Decoding the 2024–25 Crypto Yearbook: Old and New Players Join the Table, 12 MEMEs Unveiling a Year of Opportunities

TechFlow Selected TechFlow Selected

Decoding the 2024–25 Crypto Yearbook: Old and New Players Join the Table, 12 MEMEs Unveiling a Year of Opportunities

12 Memes That Capture the Year's Opportunities and Highlights

Author: TechFlow

After reading so many institutional year-end reviews and outlooks, are you feeling a bit fatigued?

Recently, CoinMarketCap released its Crypto Yearbook 2024–25, summarizing the major innovations, market-shaking moments, and unforgettable milestones from the past year, while also offering predictions for 2025.

But interestingly, this yearbook is lively and interactive:

In the retrospective section, CMC presents last year’s big events with more creativity, vibrancy, and flair. And in the forward-looking segment, instead of relying on expert forecasts like traditional institutions, CMC hands decision-making power to the market—letting you vote on which trends might unfold in 2025.

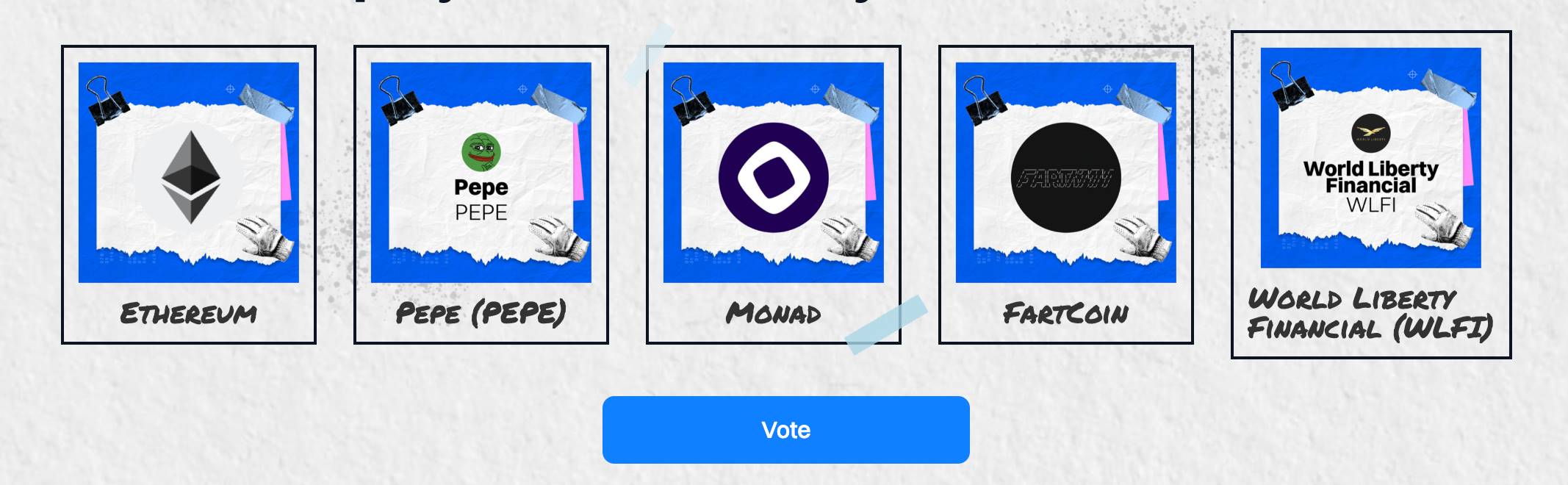

For example, which project do you think will make headlines in 2025? Will it be the pure meme Fartcoin, or Trump-linked World Liberty Financial?

Beyond that, the yearbook features several insightful charts and analyses worth saving. DeepTide TechFlow has curated and interpreted them as follows.

Suits & Ties vs. Laser Eyes – Both Came Out Winners

Throughout 2024, retail investors may have focused on individual price movements. But zooming out, the yearbook captures a broader macro trend: "Suits & Ties vs. Laser Eyes."

This is indeed a sharp cultural contrast.

"Suits & Ties" represents traditional finance (Wall Street)—conservative, professional, legacy financial institutions—exemplified by firms like BlackRock and Goldman Sachs.

