Market liquidity remains parched—when will the "rising tide" come?

TechFlow Selected TechFlow Selected

Market liquidity remains parched—when will the "rising tide" come?

Sideways volatility shakes out ordinary investors, and the market rallies just when you give up.

Author: @DistilledCrypto

Translation: TechFlow

When will liquidity flood the market?

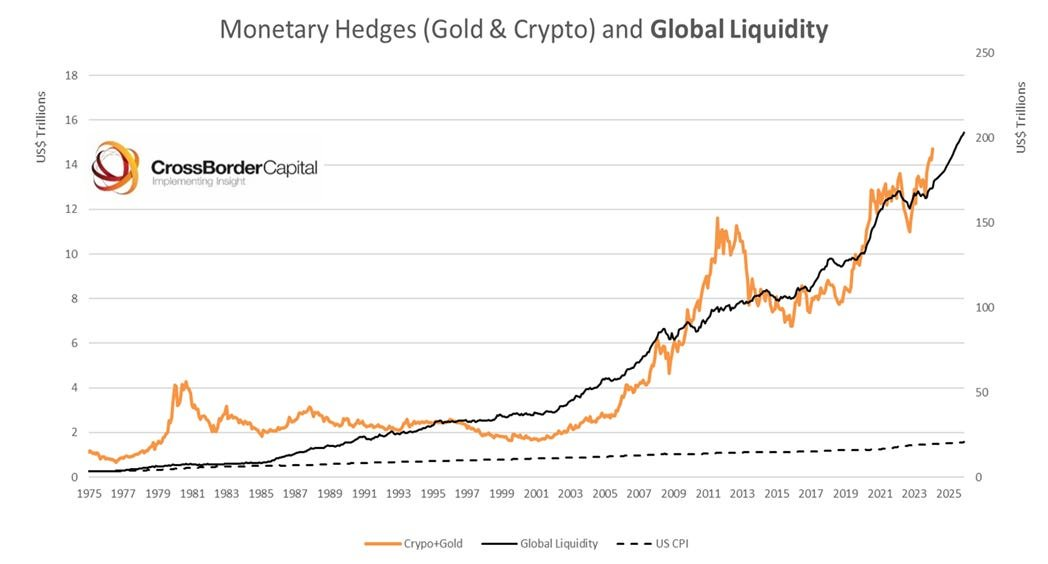

Thanks to liquidity, more money flowing in usually means higher cryptocurrency prices.

However, the current market remains parched, with no trace of the "rising tide" seen in 2021.

I’ve examined insights from macro expert CG (@pakpakchicken) to uncover some clues.

Policy-Driven

@pakpakchicken spends hours daily tracking policy changes: “Policy drives liquidity, liquidity drives assets, assets drive GDP... and so on.”

His conclusion: the biggest risk comes from the upside.

@CryptoHayes and @RaoulGM agree with this view.

An Overlooked Insight

@pakpakchicken points out that few are discussing the expectation that the U.S. dollar might weaken.

He forecasts a coordinated move ahead to devalue the dollar—an action that could unleash significant liquidity.

Historical Context: The Events of 1985

The policy backdrop around 1985 helps illuminate policymakers’ mindset:

→ Tight monetary policy

→ High long-term interest rates

→ Strong U.S. dollar (explore the “milkshake theory”)

→ High deficits

Unprecedented Volatility Ahead

As the volatile season approaches, @pakpakchicken anticipates extreme turbulence.

