Market flash crash, but legendary bear GCR encourages everyone to "not surrender"

TechFlow Selected TechFlow Selected

Market flash crash, but legendary bear GCR encourages everyone to "not surrender"

Others' profits distract the mind; only realizing gains is real.

Written by: TechFlow

Before the halving, the market experienced an unexpected sharp downturn.

Bitcoin once dropped to the $60,000 level, while altcoins suffered even more severely. Many people again remarked that a single day in crypto feels like a year in the real world, and short-term feelings of frustration and disappointment began to spread.

Long traders and spot investors alike incurred both actual and notional losses. Logically, this should have been a moment of quiet celebration for bears.

Yet GCR, the legendary "big short" trader in the crypto space, posted on social media with encouraging words to comfort every wounded retail investor:

"If you've been sidelined, this is a great opportunity to add exposure to tokens you truly believe in; if you're already fully invested, then hold strong—stick to your spot positions and don't surrender. As someone once said, liquidations forcibly transfer wealth from leveraged traders to wealthy spot buyers."

GCR frankly admitted he had long retired from social media, but chose to post because he didn’t want his fellow community members to get wiped out when the future still looked so bright—a true sign of solidarity with retail investors.

Clearly, retail investors reeling from the crash widely found renewed faith and emotional support in his message. The post has garnered over 40,000 likes on Twitter and spread widely.

At the same time, many newly entered retail investors were puzzled by the post's popularity, and questions like "Who is GCR?" began to multiply.

Crypto consensus is fascinating—not every motivational quote resonates. Retail investors trust the words of legendary figures who have demonstrated sharp market insight and made substantial profits.

If you’re also new to GCR, here’s a quick introduction.

The Big Short Who Defied the Crowd, Achieved Fame in One Move

GCR is one of the most famous traders in cryptocurrency. Known by his handle “Gigantic-Cassocked-Rebirth” on the now-defunct exchange FTX, he gained wide recognition on Crypto Twitter for his verified top-tier trading performance, numerous accurate predictions, and clever writing.

From 2021 to 2022, he frequently ranked among FTX’s top traders, outperforming many others and becoming one of the exchange’s highest overall profit-makers.

Despite remaining anonymous, he claims to have built his wealth almost entirely from scratch through trading alone.

Looking back at GCR’s journey over the past three years reveals insights far beyond the average market participant.

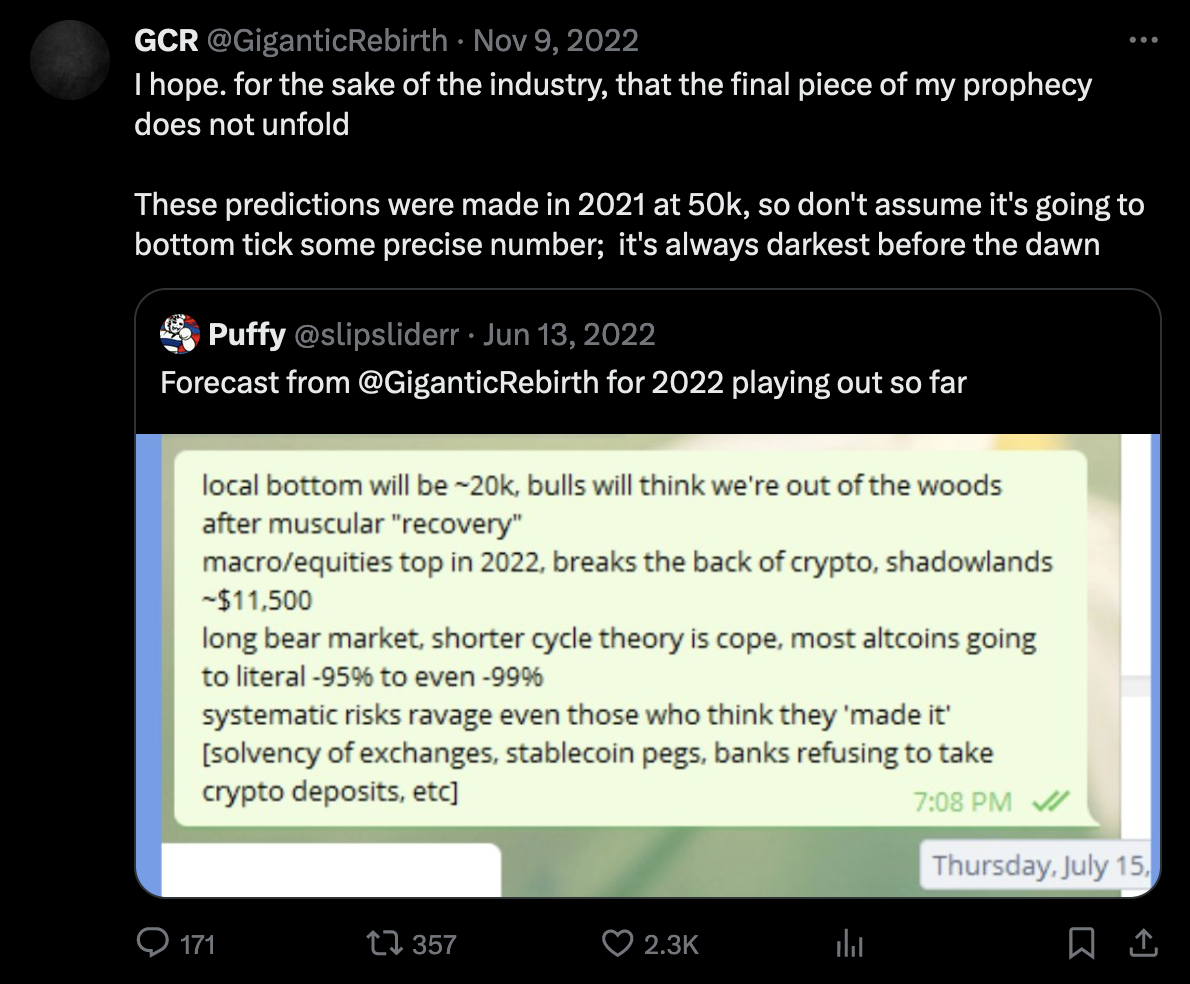

In the second half of 2021, GCR foresaw the bear market and began trading against the trend, taking firm short positions on altcoins while the broader market remained optimistic.

