Interview with Hashed CEO: Focusing on New Investment Opportunities in the Asian Market, Bullish on the Future of Gaming and Stablecoins

TechFlow Selected TechFlow Selected

Interview with Hashed CEO: Focusing on New Investment Opportunities in the Asian Market, Bullish on the Future of Gaming and Stablecoins

In Western blockchain markets, 71% are infrastructure projects, while in Asia, 67% are application and content projects.

By: JAY JO AND YOON LEE

Translated by: TechFlow

Recently, Tiger Research conducted an interview with Simon Kim, CEO of Hashed, focusing on Hashed’s investment strategy in Asia and its perspectives on Web3 markets across multiple Asian countries. TechFlow has translated the full interview.

Background: Hashed is South Korea’s largest crypto asset fund and community builder, actively investing in Web3 projects across Asia. Tiger Research is a research and consulting firm specializing in the Asian Web3 market.

Introduction

2023 was a pivotal year for seizing opportunities and potential in Asia's Web3 market. While Western nations largely maintained conservative stances, intensifying regulations on cryptocurrencies and blockchain industries, Asia took a more open approach through regulatory reforms and embracing Web3. This year also saw the emergence of several Web3 initiatives focused on Asia, particularly Hashed—a South Korea-born firm that has grown into a globally recognized venture capital company.

Among global cryptocurrency venture capital firms, Hashed stands out with its primary focus on Asia. Its portfolio consists predominantly of teams from Asia, unlike other crypto VCs whose investments are mainly concentrated in North America. Hashed has consistently backed Asian founders and technologies. This report delves into Hashed’s pioneering role in the Asian Web3 landscape. Through an interview with Hashed CEO Simon Kim, we explore the uniqueness of Asia’s Web3 market and the opportunities it presents.

Hashed, Leader in Asia’s Web3 Market

Since its founding in 2017, Hashed has shown particular interest in the Asian market, actively investing in major Asian Web3 projects such as Vietnam’s Kyber Network, Sipher, Sky Mavis, and Coin98. Given that most Asia-based crypto VCs funded by Asian partners primarily target North American portfolios, Hashed’s level of commitment to Asia is clearly distinctive.

By 2020, the company had evolved into a full-fledged venture capital firm by launching Hashed Ventures and raising its first and second funds totaling 360 billion KRW (approximately $275 million). Notably, Hashed is not merely a capital provider but also a company builder and project accelerator. It has played a catalytic role in revitalizing the Web3 ecosystem across Asian countries through various initiatives—establishing the Web3 startup “Unopnd,” operating the think tank “Hashed Open Research,” running the Web3 builder bootcamp “Protocol Camp,” hosting community events like the “Hashed Potato Club,” and organizing global blockchain events such as KBW (Korea Blockchain Week).

More recently, the company has accelerated its expansion across Asia. In 2023, Hashed expanded beyond South Korea, establishing physical offices in Singapore, India, and other key Asian hubs. This move goes beyond mere investment—it reflects Hashed’ s commitment to working more closely with key stakeholders across Asia and actively participating in the development of each country’s Web3 ecosystem.

Particularly impressive is Hashed’s significant effort in entering the Indian market. In 2022, the company launched Hashed Emergent, which now employs over 15 people dedicated to investment evaluation and ecosystem support.

Today, Hashed Emergent has raised 512 billion KRW (about $39 million) for investments in India and other emerging markets. In December 2023, Hashed Emergent organized the first-ever India Blockchain Week, consolidating fragmented blockchain-related activities across India and showcasing the nation’s Web3 potential to the world.

In Thailand, Hashed is collaborating with major financial institutions to innovate Web3 technologies. In September 2023, Hashed Emergent co-founded Shard Lab with SCBX, Thailand’s largest financial holding company, to advance financial infrastructure innovation. These initiatives highlight Hashed’ s proactive and diverse engagement across Asia.

Why Hashed Focuses on Asia

Simon Kim, CEO of Hashed, revealed the reasons behind Hashed’ s strategic focus on Asia’s market potential.

