No one misses Gary Gensler

TechFlow Selected TechFlow Selected

No one misses Gary Gensler

For most participants, a lenient environment without regulation is what they truly desire.

Author: Lu Boning

"And is that when we do the mic drop?"

In front of the camera, Gary Gensler smiled and ended his final tweet video with the classic "Mamba out" gesture—two days after posting it, on January 20, 2025, the notoriously controversial SEC chairman finally concluded his career. Taking over as acting chair was Mark Uyeda, a Japanese-American SEC commissioner seen as relatively more friendly toward the crypto industry.

If Federal Reserve Chair Powell indirectly influences Bitcoin’s price chart through eight thirty-minute speeches per year, Gensler’s approach has been far more direct:

Just three months into his tenure, he announced plans to significantly increase SEC staffing to tackle regulatory challenges in the so-called “Wild West” environment; prioritized oversight of “emerging technologies and virtual assets”; classified most cryptocurrencies as securities under SEC jurisdiction; filed lawsuits against major industry players like Binance, Coinbase, and Ripple; and systematically transformed internal controls into formal regulations...

Fast forward six years earlier, sitting in an MIT classroom, even after hearing classmates rave about the impressive new professor—once Goldman Sachs’ youngest partners, who helped secure a $3.6 billion TV rights deal for the NFL—you’d never have imagined that this balding, cheerful man teaching Bitcoin and encouraging students to build Uber on blockchain would one day become the SEC chair and turn against the very industry he once inspired. Likewise, hopes that Trump would usher in a perpetual Bitcoin bull market began fading the day before Gensler took office.

Love him or hate him, one thing remains certain: Gary Gensler's name continues to be mentioned constantly, even today.

The Financial Cop from Baltimore

Time magazine described the man in a 2012 profile:

"For someone who makes shameless bankers tremble, Gensler is remarkably affable. The 55-year-old single father smiles easily, cracks jokes, and pokes fun at his role in making our financial system safer—all while recounting the trials and joys of raising three daughters (Anna, 22; Lee, 21; Isabel, 16) alone after his wife Francesca died of cancer in 2006, following 20 years of marriage."

As chairman of the CFTC (Commodity Futures Trading Commission), Gensler rarely lived in Washington, D.C., instead residing near Baltimore, where he grew up—juggling laundry for his daughters while overseeing regulation of what was then another “Wild West”: over-the-counter derivatives.

This $400 trillion market had been one of Wall Street’s most profitable ventures and ultimately played a central role in triggering the 2008 financial crisis.

In May the following year, Obama-nominated Gary Gensler officially swore in as the 11th CFTC chair, pledging to urgently close legal loopholes, bring much-needed transparency and oversight to the OTC derivatives market, reduce systemic risk, strengthen market integrity, and protect investors.

But many dismissed this as mere rhetoric—after all, around the turn of the millennium, while serving at the Treasury Department, Gensler had gained fame for advocating deregulation. Under Treasury Secretary Lawrence Summers, a proponent of financial liberalization, Gensler helped pass the Commodity Futures Modernization Act.

One of the act’s most consequential provisions? Removing CFTC oversight over OTC derivatives—including credit default swaps (CDS).

Yes, those same CDS instruments used by the protagonists in *The Big Short* to bet against subprime mortgages.

In *The Big Short*, the FrontPoint team and Vennett argue.

At the time, the CFTC long operated in the shadow of the SEC, managing only a handful of on-exchange futures contracts, including agricultural commodities. Gensler’s earlier support for deregulation had cemented the CFTC’s role as a passive observer in the OTC derivatives space—a twist of fate that eventually boomeranged back to him years later.

Yet Gensler did tighten the reins. Within two months of taking office, he proposed limits on position sizes held by market participants (such as ETFs) in energy futures markets. In August, he wrote to Congress criticizing Obama’s proposed OTC derivatives reform as insufficient.

"There’s a new sheriff in town," former CFTC official Michael Greenberger said in an interview. Finally, on July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act passed Congress, formally granting the CFTC authority over this vast market.

Following that, Gensler led enforcement actions against banks manipulating the London Interbank Offered Rate (Libor). After years of investigation, Barclays became the first major bank to publicly admit to longstanding Libor manipulation, paying a $450 million fine. Over ten other banks faced investigations, with potential penalties mounting—UBS alone reportedly prepared to pay nearly $610 million.

"We’ve had to cut 41 positions due to budget cuts, yet our staff is only 36 people larger than two decades ago... The President places great expectations on this small agency—and even greater ones on its leader," Gensler complained, carrying this obsession with expanding personnel all the way into his tenure as SEC chair.

"History Tells Us Private Money Doesn’t Last"

In early 2014, after completing a five-year term, Gary Gensler left the CFTC. He went on to chair Maryland’s Financial Consumer Protection Commission (having previously served as treasurer of the Maryland Democratic Party) before joining MIT as a professor, teaching the history of money, Alipay, Bitcoin, and blockchain.

Gary Gensler’s course materials from his MIT days.

