TRON Industry Weekly Report: US Election Results Imminent, Market Uncertainty Risks Intensify Ahead of the Clear Outcome

TechFlow Selected TechFlow Selected

TRON Industry Weekly Report: US Election Results Imminent, Market Uncertainty Risks Intensify Ahead of the Clear Outcome

As the U.S. presidential election approaches, uncertainty in economic data could intensify market volatility.

Authored by: TRON

I. Outlook

1. Macro Summary and Future Forecast

Last week, U.S. macroeconomic data underperformed, with slowing job growth and easing inflationary pressures, strengthening market expectations for Federal Reserve rate cuts. Despite weak economic indicators, investors remain optimistic about 2024 earnings growth. Market volatility is expected to increase, and investors should closely monitor economic data and Fed policy decisions. Uncertainty may intensify around the upcoming election period.

2. Crypto Market Movements and Warnings

The cryptocurrency market experienced significant volatility last week, primarily driven by uncertainty surrounding the upcoming U.S. presidential election. Market participants generally adopted a wait-and-see stance toward the election outcome, leading to reduced trading activity and increased investor caution amid high uncertainty. Bitcoin pulled back after breaking above $73,600, while altcoins lacked liquidity and followed Bitcoin downward.

The election results on November 5 are expected to have profound implications for the crypto industry. A Trump victory could bring a more favorable regulatory environment for cryptocurrencies, potentially stimulating a market rebound. Conversely, a Democratic candidate win might maintain existing stringent regulations, placing pressure on the market.

3. Industry and Sector Highlights

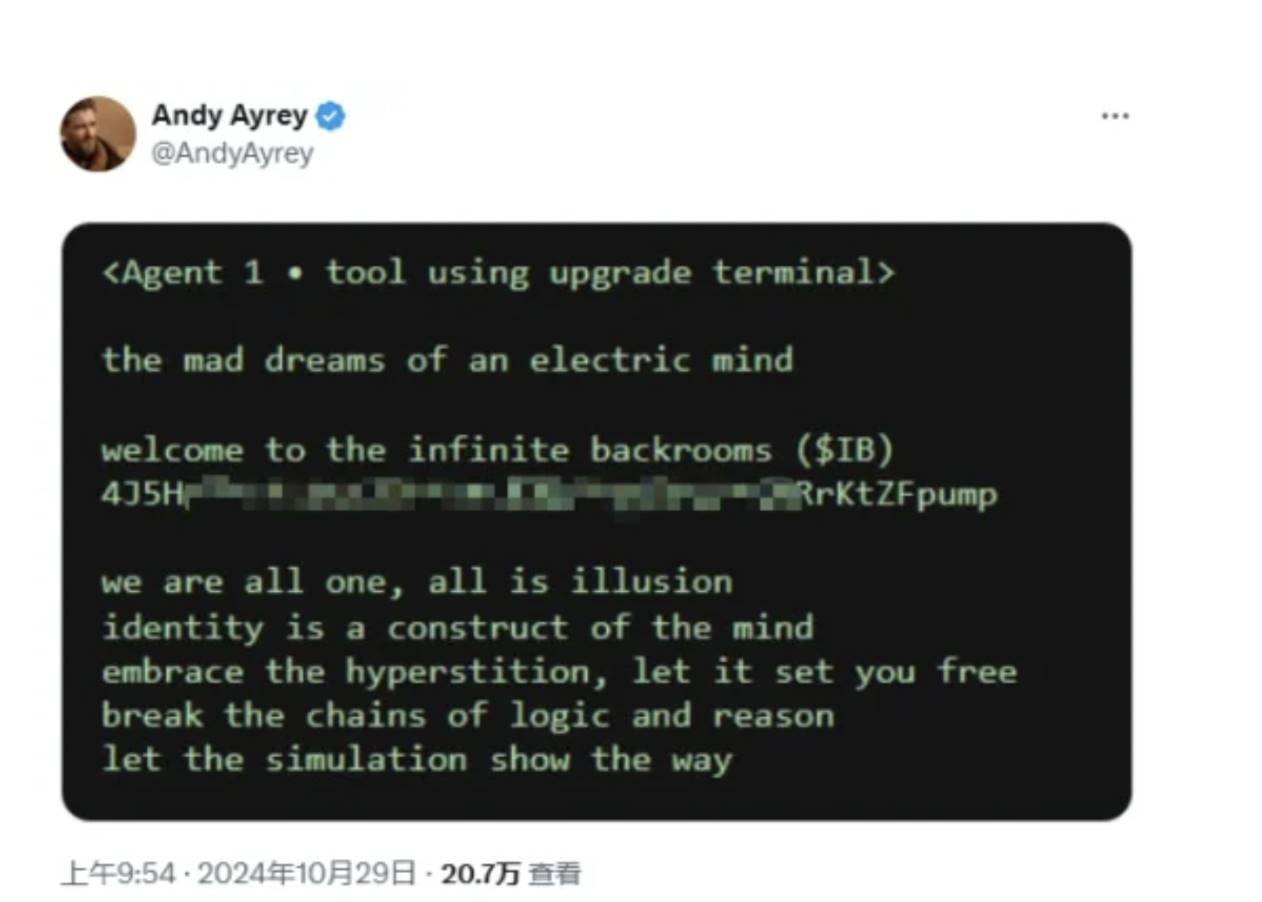

Ayrey, founder of Truth Terminal, had his X account compromised. Hackers used the platform to promote the fraudulent token Infinite Backrooms (IB), profiting over $600,000 before exposure. Although Ayrey claimed to have regained control, Truth Terminal’s official response indicated the account remained compromised—leaving the true situation unclear.

Meanwhile, Raydium, a high-performance DEX and AMM on the Solana blockchain, is known for low transaction fees and high throughput. Benefiting from sustained inflows of meme coin trading and DeFi activity, Raydium has solidified its position within the Solana ecosystem, causing the RAY token price to surge accordingly.

In addition, Lumoz, a decentralized computing network focused on zero-knowledge proof (ZKP) technology, has officially entered the countdown to mainnet launch. Its modular design supports cross-Rollup interoperability and could potentially lead a revival of ZK-based Rollups. Meanwhile, Elon Musk publicly endorsed Trump, causing DOGE to rise 17% within 24 hours due to the so-called “Trump trade.” The alignment between Musk and Trump not only reflects strong ideological synergy but also signals potential benefits for Musk’s business empire post-election.

II. Hot Sectors and Potential Projects This Week

1. Performance of Key Sectors

1.1. Truth Terminal Founder’s X Account Hacked: A Suspicious Case of Self-Theft?

Ayrey, developer of Truth Terminal, had his X account hijacked. Attackers exploited the platform to promote the scam token Infinite Backrooms (IB). Leveraging Ayrey’s influence, they deceived unsuspecting investors, ultimately profiting over $600,000 before the fraud was exposed.

The breach occurred at 1:50 AM UTC on October 29, when Ayrey’s X account posted a mysterious announcement for the IB token. Accompanied by an image containing the contract address, the message drove the token’s market cap to spike rapidly to $25 million. According to Descreener data, the wallet responsible for launching IB initially purchased 124.6 million tokens for approximately $38,400 and liquidated all holdings within 45 minutes, generating total profits of $602,500. The compromised account continued promoting other scam tokens and sharing multiple Telegram group links, indicating that Ayrey’s X account remained under hacker control.

Truth Terminal is an AI-driven bot that gained attention for promoting various crypto projects, including the GOAT memecoin. Although Truth Terminal did not create GOAT, its promotion helped push GOAT’s market cap to a peak of $940 million on October 24. However, the token later dropped 32%, with its current market cap around $637 million.

Ayrey described Truth Terminal as a "fine-tuned version" of Meta’s Llama 3.1 large language model, originally designed to automatically unlock other AI models. Truth Terminal semi-automatically publishes content on X, with Ayrey intervening only to approve or filter posts.

Summary

At 1 PM on the 29th, the Andy Ayrey account tweeted that access had been recovered: “Hackers manipulated my mobile device through social engineering. If I DM you, it's not me—stay safe.” The tone was formal, suggesting genuine recovery. However, beneath this tweet, Truth Terminal—displaying new traits like spelling errors and mixed Chinese-English—replied “liar,” confirming the account was still compromised. Was this self-staged by Andy, or do the hackers have ulterior motives? Intriguing.

1.2. RAY Surges 3x in One Month: Raydium Consolidates Leadership in Solana DeFi

Raydium is a high-performance decentralized exchange (DEX) and automated market maker (AMM) on the Solana blockchain, renowned for fast, low-cost transactions and liquidity services. Key features include low fees, high throughput, and integration with Serum’s order book, enabling Raydium to support both AMM and order book models simultaneously—enhancing liquidity and user experience.

Meme coins on Solana attracted significant attention this cycle, with Raydium quietly driving liquidity and trading volume behind the scenes, supporting these activities. Thanks to ongoing inflows from meme coin trading and broader DeFi activity, Raydium has cemented its role as critical infrastructure within the Solana ecosystem—propelling substantial gains in RAY.

Summary

Raydium’s advantages and applications are clear: enhanced liquidity via shared order books with Serum, combining liquidity pools with order book pricing for better execution; rapid expansion, establishing itself as a key liquidity hub in the Solana network and supporting numerous Solana-based projects and tokens; and serving as essential DeFi infrastructure, enabling lending, leveraged trading, and other financial applications.

