From the Libra scandal to Solana's bloodbath, can Jupiter's multi-strategy approach restore market confidence?

TechFlow Selected TechFlow Selected

From the Libra scandal to Solana's bloodbath, can Jupiter's multi-strategy approach restore market confidence?

Jupiter is recently attempting to signal a breakout against the odds through multiple strategies, including ecosystem expansion, token buyback programs, and product iterations.

By Nancy, PANews

Currently, the Solana ecosystem is undergoing a "bleeding" crisis triggered by the Libra token scandal, with liquidity outflows and eroded market confidence intensifying internal challenges. As a flagship project within the Solana ecosystem, Jupiter once played a central role due to its exceptionally high share of liquidity. However, entangled in the fallout from the Libra incident and the broader ecosystem crisis, Jupiter now finds itself mired in difficulties. Despite this, Jupiter has recently launched multiple initiatives—including ecosystem expansion, token buybacks, and product upgrades—aiming to signal resilience and breakout potential amid adversity.

Slowing Trading Engine? Jupiter Still Holds Key Advantages in Solana Ecosystem

Jupiter previously drove prosperity across the Solana ecosystem through strong market appeal, but the overall loss of confidence in Solana has slowed its momentum, making it impossible for Jupiter to remain unaffected.

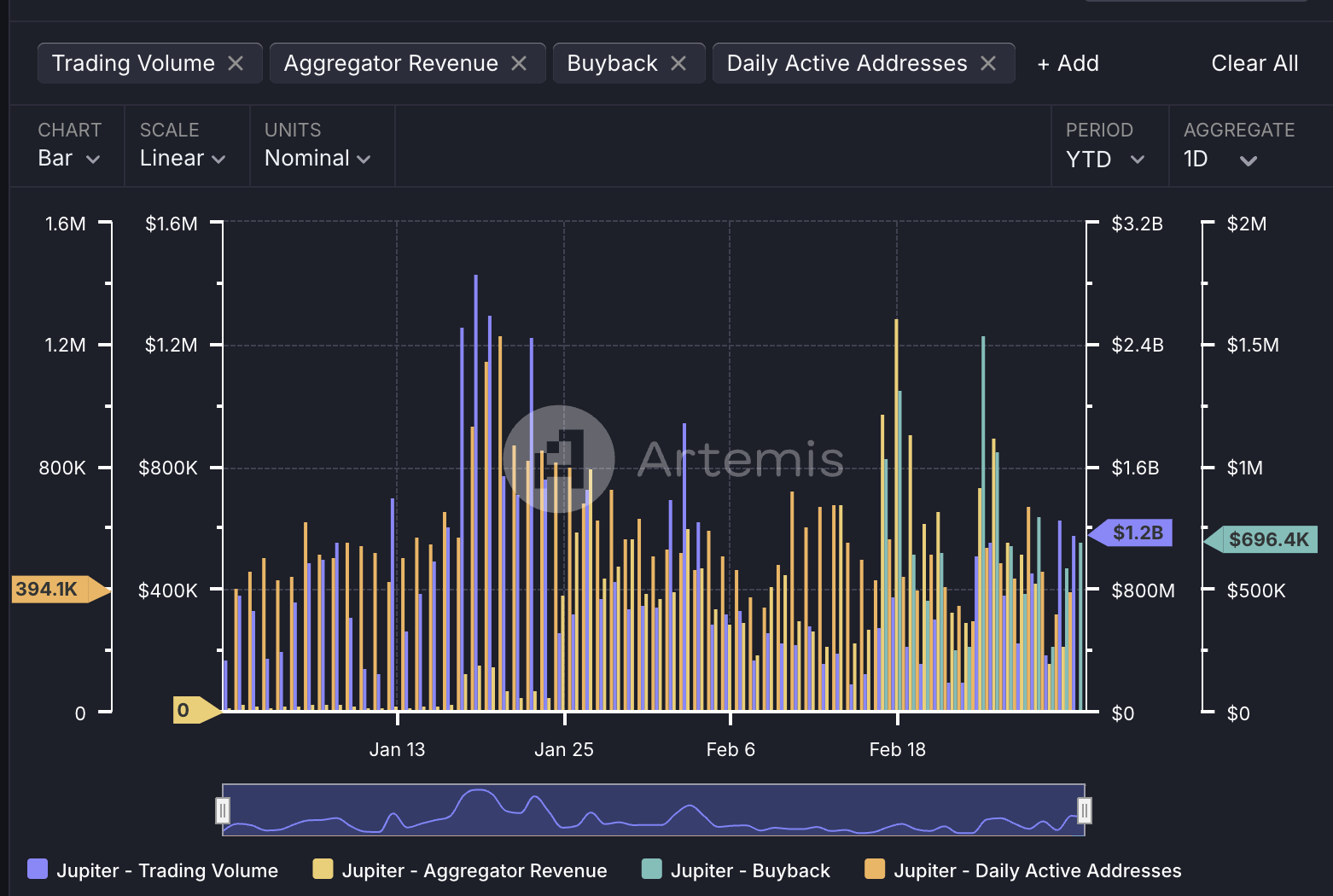