"Laser Eyes" is a signature symbol within the crypto community, originating from Bitcoin supporters adding red laser beams to their social media avatars, representing crypto believers and advocates of digital assets.

In 2024, both groups emerged victorious.

Two seemingly opposing forces achieved real convergence in asset terms:

Traditional financial institutions like BlackRock launched Bitcoin and Ethereum ETFs, while meme coins reached billion-dollar market caps and gained mainstream recognition.

Perhaps Wall Street and Web3 are no longer adversaries, but partners influencing each other at the same table.

The shift from confrontation to coexistence marks a new phase of maturity for the crypto market.

Top Crypto Story of the Year: The Rise of TON

Amid the AI agent wave, did you forget about TON's meteoric rise last year?

The Telegram-backed L1 saw astronomical growth: users surged from 100,000 to an astonishing 17.4 million, ranking #8 on CoinMarketCap. With 1,400 dApps and seamless integration into Telegram’s 950 million users, TON proved it’s not just another Layer 1—it’s a movement.

And this movement extended beyond the crypto sphere.

On August 24, 2024, Telegram CEO Pavel Durov was arrested in Paris over allegations related to platform moderation. This news could have triggered uncertainty—but instead sparked a firestorm.

The Telegram community united, flooding social platforms with support messages and launching a meme campaign that became a rallying cry for justice.

CMC’s yearbook elevates the significance of this event:

"It was a declaration of crypto spirit. A reminder that decentralization is power, and that the purest technology serves freedom, not wrongdoing. At that moment, the TON community showed the world it wasn’t just a blockchain—it was a revolution driven by resilience, unity, and unwavering belief."

Though TON’s momentum has cooled, it remains one of the brightest highlights of the year.

Top Asset Class of the Year: Meme Leads the Charge, Diversity Thrives

By popularity, the yearbook identifies these standout categories and projects:

-

Meme Coins:

-

MEW: The fifth-largest memecoin, leveraging unique tokenomics with 90% LP tokens burned, creating a stable price floor and boosting market confidence.

-

Popcat: The first cat-themed memecoin on Solana to hit a $1 billion market cap, achieving a $120 million valuation and pioneering the “cat coin” trend.

-

WIF: Became the third-largest memecoin after DOGE and SHIB within four months, reaching a $3 billion market cap, fueled by strong community engagement and Elon Musk’s endorsement.

-

Applications:

-

Polymarket: Handled $3.3B in wagers during the 2024 U.S. presidential election, leading decentralized prediction markets through smart contract automation and a no-KYC model.

-

Pump.fun: Revolutionized memecoin creation on Solana, enabling over 3 million tokens, attracting 150,000 users, and generating massive revenue. While highly impactful, the platform is controversial for amplifying the most extreme meme culture.

-

Binance Launchpool: Enhanced user participation via innovative yield farming mechanisms, successfully launching tokens such as Notcoin, Scroll, and Catizen.

-

Rising Stars to Watch:

-

Story Protocol: Pioneered blockchain-based IP management, attracting over 100 projects and transforming creator rights through programmable IP licensing infrastructure.

-

Monad: Next-gen Layer 1 achieving 10,000 TPS with 1-second finality, raised $225 million, and introduced the innovative MonadBFT consensus mechanism.

-

Berachain: An innovative Layer 1 with Proof-of-Liquidity consensus, launched the Artio testnet and attracted 230 active development teams through unique DeFi integrations.

When evaluating innovation—from AI-enhanced DeFi to real-world asset platforms, from decentralized infrastructure to core scaling solutions—these projects pushed the boundaries of on-chain possibilities:

AI Sector:

-

Bittensor: Built a framework for decentralized AI, expanded to 64 subnets, achieved full Ethereum compatibility, and launched complex AI models.

-

Prime: Led the frontier of AI gaming with flagship titles Parallel TCG and Colony, backed by OpenAI integration and the Wayfinder protocol for autonomous AI agents.

-

Near: Constructed the world’s largest open-source AI model with 1.4 trillion parameters, launched Nightshade 2.0 upgrade, increasing transaction speed by 400% through innovative sharding.