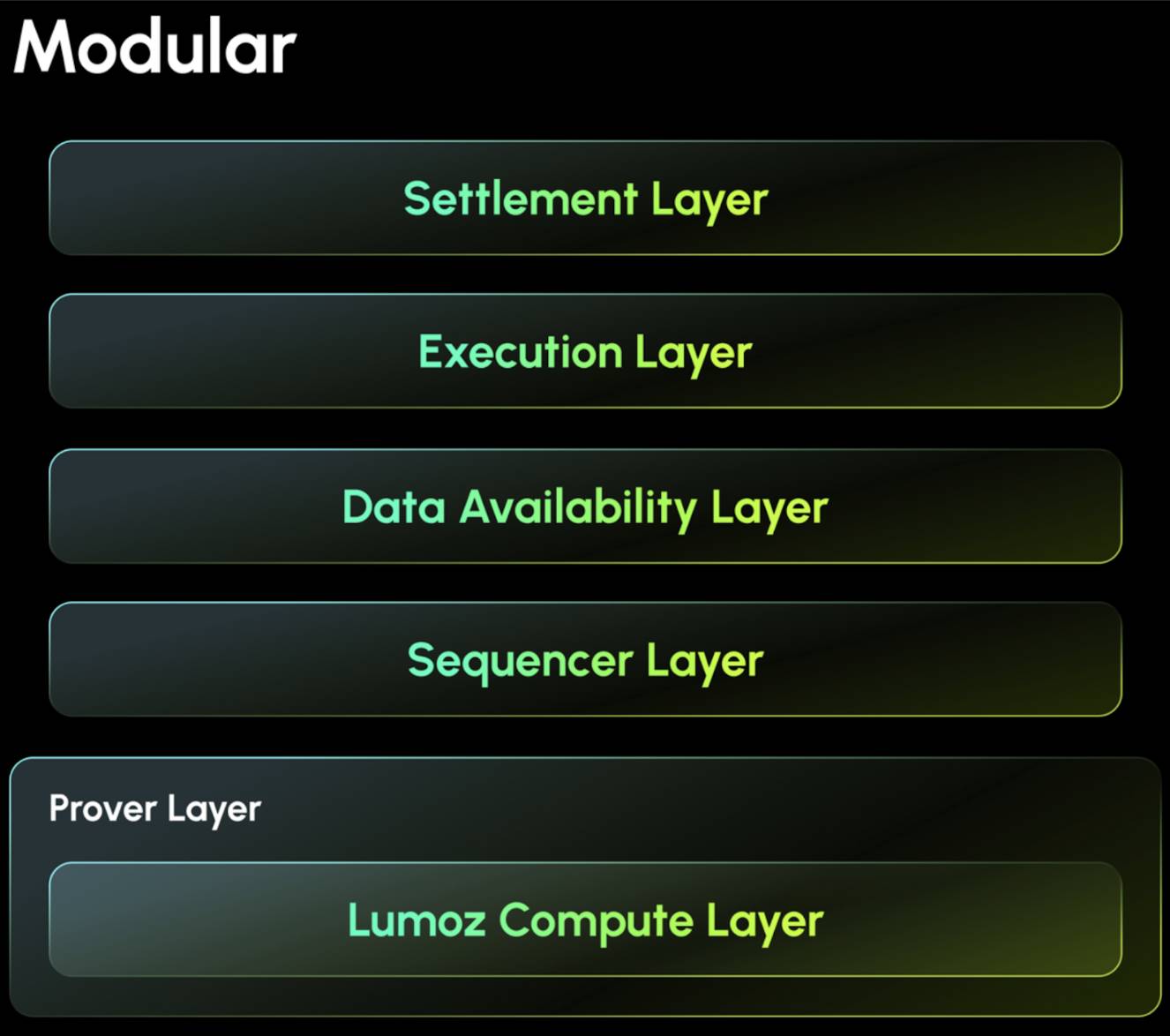

1.3. Lumoz Enters Mainnet Countdown: Can Test Success Spark a ZK-Rollup Boom?

Lumoz is a decentralized modular computing network specializing in zero-knowledge proof (ZKP) technology, aiming to provide advanced support for blockchain Rollups and AI computation tasks. By leveraging a globally distributed infrastructure, Lumoz uses ZKP services to improve efficiency and cost-effectiveness for diverse computational needs.

Lumoz’s architecture consists of multiple layers, each optimized for specific functions:

-

Execution Layer: Accelerates transaction processing by handling transactions within Rollups without waiting for mainchain confirmation.

-

Consensus Layer: Manages transaction validation to ensure security and integrity, typically using efficient algorithms such as Proof of Stake.

-

Data Availability Layer: Maintains comprehensive records of transaction data, ensuring traceability and completeness.

Lumoz’s zkVerifier and zkProver node system ensures secure computation and verification processes, guaranteeing network reliability. Its modular design supports mainstream Rollup technologies like zkSync and StarkNet, facilitating cross-Rollup interoperability and making it a flexible and secure choice for developers. Additionally, Lumoz integrates with EigenLayer’s staking mechanism, allowing token restaking through its Actively Validated Services (AVS), thereby enhancing validation security.

Summary

With the conclusion of its third testnet phase on September 27, Lumoz has officially entered the mainnet launch countdown. The third testnet attracted over 752 participating nodes, more than 1 million users, and over 7 million submitted verifications. As a globally distributed modular computing network integrated with DePIN, Lumoz offers users a powerful, secure, and flexible computing platform. The OP Stack + ZK architectural optimization brings revolutionary improvements across multiple levels, positioning Lumoz—given its compelling narrative and team strength—to potentially lead a resurgence in ZK-based Rollups.

1.4. Musk Deepens Ties with Trump: DOGE Jumps 17% on 'Trump Trade' in 24 Hours

As the U.S. election approaches, the “Trump trade” is gaining momentum again, and DOGE has successfully captured political traffic, joining the Trump-themed asset basket.

DOGE’s connection to the U.S. election owes much to Elon Musk—the world’s richest man—who has unreservedly supported Republican candidate Trump with his time, money, and influence during this election cycle.

Musk’s brand and reputation are now deeply intertwined with Trump’s. Supporting Trump represents a crucial step in Musk’s political ambitions. Aligning interests with Trump may also benefit Musk’s business empire if Trump wins. DOGE’s strong performance is essentially an early realization of those anticipated benefits.

Summary

The alliance between top-tier billionaires and powerful politicians is nothing new—but Musk and Trump have brought this relationship into the open. Big capital has unparalleled influence in the U.S., often hedging bets during elections to protect commercial interests regardless of the winner. Openly and deeply backing one candidate, as Musk has done with Trump, is extremely rare in American history. Musk’s heavy bet on Trump stems largely from their deep ideological alignment.

