Arthur Hayes' new article: Due to liquidity impact, the crypto market may break out of its downturn in September, with BTC's next stop at $1 million

TechFlow Selected TechFlow Selected

Arthur Hayes' new article: Due to liquidity impact, the crypto market may break out of its downturn in September, with BTC's next stop at $1 million

The altcoin season will only return after Bitcoin and Ethereum break through $70,000 and $4,000 respectively.

Author: ARTHUR HAYES

Translation: TechFlow

(The views expressed here are the author’s own and should not be taken as investment advice, nor interpreted as a recommendation or suggestion to engage in any investment transaction.)

Water, water, everywhere,

And all the boards did shrink;

Water, water, everywhere,

Nor any drop to drink.

— Coleridge, "The Rime of the Ancient Mariner"

I love specialty coffee, but my home brews always fail. I spend good money on beans, yet my coffee never matches what I get at cafes. To improve, I started paying more attention to details—specifically, the quality of my water, which I had long overlooked.

Water is crucial for coffee quality. Recently, an article in Standart Issue 35 hit me hard.

During my time as a barista, I had a similar realization when I learned that over 98% of brewed coffee and about 90% of espresso is water.

This awareness often comes late, probably because it's easier to justify buying new equipment. “Ah, you’ve got a conical grinder! That’s why your brew is muddy. Switch to a flat burr!” But what if the problem isn’t with the ingredients? Could focusing on the solvent itself solve our coffee issues? — Lance Hedrick, "On Water Chemistry"

My next step was to follow the author’s advice and order a home distiller. I know a local café sells mineral concentrate to add to water, creating the perfect base to highlight their roast profiles. By winter, my morning brew will be divine… hopefully. I pray for my adventurous friends who’ll taste my “black gold” before climbing Mount Yotei.

Good water is essential for great coffee. In investing, liquidity—or “water”—is equally vital for accumulating bitcoin (sats). This is a recurring theme across all my writings. Yet we often forget its importance, fixating instead on minor factors we believe affect profitability.

If you understand how, where, why, and when fiat liquidity is created, it’s hard to lose money investing. Unless you’re Su Zhu or Kyle Davies. If financial assets are priced in USD and U.S. Treasuries (UST), then the global supply of money and dollar-denominated debt becomes the most critical variable.

We need to focus not on the Federal Reserve (“the Fed”), but on the U.S. Treasury. This helps us track changes in Pax Americana’s fiat liquidity.

We must revisit the concept of “fiscal dominance” to understand why Treasury Secretary Yellen has turned Fed Chair Powell into her “beta cuck towel bitch boy.” Read my piece titled Kite or Board for deeper analysis. Under fiscal dominance, the imperative to fund the state outweighs the central bank’s inflation concerns. This means bank credit and nominal GDP growth must remain high—even if inflation runs persistently above target.

