In crypto, fundamentals don't matter—attention is everything.

TechFlow Selected TechFlow Selected

In crypto, fundamentals don't matter—attention is everything.

Fundamental investing basically doesn't make money.

By TechFlow

There's always a legend circulating in the market about some diamond-handed investor reaping massive returns, as if achieving financial freedom were just two simple steps: buy and wait.

But when it comes to personal practice, being a diamond hand demands extraordinary mental fortitude. Everyone says “the rewards of waiting are great,” but more often than not, reality unfolds like this: you wait and wait only to realize others got rich, while opening your hands at last reveals nothing but dust blown away by the wind.

Compared to relatively stable BTC, many people prefer long-term holding various "value coins," hoping their altcoins will one day be discovered and deliver outsized returns far exceeding the broader market.

However, recently well-known DeFi OG Ignas (@DefiIgnas) stated in a tweet: simply holding altcoins due to strong fundamentals is unreliable.

Crypto doesn't believe in fundamental investing, just as Beijing, Shanghai, and Guangzhou don’t believe in tears.

Fundamental Investing? Barely Profitable

Ignas used Brave browser and its $BAT token—a project with solid fundamentals during the previous cycle—as an example:

Today, Brave has around 73 million active users and raised $40 million back in 2016–2017. Its product makes sense and its technology is sound. Judged purely as a credible crypto project, Brave is undeniably successful.

Yet the price of $BAT hasn't significantly increased. To this day, $BAT trades at roughly the same level as when it first launched in 2017—while $ETH has surged from $250 to $3,900 over the same period.

Ignas admitted he was once extremely bullish on $BAT and held it as his largest altcoin position. Although he sold near the top, the price trajectory of $BAT still offers insight: success in product development does not necessarily translate into strong long-term token performance.

The traditional financial market axiom that “strong performance supports high valuations” seems irrelevant here. In fact, paying premiums for strong metrics and solid data can lead to disastrous outcomes.

Ignas even considered whether token unlocks were suppressing the price, but unfortunately, $BAT is now fully circulating with no further emissions.

Ultimately, Ignas advised against blindly trusting any project’s promise of long-term value, especially for altcoins. Timely portfolio rebalancing and careful selection of investment targets are crucial.

Attention Is the Real Fundamental

After Ignas posted his thoughts, several interesting discussions emerged in the replies:

Some pointed out that $BAT’s poor price performance might stem from the team focusing heavily on product development while neglecting marketing. Official tweets rarely mention the token itself. In response, Ignas emphasized that in crypto, attention is everything. The team should probably engage KOLs to promote $BAT and build a stronger community to boost market awareness.

Indeed, $BAT epitomizes the classic “value coin”: solid project fundamentals, fully circulating supply—an undervalued golden egg seemingly just awaiting market recognition, followed by a frenzy of buying and price surge.

But the cold truth is: anyone who diamond-handed $BAT for seven years would have significantly underperformed the broader market.

Unlike traditional Web2 projects that emphasize technical architecture, user metrics, and funding background, in crypto, sector trends, celebrity endorsements, or even being hacked can serve as “fundamentals” that capture retail attention.

Sticking rigidly to old-school “fundamental investing” and patiently waiting for value discovery may be somewhat outdated.

Retail Loves "Fun", Institutions Want "Useful"

MEMECOINs are perhaps the most direct destroyers of traditional fundamentals in crypto. People love MEMECOINs for a simple reason: they’re easy to understand, and pumps happen fast.

Thanks to fair early distribution mechanisms and unique subcultures, MEMECOINs have maintained an image of fairness and fun among the public.

However, repeated incidents of price manipulation reveal that large capital players are unwilling to miss out on this emerging financial frontier. Many MEMECOINs show clear signs of institutional manipulation behind the scenes. See our related report: Collective Misconduct? Insiders Expose Polygon Executives Maliciously Manipulating Meme Coin Prices

One chart offers a simple breakdown of current crypto assets:

This diagram illustrates the dual nature of crypto assets: one end represented by MEMECOINs—entertainment-driven, wildly speculative; the other end represented by RWA (Real World Assets)—boring but practical.

Fun versus useful—this appears to reflect differing philosophies between retail and institutional investors.

