ETH ETF Narrative Trading Guide: Seizing the Golden Opportunity in the ETH Ecosystem and RWA Sector

TechFlow Selected TechFlow Selected

ETH ETF Narrative Trading Guide: Seizing the Golden Opportunity in the ETH Ecosystem and RWA Sector

SOL has already peaked during this period, making a long ETH / short SOL beta very attractive.

Author: 0XKYLE

Translation: TechFlow

Introduction

In this article, the author analyzes the launch of Ethereum ETFs and their potential impact on the market, proposing specific trading strategies. Although market conditions have evolved since writing began, the author believes profitable opportunities still exist. This piece not only examines Ethereum and its related assets but also explores opportunities in the RWA (real-world assets) sector under new regulatory developments.

Main Content

I started writing this article on May 24, 2024, when ETH was priced at $3,632.22 and ONDO at $1.08. While prices of certain assets have shifted during the writing process, I believe that despite a reduced risk/reward ratio, significant upside potential remains.

Dear crypto enthusiasts, congratulations. In a move that surprised everyone, the U.S. Securities and Exchange Commission (SEC) approved rule changes allowing the creation of Ether ETFs, even though Gary Gensler has publicly maintained a tough stance on ETH.

I won’t delve into the reasons behind this decision—that’s for political commentators on Twitter to debate. What matters is that this decision has happened and marks a major shift in the U.S. government’s attitude toward cryptocurrency.

This is further supported by the approval of FIT21 (“FIT21 provides the regulatory clarity and strong consumer protections needed for the digital asset ecosystem to thrive in the United States”)—ushering in a new era of regulatory compliance for businesses.