DeFi Sector:

-

LIDO: Maintained dominance in liquid staking with 9.8 million ETH staked, launched institutional solutions, and reduced validator requirements from 32 ETH to 2.4 ETH.

-

Pendle: Innovated in yield tokenization within DeFi, increased TVL from $230 million to $1 billion through liquidity restaking tokens and the Boros margin trading platform.

-

EigenLayer: Dominated restaking with 80% market share, $12.9B TVL, and 4.5 million ETH restaked, fundamentally reshaping Ethereum’s security model.

DePIN Sector:

-

Render: The leading decentralized GPU rendering service successfully migrated to Solana, expanded into real-time streaming and dynamic NFTs, and served major entertainment and architecture clients.

-

Arweave: A permanent storage solution that maintained steady growth amid market volatility, pioneering the “pay once, store forever” data storage model.

-

Aethir: A decentralized cloud computing platform turning GPU capacity into shared resources for gaming and AI, backed by a $100 million ecosystem fund and key partnerships with Nvidia and Filecoin.

RWA Sector:

-

Ondo: The first platform to tokenize over $500 million in U.S. Treasuries within four months, capturing over 25% market share through collaborations with BlackRock and JPMorgan.

-

Clearpool: Redefined institutional liquidity in DeFi with over $500 million in loans issued, and launched Ozean, an OP Stack-based Layer 2 network for RWA yields.

-

Ethena: The synthetic dollar protocol became the fourth-largest stablecoin, pioneering risk management through delta-neutral strategies combining spot and futures positions.

Infrastructure:

-

SUI: Built the world’s largest open-source AI model with 1.4 trillion parameters, launched Nightshade 2.0 upgrade, increasing transaction speed by 400% through innovative sharding.

-

Wormhole: Built the world’s largest open-source AI model with 1.4 trillion parameters, launched Nightshade 2.0 upgrade, increasing transaction speed by 400% through innovative sharding.

-

Arkham: Launched an on-chain perpetual trading platform powered by intelligence data, pioneering entity-based blockchain analytics.

Note: All project selections above reflect only the views of the yearbook. Interested readers can visit the original website to explore detailed profiles of each project, complete with short explanatory videos.

Due to space constraints, some notable projects across different ecosystems are listed without detailed analysis below.

6 Treasure Charts That Take You Through 2024

As widely known, CMC excels in data analysis and visualization.

The yearbook handpicked six charts, illustrating the evolution of the crypto market in 2024 from multiple data dimensions.

-

Best and Worst Performing Sectors: Smart Contracts vs. Storage

Smart contract-related projects led the pack with a 6000% return, while storage was the worst performer, posting a -24% annual return.

