At a time of widespread clamor, re-examining Ethereum's positioning and roadmap

TechFlow Selected TechFlow Selected

At a time of widespread clamor, re-examining Ethereum's positioning and roadmap

Value capture is important, but it's too early to discuss now.

Author: Mike Neuder, Researcher at the Ethereum Foundation

Translation: Azuma, Odaily Planet Daily

Editor's Note: This is a personal opinion piece published today by Mike Neuder, a researcher at the Ethereum Foundation. The article re-examines Ethereum’s positioning, roadmap, value capture, and more.

According to Neuder, while this article represents only his personal views, its development received feedback and support from several key figures in the Ethereum ecosystem—including Vitalik. At a time when debates around Ethereum are rampant, this piece may help the market better understand Ethereum’s operational philosophy and developmental trajectory.

1. The Essence of Ethereum: Property Rights

Ethereum is fundamentally a protocol about property rights. It creates a digital, self-custodied, permissionless asset that can be transferred globally and cannot be seized or censored. Ethereum’s unwavering commitment to decentralization exists precisely to achieve this goal—any compromise on decentralization could open the door to seizure or censorship, thereby undermining the effectiveness of this property rights system at its core.

This argument rests on three foundational pillars:

-

The key difference between blockchains and traditional finance lies in property rights—users have irrevocable control over how they store and transfer value;

-

On centralized blockchains, certain powerful entities can influence chain outcomes.

-

The value stored within a property rights system is directly tied to the credibility of that system’s property rights.

Put together, a centralized system that could (and likely will) be coerced by authoritarian actors cannot offer the same level of property rights as a decentralized one—and thus holds less value. A common misconception is that Ethereum’s decentralization only matters in extreme scenarios like “World War III” or a “post-dollar era,” but this is incorrect—decentralization matters today.

Blockchain threat models must account not only for adversaries seeking to reverse transaction finality, but also more subtle actors who attempt to control economic outcomes without fully breaking the system. Such attacks manifest in various ways, including coercing validator behavior (see the New York Federal Reserve’s latest staff report) and imposing strict KYC/AML requirements on-chain activities (see details of Blackrock’s BUIDL fund).

Solana claims to aim for the “best global, most permissionless, most accessible financial market” and a “globally shared state accessible to anyone without permission,” but these goals cannot be achieved without a clear strategy to maintain credible neutrality in block production. Without that, the chain may ultimately become nothing more than a regulated yet transparent financial settlement layer—potentially subject to government censorship. This future seems far less attractive, impactful, and valuable than a property rights system centered on “anti-censorship” and “self-custody.”

Beyond its validator set, Ethereum has effectively decentralized many other parts of its ecosystem, including (i) ETH’s early distribution via crowdfunding and PoW mining; (ii) decentralized staking distribution; (iii) meaningful activity and transaction volume on L2s; (iv) continuously improving client diversity… Ethereum’s decentralization at the “human” level is also impressive—the network is openly built by individuals and teams worldwide, allowing many to contribute to and invest in the protocol’s future. This true decentralization of value, power, and intellect is extremely difficult to replicate. Moreover, because much of the technology is researched and developed in open-source and public domains, Ethereum can also inherit advantages from ecosystems focused on execution scaling. Technology can be commoditized—but Ethereum’s decentralization cannot.

However, it’s important to note that markets—not values—ultimately determine the outcomes of these ecosystems. If the marginal cost of decentralization proves too high in terms of L1 execution, user experience, and value accrual, even the most decentralized blockchain might hold less value. The bullish case for Solana, Monad, BSC, and Tron is that these chains can provide sufficient property rights utility for most users and applications with lower levels of decentralization.

I tend to believe that, in the medium term, behaviors such as censorship, asset seizure, KYC/AML enforcement, and node coercion will lead people to question the robustness of centralized systems, potentially limiting their market reach to single jurisdictions. In a multipolar world where nations distrust each other and seek to regulate and surveil their citizens through capital controls and financial monitoring, it’s unlikely that global economic activity would naturally consolidate into a single system. Ethereum, however, makes a unique claim to credible neutrality. ETH is the asset that derives value from this credible neutrality, and it is the default choice for truly permissionless value storage within the system.

In contrast, dollar-pegged stablecoins issued by centralized institutions offer no property rights guarantees to holders. As Sreeram, founder of Eigenlayer, put it, any holder of USDxxx faces the risk of being arbitrarily “harvested” by Circle or Tether—you cannot truly own programmable money if it carries counterparty risk. I hope ETH and ETH-backed stablecoins and derivatives become the default option for protecting digital property sovereignty.

