US Spot ETF Countdown: Five Key Things to Watch for Bitcoin This Week

TechFlow Selected TechFlow Selected

US Spot ETF Countdown: Five Key Things to Watch for Bitcoin This Week

A typical phenomenon during early Bitcoin bull markets: BTC drives the overall market upward, followed by low-market-cap altcoins taking off.

Author: ILLIAM SUBERG

Translation: TechFlow

At the start of 2024, Bitcoin was up 160% compared to its price a year earlier, and one of the biggest news events for Bitcoin in years is set to unfold within days.

BTC prices remained strong at the close of 2023. What happens next? The first half of January will be unprecedented in Bitcoin's history—the deadline for approving the U.S.'s first spot Bitcoin exchange-traded fund (ETF). Opinions vary on how the market will react to this decision.

Some believe that a Bitcoin ETF will open the floodgates for institutional investment, fundamentally transforming Bitcoin. Others see the ETF launch as a mixed blessing, with an immediate reaction likely being a sharp pullback in Bitcoin’s price.

2024 is shaping up to be significant—just four months away from Bitcoin’s next block halving, on-chain data shows miners are preparing. Mining difficulty rose 1.5% this week, reaching a new all-time high.

Yet all of this could easily change amid escalating ETF tensions—after all, rejection is not impossible, though it seems everyone has forgotten this possibility.

Will BTC surge after a spot Bitcoin ETF approval?

As 2024 begins, Bitcoin’s price action hasn’t been as fiery as a New Year celebration—Bitcoin entered the new year within a choppy trading range.

According to previous TradingView data, the start of a new 12-month bullish candle barely registered attention, as markets offered only modest gains toward $43,000. (Note: At the time of translation, the price had already broken above $45,000.)

Volatility can easily shift closing sentiment, but throughout the Christmas period, no major trend continuation emerged.

When analyzing movements in the first weeks of the year, market participants suggest that continued low volatility could lead to a breakout around the ETF decision.

“I think we’ll form a symmetrical triangle over the next few weeks, then break out from there,” trader Crypto Tony wrote as part of his year-end analysis.

Crypto Tony added that altcoins are now drawing more attention than BTC, as the latter’s dominance in the crypto market begins to decline. This is typical during early stages of a Bitcoin bull run: BTC leads the broader market higher, followed by a surge in low-market-cap altcoins.

Last month, Hyland pointed out this phenomenon was unfolding as expected, with dominance falling and closing below key support levels. He considers the collapse in dominance one of the most bullish signals for both the crypto market and Bitcoin.

Hyland added that right at this point, “the real beginning of BTC/USD rising to cycle highs” commences.

The Bitcoin ETF approval window opens this week

This month, there’s only one thing on every cryptocurrency investor’s mind: the U.S. spot Bitcoin ETF approval deadline, set for January 10—a potentially pivotal moment that has been debated for years.

From industry reshuffling to ongoing meetings with U.S. regulators, the prelude to a spot ETF approval feels unprecedented.

Tension surrounding the deadline is high. A common narrative is that once expectations are priced in, it becomes bearish—Bitcoin could drop immediately after an ETF approval.

As reported by Cointelegraph, such scenarios often target around $36,000, while others believe a longer-lasting downtrend could begin this month.

This includes the notorious crypto firm Il Capo, who believes Bitcoin could fall to $12,000.

Meanwhile, trading team Stockmoney Lizards expects volatility in Q1 2024 and a potential pullback to around $30,000. Despite adopting a more bullish BTC price outlook in recent months, they still anticipate reaching new all-time highs by the end of 2025.

"We've also considered macroeconomic factors (recession, inflation). However, this isn't ultimately bad for Bitcoin," they continued. "More people are viewing Bitcoin as (and once widely adopted) digital gold and an inflation hedge—a store of value during economic downturns. Therefore, we believe this bull market won't end soon."

Federal Reserve policy pivot still months away

On the macro front, the first week of the new year has been relatively quiet, as Bitcoin investors focus their attention on the ETF.

Few U.S. data releases are scheduled, and the year’s first milestone—the Federal Reserve interest rate decision—won’t occur until the end of the month.