-

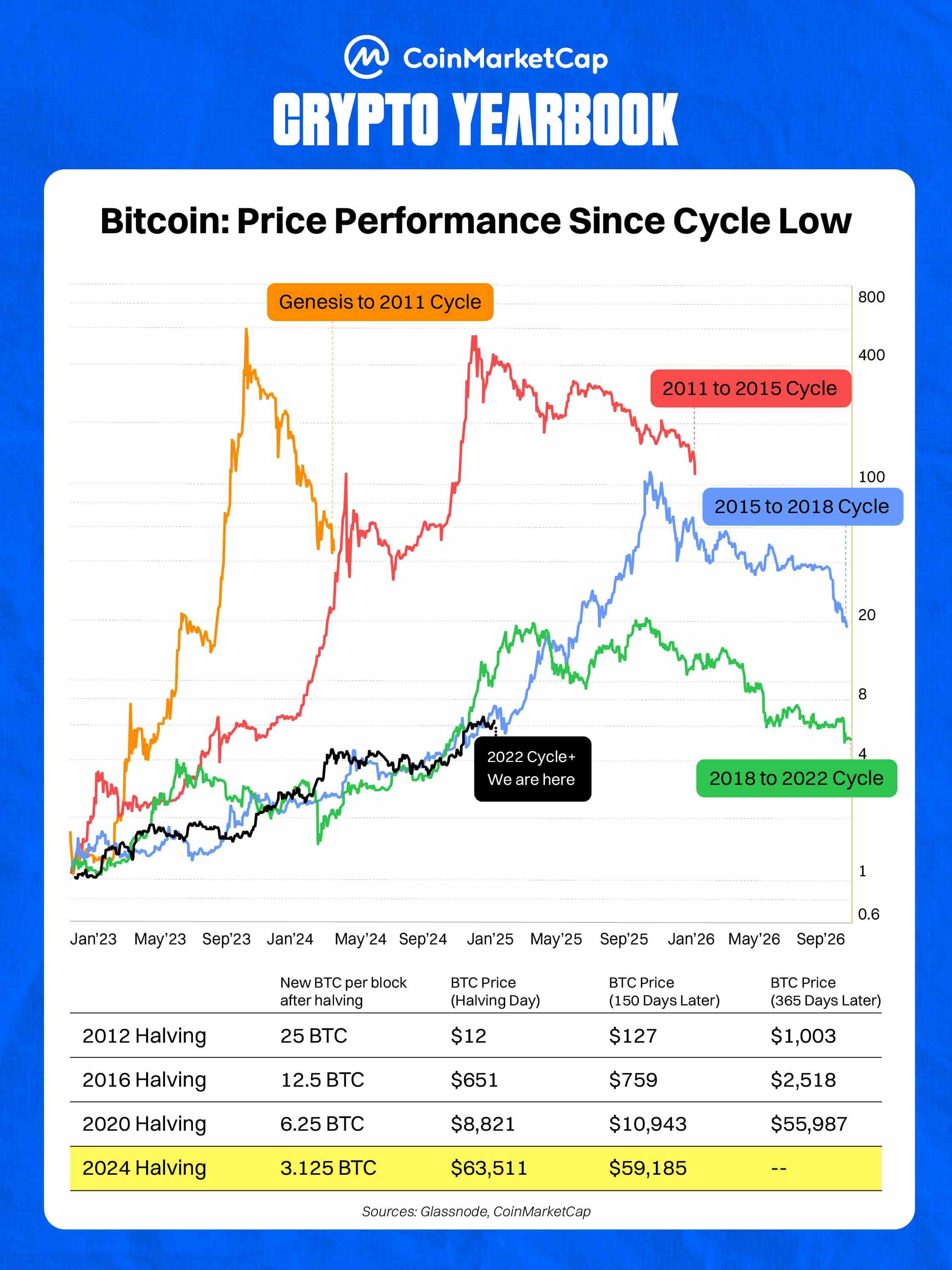

The Post-Halving Bitcoin Rally Continues

Bitcoin halved in 2024 at around $63,000. As we’ve all witnessed, what followed was another leg of its journey—from an experiment to $100,000—across BTC’s relentless 16-year run.

-

History Suggests the Bear Market Turn Hasn’t Arrived Yet

Bitcoin and the broader market typically follow 3–4 year cycles. As shown in the chart below, the current cycle (black line) shows no clear sign of reversal yet.

