5 Charts to Help You Understand the Current Market: Correction Is Inevitable, Finding 100x Gems Is Harder

TechFlow Selected TechFlow Selected

5 Charts to Help You Understand the Current Market: Correction Is Inevitable, Finding 100x Gems Is Harder

Compared to previous cycles, we are still in the early stages.

Author: THE ALTCOIN INVESTOR

Translation: TechFlow

-

Compared to previous cycles, we are still in the early stages.

-

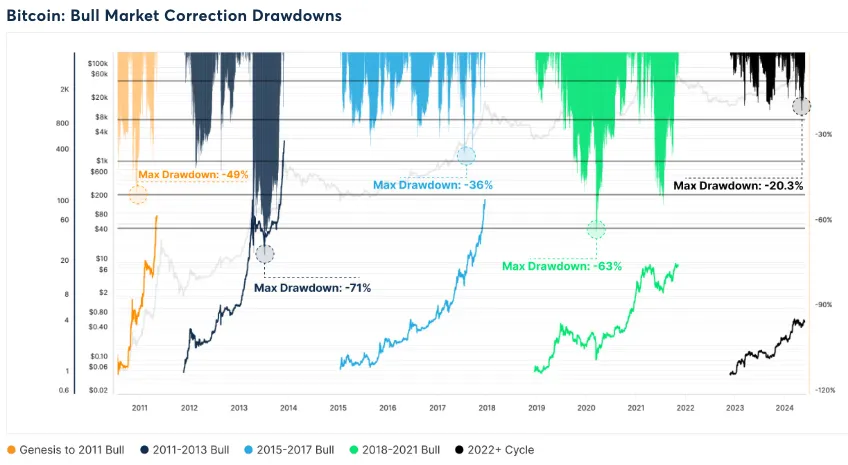

Market corrections are inevitable.

In previous cycles, the market experienced deeper corrections. For example, during 2016–17, drawdowns ranged from -25% to -35%, while during 2020–21, they reached -50% to -63%.