Inflation is cooling, and market expectations indicate growing preparations for a Fed pivot—beginning the reversal of two years of rate hikes.

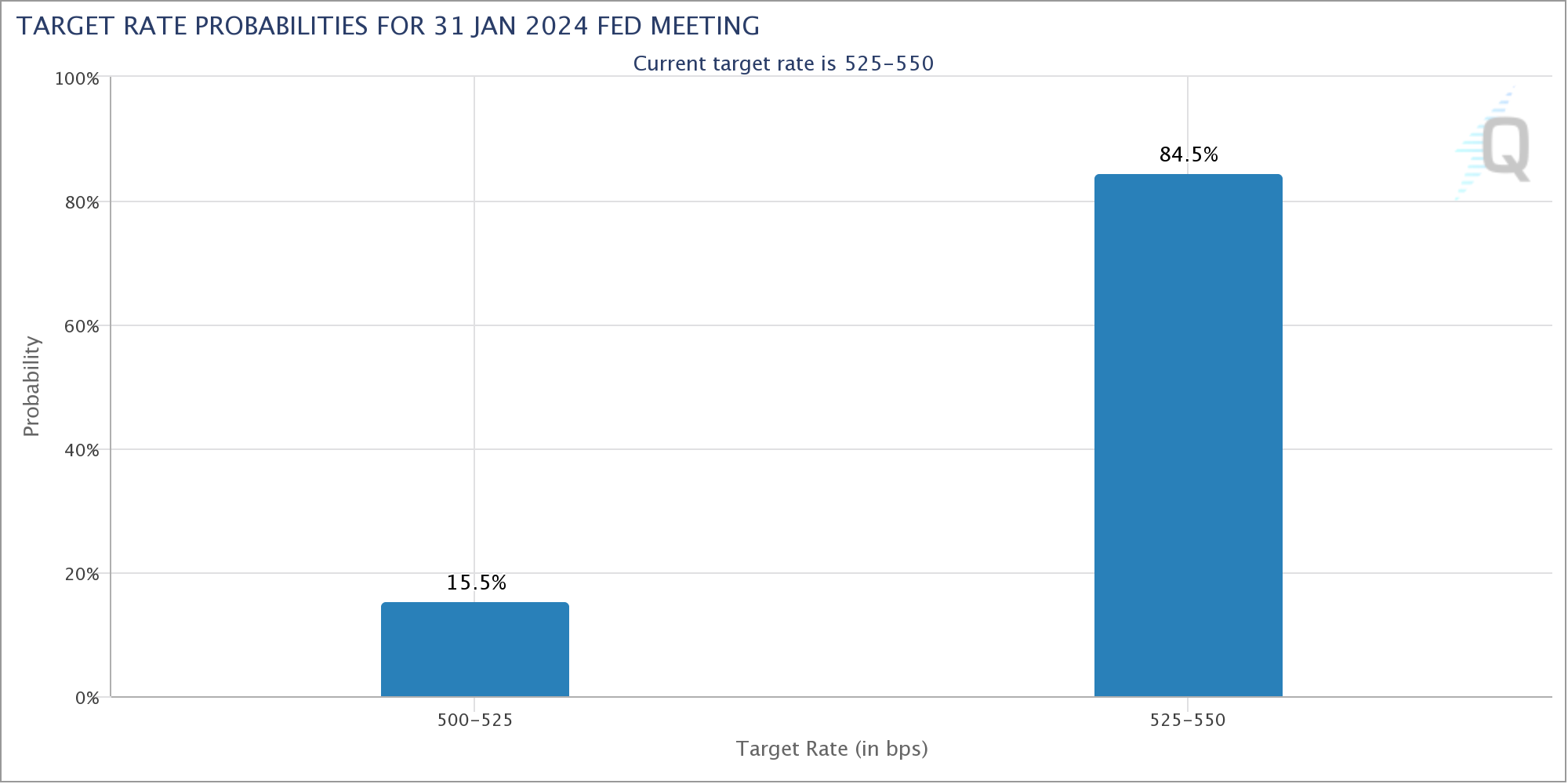

According to CME Group's FedWatch tool, the probability of such a move this month remains low—just slightly above 15%. More likely, markets suggest current rates will hold through March.