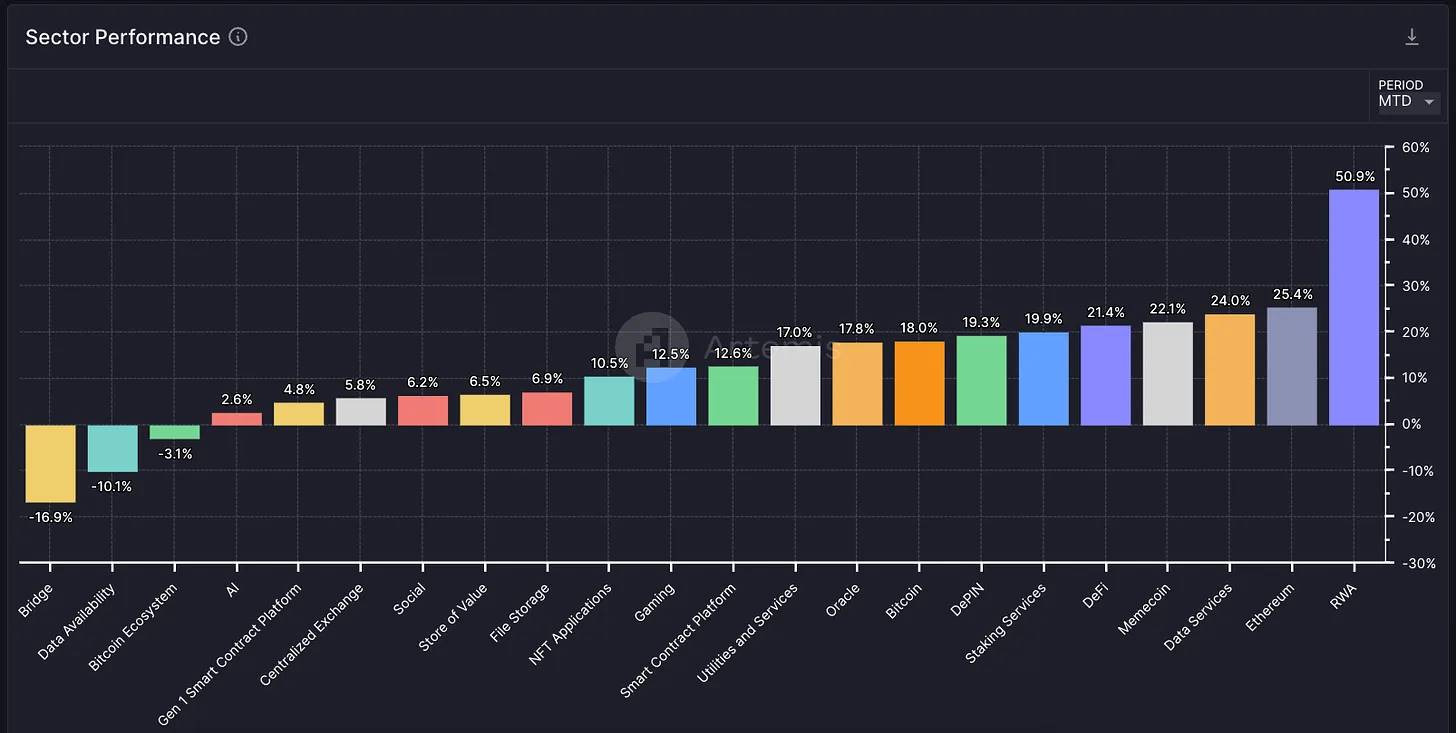

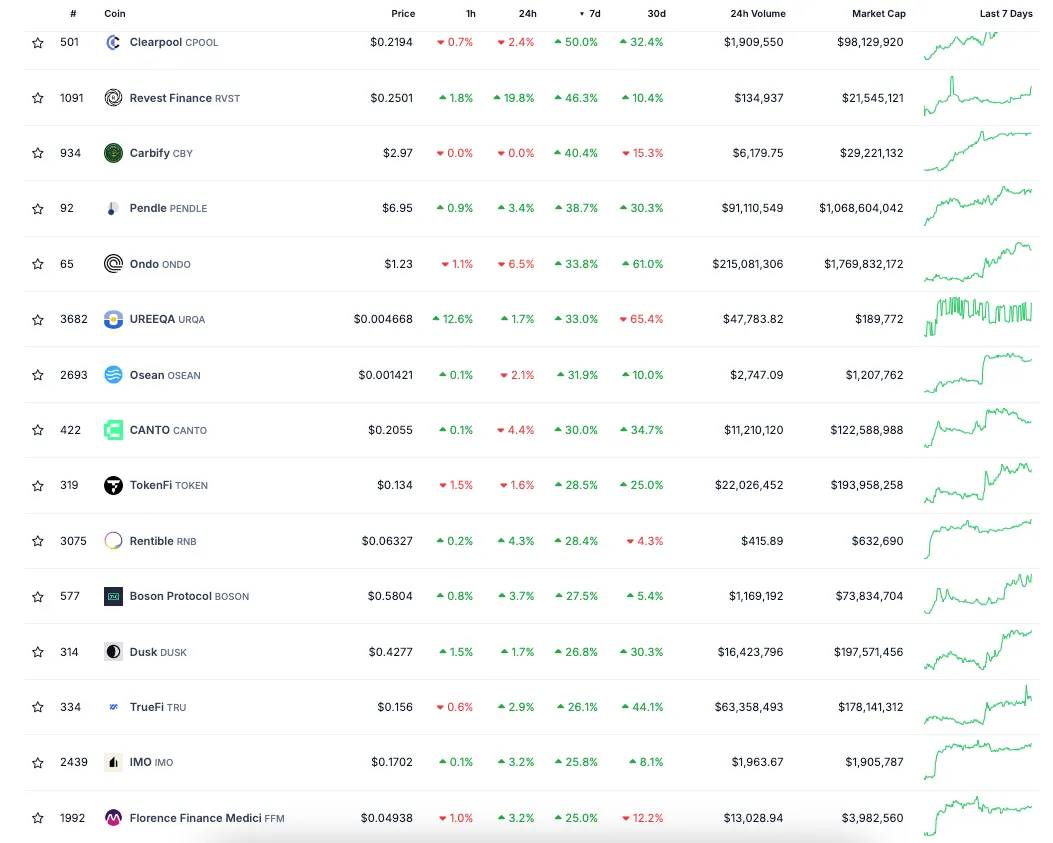

The U.S. government's new dovish stance on crypto is very bullish, and you can see how the market is digesting this news—RWA and Ethereum sectors are among the top performers month-to-date (MTD).

I believe that with the ETH ETF and recent pro-crypto regulatory signals, these two sectors are well-positioned to outperform the broader market over the coming weeks and months.

Sector performance MTD, from Artemis.xyz

Overview

This argument can be broken into two parts. First, the strong performance of Ethereum as an asset class and its associated alternatives, followed by the strong performance of the RWA sector as a beta play on the overall “bullish government stance on crypto.”

These two sectors are closely linked because:

-

With the SEC approving ETH ETFs, signaling a more dovish approach to crypto, institutional capital flows into RWA assets are likely to increase (as we’ve already seen with ONDO’s relationship with BlackRock).

-

Major institutions have long argued that Ethereum’s value lies in tokenization, stablecoins, and real-world settlement—they frequently discuss RWAs on Ethereum, which has been ETH’s core narrative all along.

Therefore:

-

Go long ETH and its best beta proxies

-

Go long RWA—ONDO is my favorite

You could consider going long other RWA assets, but I avoid doing so because ONDO itself is already an ETH altcoin; moving further down the risk curve simply exposes you more to downside market volatility.

In-depth Analysis of the ETH ETF

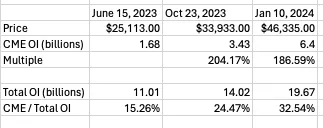

Now let’s break down the ETH ETF trade. I find this particularly interesting because unlike the BTC ETF, where we had ample time to “prepare,” the ETH ETF caught many market participants off guard. That’s why we saw a 25% surge in ETH price on the day expectations for ETH ETF approval dramatically shifted overnight.

