In the cryptocurrency circle, less frequent trading leads to a higher win rate.

TechFlow Selected TechFlow Selected

In the cryptocurrency circle, less frequent trading leads to a higher win rate.

Patience is an advantage because very few people truly possess it.

Author: 0XKYLE

Translation: TechFlow

One of my core goals for 2024 is to shift my trading frequency from hours to days.

I believe there are several fundamental principles in financial markets: I believe simplicity is good, investors should focus on their own domain, and over-trading is detrimental to performance.

Many familiar with my writing know I follow a very "high-conviction betting" style. I like placing asymmetric bets—and I prefer large positions. The issue with such trades is they tend to be capital-intensive and often involve extremely long lock-up periods before yielding results.

Now, this isn't inherently problematic. This is what I consider the essence of investing: you wouldn’t criticize venture capital firms for having long investment cycles. You wouldn’t say “this money could’ve been used elsewhere,” because that would conflate different trading styles with profit maximization.

The real problem arises when your portfolio is small, and capital efficiency becomes critical—you simply can’t operate at the same scale as a VC fund, nor do you share the same objectives.

Turning $10K into $1M is fundamentally different from turning $1M into $100M. Numerous articles discuss how risk appetite should vary based on net worth. For example, if your capital is below five figures, you should focus on airdrops and Memes. If you're at A5–A6 level, look for mid-cap cryptocurrencies. With assets above A6, you can target high-market-cap coins.

Of course, these are purely hypothetical suggestions. But you get the point—when starting small, the general consensus is to maximize your risk exposure and chase high-risk, high-reward opportunities like a degen.

So what should I do?

I won’t claim what’s right or wrong, because as I’ve learned: the world of investing is full of nuance. One cannot step into the same river twice, for it is not the same river, and he is not the same man. Likewise, trades don’t stay the same—they’re different at different points in time.

Returning to my core trading principle: I believe simple is better, investors should stick to their circle of competence, and frequent trading harms performance.

This means I believe in trading within your edge. If your edge is high-frequency trading, then focus on that and don’t worry about anything else.

I think 99% of crypto Twitter content overcomplicates this. High-frequency trading doesn’t require fancy strategies or complex derivatives. I believe the solution is far simpler: just wait patiently.

So what if the opportunity cost of other trades is higher? If your edge gives you a higher win rate and greater profits over longer timeframes, why would you do anything else?

If you’re not a singer, why bother mastering singing? Did Buffett try to become an algorithmic trading expert? Did the cheetah try to become a better swimmer? No!

If your edge is high-frequency trading, stick with it! That’s also why I argue most people shouldn’t become day traders. They should have a solid income job and treat financial markets as a hobby.

The next question: what if I’m not good at high-frequency trading? My answer is simple: the nature of markets is structurally bullish over time.

For 20 years, “Dollar-Cost Averaging into the S&P 500” has been promoted as an investment strategy—and it works! The key takeaway is that the idea “markets are long-term bullish” is a fact.

If you go long Bitcoin frequently on hourly charts, your win rate might only be 50%. But going long on a monthly timeframe, your win rate should rise to around 70%. Naturally, the longer your holding period, the higher your win rate becomes.

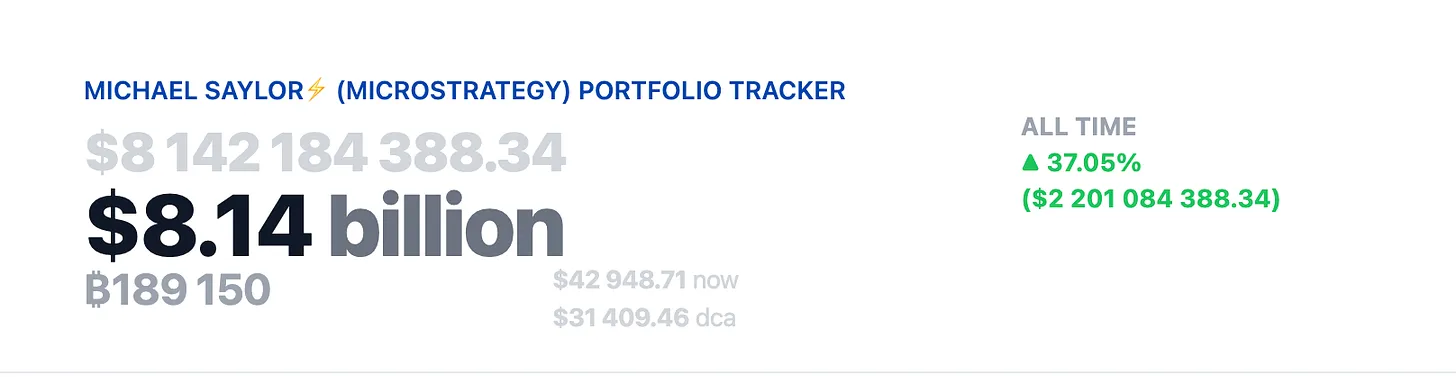

Michael Saylor is a perfect example. He bought Bitcoin at $69k and also at $30k. Every time he bought, people laughed. But at current prices, his unrealized gains exceed $2 billion.

Final Thoughts

Even with just A5-level capital, I still believe you can be a long-term trader—it just takes more time. I know this because that’s exactly what I do, and will continue doing. Sure, maybe my time horizon isn’t decades—it’s more like days to months. But even so, I’ve found I make more profit.

-

Overworld was a 3-week play that returned 3x

-

Node Monkes was a month-long play, currently breakeven

-

TAO was a coin I held for months, returning 2x

What I’ve truly realized is that patience is an edge—because very few people actually possess it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News