Considering how the rest of 2024 might unfold, Jim Bianco, president of institutional research firm Bianco Research, highlights the impact of the U.S. presidential election.

“Since 1994, the Fed has explicitly targeted the federal funds rate,” Bianco emphasized, noting that 1996, 2008, and 2020 were critical years in this period. Over the past 30 years, rate cuts in election years have primarily occurred because the economy worsened, forcing the Fed to act.

“If a true soft landing occurs, will it be enough to justify multiple rate cuts in an election year? Or will the Fed be forced to stand aside?”

Additionally, Bill Ackman, CEO and founder of hedge fund Pershing Square Capital Management, previously predicted rate cuts would begin in Q1.

Bitcoin fundamentals hit all-time highs

As 2024 begins, Bitcoin network fundamentals remain on a consistent upward trajectory compared to the prior year.

The upcoming difficulty adjustment will push competition among miners to unprecedented levels. According to monitoring resource BTC.com, difficulty will rise approximately 1.5%, reaching 73.1 trillion.

December was already a bumper month for miner revenues. Ordinals helped boost fees significantly above multi-year averages, driving daily revenue to a peak of over 1,500 BTC on December 16.

The halving remains top of mind for every miner—come April, block rewards will drop overnight by 50%, to 3.125 BTC per block.

According to on-chain analytics firm Glassnode, miners also took profits before year-end. Since mid-October, balances in miner wallets have declined by approximately 12,000 BTC.

Investor greed behavior

Despite this, overall crypto market sentiment—based on a composite estimate of holder behavior—remains cautious.

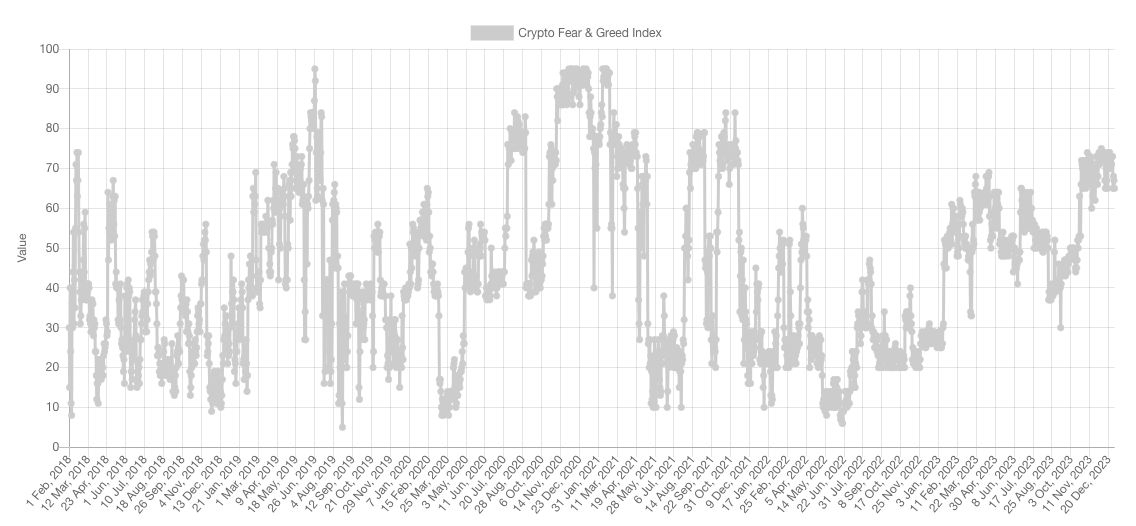

According to the Cryptocurrency Fear & Greed Index, when Bitcoin traded at $43,000, crypto investors were characterized as “greedy.” The Fear & Greed Index currently stands at 65/100. The index has proven highly sensitive to BTC price movements within the current range—even small fluctuations in BTC/USD could trigger a major shift in sentiment, rapidly turning “extremely greedy,” suggesting the rally may not last long.

However, so far, local peaks in the greed index have hovered around 75—the same level seen at Bitcoin’s all-time highs in 2021.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News