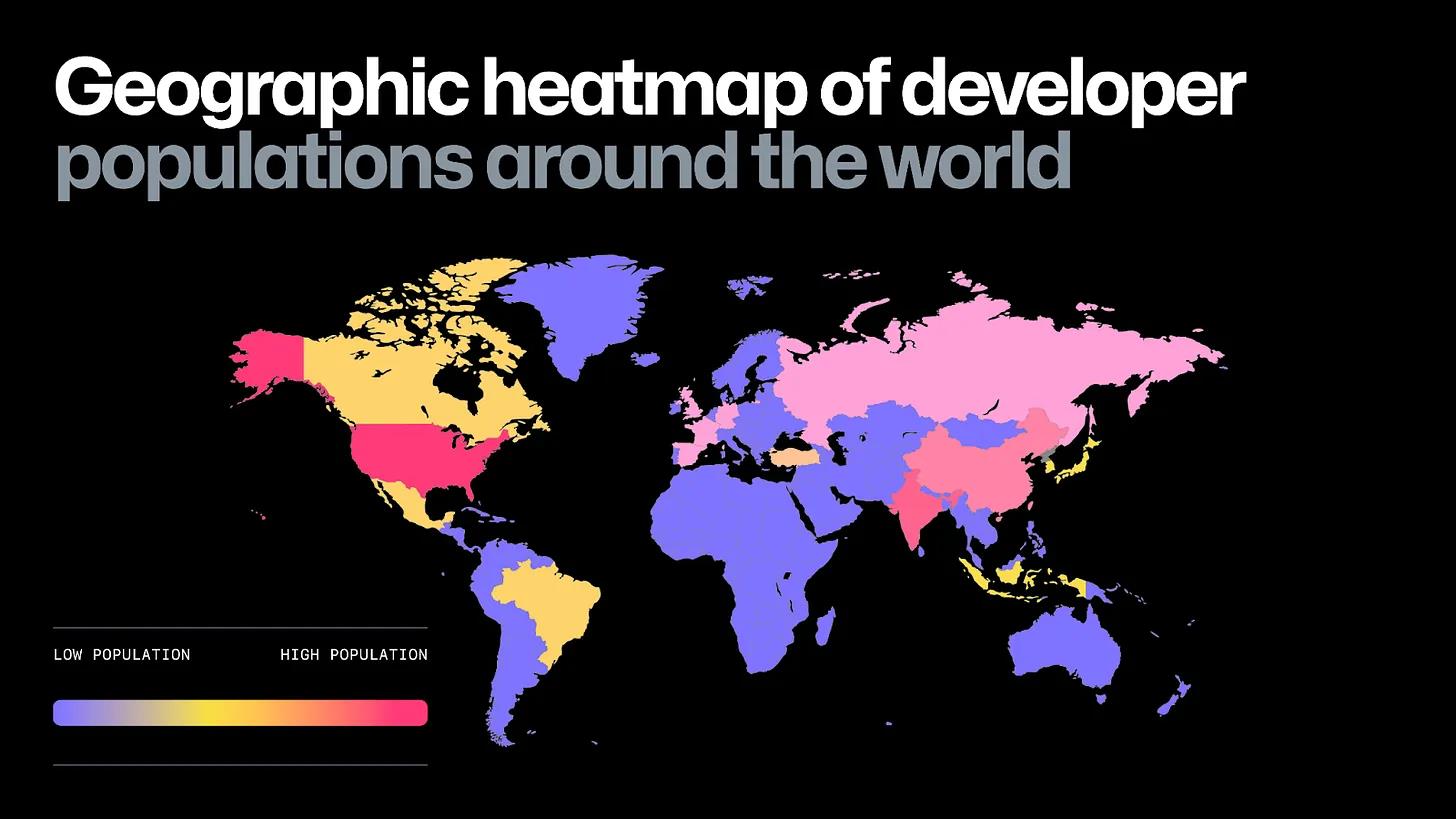

First, Asia is a critical market for Web3 adoption, stemming from fundamental differences between Asian and Western blockchain markets. Western markets primarily focus on infrastructure projects, whereas Asia demonstrates stronger competitiveness in blockchain-based applications and content. According to Hashed’s portfolio distribution, 71% of blockchain projects in Western markets—including North America and Europe—are infrastructure-focused. In contrast, 67% of projects in Asia are application- and content-driven.

This divergence is crucial for developing killer applications capable of mainstreaming Web3. Historically, breakthrough applications in the internet and mobile eras triggered explosive technological growth. Hashed believes Asia holds the potential to continue this trend.

Second, he noted that Asian markets are highly sensitive to new investment opportunities and mass retail experiences. This became especially evident following the rise of P2E games like Axie Infinity. Southeast Asia, in particular, has been at the epicenter of the P2E gaming boom, drawing large numbers of users from Vietnam, the Philippines, and Indonesia into the Web3 ecosystem. Notably, in India, over 100 million people have already engaged with the crypto market and actively participate in investment activities.

Major game companies in Asia have quickly recognized this opportunity and entered the P2E space more aggressively than their Western counterparts. For example, Korean firms such as WeMade, Nexon, Netmarble, Neowiz, and Com2Us are leading the charge in P2E gaming. This further underscores the agility of Asian markets. Additionally, Asia accounts for over 60% of global cryptocurrency trading volume, and the number of crypto holders is approximately five times that of North America—highlighting how swiftly Asian markets identify and embrace new opportunities.