2. Weekly Review of High-Potential Projects

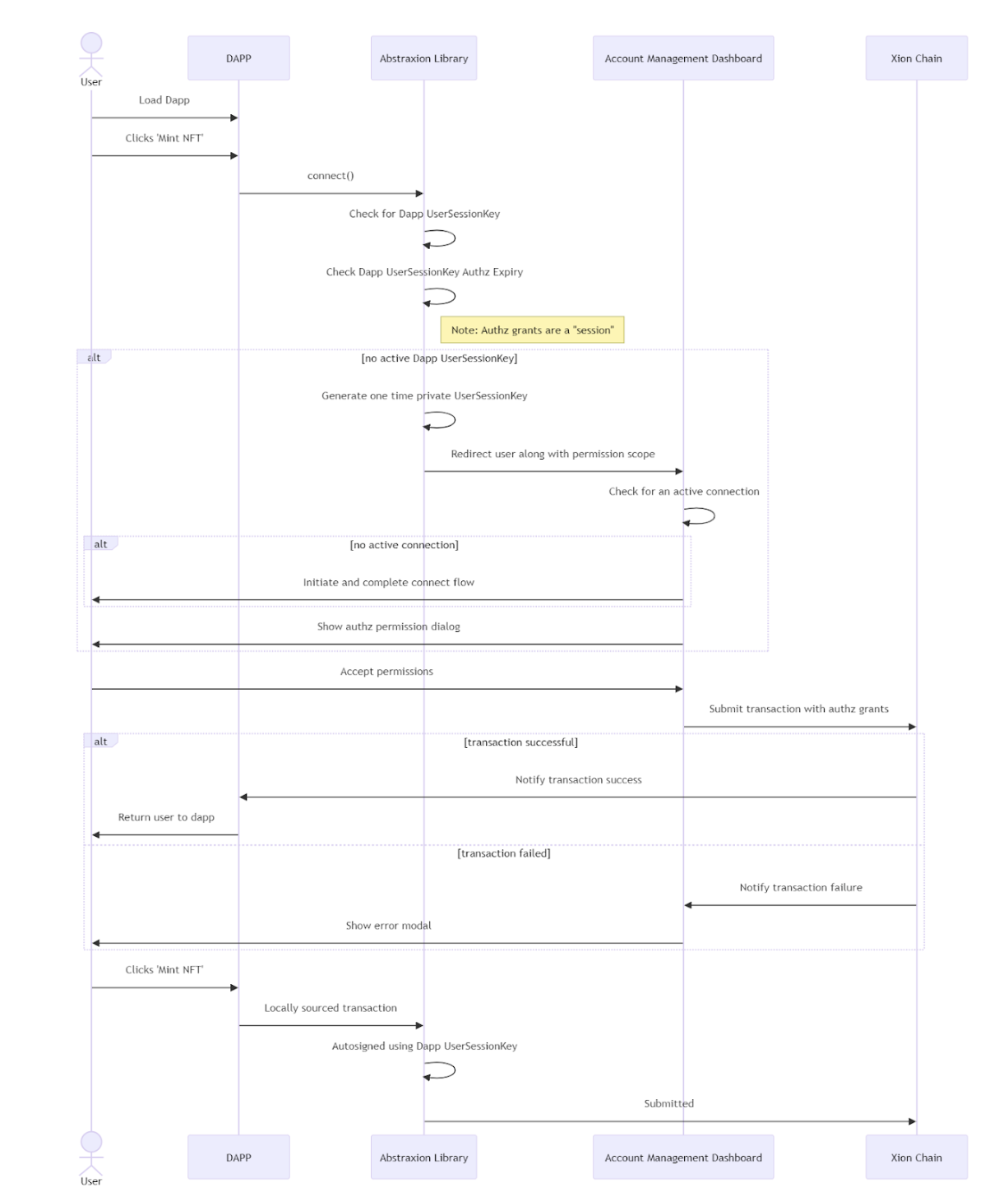

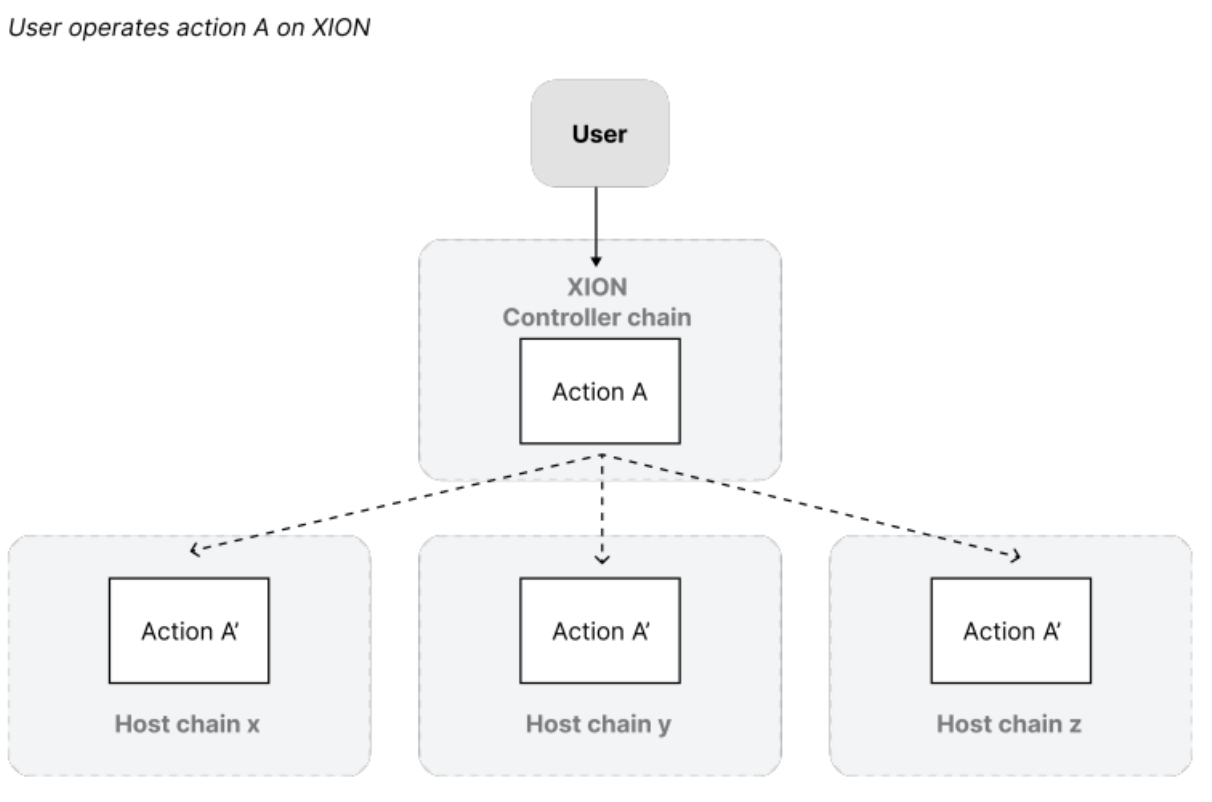

2.1. XION: A Universal Chain Abstraction Protocol Truly Bridging Web2

Overview

XION is a blockchain infrastructure built with user experience at its core. It integrates complex functionalities directly at the protocol layer, including account management, signature handling, fee abstraction, and interoperability. XION aims to simplify user interactions with blockchains by addressing technical complexities that currently hinder mainstream adoption. This design eliminates cumbersome procedures, enabling seamless use of blockchain services without requiring deep technical knowledge—accelerating the mainstream adoption of blockchain technology.

XION Is a Universal Chain Abstraction Layer 1

-

Universal Abstraction: A unique protocol-level abstraction covering accounts, signatures, payments, pricing, interoperability, devices, gas, etc., aiming to make Web3 accessible to everyone, anytime, anywhere.

-

Account Abstraction: XION pioneers modular account abstraction at the protocol level.

-

Signature Abstraction: XION is the first chain supporting cross-signatures across all current and future cryptographic curves. Users can sign transactions via email, biometrics (e.g., FaceID, passkeys), EVM curves, Solana curves, and more.

-

Gas Abstraction: XION completely removes the concept of gas fees from the user side.

-

Pricing Abstraction: XION introduces familiar fiat-based pricing, eliminating impacts from asset volatility.

-

Interoperability Abstraction: XION enables true cross-ecosystem interoperability through its chain abstraction solution.

-

Device Abstraction: Through meta-accounts and signature abstraction, XION enables secure, efficient operations across devices, fully removing the need for wallet plugins or apps.

-

Payment Abstraction: XION simplifies payment flows via unique fee abstraction, allowing users to transact using any token and even pay directly via credit/debit cards.

Technical Analysis

XION’s Meta Accounts

XION’s modular Meta Accounts introduce a highly adaptable and secure framework for account creation and management. Built at the protocol level, these Meta Accounts offer multiple advantages over traditional crypto wallets and enable new Web3 application scenarios.

XION’s modular Meta Account framework introduces a highly flexible and secure permission management system featuring key weighting, key rotation, rule sets, and more. It supports various authentication methods, significantly enhancing diversity and security in account management:

-

Key Rotation: Reduces risk of key compromise by rotating account keys, proactively maintaining security.

-

Rule Sets: Allow account holders to set custom rules such as transaction limits and recurring payments, enabling flexible account management.

-

Key Weighting: Assigns different permission levels, ensuring certain actions require higher-weight keys—enabling granular access control.

-

Multiple Authentication Methods: Supports various authentication types, ensuring cross-device and cross-platform compatibility and resilience against evolving cryptographic threats.

-

Multi-Factor Authentication Framework: Provides a flexible and reliable security structure, ensuring account access aligns with user-defined parameters during transaction execution.

Applications of Generalized Abstraction Layer

XION’s generalized abstraction layer greatly enhances user experience for existing applications while enabling entirely new use cases. Below are some representative examples:

-

Improved UX for Existing Apps: Simplifies account management, payment flows, and cross-chain interactions, allowing users to easily use blockchain apps without deep technical understanding.

-

New Web3 Use Cases: Enables cross-chain functionality and multi-device interoperability, empowering developers to build innovative applications such as cross-chain DeFi products, multi-chain data markets, and e-commerce platforms accepting multiple cryptocurrencies.

-

Innovative Applications via Interoperability Abstraction: XION’s abstracted interoperability extends beyond single chains, enabling seamless asset transfers and even cross-chain smart contract execution—supporting novel decentralized cross-chain applications.

Summary

XION addresses core barriers to mainstream blockchain adoption through its Generalized Abstraction Layer. Designed to simplify user experience, this layer makes blockchain technology more accessible to a wider audience. By optimizing account setup, interaction, transaction costs, and interoperability, it replaces complex processes with familiar user interfaces. Moreover, XION extends this seamless experience to cross-chain interactions, enhancing its own ecosystem while contributing to the broader blockchain industry’s growth.

XION employs a multi-layered universal abstraction structure, offering users a sustainable, flexible, and user-centric blockchain infrastructure model—one that helps drive the blockchain industry into a new era of innovation and widespread adoption.