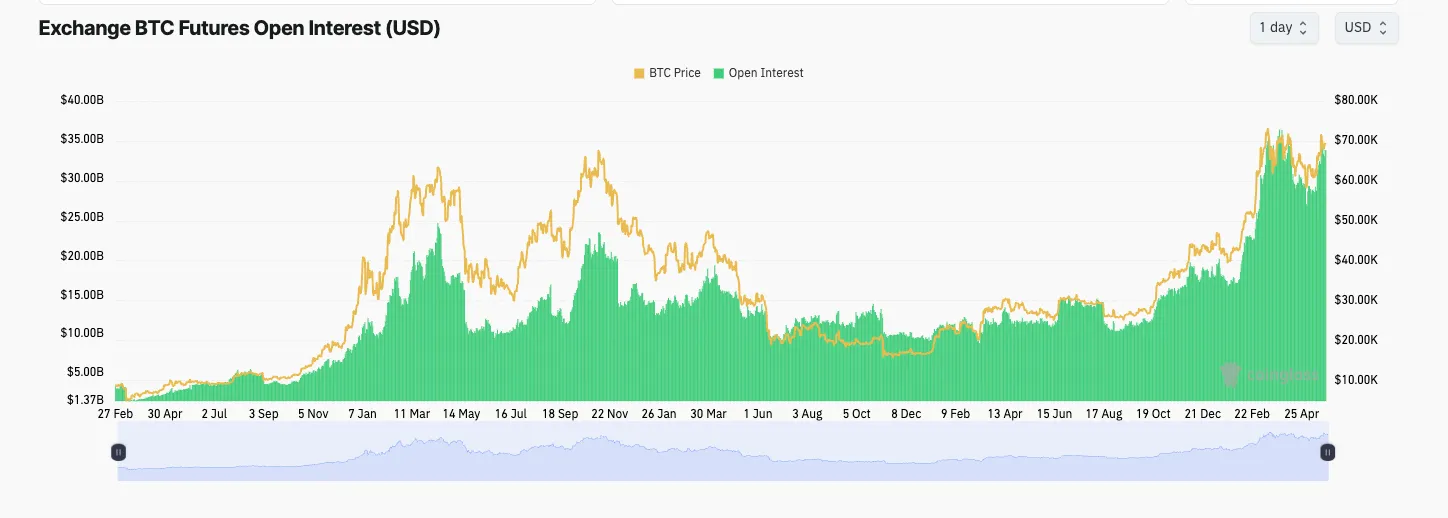

The problem is, markets rarely allow you to make the same trade twice—the thesis here hinges on the idea that “ETH ETF isn’t yet priced in.” To assess this, we first need to examine how the BTC ETF performed:

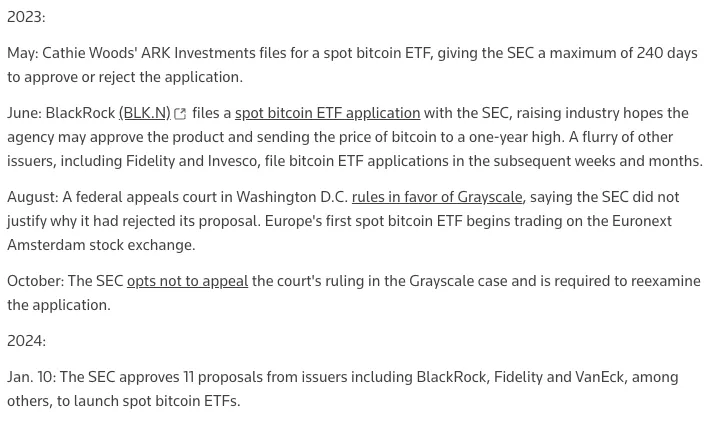

Key Dates for BTC ETF

-

June 15, 2023: A pivotal week for BTC, when BlackRock revealed its hand by filing for a spot Bitcoin ETF

-

October 23, 2023: Perhaps what truly solidified BTC ETF possibility was the SEC not appealing Grayscale’s court ruling, signaling serious consideration—market took it as confirmation