Finally, Asia stands out as a market where major corporations are among the first to launch experimental Web3 initiatives. Leading enterprises in South Korea, Japan, Thailand, and Singapore are engaging with the Web3 ecosystem in diverse ways. In South Korea, conglomerates such as Samsung, SK, LG, and Lotte, along with global gaming giants like Nexon, Netmarble, and Krafton, wield significant influence in the Web3 space.

Alongside these corporate Web3 efforts, their experimental and open-minded attitudes are equally noteworthy. Even when not directly operating Web3 businesses, Asian companies are willing to integrate blockchain technology where they see value. They view blockchain as a modular component applicable based on specific needs. This approach, known as “Web2.5,” sits conceptually between Web3 and Web2.

This flexibility in adoption is seen as a hallmark of Asian markets, providing broader access to the Web3 ecosystem. Singaporean super-app Grab’s recent launch of a Web3 wallet exemplifies this trend. Kim believes these factors make Asia a more promising market for Web3 adoption compared to the West.

Opportunities for Hashed in Key Asian Markets

While Hashed is enthusiastic about Asia’s potential to drive mass Web3 adoption, it is also closely monitoring the unique characteristics and opportunities within each region—particularly in Japan, India, Thailand, and the Middle East. Below is an overview of the opportunities Hashed sees in these markets.

Japan: A Market Where Government Policies Drive Web3 Revival and Content Strength Shines

Japan is a market expected to experience Web3 revitalization driven by government policy. Many large Japanese corporations are actively engaging in the Web3 space, signaling growing opportunities for collaboration. Hashed is closely watching these developments and potential investment avenues.

Japan’s strength in content is particularly notable, especially given the entry of major Japanese game developers into Web3. Top-tier companies including SONY, Bandai Namco, and Square Enix have established Web3 game development studios and are actively involved in ecosystems centered around Japanese blockchain mainnets such as Oasys and Astar Network. Additionally, SBI Holdings’ recent announcement of a $663 million Web3 fund is another key factor to consider.

India: The Global Brain Pool and Birthplace of Web3 Infrastructure Projects

India is both a global IT hub and an emerging Web3 market. According to Kim, the country holds distinct advantages from a builder’s perspective. India has nearly 13.2 million developers—the second-largest developer population after the United States. This was clearly demonstrated at the India Blockchain Week hackathon recently organized by Hashed Emergent. While a typical hackathon attracts 100–200 participants, this event drew over 2,500—more than ten times the average—showcasing the sheer scale of India’s developer community.

Kim also highlighted India’s impressive capabilities in IT infrastructure and systems engineering, which set it apart from other Asian nations. The success of globally recognized Web3 infrastructure projects like Polygon has drawn many Indian developers into the Web3 space. Beyond technical skills, their data-driven mindset, computational thinking, and global leadership are also noteworthy.

When speaking with Indian founders, Kim was impressed by their ability to analyze and communicate data in a multidimensional and nuanced way that goes beyond surface-level metrics. According to Kim, the top 0.1% of talent in India may even surpass their U.S. counterparts in potential. However, India still lacks institutional foundations for its crypto market, suffers from weak social infrastructure, and faces high tax rates. As a result, domestic market growth may take some time.

Nevertheless, India remains a globally promising market expected to become a powerhouse of innovation. In response, Hashed has made substantial investments in India’s Web3 ecosystem through Hashed Emergent. The firm has hired numerous Indian employees and currently maintains over 30 India-focused portfolio companies.

Thailand: A Market Characterized by Government and Traditional Finance-Driven Web3 Initiatives

Thailand is one of the Web3 markets Hashed has recently been focusing on. The country shows exceptional enthusiasm for cryptocurrencies, with 22% of Thai citizens owning crypto—far exceeding the global average of 12%. Thailand is also home to several Web3 initiatives led by the government and traditional financial institutions. The recent election of a pro-crypto prime minister further underscores this momentum. Indeed, the Thai government has announced plans to distribute cryptocurrency to all citizens as a form of universal basic income. Major commercial banks such as SCBX and Kasikornbank are also active participants in the Web3 ecosystem.

Against this backdrop, Hashed is actively seeking new opportunities in Thailand’s Web3 market. Kim, in particular, aims to go beyond simple investments—seeking to build startups and create new Web3 opportunities in partnership with key ecosystem players by leveraging Thailand’s strengths and dynamism. Recently, Hashed joined forces with Thai financial holding company SCBX to transform the country’s financial infrastructure using Web3 technologies.