Data from Artemis shows that Jupiter’s daily trading volume peaked at $2.9 billion in mid-January this year. Since then, trading activity has gradually declined. By March 3, daily volume had dropped to $1.2 billion—a 58.6% decrease from its peak.

The decline in daily active addresses similarly reflects weakening community engagement. On January 20, Jupiter recorded a new high of 1.2 million active addresses, highlighting strong user participation at the time. However, by March 3, that number had plummeted to 394,000—an alarming 67.2% drop. This sharp reduction not only indicates slowing transaction activity but also suggests shaken confidence among users in both Jupiter and the wider Solana ecosystem. That said, Solana's total daily active addresses also fell approximately 48.1% during the same period, indicating Jupiter’s downturn is largely in line with broader ecosystem trends.

The weakening trading activity has directly impacted Jupiter’s revenue performance. According to Artemis, Jupiter’s daily aggregator income dropped 83.3% from its peak of $1.3 million, reaching just $216,000 on March 3. This revenue slump underscores Jupiter’s vulnerability under current market conditions.

Despite pressure on trading activity and income, Jupiter continues to maintain a resilient position within the Solana ecosystem. Data from Artemis reveals that Jupiter accounted for 11.6% of Solana’s total daily trading volume as of March 3—slightly up from 10.4% at its January peak. However, its share of daily active addresses has declined by 36.5% compared to peak levels, standing at 9.4% of Solana’s total on March 3.

