Can抄never bottom out? Is the crypto market truly on its last legs?

TechFlow Selected TechFlow Selected

Can抄never bottom out? Is the crypto market truly on its last legs?

Major policies and data releases are upcoming, leading to heightened market risk aversion.

Author: 1912212.eth, Foresight News

On March 31, Bitcoin's daily chart showed four consecutive days of decline, dropping from $87,000 to $81,000. Ethereum performed even worse, posting seven straight days of losses on its daily chart, falling from around $2,100 to $1,800. Solana fluctuated near $130, while the majority of altcoins saw declines over gains. According to CoinMarketCap data, the Fear & Greed Index stood at 24, indicating "Extreme Fear."

Data from Coinglass shows that total liquidations across the market reached $213 million in the past 24 hours, with long positions accounting for $163 million. The largest single liquidation occurred on Binance’s ETH/USDT pair, amounting to $13.3 million.

After reaching a peak in December last year, the market has declined for three consecutive months, with retail sentiment remaining weak. Will the market recover in the future?

Bitcoin Spot ETFs Record 10 Consecutive Days of Net Inflows, But Momentum Slows

Recently, Bitcoin spot ETFs have shown relatively strong performance. Since March 14, they have recorded net inflows for 10 consecutive days, exceeding outflows. On March 17, 18, and 20, net inflows surpassed $100 million each day. However, starting March 21, daily net inflows failed to exceed $100 million again. On March 28, spot ETFs saw a net outflow of $93 million, ending the 10-day streak of consecutive net inflows.

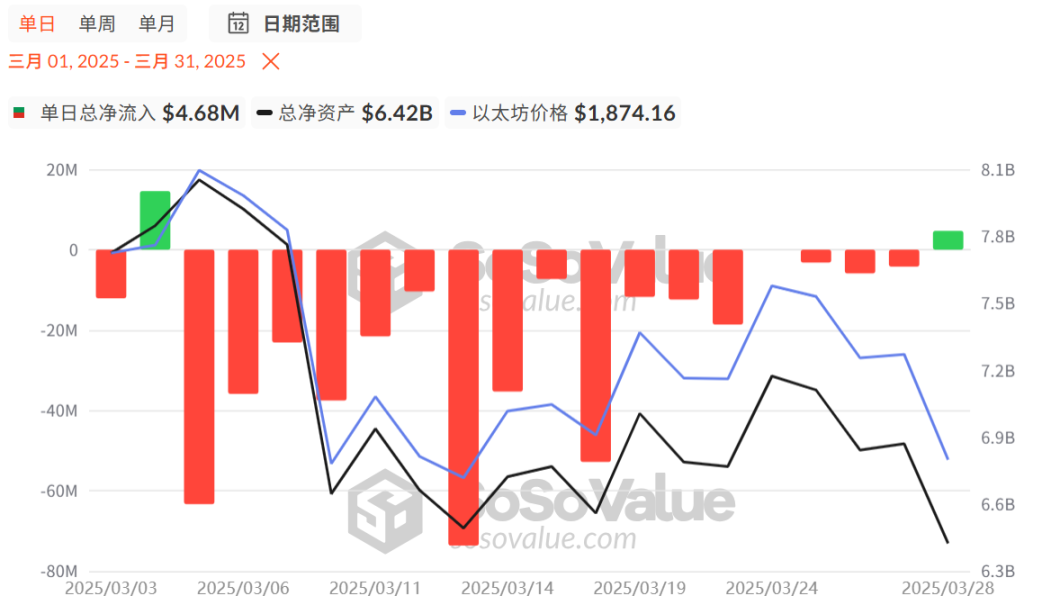

In contrast, Ethereum spot ETFs have painted a far gloomier picture. This month, they registered net inflows on only two days, with outflows dominating the rest. Unsurprisingly, ETH’s price performance has been lackluster. Ethereum’s weakness has significantly dragged down many altcoins, especially those in Layer 2 and restaking sectors.

Markets Hedging Against U.S. Tariff Policy on April 2

On March 31, Japan's stock market plunged 4%, South Korea's index extended losses to 2.3%, and U.S. futures also declined in early trading. With the announcement of new U.S. tariff policy expected on April 2, market uncertainty is approaching a new peak. According to CCTV News, on Saturday it was reported that on March 28 local time, U.S. President Trump plans to unveil new tariffs in the coming days. While he expressed some openness to reaching tariff agreements with other countries, he indicated any such deals would come only after the April 2 measures take effect.

Citigroup’s latest report outlines three main scenarios and their potential market impacts: First, if only reciprocal tariffs are announced, market reaction would be limited. Second, if reciprocal tariffs are combined with a value-added tax (VAT), the U.S. dollar index could immediately rise by 50–100 basis points, and global equities may fall. Third, if sector-specific tariffs are added on top of reciprocal tariffs and VAT, market reactions could be significantly more severe.

Following the worst first-quarter start for the S&P 500 since 2020, analysts are warning that downside risks outweigh upside potential. Some point out that future tariffs and retaliatory actions will be key—the market's reaction on “April 2” will largely depend on the timing of the tariffs, particularly sector-specific ones, and how quickly other nations respond to reciprocal tariffs.

The crypto market, led by Bitcoin, has become increasingly correlated with U.S. equities. As a frontline risk asset, it will likely face significant volatility around the policy announcement. Additionally, the U.S. will release unemployment and nonfarm payrolls data on the evening of April 4, followed by a keynote speech from Powell. With a wave of critical data and policy events approaching, some investors are choosing to exit or remain on the sidelines.

Outlook for Future Market Movements

Mike McGlone, commodity strategist at Bloomberg Intelligence, suggests the market should now focus on ETH’s price action, as ETH shows a clear correlation with other risk assets. If stocks in the S&P 500 continue to weaken, ETH could face further downside. McGlone notes that a return to the $2,000 level might signal direction for risk assets, but if Bitcoin fails to regain stable upward momentum, losses in altcoins could deepen—especially among major altcoins, which may continue weakening and potentially lead ETH to fall toward $1,000 later this year.

David Duong, Head of Research Strategy at Coinbase, believes the market’s reaction on April 2 may appear relatively calm. However, he warns that no one is truly prepared, due to the numerous variables and possible paths involved. This leaves the market exposed to extreme outcomes, particularly regarding specific sector performances and broader economic impacts. Nevertheless, with earnings season soon becoming the next focal point, the market is unlikely to form a decisive stance before mid-April.

Paoul, founder of Real Vision, shared a chart comparing global M2 liquidity with Bitcoin’s price and commented that the market is currently in a bottoming zone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News