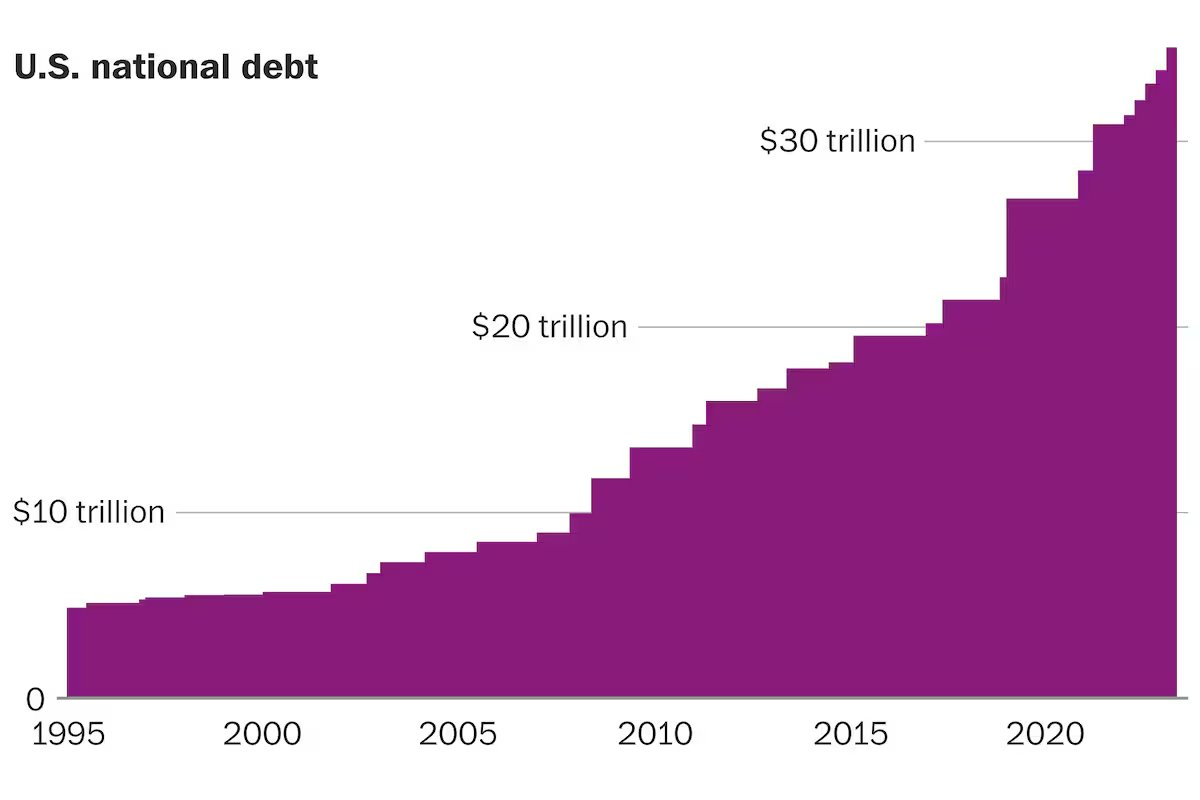

This will be driven by the U.S. need to refinance its $35 trillion debt burden.

Why Volatility Is Good

@pakpakchicken sees volatility not as a flaw, but as an ideal condition for profit.

Big money is made during short bursts.

Sideways consolidation shakes out retail investors, and the market rallies just when you give up.

Debt’s Impact on Crypto

To manage its massive debt, the U.S. may increase liquidity to devalue the currency.

This would keep debt rollover manageable—without such intervention, yields could spiral out of control.

Larry Fink’s View

BlackRock CEO Larry Fink on national debt stated:

No matter how much the U.S. increases taxes or cuts spending, these measures alone won’t solve the debt problem. Therefore, he emphasizes that building new infrastructure is critical. He believes that developing new infrastructure can not only boost economic growth but also lay the foundation for future development.

CG (@pakpakchicken) believes institutions will tokenize all assets while the dollar still holds value.

CG’s Macro Update (Late Q2)

By late Q2, U.S. weekly liquidity support reached up to $2 billion per operation, while QT slowed from $6 billion to $2.5 billion monthly.

U.S. policy increased short-term bill issuance, while the Chinese yuan may face depreciation.

Trillions in yuan liquidity expansion in China could benefit crypto, as deflation in goods, services, and asset values looms alongside imminent currency devaluation—factors pointing to potential bullish momentum in the second half.

U.S. Treasury Buybacks

Since May 29, U.S. Treasury buybacks have ramped up weekly liquidity injections to $2 billion. This liquidity surge could amplify crypto prices during the turbulent election season.

CG (@pakpakchicken) believes upward momentum may emerge in H2 2024.

Exponential Summer

@pakpakchicken champions crypto as a leading asset class. Yet he cautions: “The market can stay irrational longer than you can stay solvent.” A future of surging global liquidity is on the horizon...

Narrative Fatigue

CG (@pakpakchicken) stresses that understanding narratives is key.

