Grayscale Report: AI and Cryptocurrency Are "Two Sides of the Same Coin" — Decentralization in Crypto Will Enhance AI Transparency

TechFlow Selected TechFlow Selected

Grayscale Report: AI and Cryptocurrency Are "Two Sides of the Same Coin" — Decentralization in Crypto Will Enhance AI Transparency

AI and cryptocurrency are "two sides of the same coin," and "Web3 will help us trust AI."

Author: Will Ogden Moore

Translated by: TechFlow

Artificial intelligence (AI) is one of the most promising emerging technologies of this century, with the potential to greatly enhance human productivity and drive medical breakthroughs. While AI is already important today, its impact continues to grow. PwC estimates that by 2030, AI will become a $15 trillion industry.

However, this promising technology also faces challenges. As AI capabilities strengthen, the AI industry has become highly concentrated, with power held by a few large companies, potentially creating negative societal impacts. This concentration has also raised serious concerns about deepfakes, embedded biases, and data privacy risks. Fortunately, the decentralized and transparent nature of cryptocurrency offers potential solutions.

Below, we explore the problems created by centralization and how decentralized AI can help address them, discussing the intersection of crypto and AI while highlighting some crypto applications that have shown early signs of adoption.

Problems with Centralized AI

Currently, AI development faces several challenges and risks. The network effects and high capital requirements of AI make it difficult for developers outside major tech firms—such as small startups or academic researchers—to access necessary resources or monetize their work. This limits overall competition and innovation in AI.

As a result, influence over this critical technology is concentrated in a few companies such as OpenAI and Google, raising serious questions about AI governance. For example, in February this year, Google’s AI image generator Gemini revealed racial bias and historical inaccuracies, illustrating how companies can manipulate their models. Additionally, in November last year, a six-member board voted to fire OpenAI CEO Sam Altman, exposing how much control a small group holds over companies developing these models.

As AI grows more influential and important, many fear that having decision-making power over socially impactful AI models rest within a single company could allow behind-the-scenes manipulation, selective safeguards, or model tampering for profit—at the expense of broader society.

How Decentralized AI Can Help

Decentralized AI refers to using blockchain technology to distribute ownership and governance of AI, thereby increasing transparency and accessibility. Grayscale Research believes decentralized AI has the potential to shift these crucial decisions from closed ecosystems into the hands of the public.

Blockchain technology can help expand developer access to AI, lowering the barriers for independent developers to build and monetize their work. We believe this could foster greater overall AI innovation and competition, balancing models developed by tech giants.

Moreover, decentralized AI can help democratize access to financial participation in AI. Currently, there are almost no avenues to gain financial exposure to AI development beyond a handful of tech stocks. Meanwhile, vast amounts of private capital have been allocated to AI startups and private companies ($47 billion in 2022 and $42 billion in 2023). As a result, financial gains from these companies are accessible only to a select group of venture capitalists and accredited investors. In contrast, decentralized AI crypto assets are open to everyone, allowing all individuals to own a piece of AI's future.