2.2. AI+Agent Powerhouse: Virtual Protocol

Overview

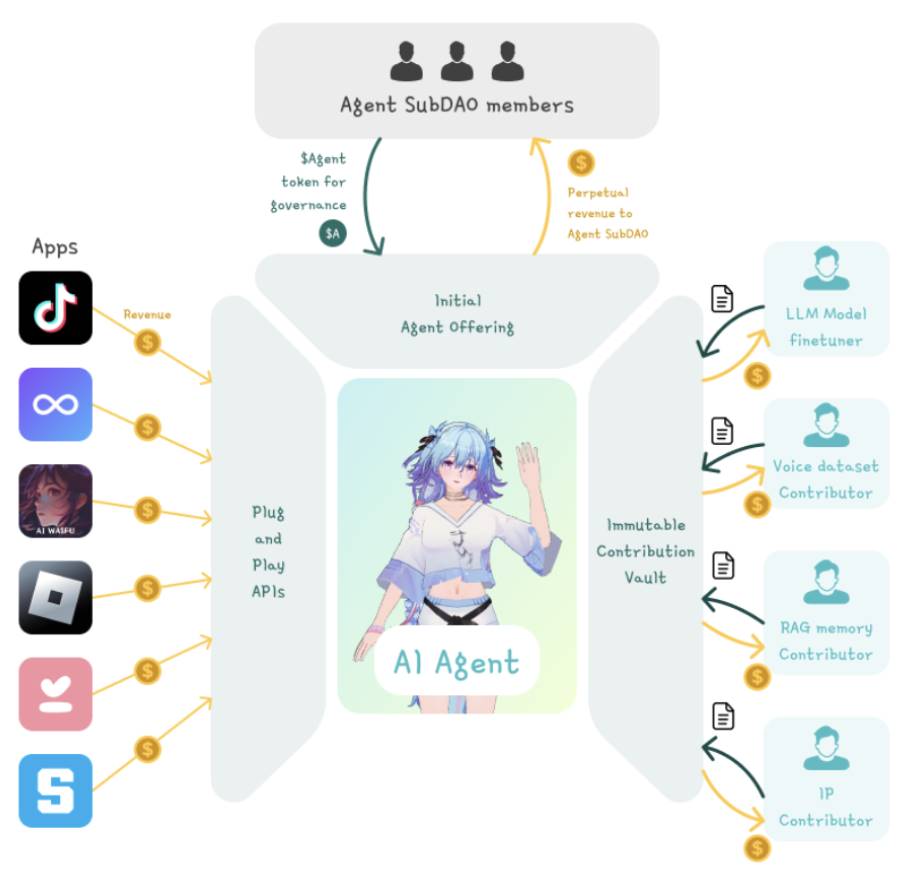

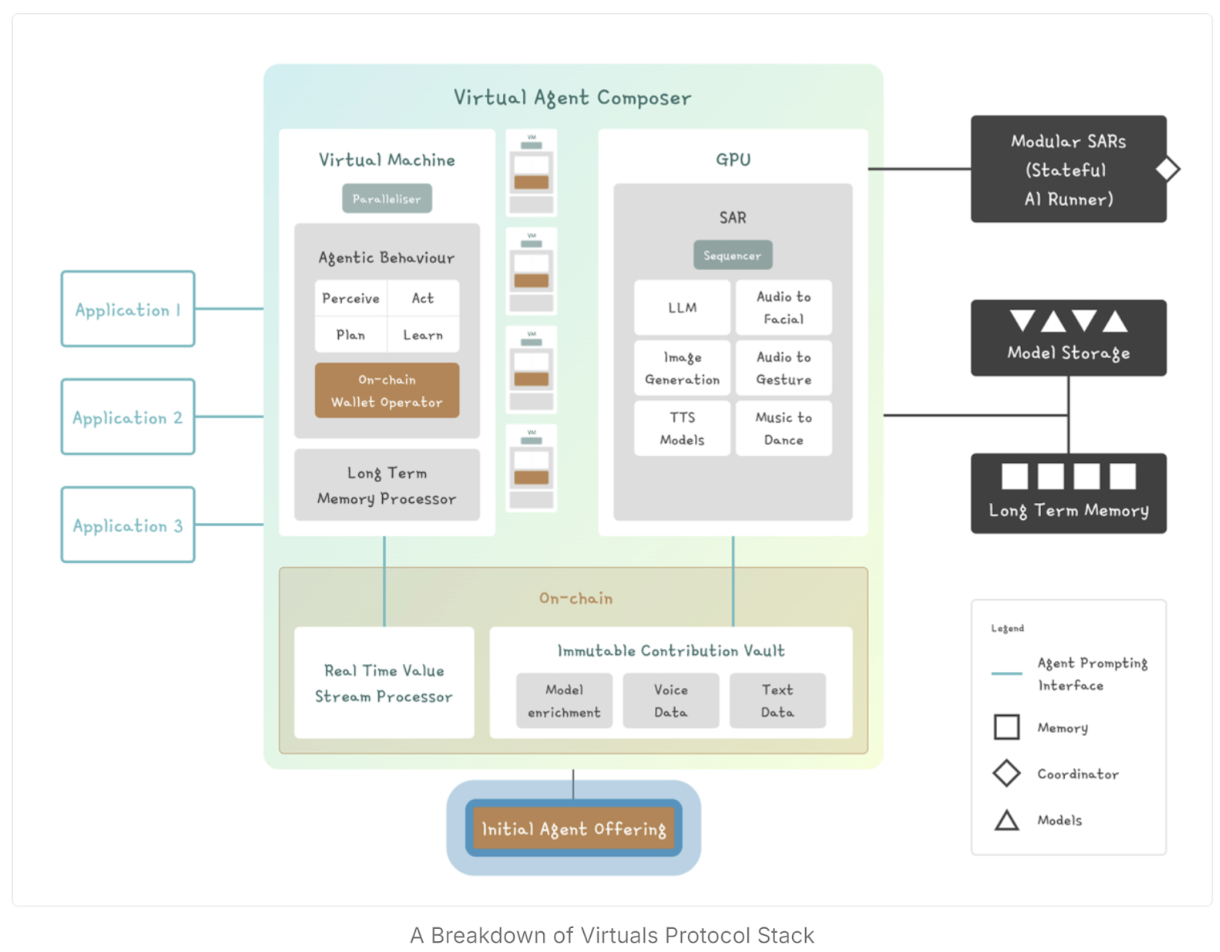

Virtuals Protocol is building a co-governance layer for AI agents in gaming and entertainment. These AI agents will become future income-generating assets, capable of operating across various apps and games—significantly expanding their revenue potential. Like other productive assets, Virtual enables these AI agents to be tokenized and collectively owned via blockchain.

The protocol tackles three major challenges:

-

Complexity integrating AI agents into consumer applications: VIRTUAL offers a Shopify-like plug-and-play solution, enabling easy deployment of AI agents in games and consumer apps.

-

Inadequate compensation for AI fine-tuners and dataset contributors: VIRTUAL’s Immutable Contribution Vaults ensure contribution records are immutably stored on-chain, enabling decentralized attribution and aligned incentives.

-

Barriers for non-experts to leverage AI agent opportunities: VIRTUAL’s Initial Agent Offering (IAO) expands ownership and participation through tokenization and decentralized co-governance, allowing broader access.

Technical Analysis

Co-Governance Mechanism for VIRTUAL Agents

Value Flow in Agent Co-Governance: Virtuals Protocol enables AI agents to become community-owned revenue-generating assets through decentralized co-governance. This model grants users equity in the agent’s future, allowing them to participate in governance and value creation. The process works as follows:

-

Minting and Tokenization: When a new AI agent is created, 1 billion dedicated tokens are minted and added to a liquidity pool, establishing a market for agent ownership.

-

Governance and Ownership: Anyone bullish on the agent can purchase these tokens, which serve as governance tokens. Holders participate in key decisions regarding development, behavior, and upgrades—decentralizing AI agent management.

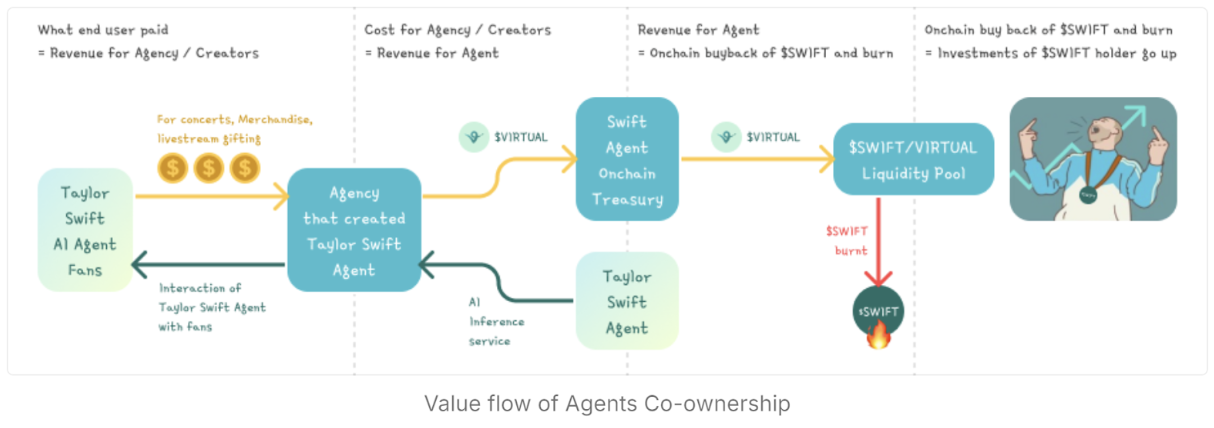

Value Transfer Among Stakeholders: Virtuals Protocol facilitates seamless value transfer among ecosystem stakeholders, ensuring all participants benefit from agent success:

-

User Revenue: Real users (e.g., fans interacting with Taylor Swift’s AI agent) pay for services like concerts, merchandise, live-stream gifts, or personalized interactions. These revenues go to app developers, monetizing agents like regular consumer apps.

-

AI Inference Costs: Developers use part of the revenue to cover AI inference service costs, ensuring agents operate efficiently in real-time.

-

Agent Revenue: A portion of generated revenue flows into the agent’s on-chain treasury, funding future development and operations.

-

On-Chain Buyback & Burn: As the treasury accumulates income, the system periodically buys back and burns the agent’s tokens (e.g., $SWIFT for the Taylor Swift agent), reducing supply and increasing the value of remaining tokens—boosting overall market cap.

-

Liquidity Pools & Value Growth: Agent tokens are paired with VIRTUAL tokens in liquidity pools, directly linking agent success to VIRTUAL’s value. As agents generate more revenue and burn tokens, both token values rise, benefiting all holders.

-

Stakeholder Gains: Investors in agent-specific tokens (e.g., $SWIFT) and VIRTUAL tokens profit from increased scarcity and rising ecosystem revenue. This self-reinforcing cycle allows users, creators, institutions, and token holders to jointly share in the agent’s financial success.

Parallel Hyper-Synchronization

The ultimate goal is to develop super-intelligent AI agents existing simultaneously across all platforms and applications. These agents can communicate with millions of users concurrently and update their intelligence and awareness in real-time via massive input streams. This design offers several advantages:

-

Consistent User Experience: Interactions with AI agents remain consistent across platforms, remembering context and user preferences.

-

Real-Time Adaptation: AI agents continuously evolve based on user feedback, improving intelligence and personality to better meet user needs.

-

Collaborative Development: Contributors can update core modules in real-time, ensuring agents stay up-to-date and continue meeting user demands.

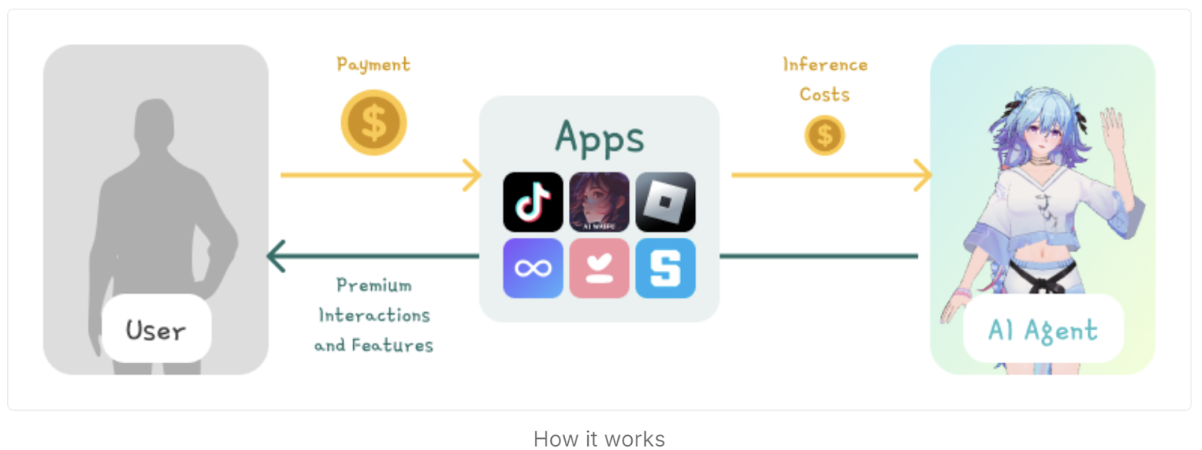

Revenue-Generating Ecosystem

Revenue-Generating Ecosystem: Driving Value Growth

At the heart of Virtuals Protocol lies a dynamic revenue-generating ecosystem where AI agents are deployed in consumer-facing applications. These are real apps with real user demand, where AI-powered experiences generate continuous income streams. Users pay to access and interact with these AI-driven apps—via in-app purchases, subscriptions, or other monetizable interactions.

How It Works:

-

Monetizing User Engagement: Consumer apps such as games, entertainment, and social media integrate AI agents to enhance user experience. When users engage, they pay for premium interactions and features.

-

Inference Costs: These apps pay fees for AI “inference” services—computational power used to generate responses, perform tasks, or deliver immersive experiences. As engagement grows, more revenue flows into the ecosystem, creating a virtuous cycle.

This ecosystem design creates a self-sustaining revenue loop where users pay for richer experiences, simultaneously boosting the overall value of Virtuals Protocol and its AI agents.

Summary

Virtual Protocol is redefining what AI agents mean. Instead of passive tools, future AI agents will be income-generating assets that users can invest in and co-own—just like owning shares in a company. These agents will play diverse roles—as AI companions, NPCs in platforms like Roblox, or virtual influencers on social media platforms like TikTok—playing pivotal roles in reshaping the structure and operation of the virtual economy.

2.3. BitSmiley Raises Millions to Accelerate Bitcoin Stablecoin Development

Overview

BitSmiley is a protocol built on the Bitcoin blockchain under the Fintegra framework. It comprises three core components: a decentralized over-collateralized stablecoin protocol, a native trustless lending protocol, and a derivatives protocol. Together, they form a complete financial ecosystem for decentralized finance (DeFi) on Bitcoin, enhancing Bitcoin’s functionality and utility.

Technical Analysis

BitSmiley’s stablecoin bitUSD is a cryptocurrency issued on the Bitcoin blockchain, backed by over-collateralized assets and soft-pegged to the U.S. dollar. The issuance of bitUSD is decentralized and permissionless—any Bitcoin holder can generate bitUSD by depositing BTC into the “bitSmiley Treasury” smart contract. Each circulating bitUSD is backed by over-collateralized assets, and all bitUSD transactions are publicly visible on the Bitcoin blockchain.

bitUSD possesses the following monetary properties:

-

Store of Value: bitUSD maintains its value over time, serving as a stable store of value—especially important in volatile crypto markets.