-

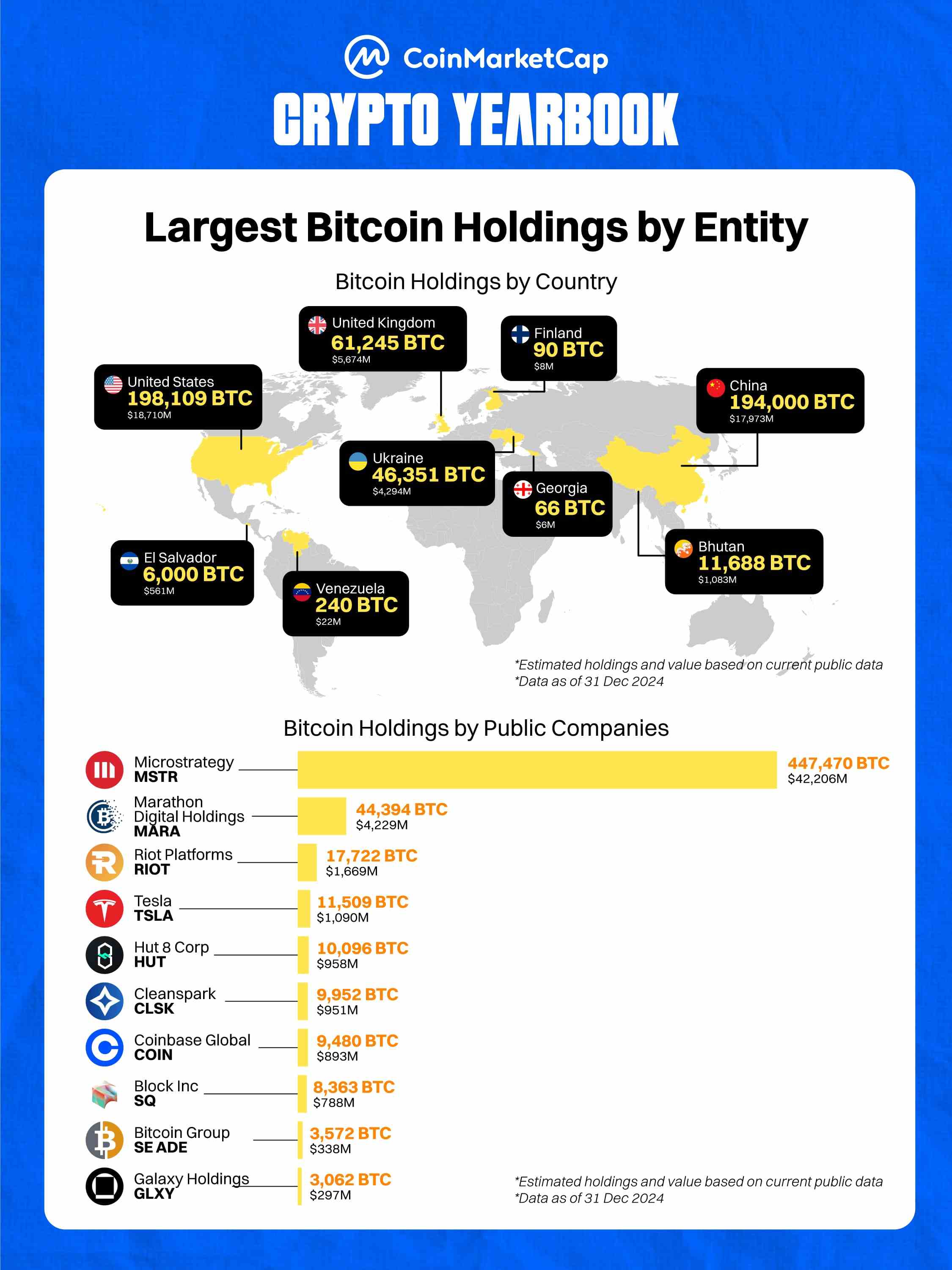

MicroStrategy Leads Global Institutional/National Bitcoin Holdings

MicroStrategy holds 440,000 BTC, far ahead of any other institution—and more than any single country. Meanwhile, China and the U.S. remain close in total BTC holdings.