2. Ethereum and Rollups

Ethereum’s neutrality and anti-censorship properties make it the ideal place for settlement, storage, and expression of value. However, settlement alone on L1 does not fully capture the vision behind Ethereum’s rollup-centric roadmap. Ethereum also serves as a settlement and data availability (DA) layer for rollups.

I view rollups (and their corresponding platforms like Optimism Superchain and Arbitrum Orbit) as independent territories. Each territory competes to give users what they want—fast transactions, low fees, easy onboarding, etc.—but often at the expense of some decentralization.

I call them territories because, for now, the teams building and expanding these ecosystems continue to wield significant influence over their respective domains. But this seems acceptable. The point of rollups is that they make trade-offs that Ethereum L1 refuses to make. If rollups were required to be as decentralized as Ethereum L1, why build this symbiotic relationship in the first place? Rollups rely on Ethereum for security and decentralization, while Ethereum relies on rollups to scale economic activity within the ecosystem.

A crucial prerequisite is that rollups must reach Stage 2—where upgrade rules for bridge contracts are highly robust and provide clear exit paths for bridged assets. However, Stage 2 does not emphasize (i) the degree of decentralization of rollup sequencers; (ii) where the fees and MEV (Maximal Extractable Value) generated by rollup activity go; or (iii) interoperability between rollup ecosystems.

Stage 2 sets a standard for how rollups can inherit Ethereum’s security and decentralization, but leaves other design dimensions largely unconstrained. I won’t weigh in on debates about how or when rollups should decentralize their sequencers (though I generally agree with Max—I don’t see their incentive to do so). Still, I concur with Vitalik: this shouldn’t be the top priority. I believe the most critical tasks for rollups right now are (i) inheriting Ethereum’s security by achieving Stage 2; and (ii) inheriting Ethereum’s anti-censorship properties through a transparent and efficient forced inclusion mechanism (unlike the current delayed ones). To me, these are the key elements—all pointing back to Ethereum’s role in providing the most robust property rights system for both L1 and L2 assets.

(2.1) Ethereum’s Data Availability (DA)

A key aspect of rollup design is where transaction data is published (i.e., which DA service is used). In practice, we’re already seeing new projects adopt alternative data availability layers (alt-DA) from day one.

I do not support attempts by some community members to use social pressure or coercion to force projects to use Ethereum’s DA layer—such tactics are unsustainable. Instead, we should examine what unique advantages Ethereum’s DA service offers and consider potential network effects. The primary benefit of using Ethereum DA is inheriting its property rights utility and anti-censorship (am I sounding like a broken record…). I like to describe this as enabling “free movement” of rollup assets. As an on-chain user, if I know my assets cannot be seized and I retain the same level of self-custody assurance, I’d be happy to conduct most of my daily financial activities on a rollup that’s slightly less decentralized than Ethereum. With that in mind, consider the following scenario:

Scenario: For a user who bridges ETH from L1 to an L2 via a standard smart contract bridge, under what conditions can they withdraw funds back to a different address on L1?

An L2’s escape capability depends on where it publishes its data.

If the L2 is a rollup using Ethereum DA and posts transaction data to Ethereum Blobs, users can unconditionally use the “escape hatch” mechanism. Since every state update on the bridge contract is backed by data committed to Ethereum Blobs, rollup users can prove the validity of withdrawals and use L1 for transaction packing (they always retain sovereignty over their L2 assets).

If the L2 chooses to publish transaction data to another DA solution, the escape hatch is only usable while the rollup remains active. By posting L2 transaction data off-chain, state updates on the bridge contract become dependent on the availability of data on the alt-DA chain. In other words, if someone publishes an invalid state root to the bridge contract without publishing the corresponding transaction data to the alt-DA chain (commonly known as a “data withholding attack”), L2 users cannot prove their withdrawal is valid and thus cannot move ETH back to L1 (they lose sovereignty over their L2 assets).

Note that the second outcome requires the L2 to permanently halt block production to freeze all assets on the standard bridge—a highly extreme intervention. Based on this scenario, we can draw a simple conclusion: only Ethereum rollups that have reached Stage 2 and post transaction data to Blobs can offer the same level of property rights protection for assets bridged to L2.

This scenario highlights the first network effect of Ethereum’s DA service (and in my view, the best one): a rollup publishing data to Ethereum DA benefits from others doing the same, as all chains share equivalent trust assumptions. Sreeram calls this a “trustless composability network effect”—I like the name, though its value from a user perspective remains unclear. We’re still in the very early stages of L2 adoption, so speculating too much about this may not be necessary. More importantly, we should ensure rollups lack immediate incentives to use external DA services. The goal of scaling Ethereum’s DA performance via PeerDAS and Danksharding aligns perfectly with the vision of providing abundant Blobs for rollups—it’s a straightforward decision.