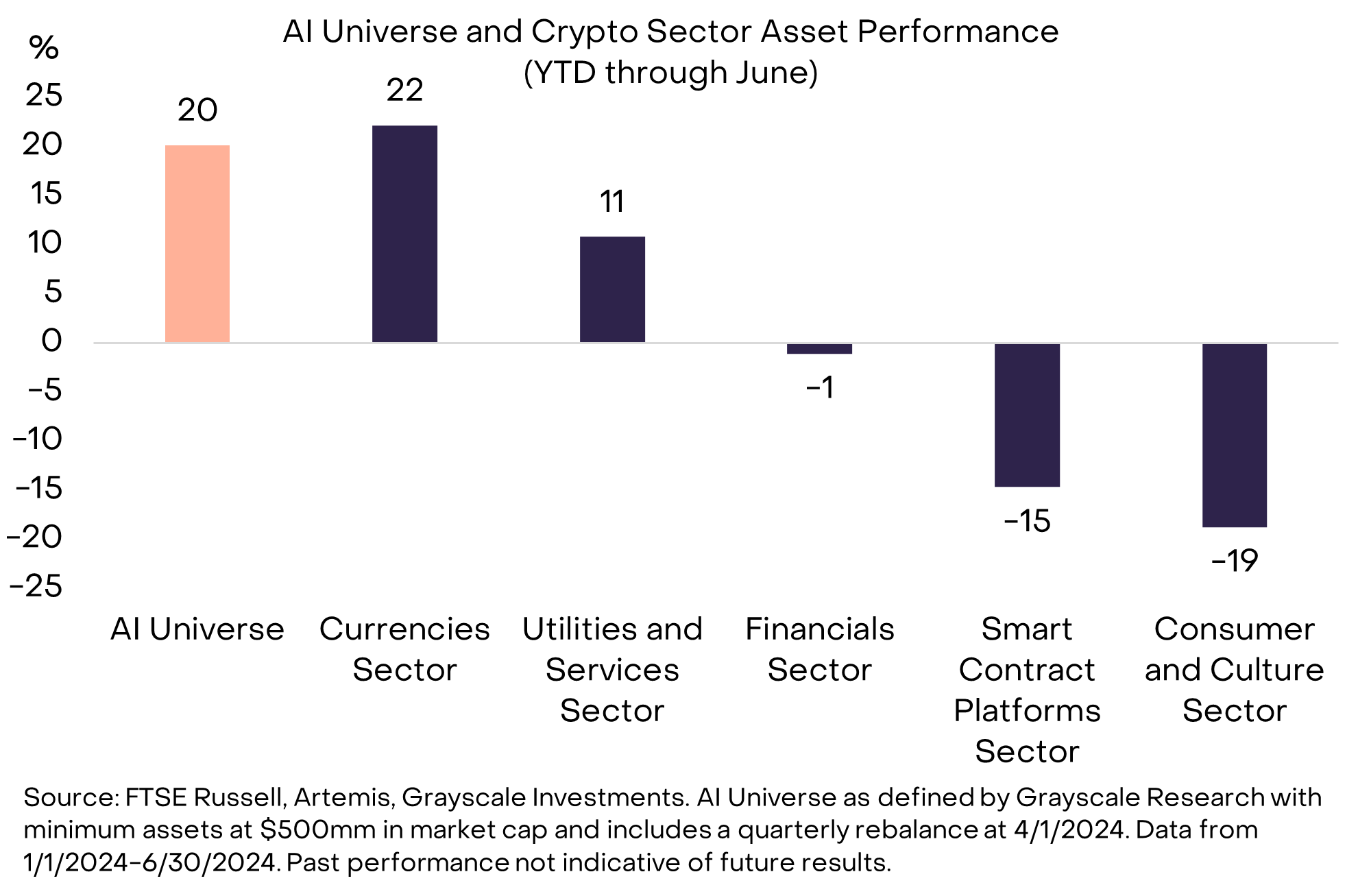

Current State of the Intersection

Currently, the intersection between cryptocurrency and AI remains in early stages of maturity, but market response has been encouraging. As of May 2024, AI crypto assets delivered a 20% return year-to-date (based on Grayscale Research’s definition of the AI Universe, which includes assets with a minimum market cap of $500 million and quarterly rebalancing as of April 1, 2024. Assets in the universe include NEAR, FET, RNDR, FIL, TAO, THETA, AKT, AGIX, WLD, AIOZ, TFUEL, GLM, PRIME, OCEAN, ARKM, and LPT), outperforming every other crypto sector except currencies (see Figure 1). Additionally, according to data provider Kaito, AI currently dominates the largest share of “narrative mindshare” on social platforms, surpassing other themes such as decentralized finance, Layer 2, memes, and real-world assets.

Recently, several prominent figures have embraced this emerging convergence, focusing on addressing the shortcomings of centralized AI. In March, Emad Mostaque, founder of leading AI firm Stability AI, left the company to pursue decentralized AI, stating, “Now is the time to ensure AI remains open and decentralized.” Additionally, crypto entrepreneur Erik Vorhees recently launched Venice.ai, a privacy-focused AI service featuring end-to-end encryption.

Figure 1: AI crypto assets have outperformed nearly all crypto sectors year-to-date

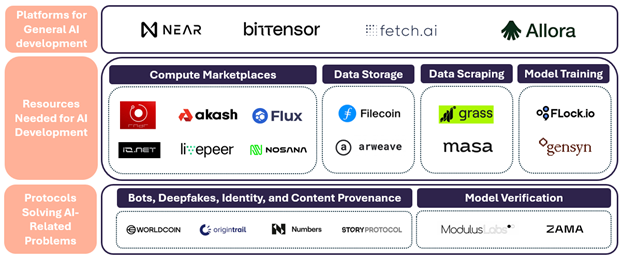

Today, we can categorize the convergence of crypto and AI into three main subcategories (assets listed are illustrative examples, ordered by market cap from largest to smallest):

-

Infrastructure Layer: Networks providing platforms for AI development (e.g., NEAR, TAO, FET)

-

AI Resources: Assets providing key resources required for AI development (compute, storage, data) (e.g., RNDR, AKT, LPT, FIL, AR, MASA)

-

Solving AI Problems: Assets attempting to solve AI-related issues (e.g., bots, deepfakes, model verification) (e.g., WLD, TRAC, NUM)

Figure 2: AI and Crypto Market Map

Source: Grayscale Investments. Protocols listed are illustrative examples.