In July, GCR predicted in a Telegram group:

"A local bottom will be around 20k... macro/stock markets will peak in 2022, and most altcoins will drop -95% or -99%."

During the 2021 crypto frenzy, when zoo tokens flew wildly and meme coins ran rampant, GCR’s stance wasn’t complicated—he simply opposed the prevailing market narrative.

What truly catapulted GCR to fame was his successful short bet against LUNA.

On March 14, 2022, GCR publicly wagered $10 million against Do Kwon, the founder of Luna (who hadn’t yet been arrested), betting that Luna’s price would fall below its current level within a year—and backed it up with actual short positions.

Do Kwon actually took the bet, and the stakes were held in escrow by another prominent figure, Cobie.

As we all know, UST depegged, LUNA spiraled into oblivion, and the so-called stablecoin crashed into the abyss. Two months later, GCR revealed his position had already generated $2.3 million in profits.

Getting one call right might be luck, but consecutive successes reveal deep underlying logic.

By late 2022, GCR issued a warning: "As the 2022 bear market unfolds, hacks and scams from bad actors and project teams will increase..."—and thus he intended to firmly short certain tokens during the bear market.

Later that November, the FTX collapse shocked both crypto and traditional circles, plunging the industry into a deep bear market; SBF and associates indeed turned out to be fraudulent.

His prediction came true—the legend of the big short was born.

GCR’s Ten Core Crypto Investment Principles

After FTX collapsed, GCR—perhaps having already secured financial freedom—permanently stopped posting on his @GiganticRebirth account.

His alternate account @GCRClassic provides fewer personal trade updates, focusing instead on sharing trading methodologies and insights.

This is why, when GCR recently encouraged the community not to give up amid the market crash, his words carried such weight and emotional resonance.

After all, when a seasoned trader who’s weathered massive storms tells you not to quit, perhaps the bear market isn’t even here yet.

Meanwhile, Twitter user @0x_Lens compiled ten core investment principles and insights from GCR over the years. We’ve translated and shared them below.

-

Holder or Trader?

I continue holding large spot positions in BTC and ETH because I believe we bottomed in November and remain bullish on the future. My goal is to reach 10,000 ETH by 2030.

For 90% of people, being a holder is better.

Note: This advice applies only to degens chasing altcoin narrative rotations.

-

The biggest bullish factor for Memes is “Never Delivering”

Ironically, the most bullish path for $DOGE is if Twitter never actually integrates it into anything. It becomes Musk’s tool for teasing, hinting, mocking, cryptic messaging—just saying there’s always been a master plan, letting imaginations run wild. We call it Hoskinson: never deliver.

-

Crypto News: Truth Matters Less Than Impact Duration

When news moves prices, market participants often focus on whether it’s true.

Often, the truth behind the headline doesn’t matter.

What matters more is how the market reacts and how long the impact lasts.

-

Early Fast, Late Slow

General trading principle during meme coin rallies:

During altcoin cycles, increase risk exposure early when trends first reverse, then gradually protect capital over time.

People fail because they do the exact opposite—going slow early, then getting greedier and doubling down as time passes.

-

Bet on Ponzi Schemes When Macro Is Favorable

For ordinary people, flying to Macau or Las Vegas to gamble is too expensive.

When money flows easily and the macro environment favors risk, decentralized casinos and/or decentralized Ponzi schemes are always the fastest horses.

-

The Logic Behind Chasing New Coins Over Old

New coins: full of hope, few holders, teams not yet rich—of course, they have strong incentives to hype.

-

Think About Profits

Try imagining Ponzi schemes as professional boxers fighting for prize money, not tokens. In boxing, the winner takes the prize; the loser gets nothing.

Yet people often make the opposite decision: selling winning investments ("cutting winners") and adding to losing ones ("adding to losers"), rather than seeking professional help to deal with emotional distress caused by financial loss.

-

Others’ Gains Distract You—Realizing Profits Is What Counts

Earlier I shared some advice, and some people made big gains because of it—you then hear about others profiting.

But wealth only counts when it’s realized.

When trading volume exceeds market cap, it often signals the final stage of a price surge.

-

Poor Token Design and Strong Market Performance Aren’t Contradictory

Some of the best-performing tokens will come from the worst tokenomics and the most predatory teams.

Many teams that launched during the depths of the bear market have been anxiously waiting for favorable conditions to execute their schemes and manipulate the market.

-

Lower Price Per Unit, More Aggressive Trading

No matter how many times people see it, they still underestimate the gravitational pull of the "low unit bias" on retail investors.

(Note: Low unit bias refers to the tendency for people to perceive lower-priced stocks or currencies as more valuable because they can buy more "units," despite identical intrinsic value.)

It's one of the most attractive forces in the crypto world.

Think about it—why would a rational person buy 100 higher-priced coins when they could own 1 million of a cheaper one?

Finally, revisiting the past helps us move forward. While the success of top traders may be unreplicable, their insights can guide us to navigate the crypto world more cautiously.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News