In the future, we might imagine additional network effects for Ethereum DA. For instance, in scenarios requiring real-time proof of transaction validity and preconsensus (preconfs), rollups using Ethereum DA could enjoy better cross-chain UX, greater liquidity, and more users. These arguments may seem overly futuristic for many to take seriously.

DA network effects will only become truly significant when we treat DA fees as a core component of ETH’s asset value. Let’s dive deeper into this issue.

(2.2) ETH Value Capture

So far, we haven’t discussed fees and how they bring value to Ethereum (ETH) as an asset—despite this being a major topic over the past few weeks. In the structure of this article, I rank this below (1) Ethereum’s property rights utility and anti-censorship as a settlement layer, and (2) Ethereum’s ability to extend security and decentralization to rollups as a DA layer. That said, it’s still worth considering more “direct” forms of ETH value accrual.

Personally, I most closely align with Dankrad Feist’s (another Ethereum Foundation researcher) recent AMA comments on DA fees:

“I don’t believe blob fees will be Ethereum’s optimal value capture mechanism. The data availability market is too unstable—while Ethereum offers the best security, getting something ‘close enough’ is too easy, making it never a good way to extract value.”

Fundamentally, I don’t think Ethereum DA will have strong user stickiness. The network effects mentioned above aren’t strong enough to consistently demand high Blob fees from L2s—but I don’t see this as a problem. By offering cheap DA to rollups, Ethereum encourages them to grow economic activity within the Ethereum ecosystem. Therefore, proposals aiming to drive short-term burn rates by increasing Blob pricing seem completely misguided (again agreeing with Dankrad). Francesco (an Ethereum Foundation researcher) recently gave a great explanation in an AMA, outlining how many L2 transactions could be supported under proposed DA scaling.

Another source of ETH value accumulation is the burning of execution fees at the L1 level. Max Resnick (Ethereum Foundation researcher) and colleagues have started a campaign advocating bringing all DeFi execution back to L1; meanwhile, Justin Drake (Ethereum Foundation researcher) believes L1 execution has “no future.” My view sits between the two. Again, I’ll quote Dankrad:

“Ethereum L1 will become the intersection point among all these subdomains, and many high-value activities will continue to happen on it, generating valuable fees. (To achieve this, some degree of L1 scaling will be needed.)”

It seems high-value activities will always occur on Ethereum, and creating a platform that fosters massive L2 economic activity will also drive usage of the base layer. Therefore, scaling the L1 execution layer is necessary to support this growth—but I believe its urgency ranks below maintaining and enhancing Ethereum’s role as a settlement and DA layer. This again reinforces my central thesis: Ethereum should maximize economic activity within its ecosystem (including rollups), and ETH should be positioned as a truly permissionless store of value, not merely an interest-bearing asset.

This focus on ETH’s store-of-value attributes naturally raises the question: “Why wouldn’t I just choose BTC?”

I’ll end this section with a brief answer.

3. On Bitcoin

There’s much to discuss about Bitcoin (BTC), especially given its renewed research and development activity in areas like ordinals, runes, Rrollups, and BitVM. However, this article won’t delve into those details, nor am I the right person to do so. Still, I’ll highlight several points closely related to the Ethereum vision outlined above.

First is Bitcoin’s fixed supply cap of 21 million coins. This revolutionary idea of engineered digital scarcity is incredibly powerful, making Bitcoin one of the world’s most valuable assets (reaching a $1 trillion market cap as of September 2024, ranking tenth). Yet, I believe the 21 million cap commitment is a fatal flaw in the Bitcoin system, as I find its fork-choice rule inherently “unstable” under diminishing block rewards. The common market response is that fee income will eventually become high enough to incentivize honest mining—but I disagree.