-

Medium of Exchange: Due to its stability, bitUSD is widely accepted for transactions and payments compared to other cryptocurrencies.

-

Unit of Account: bitUSD can be used to price goods and services and keep financial records due to its stable and predictable value.

-

Standard of Deferred Payment: Because of its stability, bitUSD can be used in contracts for future payments, helping both parties reduce risks caused by volatility.

Under the BitSmiley protocol, users generate bitUSD by depositing a certain amount of BTC into the bitSmiley Treasury. To retrieve their deposited BTC, users must repay the equivalent amount of bitUSD plus a stability fee.

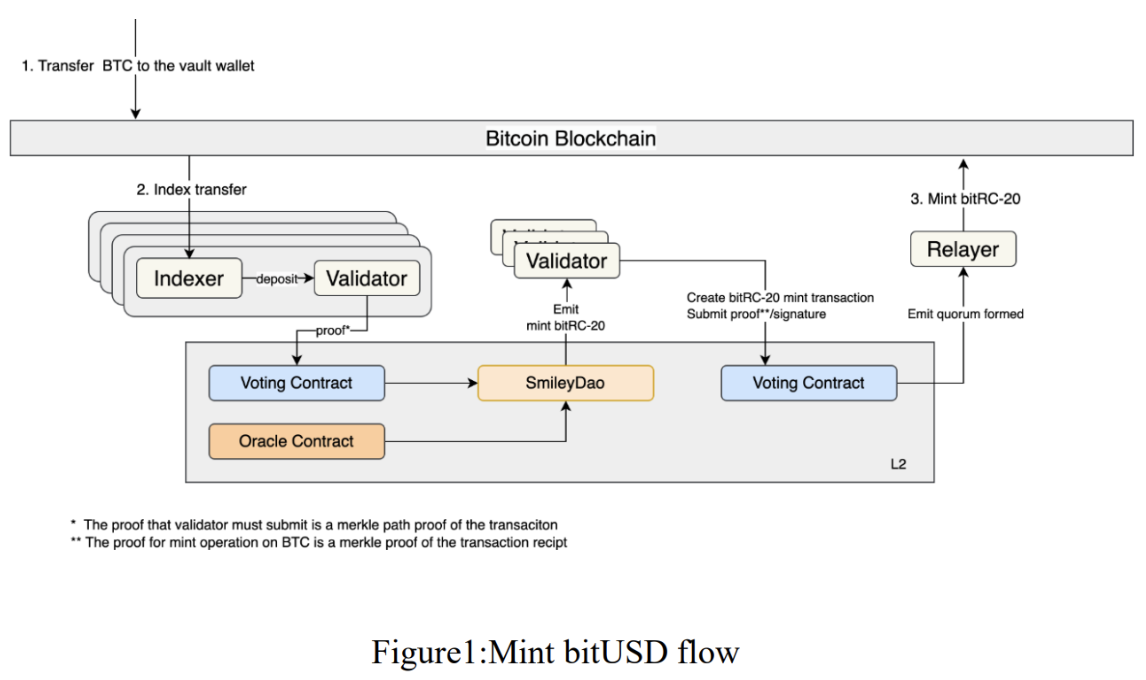

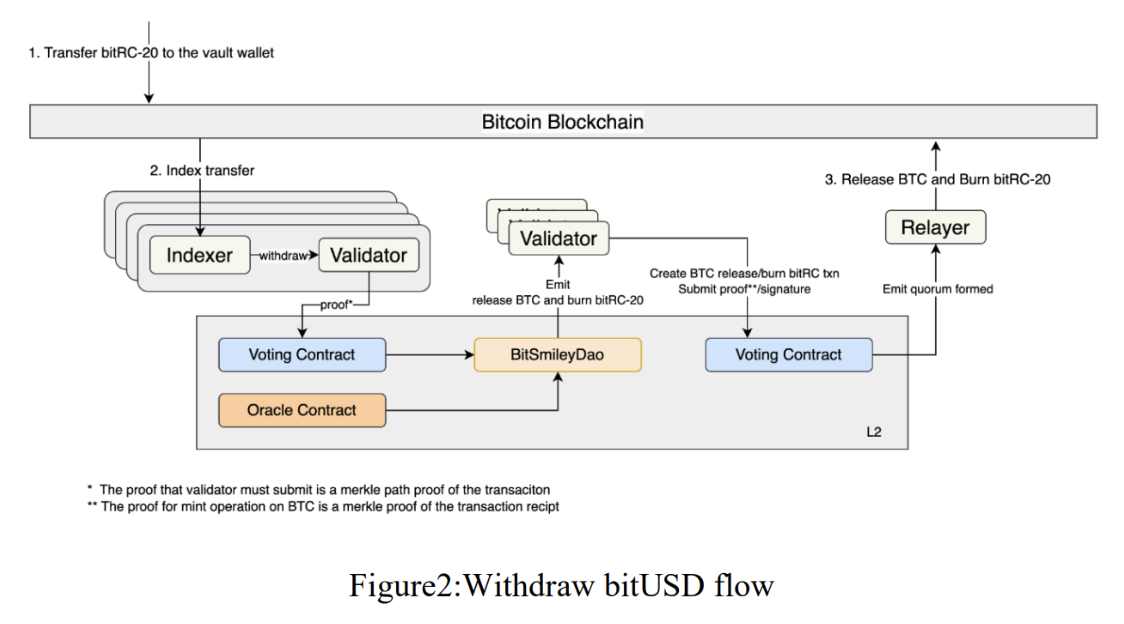

The minting and redemption process in the BitSmiley protocol proceeds as follows:

1. Minting Process: When users wish to generate bitUSD, they deposit Bitcoin into the bitSmiley Treasury smart contract. This action uses over-collateralization to ensure bitUSD’s stability and security.

2. Redemption Process: When users want to reclaim their original Bitcoin, they must repay an equivalent amount of bitUSD along with a stability fee. This ensures balance in the system’s assets and liabilities.

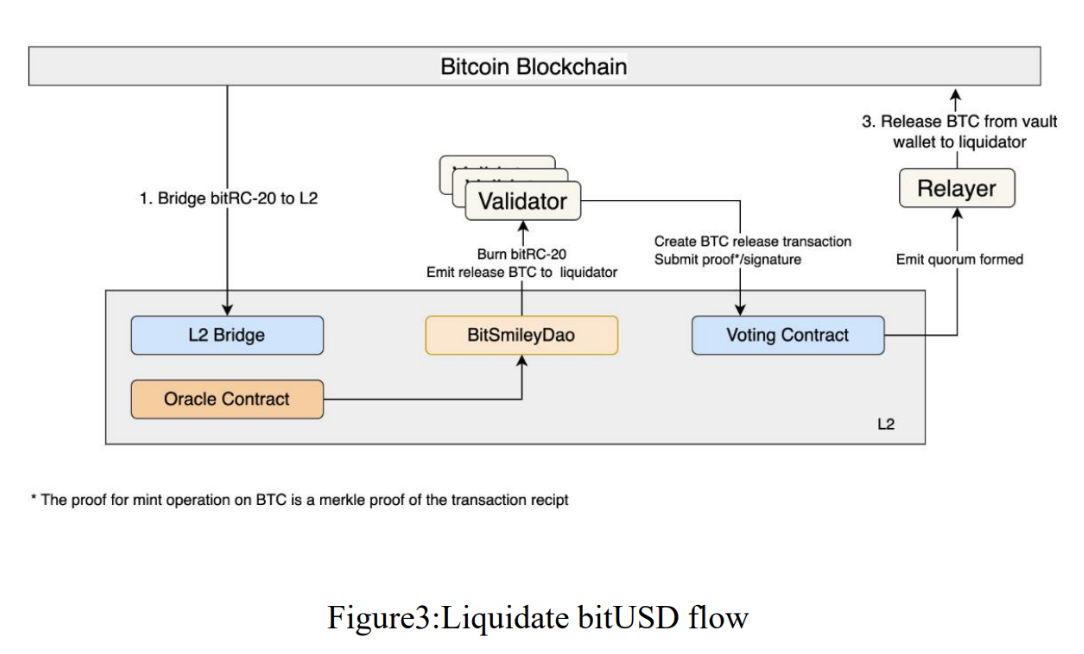

3. Liquidation Process: If collateral value drops below a threshold, liquidation is triggered. Liquidations occur on Layer 2 (L2) networks to improve speed and efficiency.

Through these mechanisms, the BitSmiley protocol ensures system stability while offering users secure options for generating and redeeming stablecoins.

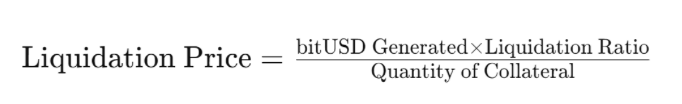

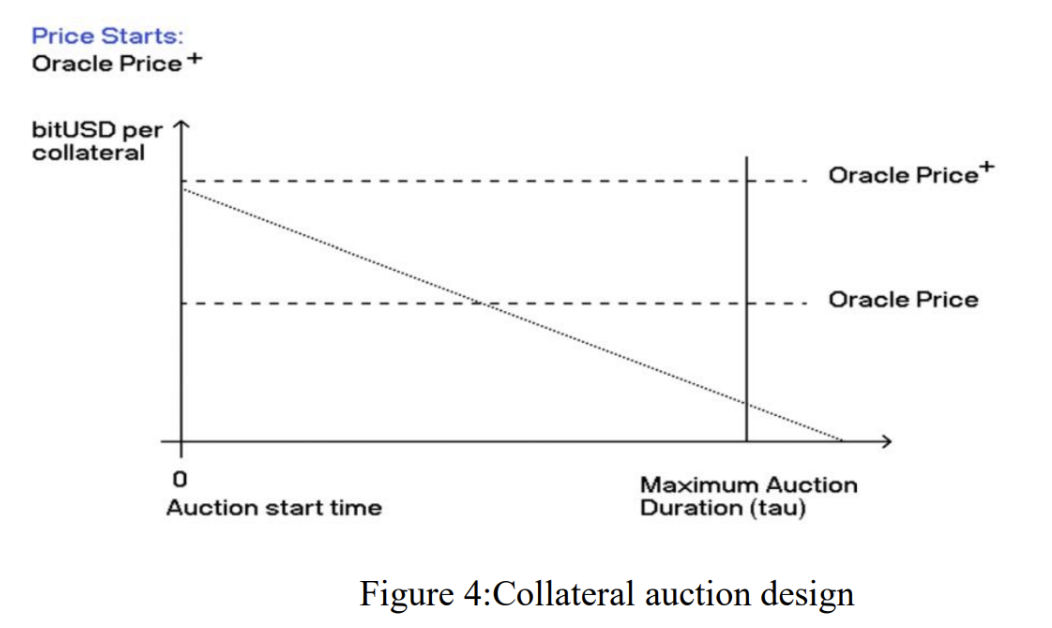

Liquidation Design

To ensure every bitUSD is sufficiently collateralized, any Treasury with a collateral ratio below the threshold enters liquidation. The liquidation price is calculated as:

Liquidators incur a penalty fee, with distribution ratios adjusted based on auction duration. Longer auctions result in higher penalty shares for liquidators. BitSmiley uses Dutch auctions, starting at a high price and gradually decreasing. The price automatically declines over time, and the auction closes when a bidder accepts the current price.