-

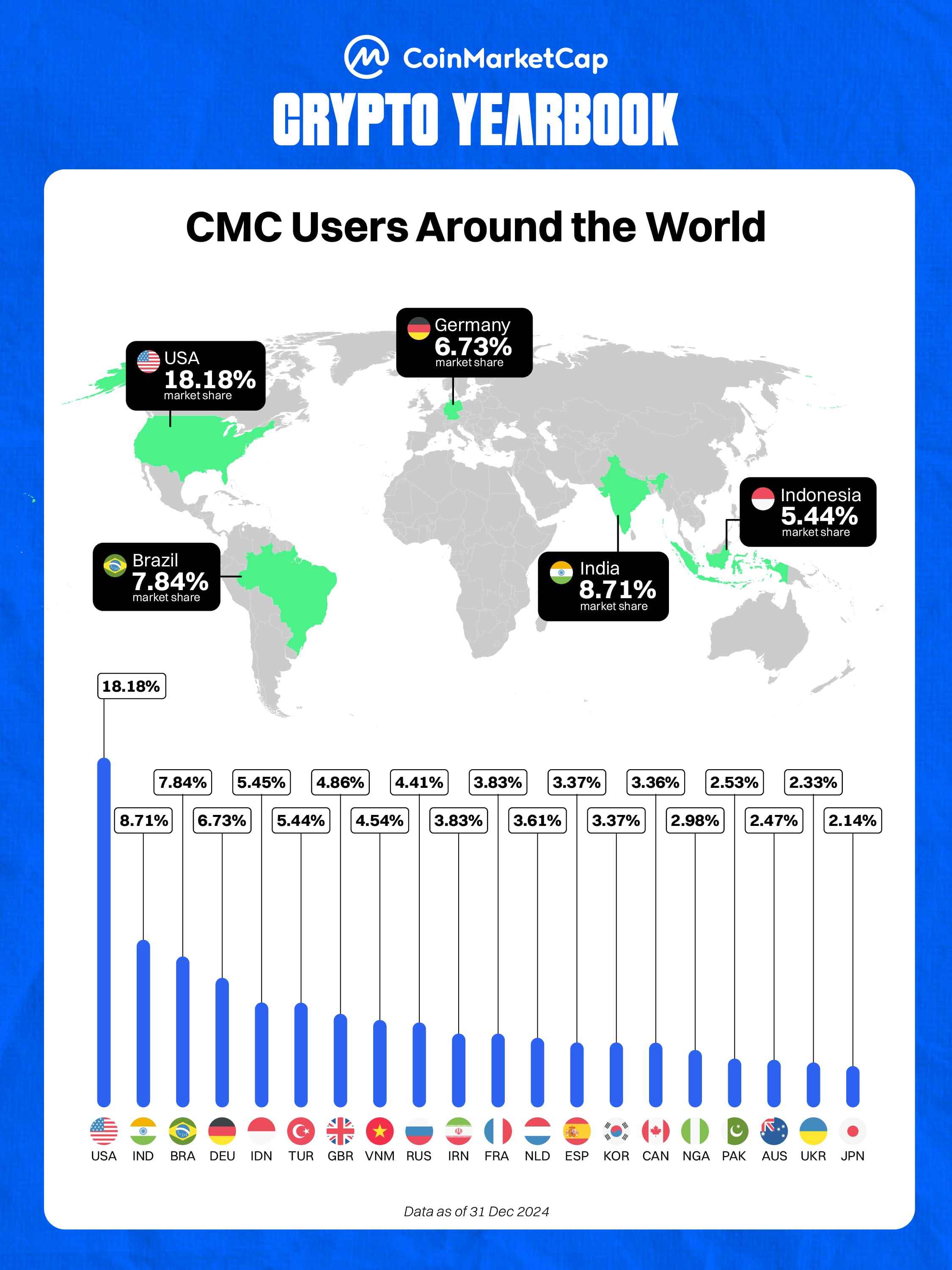

Top Country Using CMC: The United States

Surprisingly, India ranks second.