-

January 10, 2024: Spot Bitcoin ETF officially launched

Key Observations

-

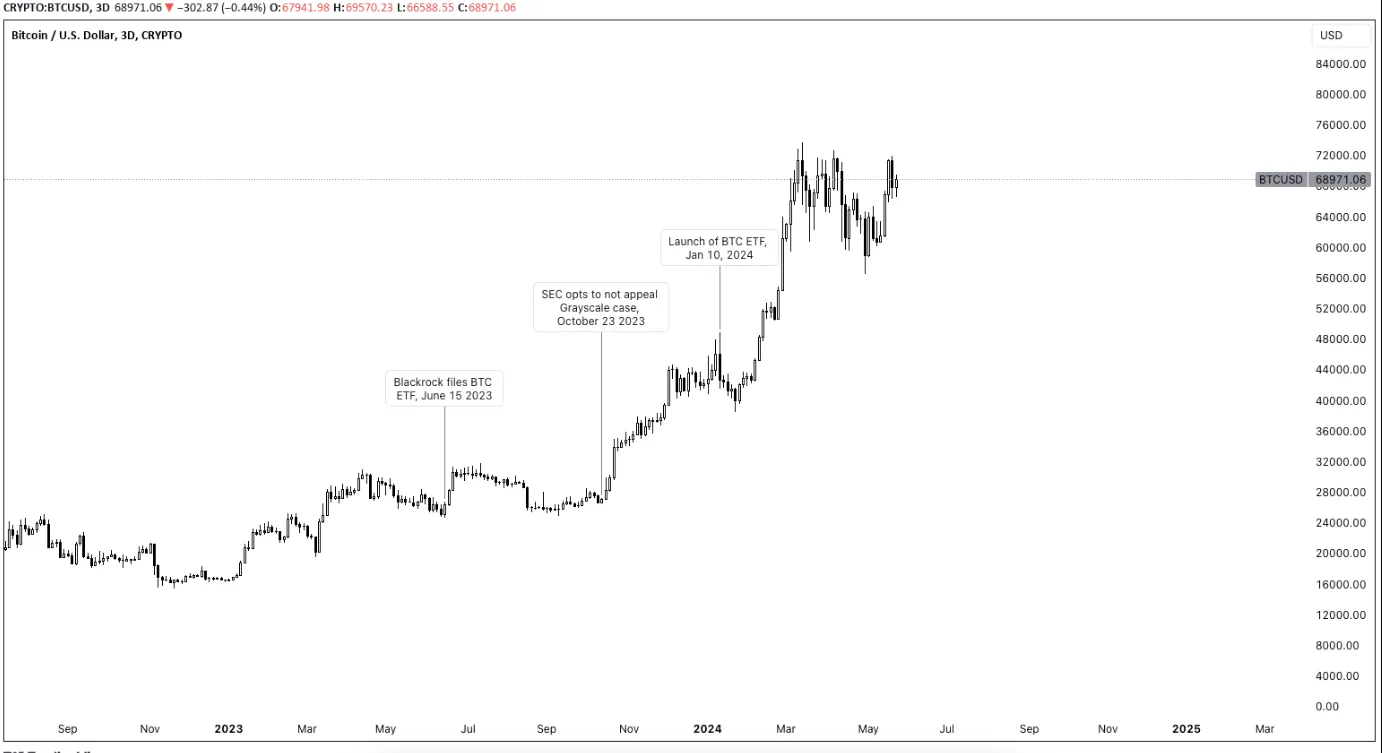

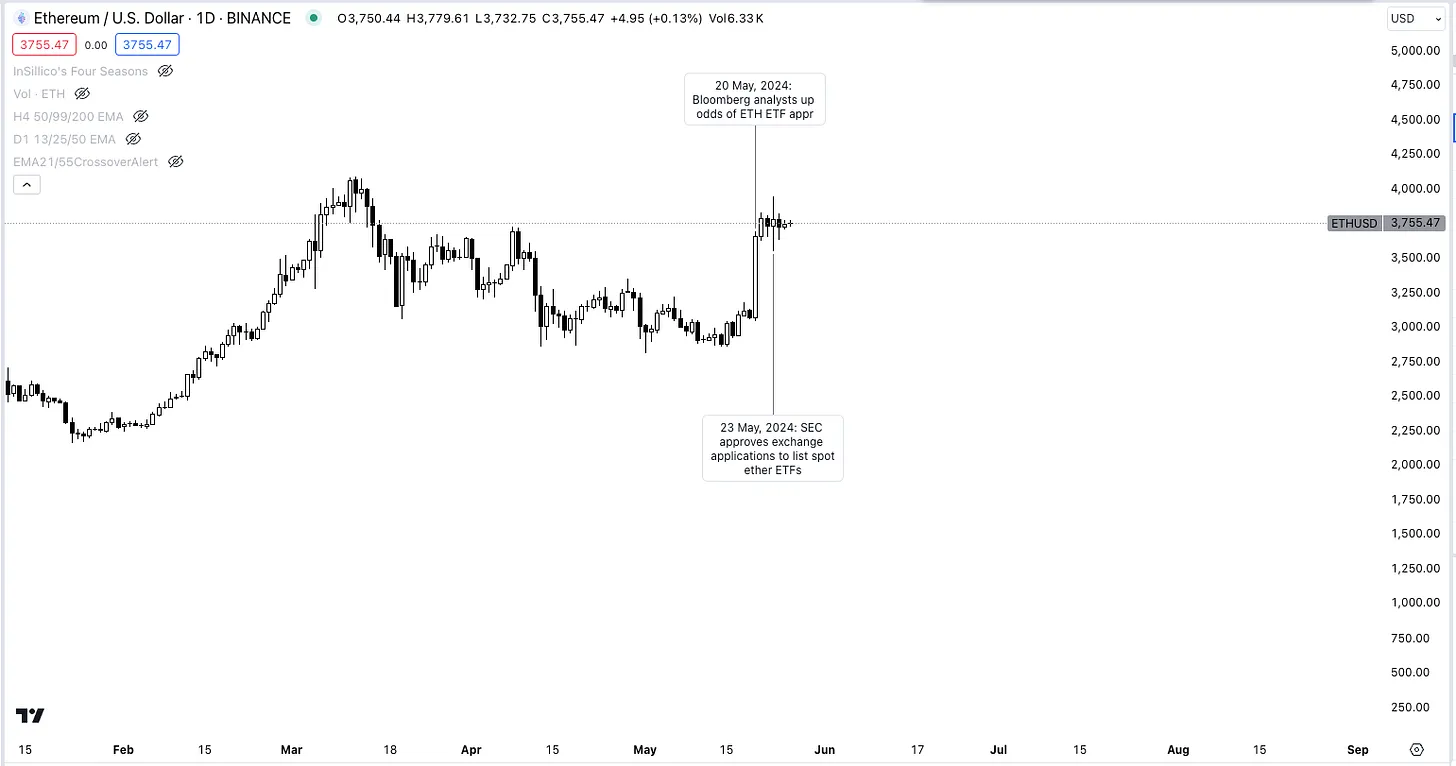

The announcement of the BlackRock ETF effectively ended the discount trading

-

The discount fully closed only upon ETF launch (this seems obvious, but think deeper—it’s like “free money”; once we’ve “proven” the ETF will launch, the discount could close even before launch)

-

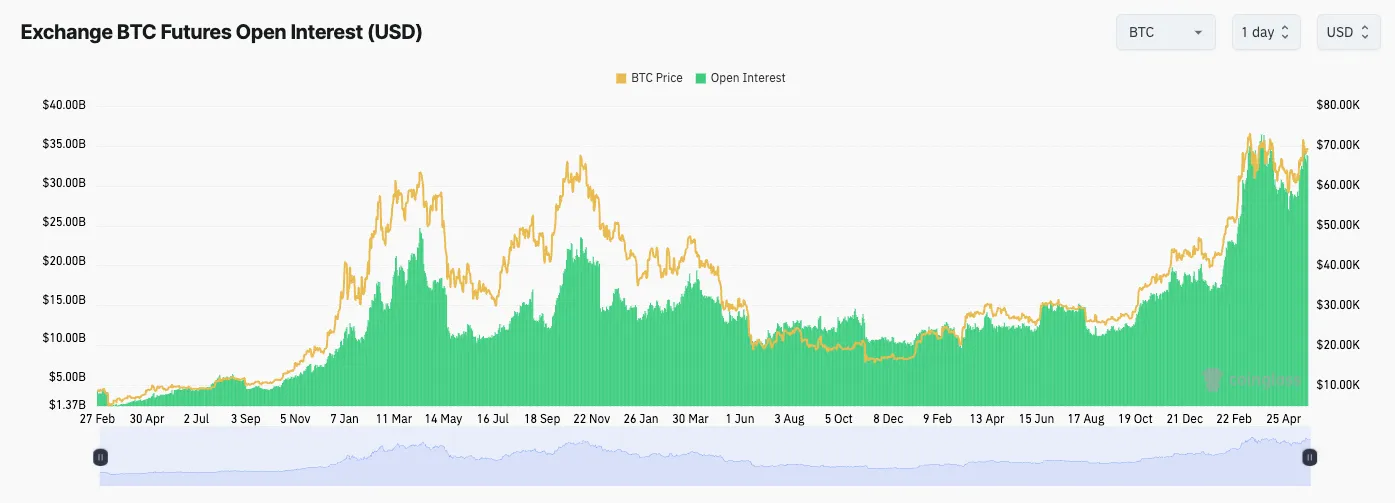

After June 15, open interest (OI) surged, dipped slightly in August, rose again in October, and peaked in February

-

I focus on CME OI as it’s the best indicator of institutional positioning

Key Dates for ETH ETF

-

May 20, 2024: Bloomberg analysts raised the odds of ETH ETF approval from 25% → 75%

-

May 23, 2024: SEC approved exchange applications to list spot Ether ETFs

Notable Observations:

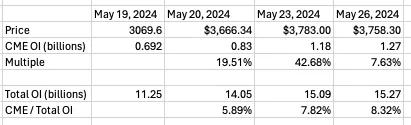

-

Grayscale Ethereum Trust (ETHE) discount narrowed from -24% to -1.28% within two days, whereas GBTC took months to close its discount