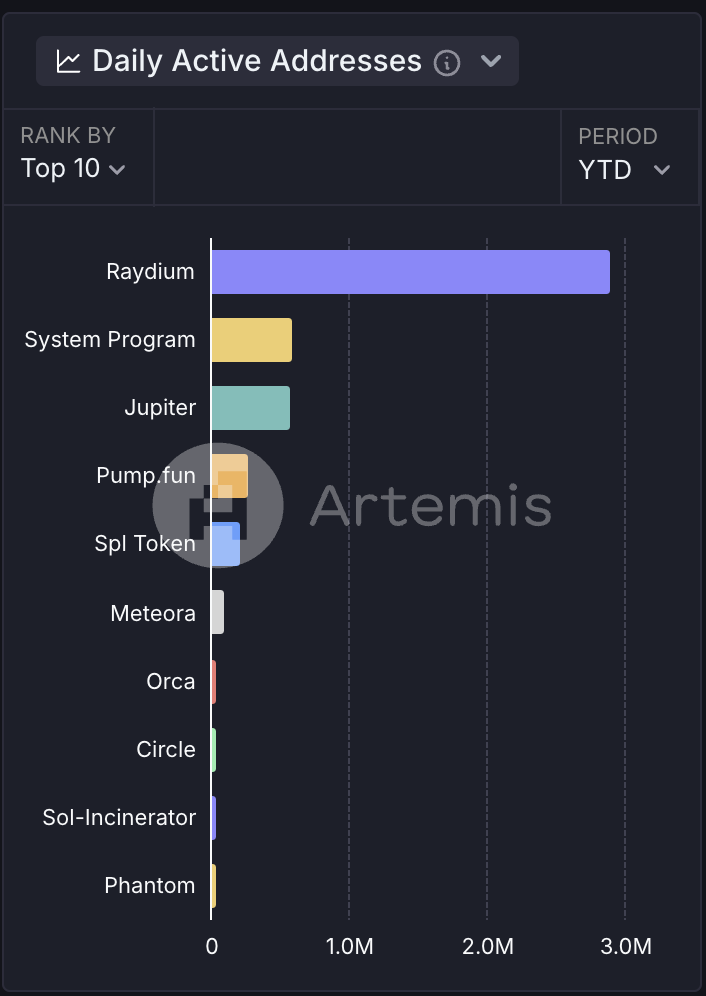

In terms of ecosystem rankings, Artemis data shows that since 2025, Jupiter has consistently ranked second in daily trading volume on Solana at $260 million, trailing only Raydium; it ranks third in daily active addresses with 572,000; and second in gas fee consumption with $45.7 million. These figures confirm that Jupiter remains a core pillar of liquidity on Solana, albeit with reduced influence.

Additionally, according to its official website, over 580 million JUP tokens have been staked—more than 21.5% of the circulating supply—reflecting ongoing community participation in JUP DAO governance, which may help buffer short-term selling pressure on the token.

From Trust Crisis to Long-Term Vision: Jupiter’s Multi-Pronged Strategy to Restore Confidence

The Libra scandal served as the catalyst pushing Jupiter into crisis. In February, amid the Libra insider trading controversy, Libra created a liquidity pool on Meteora, leading to allegations that Jupiter colluded with Meteora due to Meow’s dual identity as a co-founder of Meteora. Although Meteora co-founder Ben later resigned and Jupiter stated it did not participate in any form in Libra’s launch—claiming no team members engaged in front-running—the reputational damage persisted, and its JUP token suffered price declines.

"We talk about crypto being the future, yet in reality, we often show a serious lack of commitment to long-termism and accountability. One thing is certain: we believe in what we’re building, we believe in being accountable for long-term outcomes, and we believe the crypto industry will truly change the world—even if short-term volatility is intense," Meow recently wrote.

Facing Solana’s slowdown and the aftermath of the Libra incident, Jupiter has responded with a diversified strategy. Over recent weeks, it has announced moves spanning acquisitions, tokenomics adjustments, and transparent governance—all aimed at rebuilding market trust.

On ecosystem expansion, Jupiter has conducted multiple hires and acquisitions over the past year, including taking majority stakes in Sonarwatch and Moonshot in recent months. It is currently pursuing two additional undisclosed acquisitions to strengthen its three core platforms: Jup.ag, Jupiverse, and Jupnet. Funding for these acquisitions will come from the treasury.