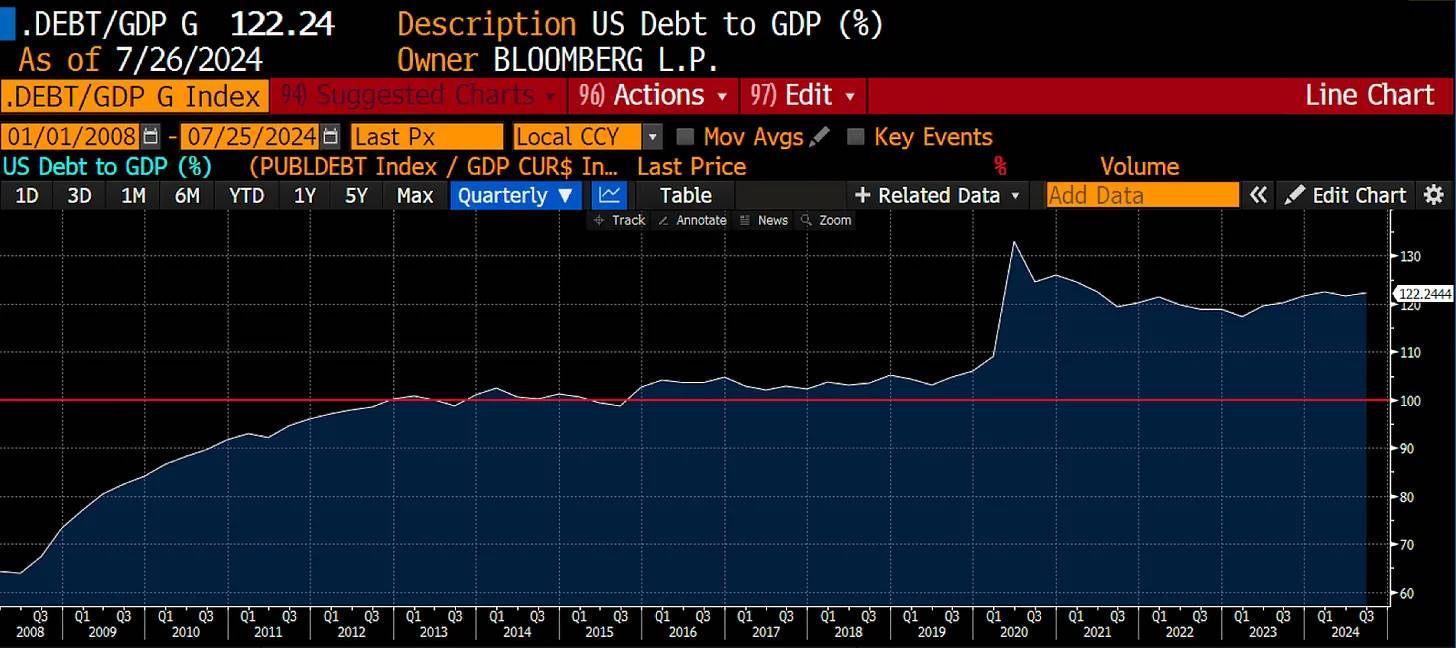

Time and compounding interest determine when power shifts from the central bank to the Treasury. When debt-to-GDP exceeds 100%, debt grows mathematically faster than the economy. Beyond this event horizon, the institution controlling debt issuance is crowned emperor. The Treasury decides when, how much, and what maturity debt gets issued. Moreover, since the government now relies on debt-fueled growth to maintain stability, it ultimately directs the central bank to monetize its deficits. Central bank independence no longer matters!

The outbreak of COVID and the U.S. government’s response—locking people indoors and issuing stimulus checks for compliance—pushed the debt-to-GDP ratio rapidly past 100%. It was only a matter of time before “Grandma” Yellen transformed into “Bad Girl” Yellen.

Before the U.S. enters full-blown hyperinflation, Yellen has a simple way to create more credit and boost asset markets. The Fed’s balance sheet holds two sterilized liquidity pools. Releasing them into the market would fuel bank credit growth and lift asset prices. The first pool is the Reverse Repo (RRP) facility, where money market funds (MMFs) park cash overnight at the Fed for interest. The second is bank reserves, which the Fed similarly pays interest on.

When funds sit on the Fed’s balance sheet, they cannot be rehypothecated into financial markets to generate broad money or credit expansion. By incentivizing MMFs and banks with RRP and reserve interest, the Fed’s QE program inflated financial asset prices without rapidly expanding bank credit. Had QE not been sterilized this way, bank credit would have flowed into the real economy, increasing output and goods/services inflation. Given Pax Americana’s total debt burden, strong nominal GDP growth combined with goods/services/wage inflation is exactly what the government needs—to raise tax revenue and de-lever. Thus, “Bad Girl” Yellen steps in to correct the course.

Yellen doesn’t care about inflation. Her goal is to generate nominal growth so tax receipts rise and the U.S. debt-to-GDP ratio falls. With no party or voter base committed to spending cuts, deficits will persist indefinitely. And given that federal deficits are historically large for peacetime, she must use every tool available to finance the government—specifically, moving as much money as possible from the Fed’s balance sheet into the real economy.

Yellen needs to give banks and MMFs what they want: a risk-free, low-interest-rate-risk cash-like instrument to replace their Fed-held balances. Treasury bills (T-bills) maturing in under a year, yielding slightly more than Interest on Reserve Balances (IORB) or RRP rates, are the perfect substitute. T-bills are leveragable assets that can generate credit and drive asset price growth.

