analysis shows that digital asset adoption—led by BTC—is still in its early stages, far from being a saturated red ocean market. Even in terms of industry influence, traditional financial giants like BlackRock and Fidelity have only just entered. Would they really step in foolishly just to be the bagholders?

Logically and analytically, we must acknowledge that if digital assets represent the future—or if Web3 is indeed the intersection of the internet and AI—then this race has likely only progressed from the starting line to the midpoint, with a long journey ahead.

Is the Web3 Market Now Dominated Only by Hype-Driven MEME Narratives?

Certainly, for many value creators in the industry, the biggest criticism over the past year has been the explosion of MEMEs. MEMEs captured excessive attention and led to a purge of many newcomers, even causing some to lose faith in the sector. But as I mentioned in a previous Weekly, MEMEs are evolving. After going through a bubble phase, they’re now entering a recovery and growth cycle—one that could eventually bring real value to the ecosystem.

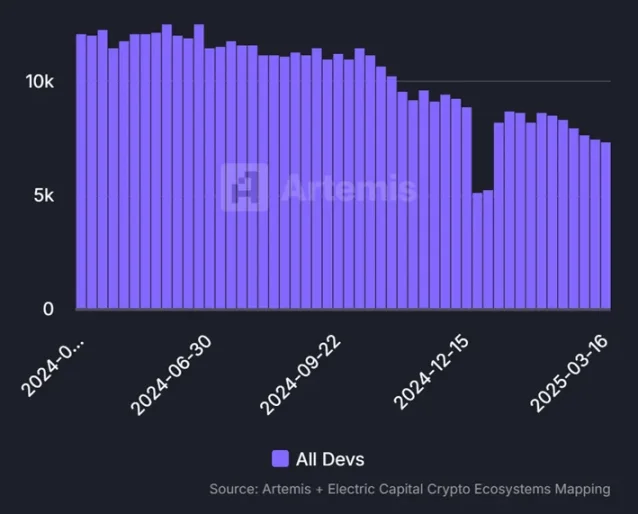

Moreover, we shouldn’t fixate solely on superficial trends. Builders continue to build, and value-driven projects are still seeking breakthroughs. Looking at the number of active developers over the past year, despite a dip, the figure remains relatively high.

While the market may appear quiet now, lacking a transformative narrative like DeFi in the previous cycle, it’s always easier to spot opportunities in hindsight. When looking forward into the unknown, certainty naturally diminishes—but isn’t this exactly how all things evolve?

Looking back at the Web3 landscape in 2018, it was arguably far worse—orders of magnitude worse than today—yet that didn’t prevent the massive breakout that followed. We simply need time and patience for incremental changes to accumulate into transformation.

Will the Web3 Market Keep Falling Indefinitely?

Finally, there's the question of price. Over 90% of people feel this market cycle is fundamentally different from previous ones, with few similarities, rendering many "carved boat" predictions obsolete. But if market cycles still hold validity, we're likely still within this cycle—just without the euphoric, across-the-board rallies of the past.

Recently, due to GS-related issues, the U.S. stock market plunged, wiping out nearly $6.5 trillion in market value in just two days—the worst two-day and weekly drop since March 2020 for the three major indices. This triggered extreme movements across global financial markets. Whether this downward momentum will reverse soon remains uncertain and requires caution.

When BTC has pulled back nearly 30%, and global financial markets face a once-in-a-decade shock, can the crypto market truly remain unscathed? That’s a difficult question to answer.

Yet there’s a timeless insight from Fan Li, one of China’s earliest economists—revered as the "God of Wealth"—that’s worth pondering: "When prices rise to the extreme, they turn cheap; when they fall to the extreme, they rebound. Sell high as if discarding manure, buy low as if acquiring jewels."

Perhaps right now, we are in that delicate moment where everything feels worthless.

Will BTC eventually reach $500,000 per coin? Seven years ago, saying BTC would hit 1 million RMB each sounded like a joke—yet now, it doesn’t seem so far off. Living in the present means facing reality, but facing the future requires cautious optimism. Keep moving forward. Keep building.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News