Market Condition Analysis: Which Phase of the Bull Market Are We In?

TechFlow Selected TechFlow Selected

Market Condition Analysis: Which Phase of the Bull Market Are We In?

There are many reasons to feel excited.

Author: The DeFi Investor

Translation: TechFlow

In today's article, we'll discuss:

-

Which phase of the cycle are we currently in?

-

On-chain data analysis

Where Are We in the Cycle?

If you've seen my recent X posts, you already know I’m optimistic about the crypto market in Q4.

But in this piece, I’ll go into detail about where exactly I believe we stand in this crypto cycle and explain why I remain optimistic about the near-term future.

Summary: There are plenty of reasons to be excited.

Let’s start with some crypto charts I find relevant.

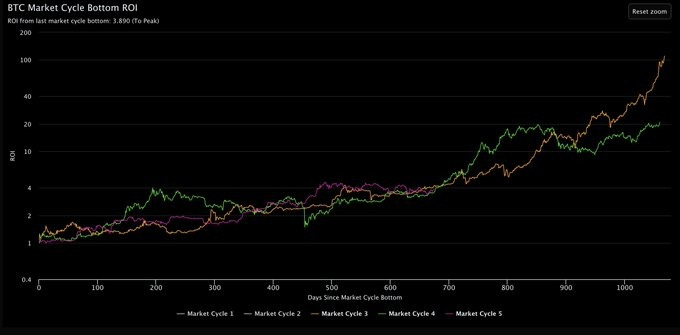

BTC Cycle ROI is right where it typically should be at this stage of the cycle.

Source: @intocryptoverse

The BTC performance in this market cycle closely resembles the 2016 and 2020 bull markets.

Financial markets tend to be cyclical because human nature remains constant. This is why it seems unlikely that BTC has already peaked.

The past two bull runs had two things in common:

-

The real upward momentum in BTC began approximately 170–180 days after the Bitcoin Halving

-

The BTC cycle top was reached roughly 480 days after the halving

cryptoquant.com

It has only been 160 days since the 2024 Bitcoin Halving event.

Based on historical patterns, we’re likely just weeks away from when BTC typically resumes its strong upward trend.

Of course, this assumes history repeats itself—but I don’t see any major reason why this time would be fundamentally different.

BTC Exchange Reserves are declining rapidly.

Over 500,000 BTC have been withdrawn from exchanges since January 2024.

When large holders withdraw their tokens from exchanges, it usually means they intend to hold for the long term rather than sell in the near future.

The chart above appears to show significant accumulation of BTC by large holders over the past few months.

If this accumulation continues, supply scarcity will become inevitable.