Narratives drive markets until their value is exhausted.

The CPI/inflation narrative is fading; recent reports lack impact.

The Next Mainstream Focus

With bank reserves weakening, employment takes center stage, and rate cuts arrive earlier than expected.

TLDR: “Stay long.”

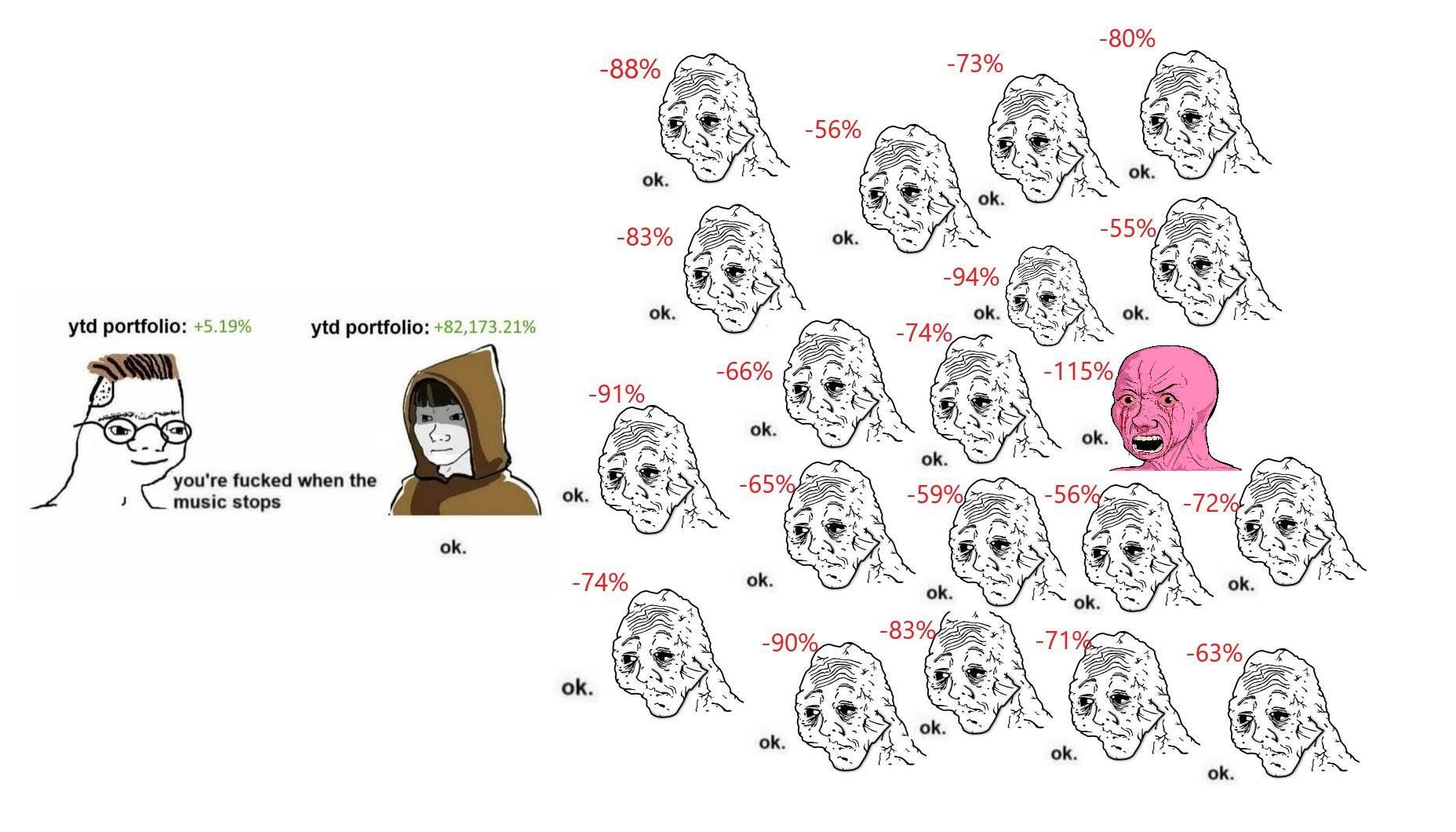

The Most Painful Market Move

As macro forces converge, CG expects a “most painful market move” according to market logic.