Retail investors (C-end) favor retail-driven markets fueled by high speculation and entertainment, exemplified by the MEMECOIN craze and the AI bubble in Q4 2023. Meanwhile, institutions (B-end) lean toward regulated, utility-focused narratives such as BTC/ETH ETFs and RWA assets.

Though seemingly divergent, both paths ultimately converge.

Phantom ranks among the top downloads in Google Play across multiple countries, showing how the retail-driven MEME wave has gone global. Retailers willingly pay for the附加 value embedded in MEME culture—freedom, absurdity, chaos.

Everyone wants a piece: political MEMEs, celebrity MEMEs, Pump.Fun livestreams... Everything becomes meme-ifiable. Metrics of influence turn into price swings of meme coins—the ultimate paradise for monetizing attention and traffic.

The attitude shift among legacy financial institutions is equally telling—from initial disdain and skepticism toward crypto, to rushing into BTC/ETH ETFs. Even “regulation,” once seen as the sword of Damocles hanging over crypto, has become a bull market catalyst. Now, in the U.S. election cycle, crypto itself has become a campaign tool.

From “deemed useless” to “can’t afford to ignore,” attention has贯穿crypto’s journey from underground to mainstream.

Crypto operates under investment logic vastly different from traditional finance. And the meaning of “fundamentals” changes completely depending on whether real-world performance exists or not.

Retail investors, having been fooled too many times by fundamental stories, naturally gravitate toward straightforward MEMECOINs. Do institutions really favor utility tokens because of strong project fundamentals? Not necessarily.

Institutions certainly recognize the value of MEMECOINs—but investing in them is hard to justify to LPs. Can you really say, “I invested in a meme/a cat”?

LPs likely prefer institutions invest in more “serious” assets, so fundamentals become packaging for serious investing.

So perhaps no one is truly doing pure fundamental investing—retail is just more direct, institutions more indirect.

Therefore, pumping MEMEs and building infrastructure aren’t mutually exclusive. The smart play is to embrace both.

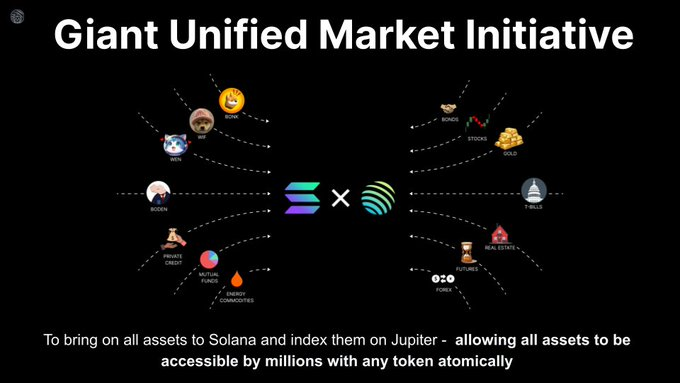

Take Jupiter, which started as a MEME playground, now aiming to create a unified marketplace—forming the GUM Alliance with multiple projects and institutions. Whether it’s MEMECOINs, RWAs, stocks, or forex, they embrace all—true omnivores.

With both MEMEs and “fundamental” assets, Jupiter’s inclusiveness reflects a business logic that doesn’t rely solely on fundamentals.

Viewpoint

By this bull market cycle, the landscape is no longer simplistic. All participants have evolved, making basic fundamental investing increasingly ineffective.

Historical lessons show that some fundamentally sound investments haven’t even kept up with inflation, let alone those strong-fundamental projects heading straight to zero. Investment logic is shifting, and fundamental investing is no longer the default correct choice.

Of course, if time horizon is stretched infinitely, value investing might tell a different story.

But retail can’t afford to wait.

In the fast-moving crypto world where information cycles rapidly, new hot topics emerge constantly—the most valuable resource is attention. As market drivers evolve, a project’s ability to capture attention often dominates token pricing. Attention economics is rising in importance, and the window for gradual value discovery is shrinking.

Famous blogger @redphonecrypto also noted in his latest article: A token’s ability to attract attention matters more than any other metric—the stronger the attention-grabbing power, the greater its upside potential.

“Pumpmental > Fundamental” has become a shared consensus. For retail investors putting real money on the line, a pump *is* the best fundamental.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News