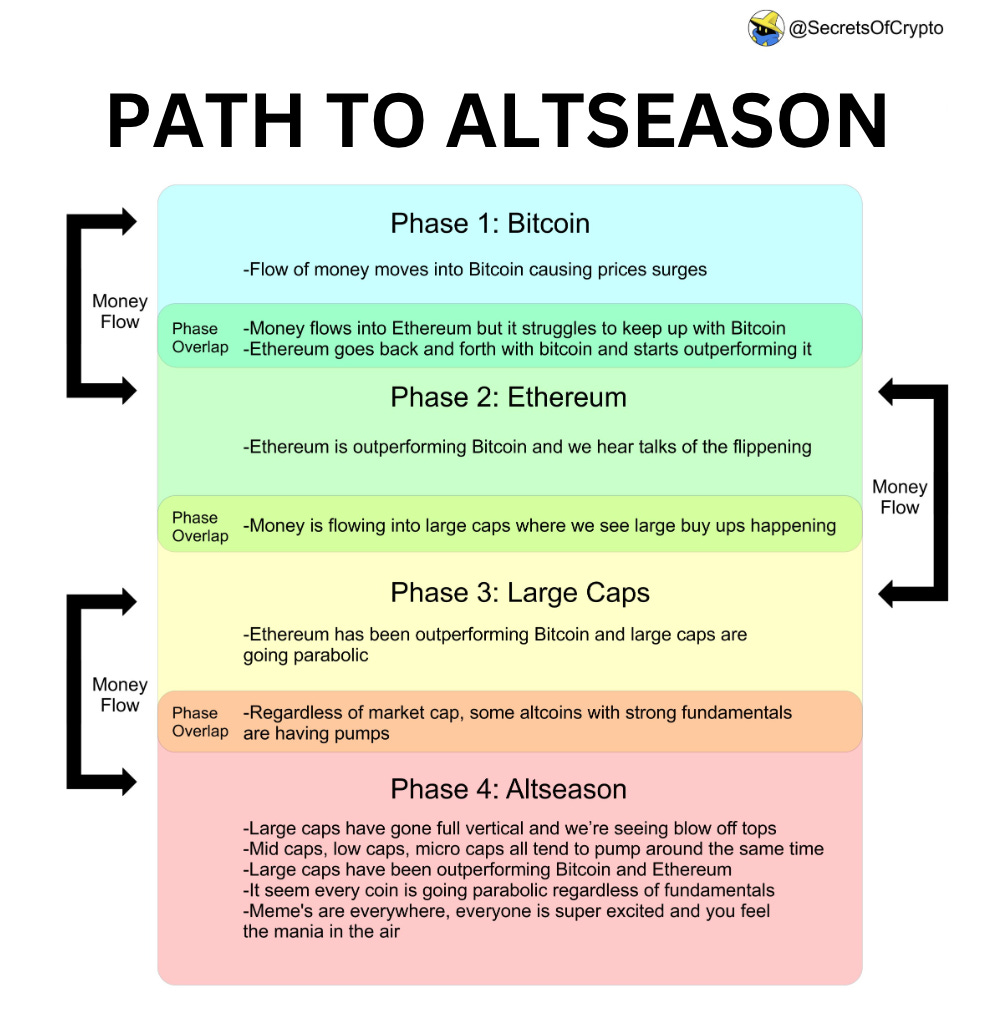

Bitcoin Season has historically been the first phase of each new cycle.

This infographic was created years ago, but it effectively summarizes what happened during the 2016 and 2020 cycles.

-

First, BTC begins rising, along with its market dominance.

-

Then, attention shifts toward large-cap altcoins (such as ETH, SOL, etc.).

-

Finally, nearly every altcoin starts rising—regardless of market cap or fundamentals.

Recently, BTC’s market dominance reached a multi-year high.

This may suggest we’re still in the first phase. Historically, "altseason" tends to begin only after BTC dominance starts to decline. I believe we’re approaching the second phase.

All the charts above, combined with historical data from previous bull cycles, lead me to believe BTC is highly likely to reach a new all-time high in Q4.

Could things go wrong?

Let’s briefly discuss bearish possibilities.

There are still many macroeconomic uncertainties.

If a global economic recession begins, digital assets will be significantly impacted.

However, I believe the likelihood of a recession in the near term is low, especially because 2024 is a U.S. election year.

To give Kamala Harris a chance at winning the U.S. presidential election, the Democratic Party will do everything possible to avoid an economic downturn before November.

While I think a U.S. recession might eventually occur in the next 3–4 years, I consider it very unlikely in 2024.

Therefore, I remain optimistic about cryptocurrencies in Q4.

Hopefully, our conviction and patience will soon be rewarded.

On-Chain Dynamics

Sui’s Total Value Locked (TVL) has surpassed Polygon’s for the first time.

Sui is one of the fastest-growing blockchains—an L1 leveraging parallel transaction execution to achieve high throughput.

Two key factors appear to be driving its recent surge across most metrics: its exceptionally strong community and growing popularity on X.

Beyond that, its team has secured several important partnerships with both Web2 and Web3 giants, including Circle and TikTok’s parent company.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News