Can Yellen issue $3.6 trillion in T-bills? Of course. The federal government runs a $2 trillion annual deficit, which must be financed by Treasury-issued debt securities.

However, Yellen—or her successor in January 2025—doesn’t necessarily have to issue T-bills to fund the government. She could sell less liquid, higher-interest-rate-risk long-term bonds. But those aren’t cash equivalents. And due to the shape of the yield curve, long-dated debt yields less than T-bills. Profit-driven banks and MMFs won’t swap their Fed-held cash for anything other than T-bills.

So why should we crypto traders care about the flow of funds between the Fed’s balance sheet and the broader financial system? Behold this beautiful chart.

As the Reverse Repo Program (RRP) (white line) declines from its peak, Bitcoin (gold) rebounds from its lows. As you can see, there’s a tight relationship. When funds leave the Fed’s balance sheet, liquidity increases, driving up prices of scarce financial assets like Bitcoin.

Why does this happen? Let’s consult the Treasury Borrowing Advisory Committee (TBAC). In its latest report, TBAC clearly outlines the link between increased T-bill issuance and MMF holdings in the RRP.

Large overnight reverse repo balances may indicate strong demand for T-bills. From 2023–24, overnight RRP funds transitioned almost one-for-one into T-bills. This rotation enabled smooth absorption of record T-bill issuance. — Slide 17, TBAC July 31, 2024

As long as T-bill yields are slightly above RRP rates, MMFs will shift cash into T-bills—currently, 1-month T-bills yield about 0.05% more than RRP funds.

Next question: Can “Bad Girl” Yellen redirect the remaining $300–400 billion in RRP into T-bills? If you doubt “Bad Girl” Yellen, you might face sanctions! Ask the poor souls from developing nations what happens when you lose access to dollars to buy basic necessities like food, energy, and medicine.

In the recent Q3 2024 Quarterly Refunding Announcement (QRA), the Treasury said it will issue $271 billion in T-bills by year-end. That’s good, but RRP still holds cash. Can she do more?

Let me briefly discuss the Treasury Buyback Program. Through this, the Treasury repurchases illiquid non-T-bill debt securities. Funding can come from reducing the Treasury General Account (TGA) or issuing more T-bills. If the Treasury increases T-bill supply while reducing other debt, it nets an increase in liquidity. Funds will exit RRP—positive for dollar liquidity—and as other Treasury supply shrinks, holders will reach further along the risk curve for substitutes.

The latest buyback program through November 2024 totals $30 billion in non-T-bill purchases. This equates to another $30 billion in T-bill issuance, bringing total RRP outflows to $301 billion.

That’s solid liquidity injection. But just how powerful is “Bad Girl” Yellen? How badly does she want minority presidential candidate Momala Harris to win? I call her “minority” because Harris changes her phenotypic identity depending on her audience. It’s a unique ability she possesses. I support her!

The Treasury could inject massive liquidity by draining the TGA from ~$750 billion to zero. They can do this because the debt ceiling resets on January 1, 2025, legally allowing the Treasury to spend TGA balances to avoid or delay a shutdown.

“Bad Girl” Yellen will inject at least $301 billion, possibly up to $1.05 trillion by year-end. Boom! This will spark a gloriousbull run across all risk assets, including crypto, perfectly timed for the election. If Harris still can’t beat that orange guy, maybe she needs to become a white male. I believe she has that superpower within her/his capability.

Grenade

Pulling $2.5 trillion from the Reverse Repo Program (RRP) over the past 18 months is impressive. But a huge pool of dormant liquidity still awaits release. Can Yellen’s successor create a post-2025 scenario that pulls funds from bank reserves held at the Fed into the broader economy?

In an era of fiscal dominance, anything is possible. But how?

Profit-maximizing banks will swap one interest-bearing cash instrument for another if regulators treat them equally and the latter offers higher yield. Currently, T-bill yields are below Fed reserve yields, so banks won’t buy T-bills.