It wasn’t until November 2020 that he was appointed a volunteer member of President Biden’s transition team, handling financial sector transitions. Four months later, the Senate confirmed his nomination, and Gary Gensler officially became SEC chair.

Interestingly, at the end of that 2012 Time magazine profile, an insider remarked: “If he hadn’t made so many enemies in the industry, he might have achieved something bigger—like becoming SEC chair or Treasury Secretary.”

Ironically, it was precisely his willingness to make powerful enemies and his successful track record confronting Wall Street that made Gensler an ideal choice for the SEC role. Democrats also needed such a figure to reverse the regulatory rollbacks of Trump’s four-year administration—particularly under former SEC chair Jay Clayton, whose “revolving door” ties led to consistent deregulation on crypto, except for one parting shot: filing a lawsuit against Ripple for selling unregistered securities (XRP).

"Clayton set everything up. He decided to sue Ripple and left the legal mess for his successor—that was truly shameful," said Ripple CEO Brad Garlinghouse, who viewed it as hostility toward crypto from the Trump administration and predicted the incoming Biden administration would be “more industry-friendly.”

Similarly, many in the crypto industry interpreted Gensler’s past public statements and praise for various blockchain projects as signs of a dovish stance.

Would this single father from Baltimore really go easy on crypto, as many expected? The answer was no.

In an interview with The Washington Post, Gensler stated the SEC “has strong powers, but as I’ve found, there are gaps,” affirmed the need for collaboration with Congress, and questioned whether digital assets could serve as a lasting alternative to public money: “History tells us private forms of money don’t last long.”

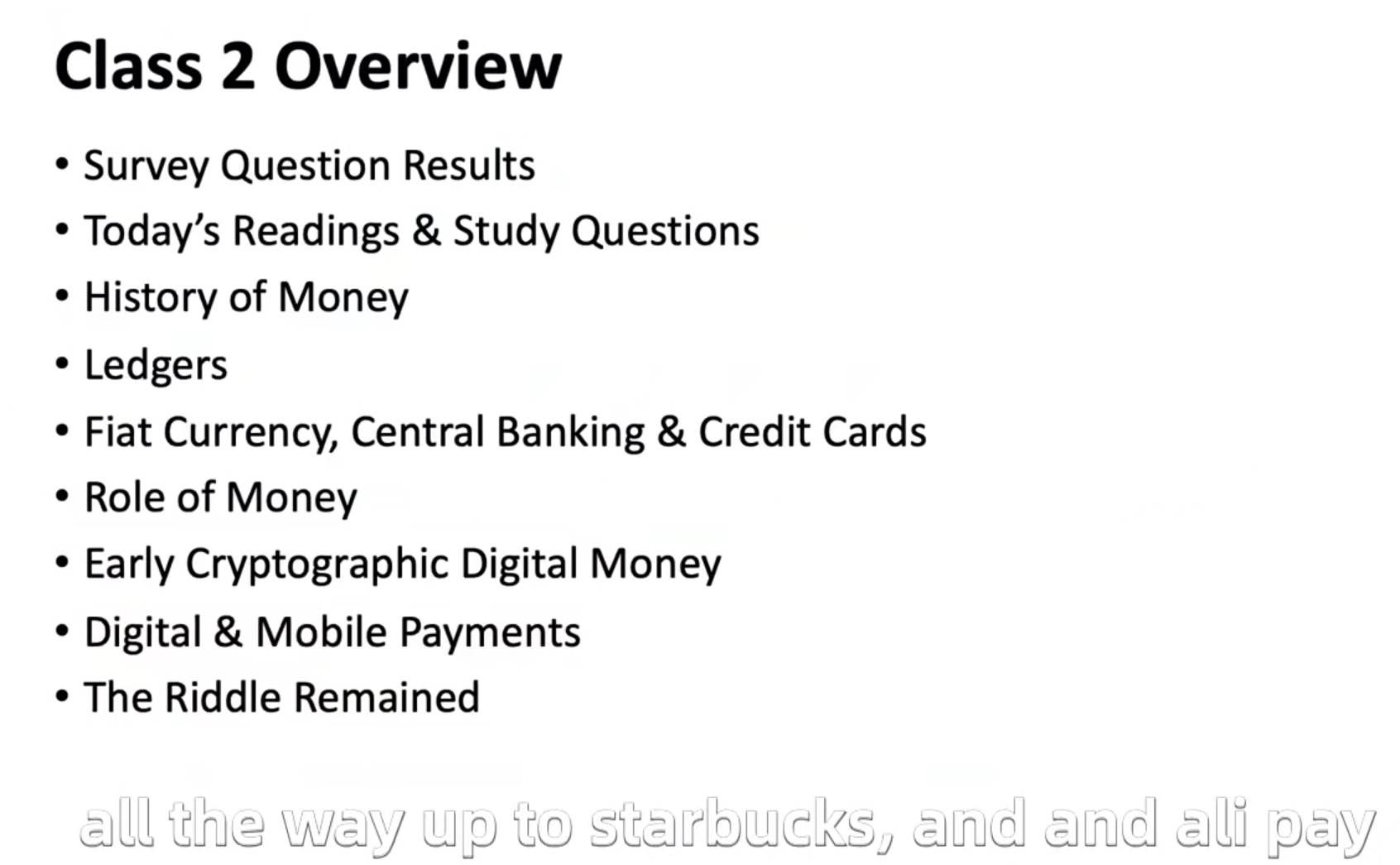

Alignment between Congress and key actions taken by Gary Gensler.