Source: Glassnode

-

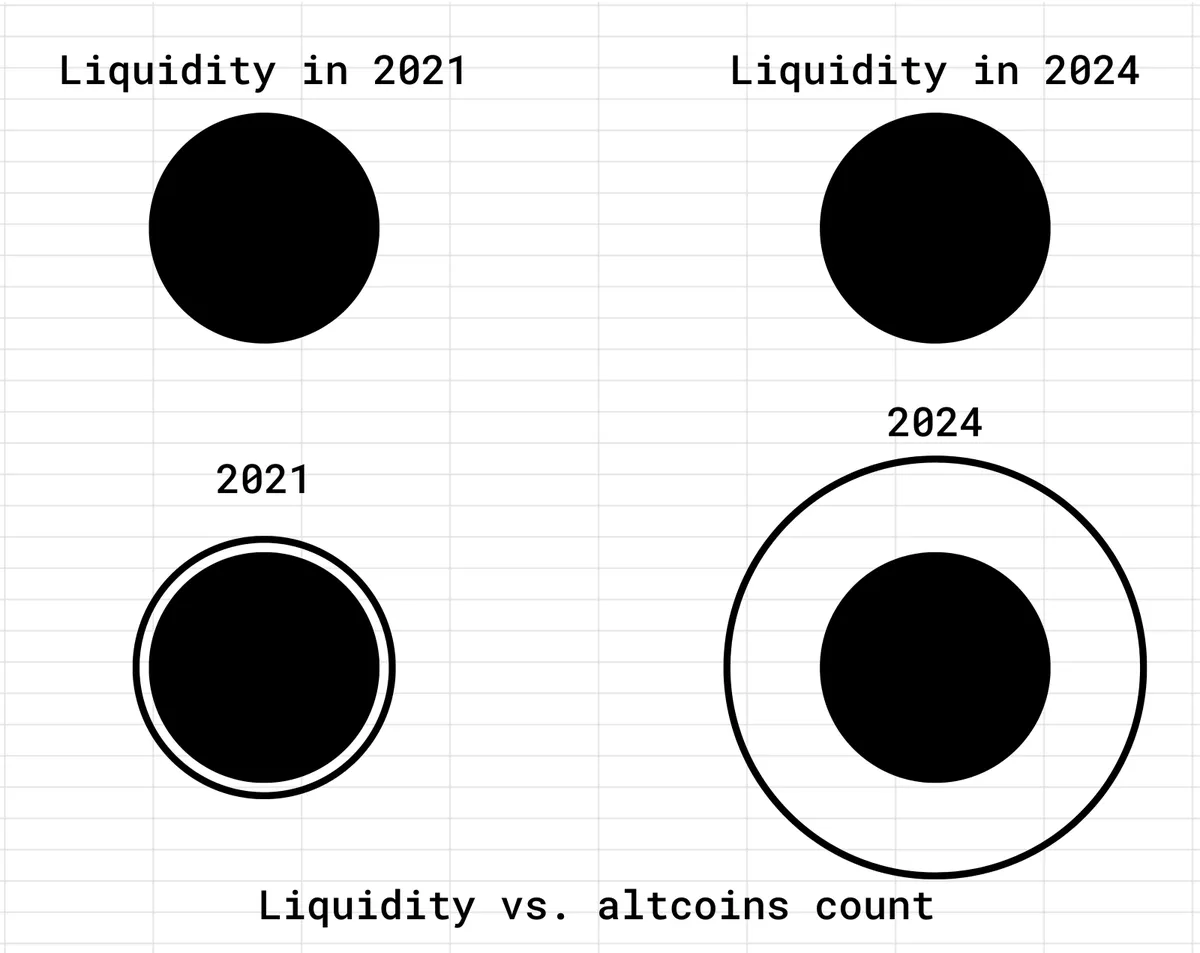

While liquidity is similar to 2021 levels, the number of tokens has increased 50-fold.

In other words, it’s now much harder to find tokens capable of delivering 100x returns.