-

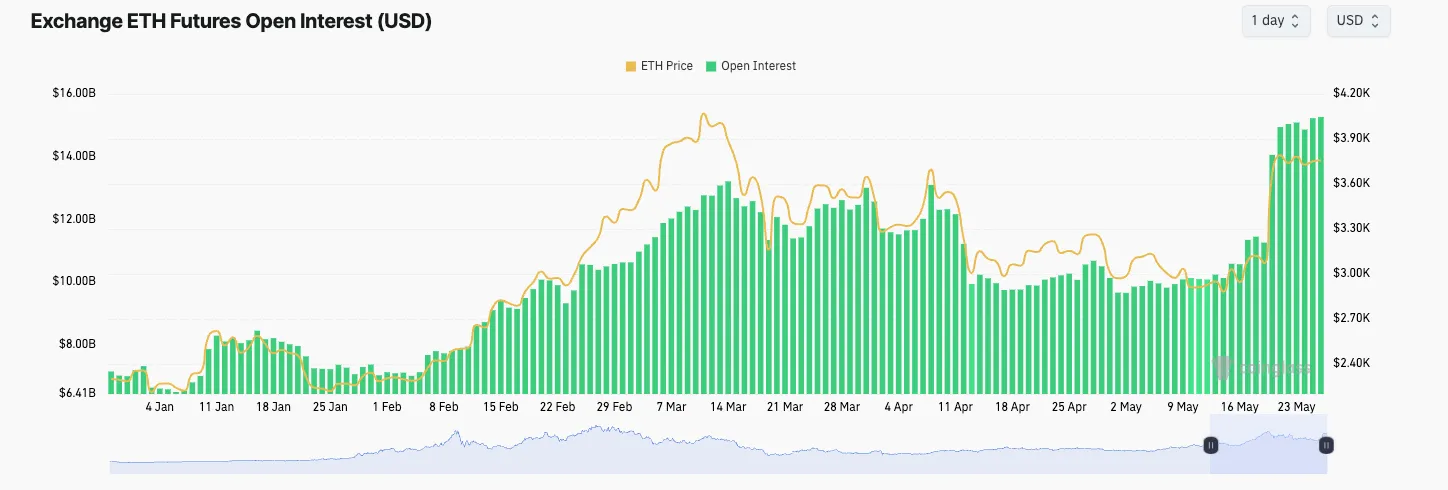

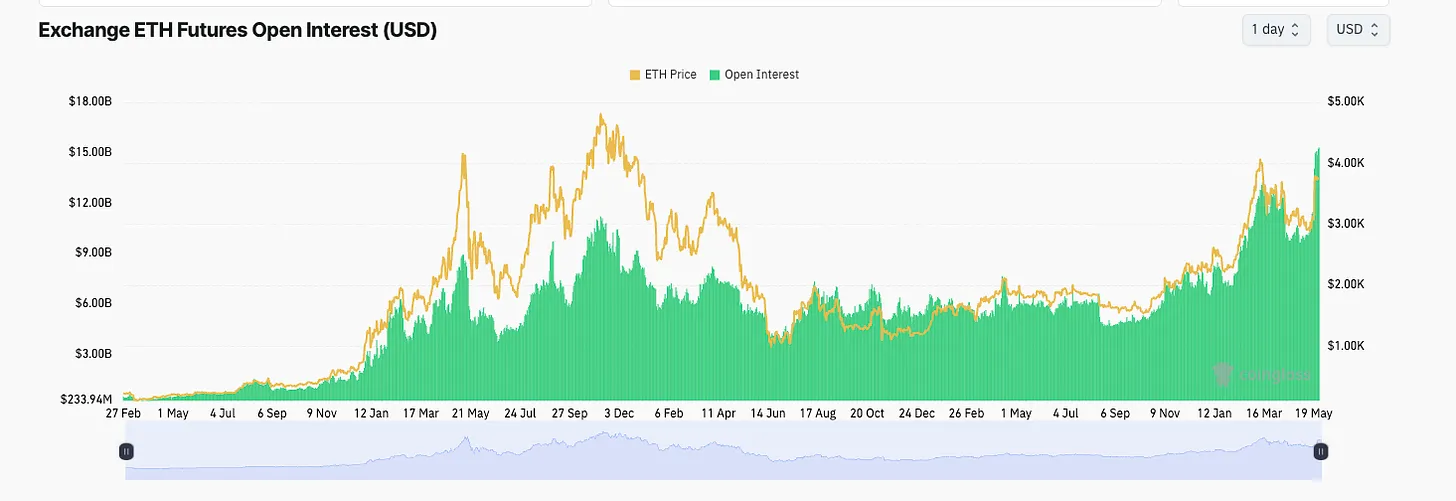

CME OI growth is less robust compared to BTC ETF buildup

-

Much of ETH’s price movement occurred when market expectations for ETF approval increased, rather than during the actual approval event. This means the market front-ran the news, reflecting changing ETF expectations. In contrast, each BTC ETF announcement triggered sharp price increases—a clear sign the market doesn’t react the same way twice to identical setups.