If before FTX’s collapse the SEC chair’s regulatory stance remained ambiguous, afterward there was only one path forward.

Much like his CFTC days, developments unfolded predictably. Ripple’s overtures were ignored. In the years that followed, the company and the SEC engaged in repeated legal battles over whether XRP qualified as a security. Meanwhile, Coinbase, BlockFi, Kraken, and others were successively sued and ultimately paid varying amounts in fines.

The Justice Department’s investigation into Binance, launched in 2018, finally reached resolution five years later: a $4.368 billion penalty, $175 million bail, and four months of house arrest secured comprehensive settlements with multiple U.S. regulators—but not the SEC.

However, shortly after Trump returned to power, the SEC and Binance jointly requested the court to pause their litigation, citing the need to “await the development of a new digital asset framework under the Trump administration.”

Another pivotal moment was the approval of spot Bitcoin ETFs. Despite Gensler’s prior opposition—calling Bitcoin “still vulnerable to fraud and market manipulation”—and repeated rejections of applications, when BlackRock submitted its ETF filing in June 2023, the market widely believed “this time it’s different.”

In the early hours of January 10, 2024, the SEC’s official social media account announced the approval of spot Bitcoin ETFs. Bitcoin surged instantly to around $48,000. Jubilation erupted across the industry, heralding a new era.

Minutes later, Gary Gensler posted on his personal Twitter: “Not approved. The SEC’s official account was hacked. That tweet was fake.”

Waiting for Another “Savior”

Gary Gensler’s departure was inevitable—though his term wasn’t due to end until 2026, there was no place for him in the new Trump administration. Those anticipating Trump’s return felt much like they once did about Gensler, believing the new leadership would “favor the crypto market.”

Trump indeed had stronger incentives to appear crypto-friendly: Coinbase, Jump Crypto, A16z, and Ripple were major donors to pro-Trump Super PACs; his second son launched a DeFi project called World Liberty Financial, enlisting high-profile figures including Justin Sun as advisors; and he announced plans to nominate cryptocurrency advocate Paul Atkins, CEO of Patomak Partners, as the next SEC chair, along with establishing a “strategic Bitcoin reserve for the United States.”

The story peaked when Trump unveiled his own meme coin. On January 18, he posted on his social platform announcing TRUMP, declaring it the “official Trump meme coin.”

Twelve hours after launch, TRUMP traded at approximately $30, with a fully diluted valuation (FDV) of $30 billion.

Thirty-six hours in, TRUMP hit a high of about $85.2, FDV peaking at $85.2 billion.

Forty-eight hours later, Melania Trump posted online: “The official Melania meme is live.” While $Melania rose to $13.69, nearly all other tokens crashed—TRUMP halved to $35, and Bitcoin briefly touched $110,000 before sharply reversing.

Sixteen days post-launch, World Liberty Financial liquidated nearly all its ETH holdings into Coinbase Prime, while Eric Trump declared on social media: “Now is the best time to buy ETH.”

Forty-seven days in, Trump signed an executive order formally establishing the U.S. Strategic Bitcoin Reserve. Approximately 200,000 bitcoins held by the federal government were transferred into this reserve, with instructions neither to sell externally nor to acquire additional coins via market purchases. Bitcoin pulled back to $77,000.

Today, 66 days after launch, TRUMP trades at $11.30 (FDV: $11.3 billion); Melania at $0.677 (FDV: $677 million). Though Bitcoin remains elevated at $86,000, researchers at The Defi Report caution: “The bear market may take 9–12 months to fully play out.”

John Cassidy, writer for The New Yorker, commented on Trump’s incoming policies before his return to office:

"...With a crypto-supportive government preparing to take power and crypto investors cheering, there are echoes of the late 1990s internet bubble, which I documented in a book over two decades ago. Back then, seasoned market participants and observers—including myself—were equally excited, equally convinced prices would rise further, and equally uneasy."

"...Regardless of the speculative asset, my conclusion from writing about the dot-com bubble was that large-scale speculation relies on a 'four-horse carriage': exciting new technology; effective communication channels; active financial sector involvement; and supportive policy conditions."

"...The worst-case scenario is full-blown financial collapse. I’ve seen it many times in the 1990s—people wildly hyping something, forming bubbles. Crypto could see similar dynamics, possibly with government tacit approval or even encouragement."

Gary Gensler ultimately failed to regulate the crypto industry the way he once tamed OTC derivatives. And the industry neither welcomed nor mourned his departure.

For market participants, a lightly regulated, permissive environment is what they truly desire—or put differently, “life and wealth are determined by fate.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News