Middle East: A Market Defined by Nation-State-Led Web3 Initiatives Backed by Sovereign Wealth Funds

Recently, the Middle East has been reshaping the Web3 landscape, with much of the activity centered in the UAE and Saudi Arabia. According to Kim, these countries are actively pursuing industrial diversification at the national level due to concerns over depleting oil reserves. For them, transitioning to new industries and financial systems is not optional but essential. Unlike other regions approaching Web3 cautiously, Kim notes that these nations are moving rapidly at the state level to promote Web3 technologies.

The UAE is becoming a strategic hub for Web3 companies, playing a role in the Middle East similar to Singapore’s in Asia. This has attracted numerous global Web3 firms to establish headquarters there. South Korea’s Wemade and Neowiz have opened offices in Abu Dhabi. Dubai alone hosts over 600 global Web3 companies—including Binance—at the Dubai Multi Commodities Centre (DMCC) Crypto Centre.

The UAE, in particular, is proactively developing innovative Web3 guidelines at the national level, striving to become one of the world’s most Web3-friendly jurisdictions. Given that Web3 is a high-risk domain marked by regulatory uncertainty, being among the first to provide clear, secure, and forward-looking frameworks is critical to becoming a global hub. Moreover, strong financial backing from sovereign wealth funds continues to attract global investment and attention. Accelerators and co-working spaces in Abu Dhabi are also drawing international developers, adding to the excitement.

Next, Kim views Saudi Arabia as a key market due to its position as the largest retail market in the Middle East. Previously overlooked due to its closed nature, the situation has changed under Crown Prince Mohammed bin Salman, who is driving reform and innovation. In 2019, the kingdom issued tourist visas for the first time in its history, marking a shift toward more open policies.

These factors explain why Hashed is paying close attention to the Middle East. The firm stated it will continue focusing on investments, Web3 developer training, and startup-building initiatives to expand Web3 opportunities in the region.

2024: The Year of Harvest

CEO Simon Kim believes the market in 2024 will be different. He cautions that the traditional cycle centered around Bitcoin halving will likely blur. With over 90% of Bitcoin already mined, trading volumes reaching trillions of dollars, and increasing participation from institutional investors, a sudden price surge—common in past cycles—is less likely. Instead, real-world demand and mass adoption will be the key drivers.

Notably, he points out that the influx of institutional investors has created massive liquidity, while enterprise adoption of Web3 is fueling explosive demand. For instance, BlackRock’s application for a Bitcoin ETF signals that institutions now recognize crypto as a core asset class. On the retail side, the integration of Web3 wallets by global tech platforms is significant. As companies like Telegram, PayPal, and Grab—with hundreds of millions of users—enter the Web3 space, a massive user migration is expected.

Kim is most excited about three areas:

-

Web3 gaming

-

Financial innovation based on stablecoins

-

Accelerated enterprise adoption of Web3

On Web3 gaming, Kim has particularly high expectations. Gaming has always been one of the most innovative and competitive markets—and is most likely to drive Web3 mainstream adoption. From 386 PCs in the 1980s to today’s smartphones, games have historically pioneered new platforms. On Apple’s App Store and Google Play, games generate significantly higher revenue than non-gaming apps, proving their superior monetization power. Furthermore, the integration of in-game assets with real-world value has become second nature. In the past, combining finance and gaming was difficult. Now, with Web3 technology, a convergence of content and finance is expected to create powerful synergies. For example, P2E game Axie Infinity has enabled unbanked individuals to earn financial income and accumulate foundational assets through gameplay, all while being entertained.

Next, financial innovation around stablecoins is expected to accelerate. Although clear guidelines for stablecoin issuance are still lacking globally, several Asian countries—including Japan, Hong Kong, and Singapore—have created favorable environments for stablecoin development. Notably, the market cap of stablecoins like USDT continues to hit new all-time highs. As digital wallets gain wider adoption, they are poised to revolutionize consumer finance.

Lastly, enterprise adoption of Web3 is expected to grow. Specifically, an increase in non-Web3 companies adopting Web3 components. Due to their inherent complexity, Web3 technologies once had high barriers to entry. But now, they are increasingly accessible to traditional enterprises and startups alike. Use cases include New World and Lotte Group issuing stablecoin-based payment solutions and NFT memberships. Such moves could further accelerate the integration of blockchain components as standard business tools.

Conclusion

In our interview with Hashed CEO Simon Kim, we explored the significance of the Asian market and predictions for the 2024 Web3 landscape. While Kim is excited about Asia’s potential, he also emphasized the importance of engagement and collaboration with Western markets—not isolation. Western infrastructure projects ultimately require competitive applications and content to activate their ecosystems. Conversely, Asian projects need robust infrastructure and experienced open-source developers to support their applications. Clearly, Asia will play a central role in driving Web3 adoption in the coming years. Under these market conditions, Hashed’s efforts as a leader in Asia’s Web3 market to bridge East and West are truly worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News