Thesis and Risks

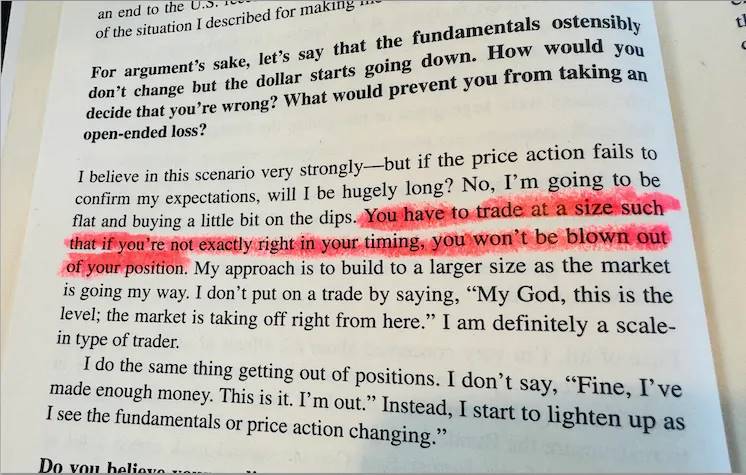

I’ll begin with the risks, because I believe assessing downside risk is more important than upside—manage your downside well, and the upside will take care of itself.

Risks:

Main Risk: Market may have topped / ETH near peak / time-based capitulation

The argument here centers on how quickly the ETHE discount closed and ETH’s price action around the announcement. It suggests traders were already positioned—essentially a one-way bet—but CME OI and total OI remain largely flat.

If ETH OI on January 10 was only $4 billion below BTC OI, it might signal “all bulls are already in—so who’s left to buy?”

Honestly, I find this argument quite compelling. I believe the market is front-running this trade—even though the ETF has just been approved, OI expansion has already surpassed historical highs, unlike the BTC trade, where such high OI wasn’t seen until after the ETF launch.

The market equated “ETF approval” with “ETF launch,” which are two entirely different things. Given the price reaction at approval and the speed of discount closure, this view holds water.

ETH OI surge

BTC OI surge

I actually agree with this view, which is why I stated at the beginning of the article “these two sectors are poised to continue outperforming over the coming weeks and months.”

I believe there could be a price pullback when market participants realize the impact of the Ethereum ETF won’t be immediate (i.e., “time-based capitulation”). That would be an ideal entry point. I’ve already placed buy orders at different price levels and plan to fill them gradually and prudently. Here’s a snapshot illustrating my trading approach:

Unique Regulatory Risks

Since I don’t fully understand how registration risks work, I hesitate to comment deeply. However, from what I’ve seen on TWITTER (DOT) COM, people are questioning why only 19b-4 filings were approved while S-1 registrations were not.

Essentially, this means "the decision can still be challenged within the next 10 days." I’m not sure if this is accurate, but if true, and if the entire event turns out to be a farce, it would pose substantial risk to the trade.

Potentially, there are other “hidden between the lines” risks associated with this approval—definitely something to keep in mind.

I like this trade. What should I go long on?

I know this article is getting long, but we’re now getting to the good part. The story so far: ETH looks good, but perhaps the market has front-run it too aggressively. Still, long-term catalysts remain bullish. So what should you buy?

When selecting ETH beta plays, many investors face analysis paralysis—you have liquid staking derivatives (LSDs), L2s, ZK-Rollups, DeFi protocols, Memes, and more to choose from.

