BOB announces launch of DeFi yield product Hybrid BTC, ushering in a new era for BTC DeFi

TechFlow Selected TechFlow Selected

BOB announces launch of DeFi yield product Hybrid BTC, ushering in a new era for BTC DeFi

By launching Hybrid BTC, BOB has solidified its position as the "ideal home" for BTC DeFi, pioneering a secure and seamless way to bridge multiple L1/L2 blockchains to access BTC DeFi yields.

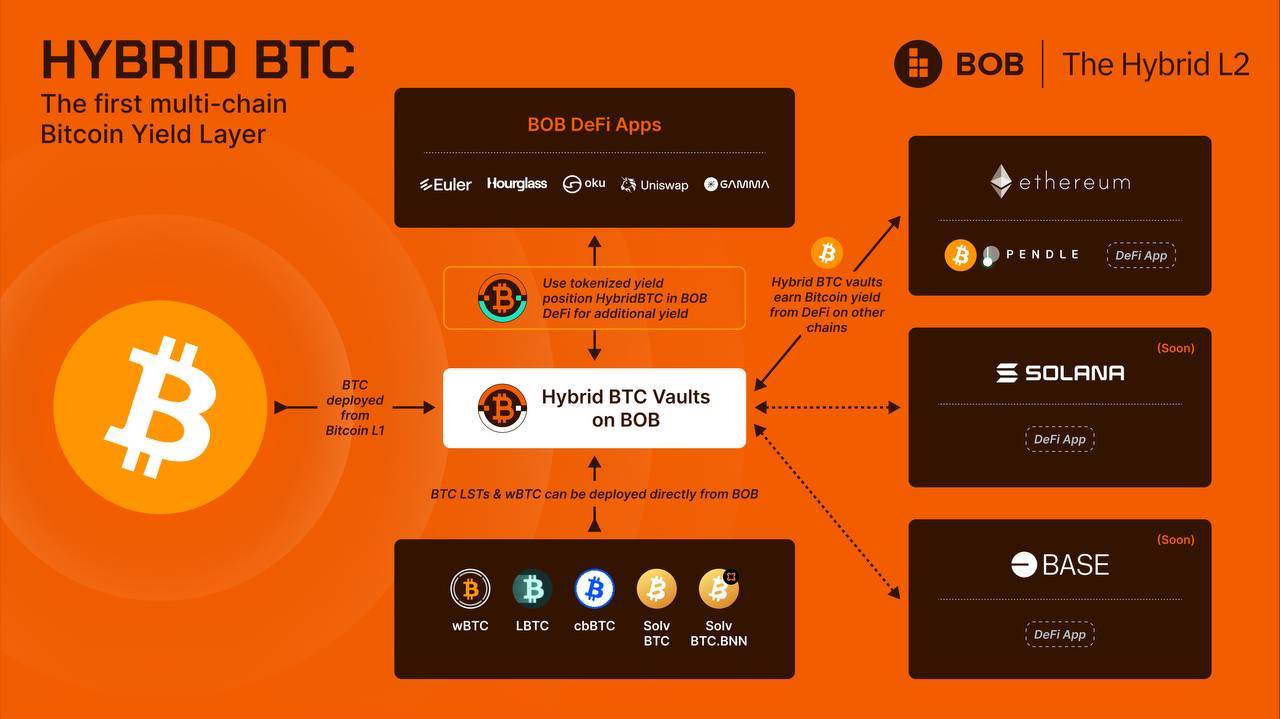

On February 26, hybrid Layer 2 project BOB (Build on Bitcoin) announced the launch of its DeFi yield product suite Hybrid BTC, establishing the industry's first multi-chain BTC yield layer through this initiative.

With Hybrid BTC, users can deposit assets into vaults on the BOB network. These vaults automatically deploy user funds into DeFi applications across other chains and ultimately return yields to users in BTC. Throughout this entire process, users only need to deposit their assets into Hybrid BTC—no need to worry about cross-chain operations or wallet integrations. It’s as simple as “one-click deposit.”

With Bitcoin Finality set to launch on the BOB mainnet in the near future, anyone will be able to pursue Bitcoin yields without compromising security, further solidifying BOB’s position as the “ideal home” for BTC DeFi. The initial partners for Hybrid BTC include Veda, an EVM expansion protocol built on Ordinals; Euler, a DeFi lending protocol; and Lombard, a Bitcoin liquid staking platform.

HybridBTC.pendle Vault is the first product in the Hybrid BTC suite, co-developed by BOB and Veda, designed to earn Bitcoin yields on the Ethereum network (returned to users in BTC). According to recent data, Veda currently has a TVL exceeding $3 billion, building consumer-grade DeFi yield products and playing a crucial role in deploying and managing these vaults.