Networks Providing AI Development Infrastructure

This category includes networks that provide permissionless, open architectures specifically built for general-purpose development of AI services. These assets do not focus on any single AI product or service but aim to create foundational infrastructure and incentive mechanisms for a wide range of AI applications.

Near stands out in this category, founded by a co-creator of the “Transformer” architecture that powers AI systems like ChatGPT. It has recently leveraged its AI expertise to launch plans via its research and development arm for building “user-owned AI,” led by an advisor who is a former OpenAI research engineer. At the end of June 2024, Near launched its AI incubator program focused on developing Near-native foundation models, data platforms for AI applications, AI agent frameworks, and compute markets.

Bittensor is another compelling example. Bittensor is a platform that uses the TAO token to incentivize AI development. It serves as the underlying platform for 38 subnets (subnets are smaller segmented parts of a larger network designed to improve efficiency and security by isolating portions of the network for specific purposes or user groups; as of June 23, 2024), each serving different use cases such as chatbots, image generation, financial forecasting, language translation, model training, storage, and computation. The Bittensor network rewards top-performing miners and validators in each subnet with TAO tokens and provides developers with permissionless APIs to build specific AI applications by querying miners across Bittensor subnets.

This category also includes other protocols such as Fetch.ai and Allora Network. Fetch.ai is a platform enabling developers to create sophisticated AI assistants (i.e., “AI agents”), which recently merged with AGIX and OCEAN, forming a combined entity valued at approximately $7.5 billion. Another is Allora Network, a platform focused on applying AI to financial applications including automated trading strategies on decentralized exchanges and prediction markets. Allora has not yet launched a token and completed a strategic funding round in June, raising a total of $35 million in private capital.

Resources Needed for AI Development

This category includes assets that provide essential resources—compute, storage, or data—for AI development.

The rise of AI has created unprecedented demand for computing resources such as GPUs. Decentralized GPU markets like Render (RNDR), Akash (AKT), and Livepeer (LPT) offer idle GPU capacity to developers needing resources for model training, inference, or generative 3D AI. Today, Render provides around 10,000 GPUs, primarily targeting artists and generative AI, while Akash offers 400 GPUs, mainly catering to AI developers and researchers. Meanwhile, Livepeer recently announced plans to launch a new AI subnet in August 2024 dedicated to tasks such as text-to-image, text-to-video, and image-to-video generation.

In addition to massive computational needs, AI models require vast datasets. Consequently, demand for data storage has surged dramatically. Decentralized data storage solutions like Filecoin (FIL) and Arweave (AR) can serve as secure, decentralized alternatives to centralized servers such as AWS for storing AI data. These solutions not only offer cost-effective and scalable storage but also enhance data security and integrity by eliminating single points of failure and reducing the risk of data breaches.

Furthermore, existing AI services like OpenAI and Gemini continuously pull real-time data through Bing and Google Search, putting other AI model developers at a disadvantage. However, data scraping services like Grass and Masa (MASA) can help level the playing field by allowing individuals to monetize their data for AI model training while retaining control and privacy over their personal information.

Assets Solving AI-Related Problems

The third category includes assets aiming to solve AI-related issues such as bots, deepfakes, and content provenance.

AI has intensified the proliferation of bots and misinformation. AI-generated deepfakes have already influenced presidential elections in India and Europe, and experts fear that upcoming campaigns will be flooded with disinformation driven by deepfakes. Assets attempting to combat deepfakes by establishing verifiable content provenance include Origin Trail (TRAC), Numbers Protocol (NUM), and Story Protocol. Additionally, Worldcoin (WLD) addresses bot issues by verifying individual identity through unique biometric recognition.

Another risk with AI is ensuring trust in the models themselves. How can we trust that the AI results we receive haven't been tampered with or manipulated? Currently, several protocols—including Modulus Labs and Zama—are working to address this issue using cryptographic techniques such as zero-knowledge proofs and fully homomorphic encryption (FHE).

Conclusion

While these decentralized AI assets have made initial progress, we remain in the early stages of this convergence. At the beginning of the year, prominent venture capitalist Fred Wilson stated that AI and crypto are “two sides of the same coin” and that “web3 will help us trust AI.” As the AI industry continues to mature, Grayscale Research believes these AI-related crypto use cases will grow increasingly significant, with the two rapidly evolving technologies poised to support each other’s growth.

By many indicators, AI is arriving—and preparing to make profound impacts, both positive and negative. By leveraging the properties of blockchain technology, we believe cryptocurrency can ultimately help mitigate some of the dangers posed by AI.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News