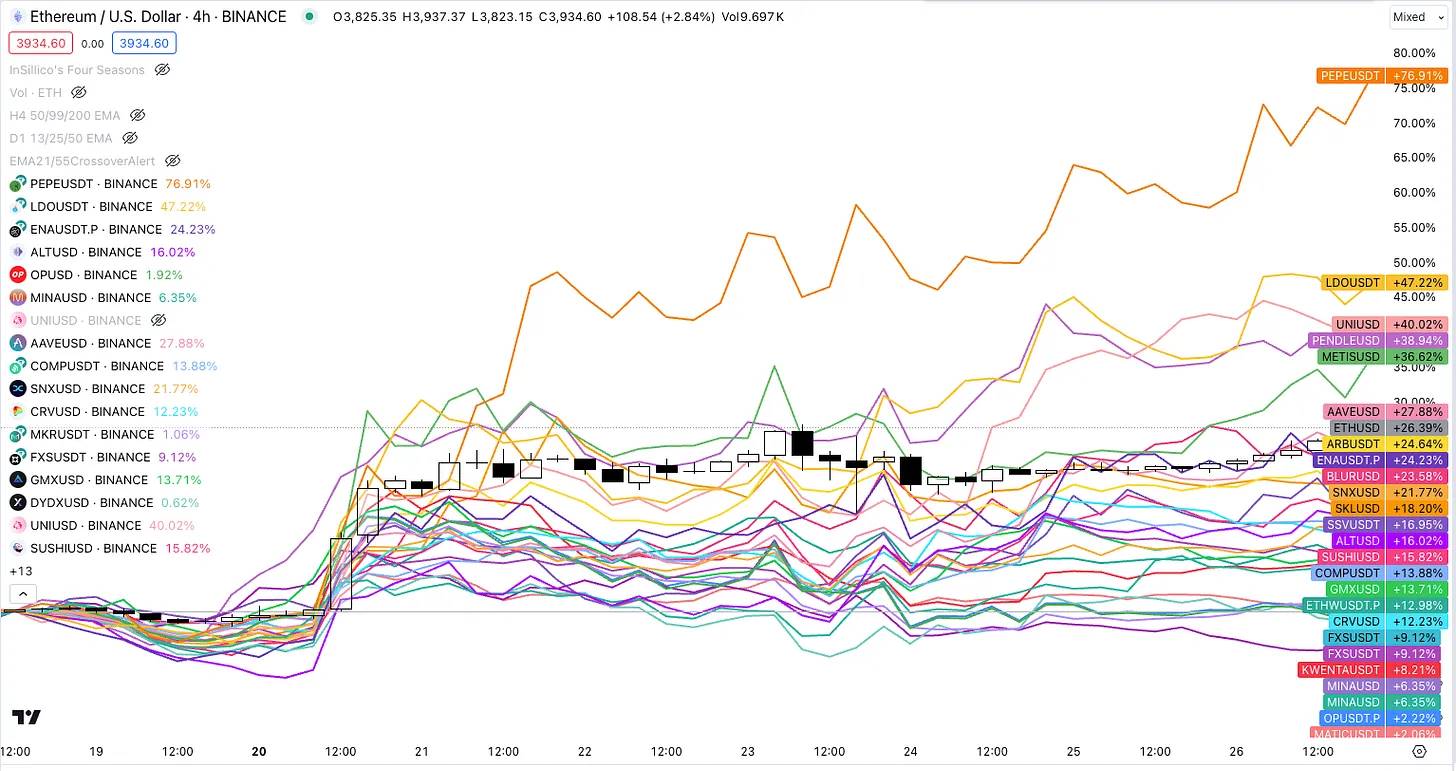

By analyzing the performance of all these tokens over a 1-week period (May 18–26), the top performers (ranked highest to lowest) are:

PEPE, LDO, UNI, PENDLE, METIS, AAVE

This is a rough method for measuring performance—more scientific approaches involve calculating actual beta over more “appropriate” lookback periods, but this works for me.

Personally, I am going long PEPE and PENDLE among all options because they’ve been market favorites throughout the year. These tokens haven’t just performed well in isolation—they’re among the best-performing assets year-to-date.

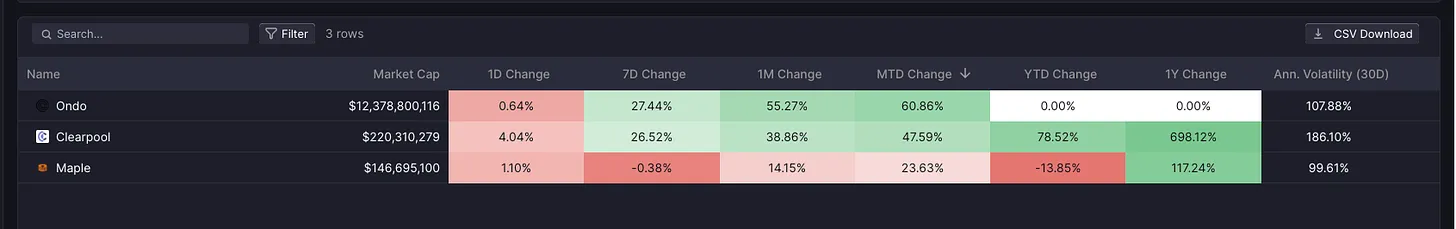

Top 100 tokens with best YTD performance

Thus, I believe PEPE + PENDLE offer the greatest upside. They also benefit from high visibility and strong market sentiment—I won’t underestimate the power of the PEPENDLE combo.

Timing the RWA Trade

I spent too much time discussing the ETH ETF trade and now lack energy to elaborate fully on the RWA trade. The thesis is simple: RWAs have consistently been promoted by institutions entering crypto, and ETH has remained the dominant chain—ONDO collaborates with BlackRock on Ethereum.

Therefore, this is a beta play on the overarching ETH narrative. For asset selection, my primary pick is ONDO. Some people I know are promoting CANTO/DUSK. Personally, I keep it simple—1 ONDO = 1 CONDO.

Other Considerations

As a side note, I think a solid hedging trade is the ETH/SOL pair. Overall, I sense SOL may have topped out during this period, making a long ETH / short SOL beta trade highly attractive.

Conclusion

Whew! If you made it this far, you deserve a cookie! Hope you enjoyed this trading idea. I’m getting back into rhythm, so I hope to keep delivering fresh trading ideas! Also, for my American readers, have a wonderful Memorial Day. I’m in New York City, so feel free to reach out if you’d like to grab coffee.

Also, here’s a screenshot I wanted to include just to illustrate how people might be overestimating the entire “spot ETF approval” event and positioning too early.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News