-

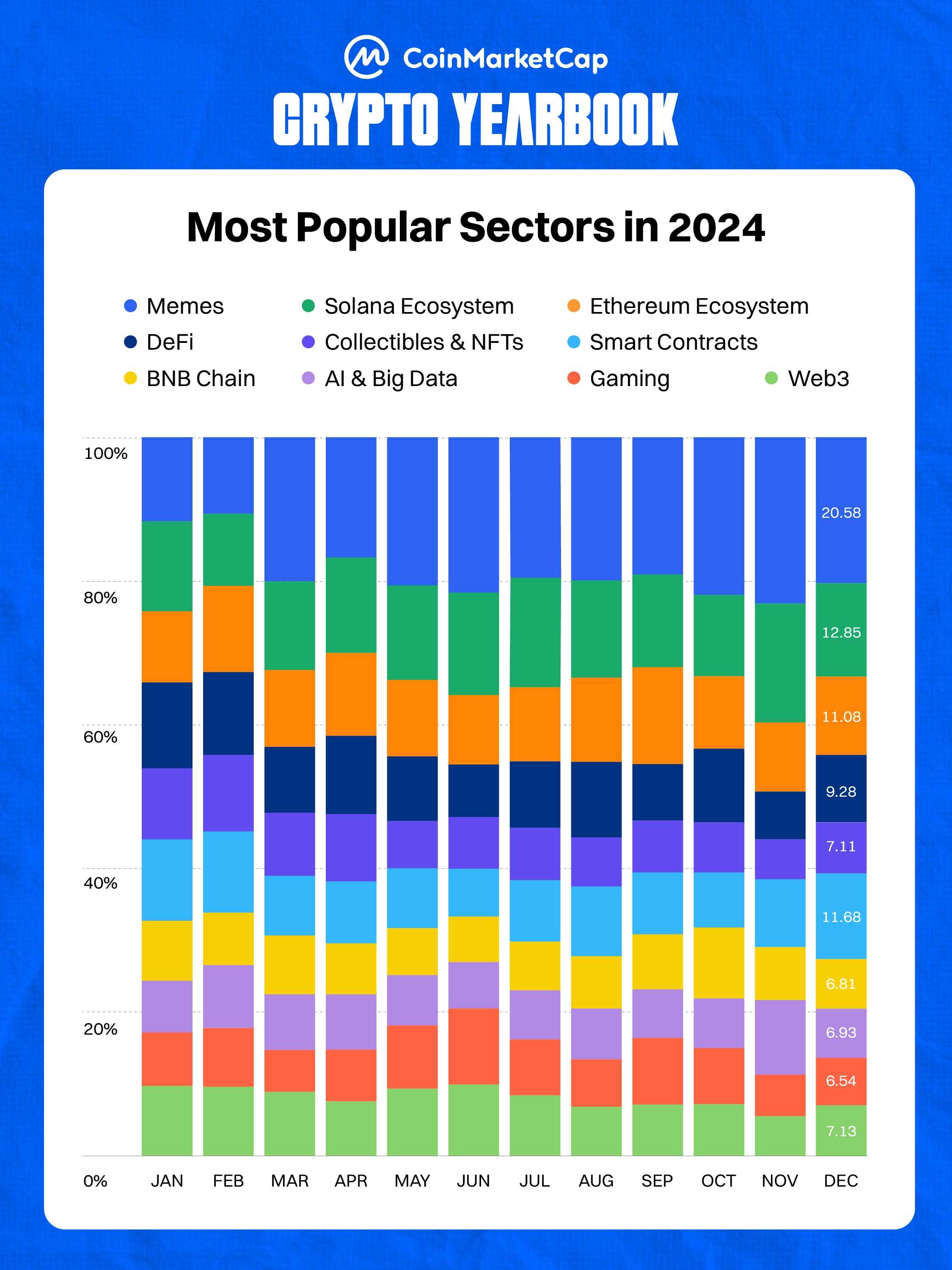

Most Popular Narrative: Meme Coins Are Proving Their Worth (Blue Area)