But what happens next year when RRP nears zero and the Treasury keeps flooding the market with T-bills? Abundant supply andmoney market funds (MMFs) unable to use RRP-parked cash to buy T-bills mean prices must fall,yieldsmust rise. Once T-bill yields exceed excess reserve rates by a few basis points, banks will deploy their reserves to buy T-bills en masse.

Yellen’s successor—I’m betting on Jamie Dimon—won’t resist dumping more T-bills into the market for political gain. Another $3.3 trillion in bank reserve liquidity waits to be injected. Say it with me: T-bills, baby, T-bills!

I believe TBAC is quietly hinting at this possibility. Here’s another excerpt from the prior report, with my commentary in [bold]:

Looking ahead, many factors may require further study to consider future T-bill issuance share:

[TBAC wants the Treasury to consider the future and how large T-bill issuance should be. Throughout the report, they advocate keeping T-bill issuance around 20% of totalnet debt. I believe they’re trying to signal what could push this ratio higher and why banks would become primary buyers.] — TBAC July 31, 2024, Slide 26

Evolution of the banking regulatory environment and ongoing assessments (including liquidity and capital reforms), and implications for meaningful participation by banks and dealers in intermediating and warehousing (expected) future U.S. Treasury tenors and supply

[Banks don’t want to hold more long-dated notes orbondsthat attract stricter collateral requirements. They’re quietly saying: we won’t buy long-dated debt anymore—it hurts profitability and is too risky. If primary dealers strike, the Treasury is in trouble, as who else has the balance sheet to absorb massive debt auctions?]

Evolution of market structure and implications for Treasury Market Resilience Initiatives, including,

-

SEC’s central clearing rules, requiring large margin postings at covered clearinghouses

-

[If the Treasury market shifts to exchanges, dealers must post billions in extra collateral. They can’t afford it, leading to reduced participation.]

-

Future (expected) size of U.S. Treasury auctions and predictability in cash management and benchmark T-bill issuance

-

[If deficits remain this large, debt issuance may surge. Thus, T-bills’ role as abufferbecomes increasingly critical. This implies higher T-bill issuance.]

-

Future money fund reforms and potential structural demand for T-bills

-

[Ifmoney market fundsreturn to the market after RRP is fully drained, T-bill issuance will exceed 20%.]— TBAC July 31, 2024, Slide 26

Banks have effectively gone on strike, refusing to buy long-dated Treasuries. “Bad Girl” Yellen and Powell nearly collapsed the banking system by stuffing banks with Treasuries, then hiking rates from 2022–2023… RIP Silvergate, Silicon Valley Bank, Signature Bank. Remaining banks don’t want to risk seeing what happens if they greedily buy expensive long-dated Treasuries again.

Illustration: Since October 2023, U.S. commercial banks have bought only 15% of non-T-bill Treasury securities. This is terrible for Yellen, who needs banks to step up as the Fed and foreigners retreat. I believe banks will happily fulfill their duty as long as they’re buying T-bills, which carry risk profiles similar to bank reserves—but with higher yields.

Widowmaker

The move in USD/JPY from 160 to 142 sent shockwaves across global financial markets. Many were reminded last week to sell everything they could. That moment was textbook correlation. USD/JPY will hit 100, but the next leg down will be driven by foreign capital repatriation from Japan Inc., not just hedge funds unwinding yen carry trades. They’ll sell U.S. Treasuries and U.S. stocks (mainly big tech like NVIDIA, Microsoft, Google).

The Bank of Japan tried to hike rates, and global markets reacted violently. They backed down, announcing hikes are off the table. From a fiat liquidity perspective, the worst case is a sideways yen carry trade, with no new low-cost yen positions established. With the yen carry threat receding, “Bad Girl” Yellen’s market manipulation returns to center stage.

Dehydration

Without water, you die. Without liquidity, you face collapse.