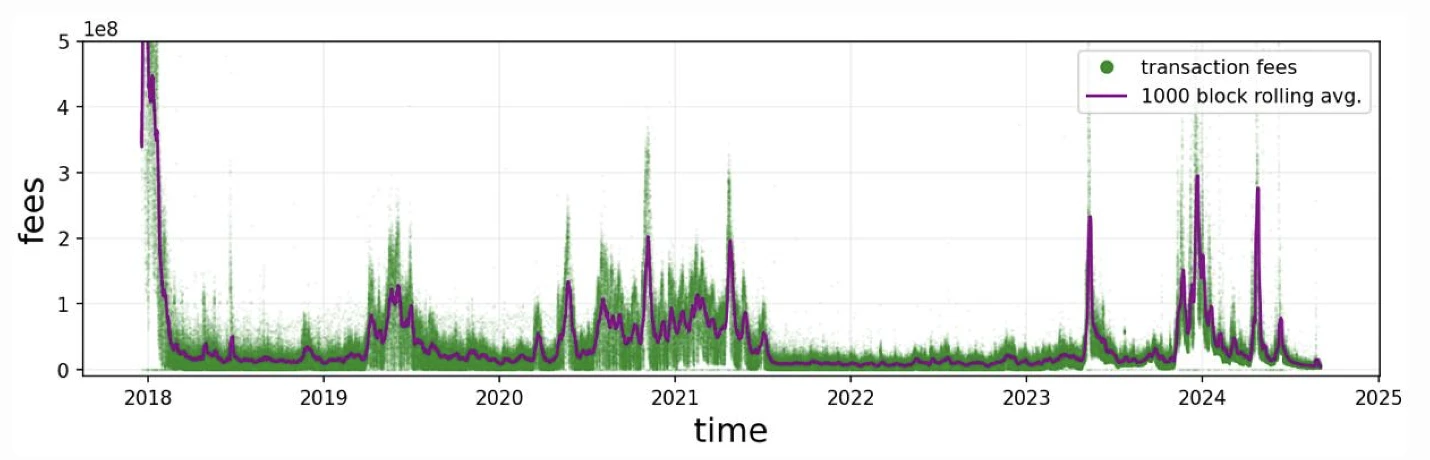

The chart below shows Bitcoin’s fee volatility over the past six years. I don’t believe mining entities can remain profitable under such an unstable revenue stream. Take the two-year period from mid-2021 to mid-2023: Bitcoin’s fees averaged less than 1 BTC per block. A more optimistic scenario might involve ETF issuers holding most BTC, subsidizing mining and earning fees through asset management—but this clearly deviates from cypherpunk ideals. Furthermore, the idea that fee income will sustain mining seems contradictory to the dominant “buy and hodl” mentality. If everyone just holds, where do the fees come from?

Second is the possibility of Bitcoin reinventing itself as a settlement and data availability (DA) layer. The most viable answer I’ve heard to Bitcoin’s fee sustainability problem is that it could serve as a settlement and DA layer for L2s (the payers). This is theoretically feasible and similar to Ethereum’s current path—but there are two key differences.

Ethereum’s core security model does not depend on fees generated from settlement and DA, thanks to its issuance mechanism. Earlier, I even stated that I don’t see DA fees as a key component of ETH’s value. For Bitcoin, however, continuous fee generation is a matter of survival—creating a strange circular dependency: “L1 security depends on fees paid by L2s, and L2s depend on L1 security.”

Bitcoin lacks both a scalability roadmap and standardized procedures for upgrading the network. This is both a strength and a weakness. While stability and predictability are core features of Bitcoin, they may also hinder its transformation into a settlement and DA layer. This appears to be a classic innovator’s dilemma—because the system is too large and successful, making major improvements (like adding OP_CAT or increasing block size) becomes difficult, even though such upgrades are necessary to provide L2s with the resources needed for meaningful scaling.

I’d be happy to be proven wrong on these points, as my understanding of the Bitcoin ecosystem is relatively limited—these views reflect only my current perspective.

There’s much more to say about Bitcoin, but I’ll stop here. BTC has strong justification as digital gold—a highly valuable but relatively static asset. I believe ETH will have a more dynamic future, serving as a censorship-resistant, programmable store of value that supports a broader digital economy through permissionless settlement, DA, and execution.

Conclusion

Ethereum remains firmly committed to decentralization, aiming to build the most secure and censorship-resistant foundation for the on-chain economy. Its rollup-centric roadmap seeks to scale economic activity without sacrificing the critical properties of the settlement layer. As a DA layer, Ethereum offers rollups a low-cost, highly trust-minimized solution, enabling them to attract more users by moderately reducing decentralization—without compromising user sovereignty over assets.

I agree with Myles Oneil: regardless of the specific mechanisms of value capture, ETH’s value will grow as economic activity within the ecosystem expands—so it’s premature to optimize for value capture just yet. Finally, while I believe preserving settlement properties and scaling data availability are the most important aspects of the roadmap, I also support parallel efforts to scale L1 execution—built upon ongoing technological innovation across the field.

At its core, I believe ETH’s value stems primarily from its role as a global, permissionless store of value. While the stories of value accumulation we discuss are deeply intertwined with ecosystem expansion, long-term user and developer growth should take precedence over short-term concerns about token mechanics. The rollup-centric roadmap makes perfect sense: first settlement, then DA, and finally L1 execution—proceed in that order.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News