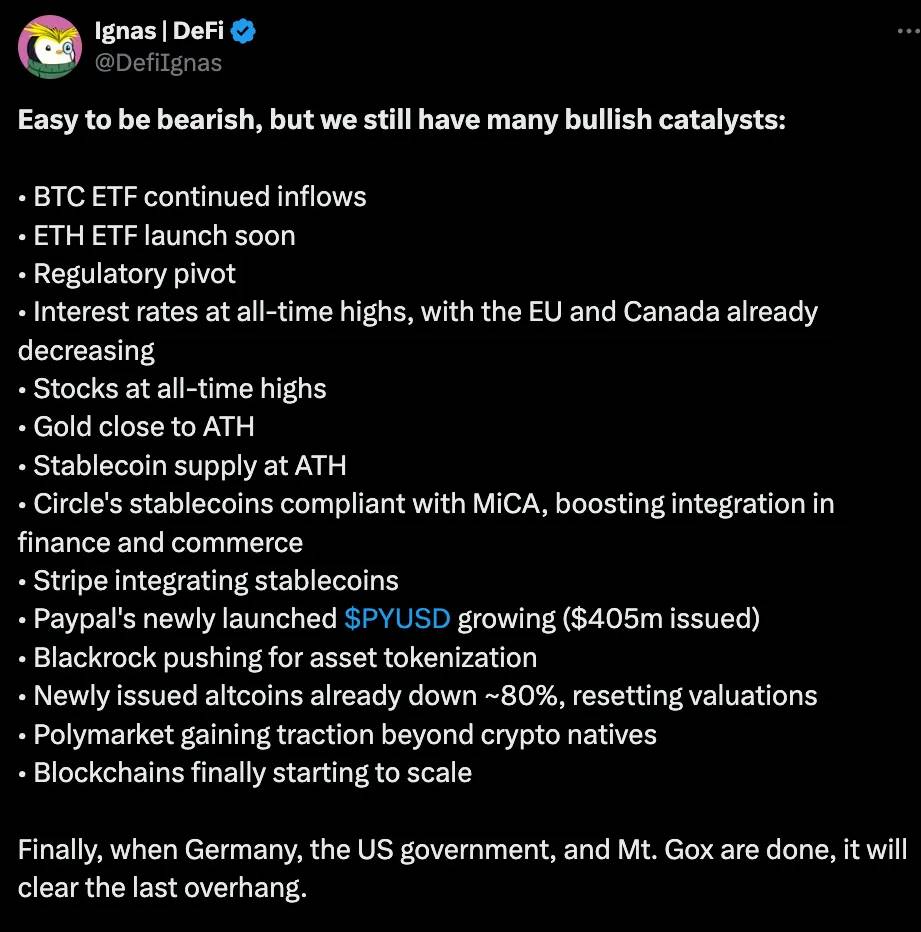

4. Bullish catalysts.

-

Sustained inflows into Bitcoin ETFs

-

Upcoming launch of Ethereum ETFs

-

Regulatory shift

-

Interest rates at historic highs, with declines already beginning in the EU and Canada

-

Equity markets at historic highs

-

Gold near historic highs

-

Stablecoin supply at historic highs

-

Circle's stablecoin compliant with MiCA standards, driving integration in finance and commerce

-

Stripe integrates stablecoins

-

$PYUSD from PayPal sees growth (already issued $405 million)

-

Blackrock pushing tokenization of assets

-

Newly launched altcoins down ~80%, resetting valuations

-

Polymarket gaining traction beyond native crypto circles

-

Blockchains finally starting to scale

Finally, once issues involving Germany, the U.S. government, and Mt. Gox are resolved, the last overhangs will be cleared.