PS: The “most painful market move” is a concept in financial markets, literally translated as “maximum pain,” referring to the price path the market takes over a given period that typically causes the greatest discomfort and distress for most investors.

The logic behind this concept is that markets often follow price movements that maximize losses for the majority of investors. Drivers behind this behavior include market manipulation, institutional investor strategies, and inherent supply-demand dynamics.

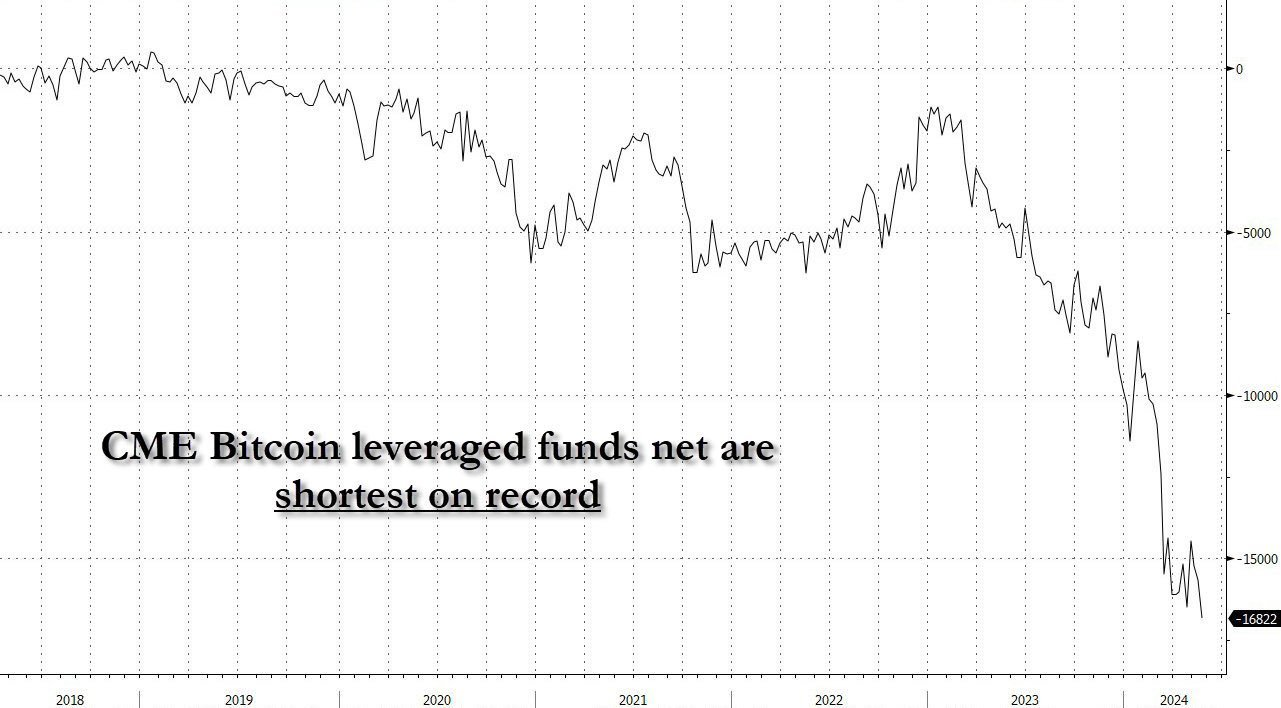

Signs Before the “Most Painful Market Move”

-

Retail isn’t positioned for a rally

-

Many influencers claim the market has topped

-

Market makers are short

-

Overwhelming bearish positioning

The end result is very likely a sharp rally.

Betting on $ETH

CG (@pakpakchicken) believes $ETH will stand out in the next bull run.

As Larry Fink noted, in the long run, debt is unsustainable.

While the dollar retains value, everything will transition and be tokenized.

Only one L1 has stood the test of time and achieved the highest adoption to date— $ETH

Respect the Odds

Although CG (@pakpakchicken) leans bullish, further downside remains possible. Macro expert @fejau_inc sees slowing economic growth as fundamental, noting a significant downside surprise risk not seen since 2019 currently exists.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News