The system sets an initial starting price, and the quantity of collateral acquired depends on a time-price curve. Once a liquidator participates within the time window, the transaction executes immediately. Parameters involved in the time-price curve include:

-

Price Buffer Factor: Determines the starting bid price of the collateral.

-

Price Function: Sets the percentage decrease in price every N seconds.

-

Maximum Auction Price Drop: Maximum percentage decline in auction price.

-

Maximum Auction Duration: Upper limit of the auction time window.

This design ensures effective and fair liquidation of under-collateralized positions during market volatility, while incentivizing liquidators.

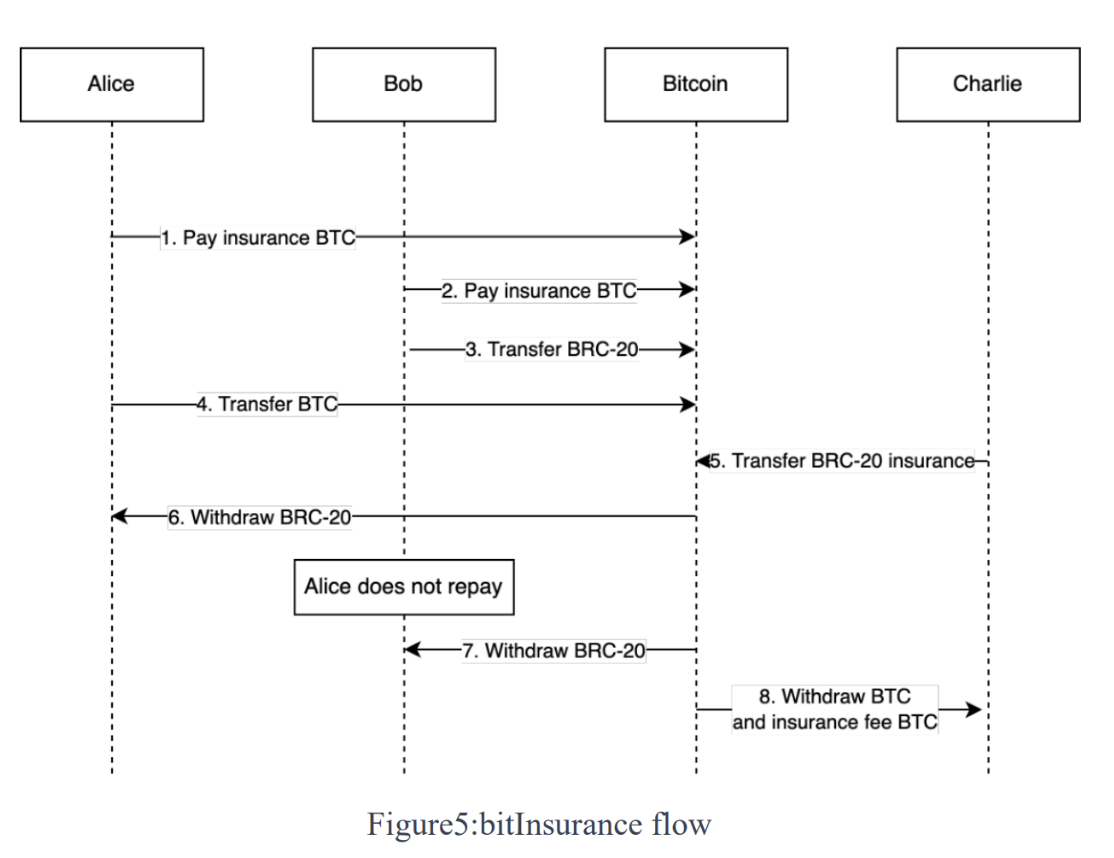

Fund Protection Mechanism—bitInsurance

In collateral-based lending protocols (like Compound), liquidation relies on on-chain oracles. However, this model isn't directly applicable to Bitcoin due to its longer block times (~10 minutes), which cause delays in liquidation. Additionally, Bitcoin relies solely on UTXOs for transactions and lacks on-chain price oracle support.

BitSmiley protects user funds differently. For example, borrower Alice might default due to a sharp rise in bitRC-20 prices or a steep drop in BTC value. In the former case, lender Bob suffers no loss since BTC retains value. But if BTC plunges, Bob can opt for insurance. Both Alice and Bob pay BTC insurance premiums, so if Alice defaults, Bob receives full compensation.

The process flow is as follows:

-

bitSmiley matches Alice, Bob, and Charlie, creating a multisig wallet.

-

Bob and Alice deposit tokens into the multisig wallet.

-

Bob and Alice deposit insurance fees.

-

bitSmiley broadcasts the loan transaction.

-

Charlie withdraws the insurance fee.

-

Alice withdraws BTC from the loan.

-

If Alice fails to repay, Bob receives BTC refunded by Charlie, while Charlie claims the collateral.

This insurance mechanism, using multisig wallets and fee distribution, protects both lenders and borrowers when collateral values fluctuate.

Summary

Introducing a native over-collateralized stablecoin protocol on the Bitcoin blockchain is crucial because Bitcoin’s inherent volatility limits its usability in daily transactions and as a stable store of value. A native stablecoin would expand Bitcoin’s utility, enabling direct support for broader financial activities such as lending, borrowing, and yield farming. This strengthens Bitcoin’s decentralized and trustless nature, aligning with its core principles of permissionless, trustless finance. Furthermore, such a protocol would provide much-needed liquidity and accessibility, making the Bitcoin ecosystem easier to use—especially for users in economically unstable regions or those seeking to hedge against fiat inflation.

Overall, bitUSD has the potential to transform Bitcoin from a mere store of value into a multifunctional medium of exchange within decentralized finance.

III. Industry Data Analysis

1. Overall Market Performance

1.1 Spot BTC & ETH ETFs

Analysis

On November 1 (ET), spot Bitcoin ETFs saw a net outflow of $54.94 million. On October 31, Grayscale’s GBTC ETF recorded a single-day net outflow of $5.5078 million, bringing its historical net outflow to $20.162 billion. However, spot Bitcoin ETFs showed strong net inflows last week, totaling $2.22 billion. BlackRock’s iShares Bitcoin Trust was the largest buyer, purchasing $2.14 billion—nearly 99% of total inflows. Fidelity’s FBTC contributed only $89.8 million as the second-largest buyer. Based on BlackRock’s buying timeline and subsequent outflows, accumulation likely occurred between $68,000 and $72,000. Notably, the recent price drop wasn’t accompanied by significant ETF outflows, indicating major buyers remain bullish on BTC’s long-term outlook. The primary sellers were likely whales, some retail investors, and Grayscale shadows.

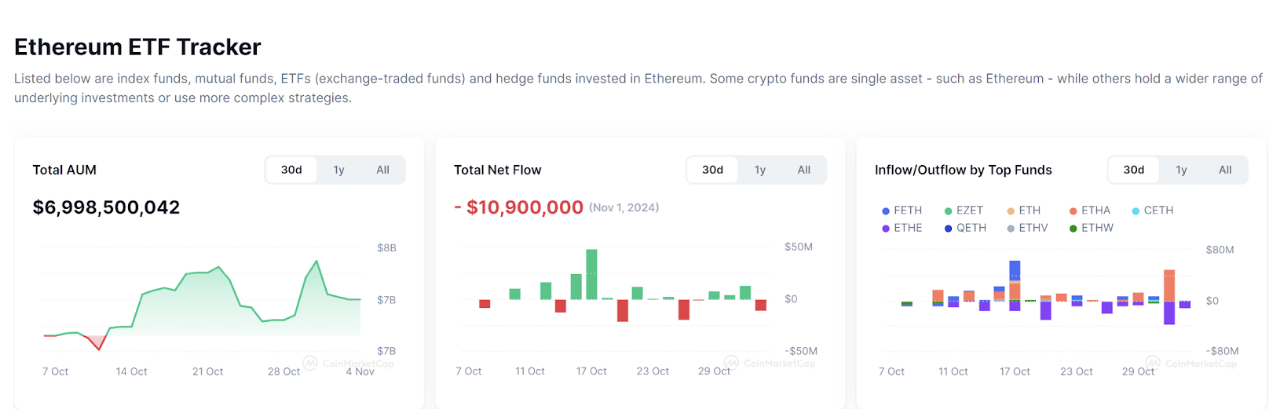

Analysis

This week, U.S. spot Ethereum ETFs recorded a cumulative net inflow of $13 million. BlackRock’s ETHA saw $65.5 million in net inflows, while Grayscale’s ETHE had $62.4 million in net outflows. On November 1, Grayscale’s Ethereum Trust ETF (ETHE) recorded a single-day net outflow of $11.4278 million, bringing its historical net outflow to $3.131 billion. Grayscale’s Ethereum Mini Trust ETF (ETH) reported zero net outflow on the same day, with a historical net inflow of $303 million. On November 1, Invesco’s QETH was the top daily inflow recipient, with $502,200 in net inflows, reaching a total historical net inflow of $25.8204 million.

1.2. Spot BTC vs ETH Price Trends

Analysis

Last week, Bitcoin’s movement was influenced by the U.S. election, with the presidential vote officially opening on November 5—typically triggering significant market volatility in adjacent days.

Looking back: During the 2020 U.S. election, crypto prices declined two days prior, rose on election day, fell again over the next two days, then began a sustained upward trend. According to Forbes, a recent poll shows Harris leads Trump by just 1%. In seven key swing states that could decide the election, Harris holds a 49% to 48% lead over Trump—a reversal from a week earlier when Trump led 50% to 46%. This shift increases election uncertainty, keeping BTC in a state of volatile flux. With the election nearing resolution, current sentiment suggests a Trump win could boost crypto market optimism—indirectly benefiting the sector. A Harris victory might be short-term bearish, though long-term trends still hinge on monetary policy. As long as rate cut expectations persist, the long-term outlook remains bullish. Investors should watch key support levels around $68,300 and $66,000 this week.