BOB’s unique hybrid Layer 2 model ensures that all blockchain networks, bridges, and transactions involved in Hybrid BTC are protected by Bitcoin’s security. This delivers unparalleled safety, usability, and Bitcoin alignment, adhering to core principles of security, decentralization, and minimal trust. Hybrid BTC vaults will also simplify access to diverse Bitcoin yield sources, enabling users to maximize BTC returns without navigating different product interfaces or wallets.

In addition, Lombard’s LBTC will serve as the underlying asset for the new vault, adding further utility to the $1.8 billion in Bitcoin liquid staking token (LST) TVL. In the future, BOB plans to launch additional vaults to capture BTC DeFi yields from chains such as Solana, BNB, Base, Move, and Berachain.

Alexei Zamyatin, Co-Founder of BOB and Core Contributor to BitVM:

As a hybrid Layer 2, BOB is building the first multi-chain yield layer for Bitcoin. Thanks to our unique hybrid Layer 2 model, BOB will become the best place to earn Bitcoin yields while securely bridging across other L1/L2 blockchains. HybridBTC.pendle is the first in the Hybrid BTC yield product suite, enabling everyday retail investors to earn large-scale yields on Ethereum just like "whales," without high gas fees or the need to manually create and manage positions.

Zamyatin added:

Hybrid BTC is a powerful BTC DeFi tool that positions BOB as the "home" for L1/L2 chains seeking BTC liquidity. Because BOB inherits Bitcoin’s security, other chains only need to verify and trust Bitcoin to confirm BOB’s safety—a straightforward task for any smart contract chain. Therefore, Hybrid BTC’s potential market impact is enormous.

Sun Raghupathi, Co-Founder and CEO of Veda:

2025 will become the inaugural year of BTC DeFi. BOB’s hybrid Layer 2 model significantly enhances security and usability in the pursuit of Bitcoin yields. At Veda, we are committed to seamless DeFi experiences while bringing real-world assets on-chain. Partnering with outstanding projects like BOB enables us to further advance this vision and extend the benefits of DeFi to a broader audience.

Yield-Bearing Assets (YBA)

These cross-chain yield positions are tokenized on BOB as yield-bearing assets (Yield Bearing Asset, YBA), which can be used within DeFi applications on BOB. HybridBTC.pendle has already integrated Euler v2, which launched on the BOB network today.

Euler is a flexible decentralized lending platform capable of maximizing yield from positions generated via HybridBTC.pendle. Its permissionless mechanism makes it a powerful tool for DeFi users seeking efficient BTC liquidity management.

To support the dual-spiral growth of HybridBTC.pendle and BTC DeFi, BOB has also launched a DeFi campaign—BOB Rise—which incentivizes users to share the 750,000 OP tokens awarded to BOB in Season 6 of the Optimism Grant. The BOB Rise campaign aims to boost BTC liquidity supply while promoting lending of Bitcoin liquid staking tokens (LST) and new YBAs.

Michael Bentley, CEO of Euler:

We are excited to offer Bitcoin holders a secure way to use their Bitcoin with the launch of Euler v2 on the BOB network. Users leveraging HybridBTC.pendle as collateral unlock new capabilities in leverage and liquidity management. We are proud to be part of this new era of BTC DeFi, partnering with BOB to take a significant step forward in innovating BTC DeFi solutions.

About BOB (Build on Bitcoin)

BOB (Build on Bitcoin) is a hybrid Layer 2 network combining the strengths of Bitcoin and Ethereum, aiming to become the “home of BTC DeFi.” Its unique Hybrid L2 model integrates advantages from both ecosystems—Bitcoin’s security and dormant BTC capital, along with Ethereum’s DeFi innovation and versatility.

By positioning BTC as the cornerstone of a new decentralized financial system, BOB unlocks novel use cases and trillions in BTC liquidity. BOB perfectly inherits Bitcoin’s network security via the BitVM protocol and establishes minimally-trusted bridges between BOB, Bitcoin, Ethereum, and other L1 networks. As a result, Hybrid L2 does not rely on third-party cross-chain bridges for interoperability, effortlessly concentrating liquidity around the Bitcoin network instead of fragmenting it across chains.

BOB is backed by leading investment firms including Castle Island Ventures, Coinbase Ventures, Ledger Cathay Ventures, and IOSG.

Website| Twitter| Discord| Telegram

About Veda

Veda is the first native yield layer built specifically for the decentralized finance (DeFi) ecosystem, enabling crypto applications, asset issuers, and protocols to build consumer-grade cross-chain yield products. Veda’s technology powers numerous mainstream DeFi vault products, including ether.fi Liquid, Lombard DeFi Vault, and Mantle cmETH. Over 100,000 users currently trust and use Veda, with approximately $3 billion in assets stored on the platform to date.

Website| Twitter| Discord| Telegram

About Euler

Euler is a decentralized, permissionless lending protocol that helps users earn interest on crypto assets or hedge against volatile markets without relying on trusted third parties, offering lenders and borrowers market-leading risk-adjusted rates. Developers can create and manage markets exactly as they wish, with institutional-grade security. For more information, visit euler.finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News