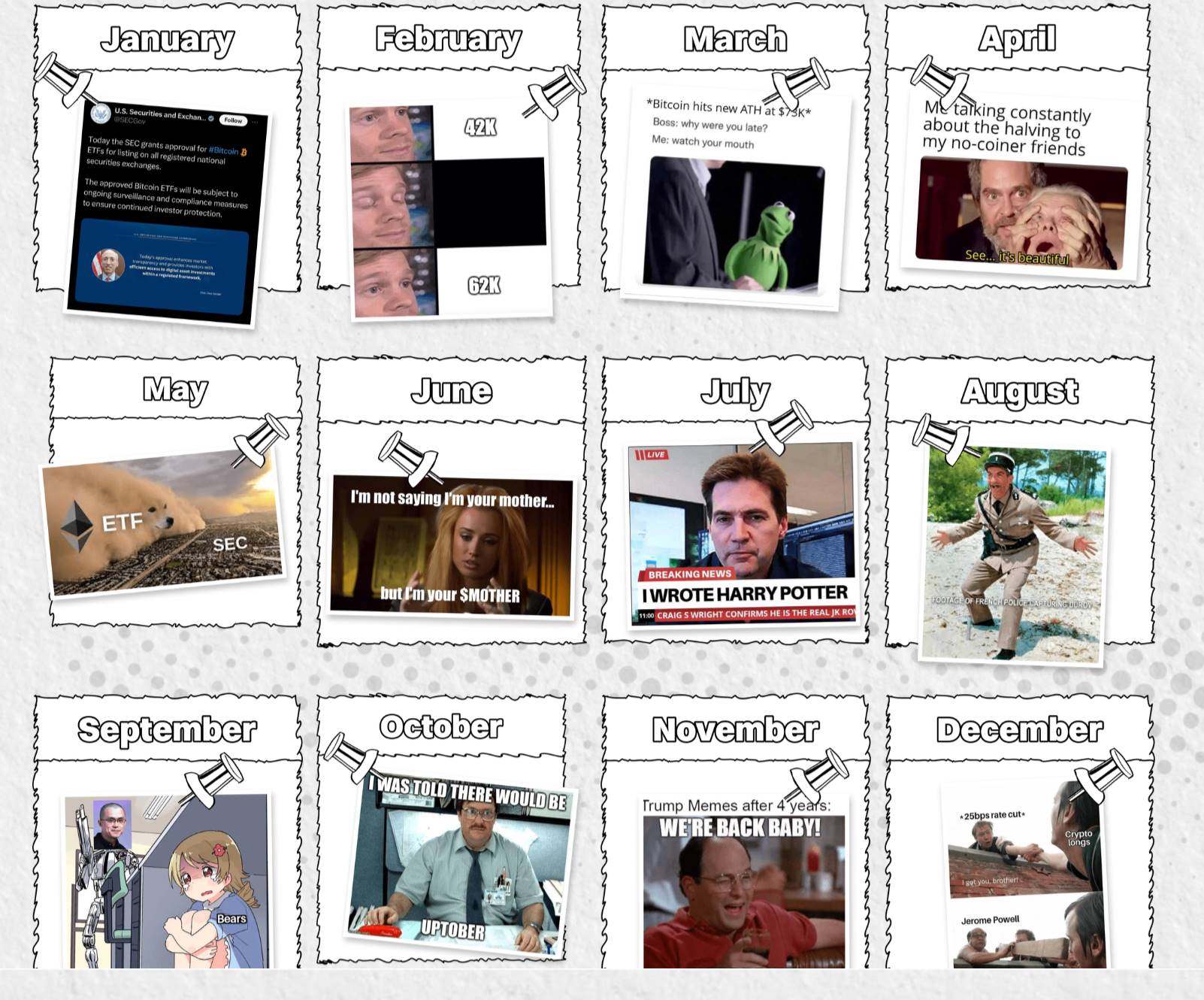

12 Memes That Capture a Year of Opportunities and Fun

Last year offered many opportunities. Catching just one or two could have changed your story entirely.

If you missed out, perhaps these memes can help you trace the contours of last year’s biggest chances and quirks.

-

January: The SEC is slower than hackers. The SEC’s official Twitter was hacked, falsely announcing “Bitcoin ETF approved.” Hours later, the SEC actually announced approval…

-

February: Did the ETF approval mean prices would rise? In fact, BTC was quite dull in February.

-

March: BTC hits $73K new high, while degens focus on airdrop farming.

-

April: BTC holders try to explain halving to friends and family—or drag people into conversations about it.

-

May: Heard you were bearish on Ethereum? The SEC approved ETH ETF!

-

June: Iggy Azalea launches her own token, kickstarting the celebrity coin trend. Call her “Mother.”

-

July: The “True Satoshi” drama returns—Craig Wright’s “Satoshi identity verification” case unfolds.

-

August: France arrests Telegram founder, sparking community backlash, meme campaigns, and inadvertently fueling the political coin trend.

-

September: That man—CZ—is back! And the market starts recovering.

-

October: The “October rally” rule gets postponed…

-

November: Brother Chang Guoqing returns—crypto gains a seat in Washington and the White House.

-

December: Rate cut expectations gradually materialize, and the crypto market seems to find its savior.

Outlook for 2025: What’s Your Prediction?

In this section, CoinMarketCap opens the floor to public voting, handing the outlook for 2025 to users—a kind of market survey showing which sectors and projects people believe in.

The following topics are up for vote. Which ones do you think will win out?

-

Which project will make big news this year?

Candidates: ETH, PEPE, Monad, Fartcoin, World Liberty Financial (Trump-linked).

-

Which narrative will dominate the scene this year?

Candidates: NFT/Gaming, Quantum-resistant tokens, Crypto IPOs, RWA, and AI Agents.

-

Which asset will get ETF approval?

-

Which project will quietly enter the top 30 by market cap?

Candidates: Virtuals, FET, Pengu, Ethena, Ondo.

-

Which old-timer will bloom again?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News