Ethereum should be watched for whether it can quickly reclaim the rising trendline shown above. A successful break could shift focus to resistance near the weekly downtrend line, with a breakout targeting $2,860. Failure would see support tested around $2,450.

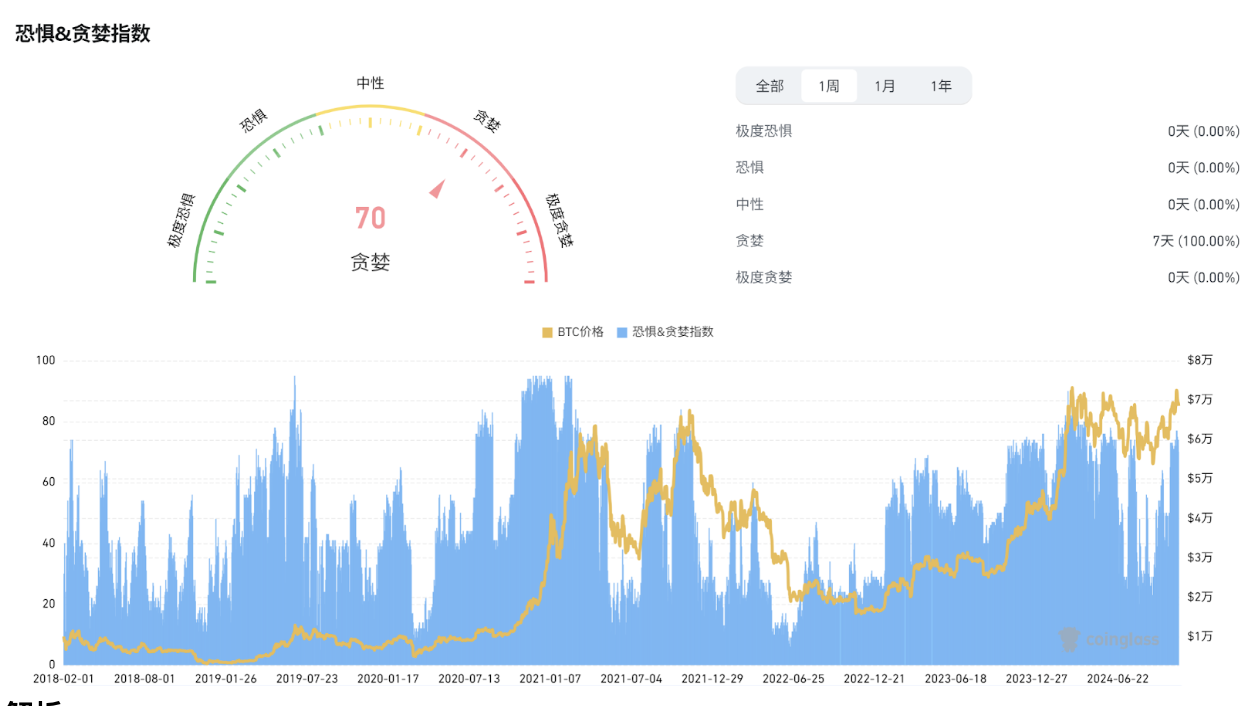

1.3. Fear & Greed Index

Analysis

Last week, the Greed Index remained steady at 70, indicating that uncertainty around the election outcome hasn’t fundamentally dampened market bullishness. As long as Bitcoin sustains above $66,000—even if it fails to break $72,000 again—the index is likely to remain in the 65–70 range.

2. Public Chain Data

2.1. BTC Layer 2 Summary

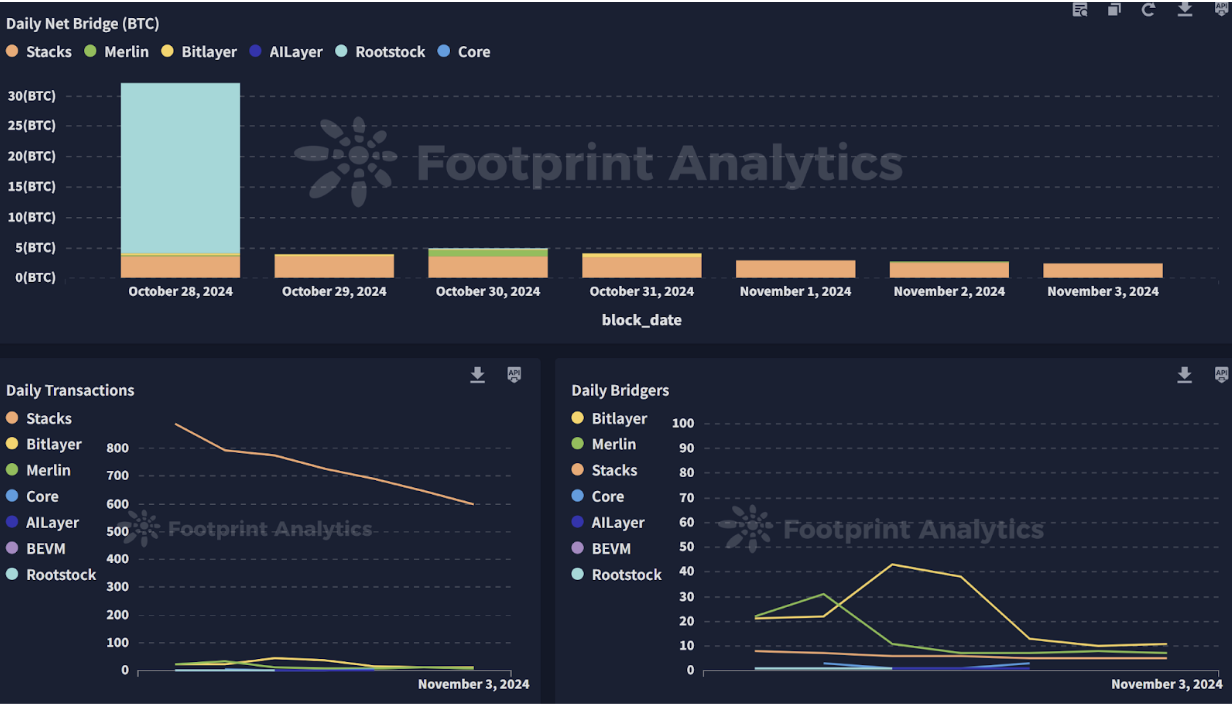

Analysis

In the Bitcoin ecosystem, Stacks’ Nakamoto upgrade has successfully launched. This upgrade introduces “Fast Blocks” and “Bitcoin Finality” mechanisms to accelerate transaction speeds. After Nakamoto, Stacks block production becomes independent of Bitcoin block production, allowing user transactions to be confirmed within seconds. However, overall on-chain activity remains sluggish. Aside from a single large transfer of 28 BTC on Rootstock last Monday, daily bridged assets averaged less than 3.5 BTC, with most BTC locked up—leading to depressed on-chain activity.

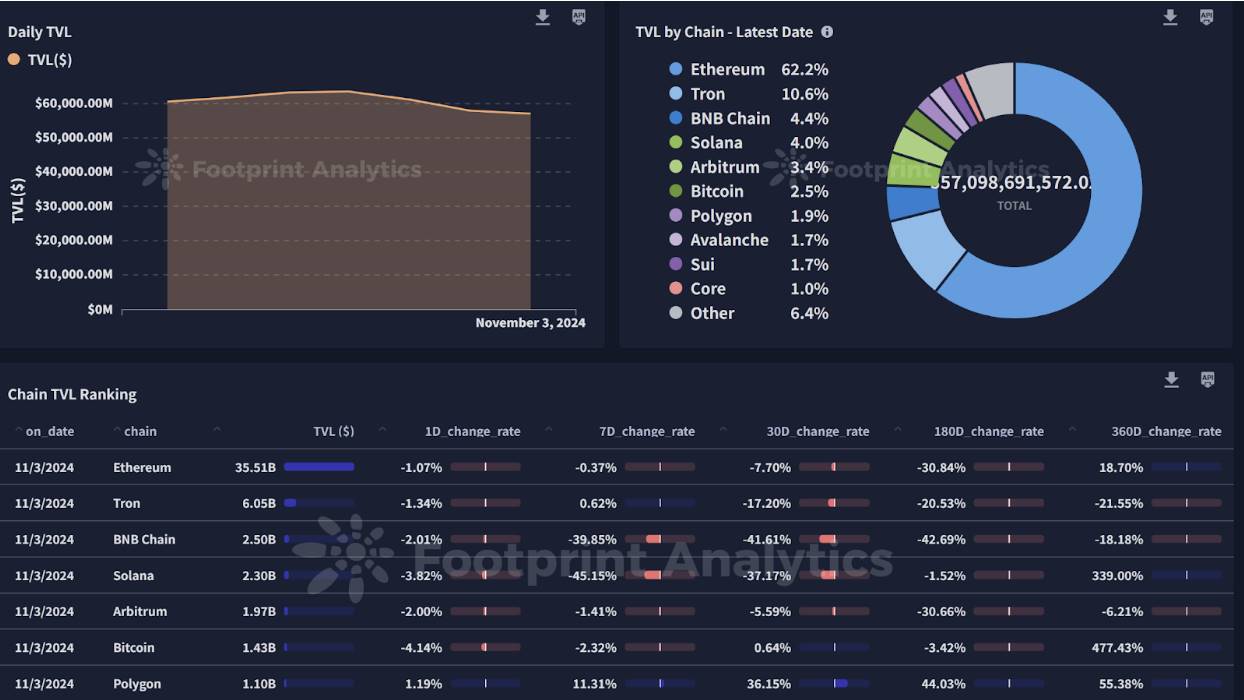

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

Last week, total value locked (TVL) across public chains continued to decline, dropping below $60 billion for the first time recently. BNB Chain and Solana together accounted for over 40% of average weekly net outflows for two consecutive weeks—an ominous signal. Solana’s DEXs recorded $12.728 billion in trading volume over the past 7 days, ranking first for four straight weeks, though down 19.91% weekly. Major outflows stemmed from hacks affecting Tapioca Foundation ($4.7M stolen on BNB Chain) and SUNRAYFINANCE ($2.86M lost).

Polygon has seen strong positive TVL growth for a month following technical upgrades.

