The big player who aggressively bought SOL at its $8 bottom is now calling ETH

TechFlow Selected TechFlow Selected

The big player who aggressively bought SOL at its $8 bottom is now calling ETH

"The Ethereum community once fell into a trap of complacency, but it has now begun to reflect independently."

Author: Chris Burniske, Partner at Placeholder

Translation: Azuma, Odaily Planet Daily

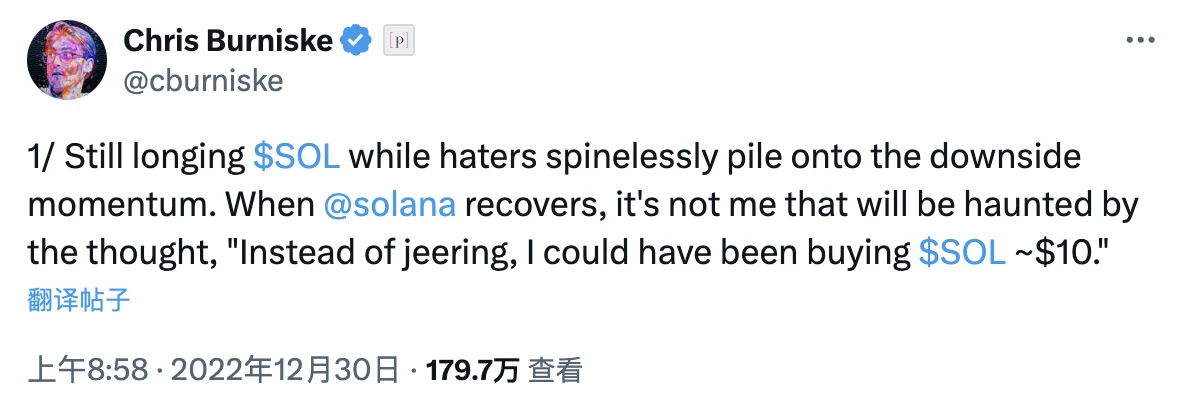

Editor's note: On December 30, 2022, Solana hit its darkest hour, with SOL briefly falling to $8—the lowest price since the FTX collapse. That day, former Ark Invest crypto lead and current Placeholder VC partner Chris Burniske posted a bullish thread on X, openly expressing confidence in SOL and stating his intention to keep accumulating. The rest is history: SOL surged dramatically and has recently broken through $240, showing strong momentum for further highs.

Now it’s November 2024. Ethereum, hampered by narrative bottlenecks and other factors, appears to be gradually losing steam. On November 17, Burniske once again published a similarly optimistic post on X, publicly backing Ethereum and predicting the chain will experience a revival over the coming years.

Below is the original text by Burniske, translated by Odaily Planet Daily.

One of the reasons Placeholder consistently focused on Solana during the last bear market was our belief that it could become a mainstream blockchain for everyday users, thanks to superior user experience advantages such as faster speeds, lower fees, and smoother transactions. This is now being demonstrated through phenomena like the meme token boom.

But we have always been supporters of Ethereum—and that hasn’t changed.

In this new cycle, even though Ethereum may have already lost some of its share in serving everyday users to Solana (which has already happened), the Ethereum community should continue strengthening its position as the core of the Internet Financial System (IFS). IFS will grow increasingly important between 2025 and 2030, attracting many more users than we’ve seen so far.

Solana and other blockchains will also compete with Ethereum in the IFS space (this is already happening), but Ethereum still has solid foundations: it has existed for over a decade, enjoys brand recognition second only to Bitcoin, possesses deep liquidity, and enables companies to build their own Layer 2 solutions around it, just like Base does.

Although everyone knows Layer 2 architectures currently face issues with fragmented liquidity (which will eventually be resolved), they are well-suited for traditional financial institutions because they allow better control and direct conversion of revenue into profit. Other blockchains like Avalanche have also been focusing on this, adopting similar subnet architectures and targeting the IFS sector.

I’m excited about recent discussions within the Ethereum community.

The community is learning from past lessons. During the 2018–2021 bull run, in my view, the Bitcoin community became complacent, believing they had already won and secured dominance. Around 2021, BTC started to seem somewhat “outdated,” even mocked as the “boomer coin,” which sparked a renaissance—one of the key reasons behind Bitcoin’s resurgence in this cycle.

Similarly, it seems to me that parts of the Ethereum community fell into the same trap of complacency between 2022 and now. But precisely because Ethereum is currently being questioned and perceived as lagging, many segments of its ecosystem are poised for revitalization.

Just as Bitcoin experienced a renaissance driven by competition and self-reflection, we may witness a similar revival for Ethereum over the next few years—an introspection forced by competitive pressure.

The evolution of mainstream blockchains is an extremely long game—anyone who assumes too early that they’ve won will fall into complacency and ultimately lose everything. We look forward to seeing how the positions of Bitcoin, Ethereum, and Solana evolve beyond 2030 and into the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News