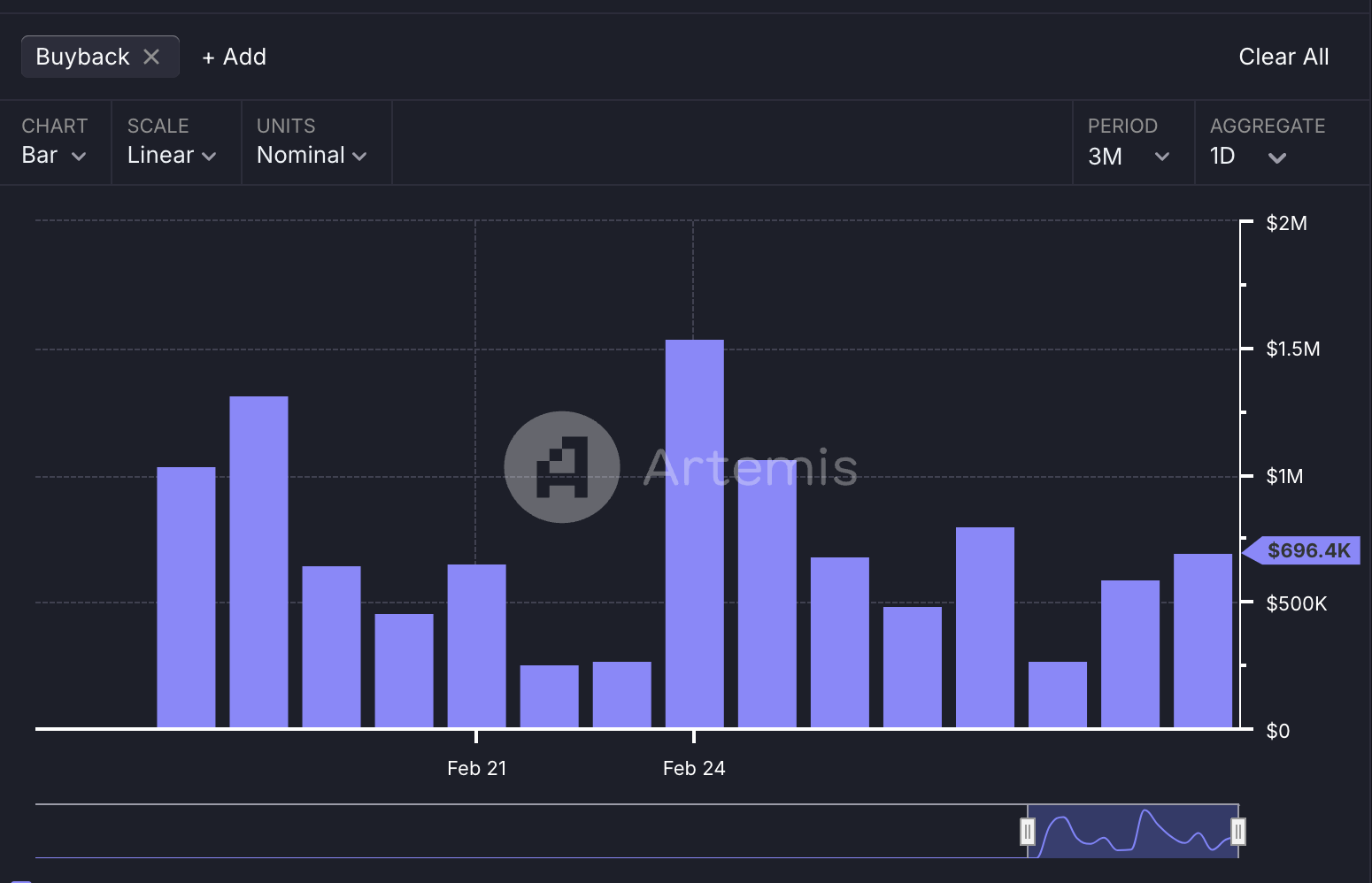

To enhance token value, Jupiter recently announced comprehensive audits—conducted by independent third parties—of tokens held by founders, the Jupiter Treasury, the Meteora Treasury, and the JUP token itself. Additionally, Jupiter established the Litterbox Trust, managed by an independent third party, which is now operational. Over the next two years, the trust will receive 50% of protocol revenues to strategically accumulate JUP, aiming to improve long-term token stability. Officials emphasize this does not affect near-term revenue distribution but supports long-term ecological and community development. Artemis data shows that since February 17, Jupiter has already repurchased $10.8 million worth of JUP.

Moreover, Meow recently proposed the “2030 Proposal,” planning to allocate his personal holding of 280 million JUP tokens for team incentives and requesting 500 million JUP in return by 2030—a plan still subject to community voting. Jupiter also recently unveiled the "GOAT Framework," aiming to establish JUP as the premier cryptocurrency in the industry through four core dimensions—Governance (including burning 30% of supply, the “Jupuary” campaign, and adjusting workgroup budgets), Organic growth (rejecting backroom deals, KOL promotions, or market manipulation), Alignment (synchronizing interests of holders, community, and team), and Transparency (three token audits, public multisig wallets, and tracking large movements)—to solidify JUP’s status as a long-term asset.

In addition, Jupiter has released its 2030 Team Strategy, focusing over the next five years on decentralized liquidity platforms, global community expansion, and the Jupnet ecosystem. It plans to allocate 280 million JUP to new team members over the next three years (with the founding team currently holding 1.4 billion JUP). The funding source requires community decision-making, with two options under consideration: one using strategic reserve funds, unlockable starting July 2025 without requiring a vote; or funded directly from Meow’s personal holdings, to be replenished to the strategic reserve by 2030, along with a request for an additional 220 million JUP as incentive (adjustable by the DAO).

On product iteration, Jupiter merged with ApePro and rebranded as Jup Trenches, offering features such as dual account types, private key export, and real-time data. Meanwhile, last year’s release of Jupiter Mobile is also set for a major update.

In summary, while a slowing trading engine has placed short-term pressure on Jupiter, its foundational role as a core pillar in the Solana ecosystem remains intact. Whether it can leverage its multi-faceted strategies—and a potential recovery in Solana—to halt ecosystem bleeding and achieve positive growth will depend on future developments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News