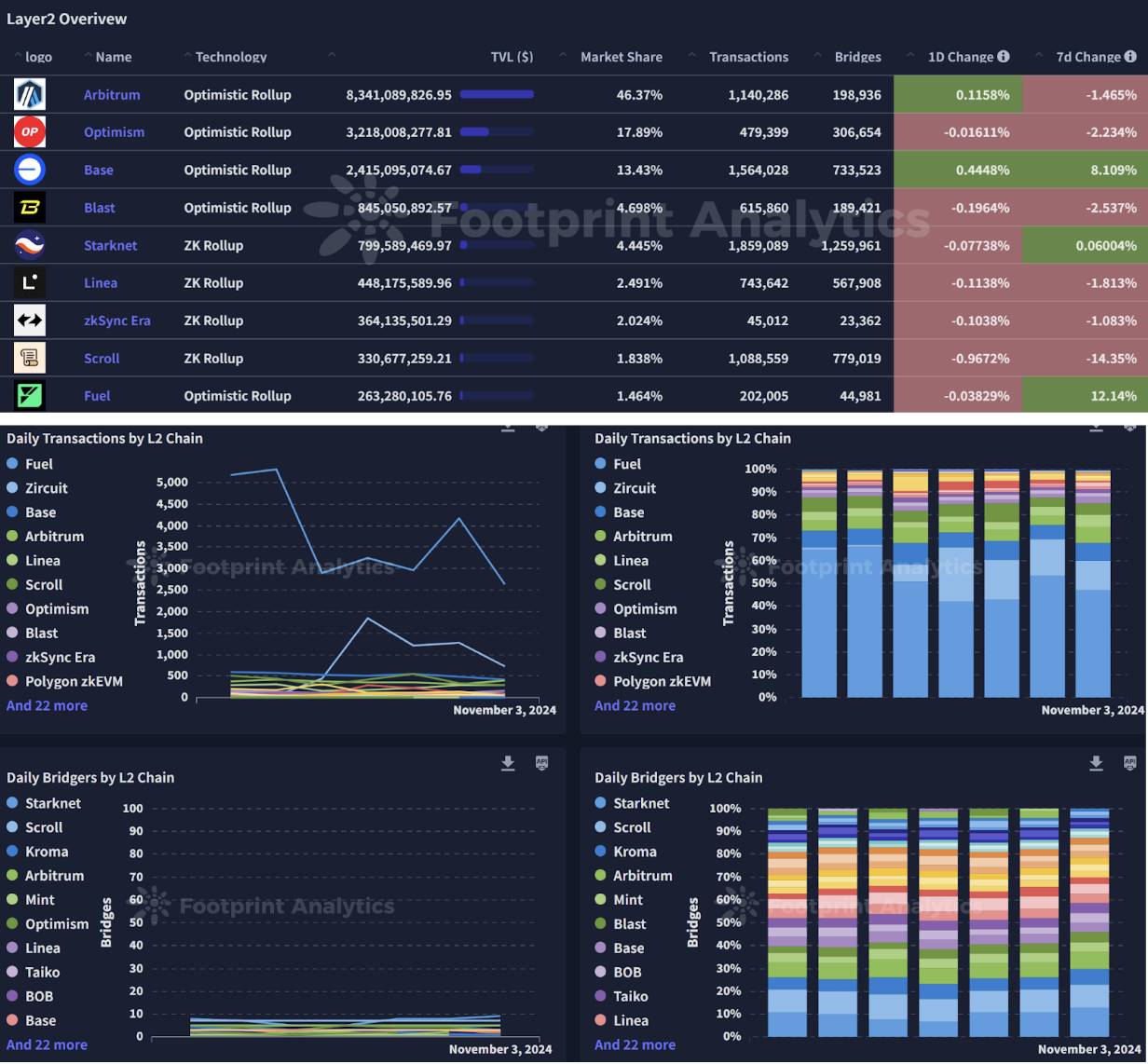

2.3. EVM Layer 2 Summary

Analysis

Last week, L2 TVL briefly surged to $29.9 billion on October 31 but has since fallen back to around $18 billion. Scroll remained the top L2 protocol for outflows, with a 7-day TVL drop of 14%. The negative impact of Essence Finance’s stablecoin rug pull continues, despite Scroll announcing collaborations with blockchain analytics platform Nansen and launching Scroll SDK and toolkits—production-ready infrastructure for sovereign blockchain deployment and customizable enhancements. FUD may ease slightly next week.

Base and Fuel emerged as leaders in TVL growth. Base benefited from the mainnet rollout of “Fault Proofs” and the launch of Franklin Templeton’s OnChain U.S. Government Money Market Fund (FOBXX) on Base.

Fuel’s mainnet launched in October, followed by Fuel Labs unveiling Fuel Ignition—an Ethereum L2 solution. Ignition aims to tackle growing centralization challenges in blockchain ecosystems through scalable architecture based on the Fuel Virtual Machine (FuelVM) and UTXO-centric asset model, ensuring Ethereum-level security.

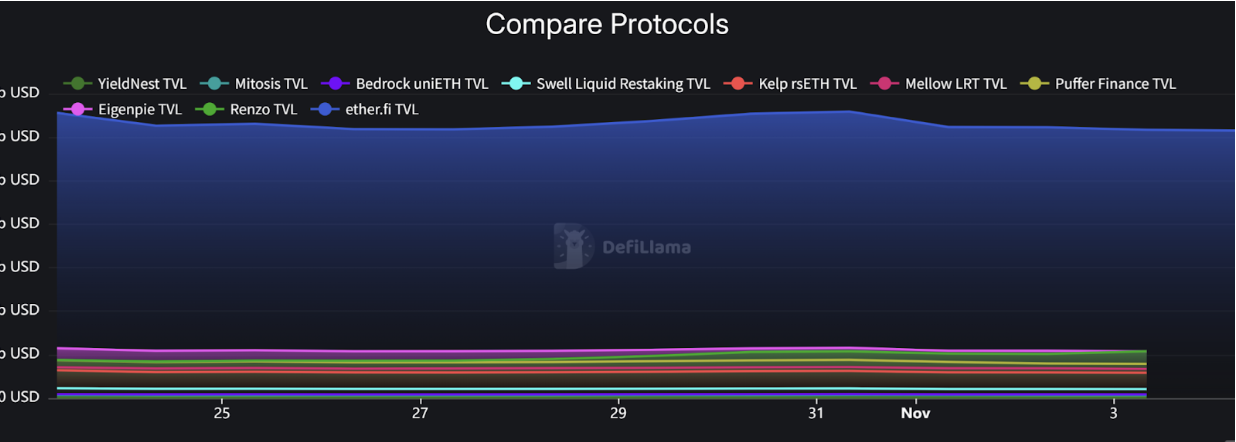

2.4. Liquid Restaking Summary

Analysis

In the liquid restaking sector, Renzo’s ezSOL launched on Jito on October 30. Whitelisted users could deposit within the first 24 hours or until caps were filled. Afterward, deposits opened to others if capacity remained. Users can mint ezSOL by depositing jitoSOL, with rewards automatically compounded. Shortly after launch, Renzo announced initial integrations and partnerships to enhance utility and rewards for ezSOL holders.

For EigenLayer, the previously disclosed theft of 1.67 million EIGEN tokens resulted from external malicious attacks, causing eigenpie TVL to remain flat and underperforming.

IV. Macro Data Recap and Upcoming Key Release Dates

U.S. macroeconomic data has drawn significant market attention. Nonfarm payrolls increased by only 12,000 in October—the lowest in four years—with unemployment holding at 4.1%. These figures were notably affected by hurricanes and the Boeing strike, reflecting mixed labor market resilience and weakness. Meanwhile, the core PCE inflation indicator remains stubborn, signaling persistent inflationary pressure. Market expectations for a 25-basis-point Fed rate cut at the upcoming meeting are nearly 100%.

Looking ahead, as the U.S. presidential election draws near, uncertainty in economic data could amplify market volatility. While current employment data is weak, the overall economic fundamentals remain healthy, with consumer spending continuing to drive growth. The Fed may adjust monetary policy based on upcoming indicators to address potential economic slowdowns.

Key macro data releases this week (November 4–8):

-

November 5: U.S. October S&P Global Services PMI Final

-

November 8: Fed Interest Rate Decision (Upper Bound); Preliminary U.S. November University of Michigan Consumer Sentiment Index

V. Regulatory Developments

With the U.S. election results imminent, discussions around crypto regulation have intensified. Broadly speaking, whether Trump or Harris wins, the general consensus is that crypto regulatory stances won’t change dramatically. Elsewhere, global regions continue refining regulatory frameworks and launching sandboxes—with Hong Kong standing out this week through concentrated activity and predominantly positive statements.

Hong Kong, China

During the ninth Hong Kong FinTech Week, Financial Secretary Christopher Hui announced that Hong Kong will release detailed stablecoin regulations by year-end and complete the second round of consultations on OTC virtual asset regulations for 2025. He also stated that Hong Kong may offer tax incentives for virtual asset investments, further affirming their role in portfolio allocation.

The Hong Kong Exchanges and Clearing (HKEX) will launch the HKEX Virtual Asset Index Series on November 15, providing reliable benchmark pricing for virtual assets. This series will offer transparent and reliable benchmarks for Bitcoin and Ethereum pricing in the Asia timezone, aiming to unify reference prices and resolve discrepancies across global exchanges. It will be Hong Kong’s first virtual asset index series compliant with the EU’s Benchmarks Regulation (BMR), jointly managed and calculated by a UK-registered benchmark administrator and virtual asset data provider CCData.

Legislative Council member (Technology and Innovation) Dominic Kwok, attending the launch of the Hong Kong Compliance Industry Association, said: “I believe stablecoins represent a huge market. Countries worldwide are exploring them with great interest. We’re waiting for Hong Kong’s regulatory details before moving forward. As a legislator, I’m interested in whether we can issue RMB-based stablecoins in Hong Kong—that would be a massive market.”

Singapore

On October 30, the Monetary Authority of Singapore (MAS) announced the establishment of the Global Finance & Technology Network (GFTN) to promote Singapore’s fintech ecosystem and foster greater synergy and networking with the global fintech community. Phase one includes developing a regulatory sandbox framework, establishing cross-border payment links, piloting digital assets and tokenization, and advancing AI adoption. GFTN will collaborate with MAS to advance industry and policy dialogues in payments, asset tokenization, and AI/quantum fields.

Russia

According to TASS on the 30th, Russia’s Deputy Energy Minister announced that due to ongoing energy shortages, the country will restrict cryptocurrency mining in specific regions, including the Far East, southwestern Siberia, and southern areas with limited power resources. Power shortages may persist until 2030, making large-scale mining unsustainable. Previously, President Putin signed a law regulating digital currency circulation, effective November 1. The law grants the Russian government authority to ban cryptocurrency mining in specific regions or territories and define procedures and conditions for such restrictions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News