-

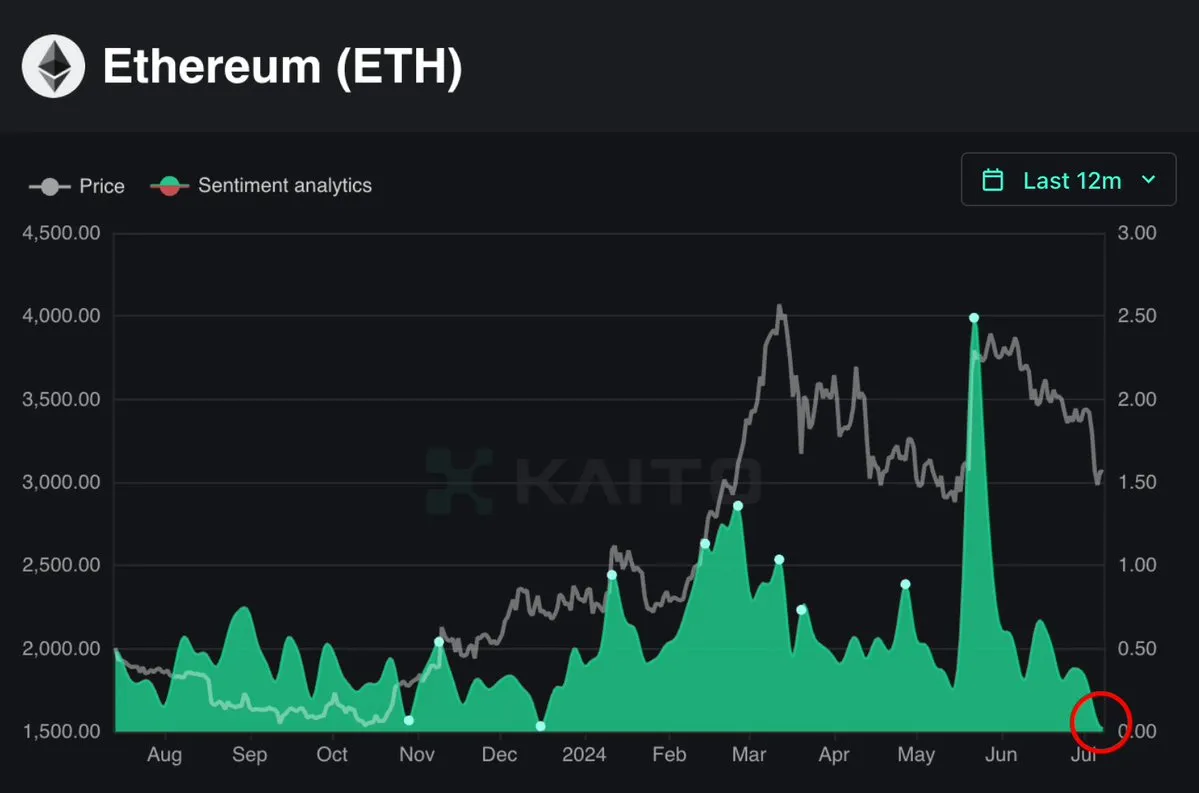

Potential bottom signal: ETH sentiment is now at its lowest point of 2024, nearing negative territory.

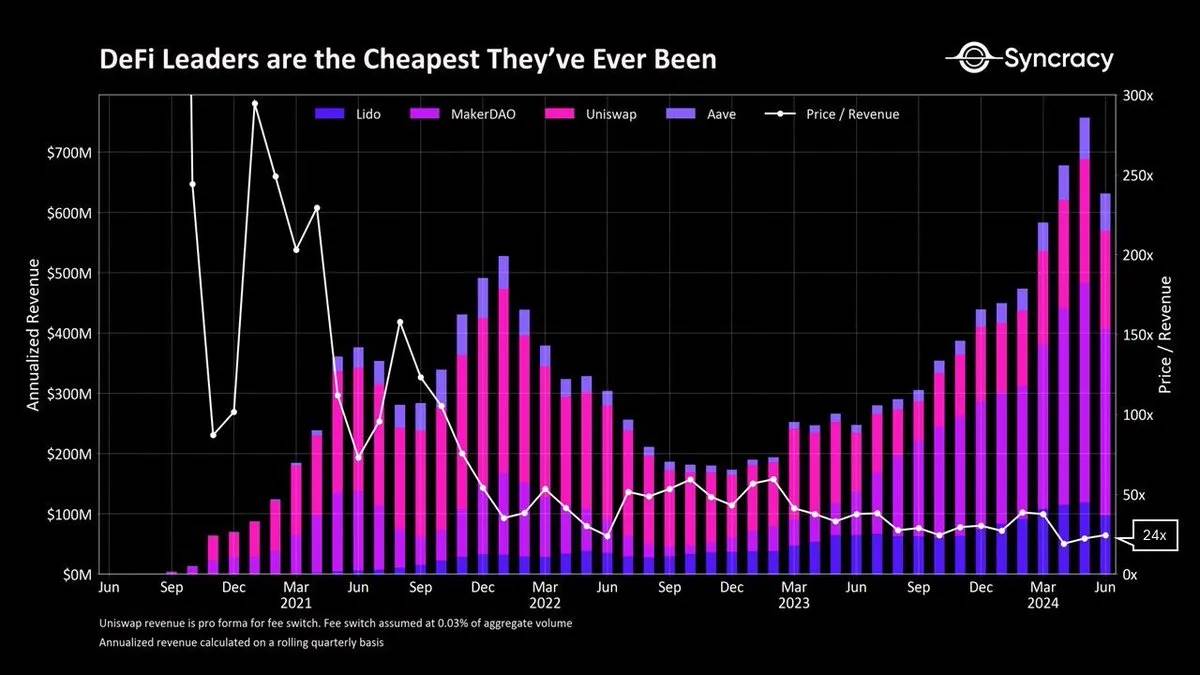

Potential opportunity: DeFi valuations are cheap

In the summer of 2020, the crypto world witnessed a phenomenon later known as "DeFi Summer."

This period marked a pivotal turning point in the adoption and development of decentralized finance (DeFi) platforms.

At the time, users frequently jumped from one DeFi project to another, chasing higher yields.

This frenzy created massive selling pressure, compounded by token unlocks from investors and team members, causing prices to fall more than 80% from their all-time highs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News