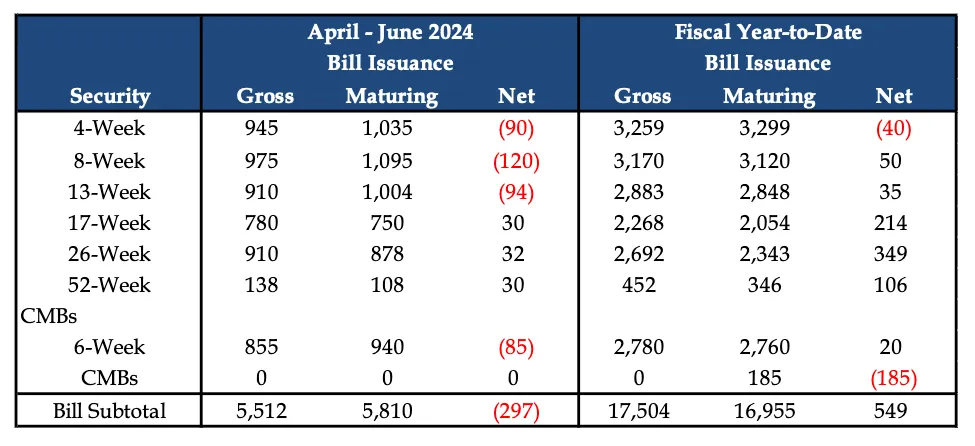

Why has the crypto risk market been flat or declining since April? Most taxes are paid in April, forcing the Treasury to reduce borrowing. We can see a drop in T-bill issuance between April and June.

With net T-bill reduction, liquidity is removed from markets. Even as total government borrowing rises, a net decrease in cash-like instruments provided by the Treasury reduces liquidity. Cash remains trapped on the Fed’s balance sheet, inside the Reverse Repo Program (RRP), unable to drive financial asset prices higher.

This chart of Bitcoin (gold) vs. RRP (white) clearly shows that from January to April, when T-bills were net issued, RRP declined and Bitcoin rose. From April to July, when T-bills were net withdrawn, RRP rose and Bitcoin traded sideways, with several sharp drops. I stop on July 1 because I want to show the interaction before USD/JPY plunged from 162 to 142, triggering broad risk asset selling.

Thus, per “Bad Girl” Yellen, we know $301 billion in net T-bill issuance will occur between now and year-end. If this relationship holds, Bitcoin will quickly recover from the yen-driven sell-off. Bitcoin’s next target: $100,000.

When is altseason?

Altcoins are the high-beta crypto play on Bitcoin. But in this cycle, Bitcoin and Ethereum now have structural buying via U.S.-listed ETFs. Despite pullbacks since April, they avoided the carnage seen in the altcoin market. Altseason won’t return until Bitcoin surpasses $70,000 and Ethereum breaks $4,000. Solana will also exceed $250, but given relative market cap, Solana’s rally will have far lesswealth effecton the overall crypto market than Bitcoin and Ethereum. By year-end, a dollar-liquidity-driven rebound in Bitcoin and Ethereum will lay a solid foundation for the return of the sexy altcoin party.

Trade Setup

With T-bill issuance and the buyback program running in the background, liquidity conditions will improve. If Harris falters and needs more firepower to lift equities, Yellen will drain the TGA. Regardless, I expect crypto to break out of its summer downtrend starting in September. So I’ll use this late northern summer weakness to increase exposure to crypto risk.

The U.S. election is in early November. Yellen will peak her manipulation in October. There’s no better liquidity setup this year. So I’ll ride the wave. I won’t liquidate my entire crypto portfolio, but will take profits on more speculative momentum trades and park capital instaked Ethena USD (sUSDe). Crypto rallies have boosted Trump’s odds. His chances peaked after the assassination attempt and Slow Joe’s disastrous debate performance. Kamala Harris is a top-tier political puppet, but she’s not an octogenarian vegetable. That’s all she needs to beat Trump. The election is a coin toss, and I’d rather watch the chaos from the sidelines, re-entering after the U.S. debt ceiling is lifted. I expect that between January and February.

Once the U.S. debt ceiling circus ends, liquidity will flood from the Treasury and Fed to normalize markets. Then, the real bull market begins. $1 million Bitcoin remains my base case.

P.S.: Once “Bad Girl” Yellen and Towel Boy Powell team up, China will finally unleash its long-awaited fiscal stimulus. The 2025 Sino-U.S. crypto bull run will be glorious.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News