Surviving the Bear Market: How to Earn Four Million in Seven Months?

TechFlow Selected TechFlow Selected

Surviving the Bear Market: How to Earn Four Million in Seven Months?

Never stop learning voraciously in the pursuit of your goals.

Author: Nakamoto Uikyou

The four things I did right this year.

-

First, I went long on Bitcoin the day after Silicon Valley Bank announced bankruptcy, then automatically took profit and exited one month later;

-

Second, in late June, I observed that the correction was nearly over, so I started going long on Bitcoin. When I realized the price lacked strength to reach my expected take-profit level, I exited just before the panic sell-off;

-

Third, starting from late June, I began researching macro liquidity and confirmed that the widely circulated idea of "monetary tightening" was a false narrative. With that clarity, I calmly began my vacation, waiting for short-term market hype to fade before fully re-entering;

-

Fourth, I returned to the market in late August. By comparing the 2021 Bitcoin bull run with the timeline of futures ETF applications, I built my coin tracking list and investment plan, then waited for an entry signal. In early September, I ramped up leverage and went all-in on Bitcoin.

Of course, my investment plan includes many other coins—some were duds, some past their prime, others still hold future promise—but I won't mention them, as I don’t want to sound like a signal-pumping guru.

Now, while I wait for an exit signal, I’m also planning to do something else. I still revisit the trading classics I never tire of reading. I deeply admire the storytelling styles of the investors I look up to, so I thought—why not try mimicking them a little, to let people get to know me? I believe I'm someone worth knowing.

More than anything, I want to document how I’ve trained myself through trading. Though I believe these experiences will never leave me, right now I have a strong urge to speak and share. I hope what I've discovered along the way might someday help others, just as I’ve received invaluable, unrepayable help from the writings of legendary traders.

Of course, I’ll remain extremely cautious not to let sharing turn into preaching.

People often treat received opinions as sacred, untouchable dogmas

I rarely tell people what I do. I tend to be quiet in social settings, preferring first to listen and understand others’ views before deciding whether to be open with them. From experience, whenever I’ve been honest, I’ve been labeled a delusional mystic, an arrogant egoist, a self-promoting MLM leader, or even a religious fanatic who betrays Marxism and worships pseudoscience.

It took me some time to understand why my sincerity came across as offensive.

This leads to my first point: people often treat received opinions as sacred, inviolable dogmas—even when those opinions are picked up randomly from the street. Yet they defend their current beliefs as fiercely as if defending their lives.

I used to be this way too. Back then, I often asked myself: why do I instinctively get drawn into pointless debates, compulsively trying to prove the other person wrong?

Eventually, I uncovered a deep-seated desire within me—to “prove myself right.” Proving I’m right means proving I’m superior, smarter, better than others.

Clashing opinions may appear to be a pursuit of truth, but in reality, it’s the cheapest form of self-gratification and superiority-seeking. This behavior is also profoundly draining. Pursuing truth never makes you angry, irritable, judgmental, or aggressive; only when your beliefs are challenged and your ego feels threatened do these reactions arise. (The inherent drive of ideas to expand themselves is even stronger than capital.)

And I realized that ego—the sense of self—is precisely what I need least, especially when engaging with markets. Getting the trade right matters far more than “being right.” The pursuit of ego breeds rigidity, causing you to interpret everything through your own wishes, biases, and beliefs, including how you view other people—and the market.

But the market will never move according to personal will

I began learning to clearly distinguish between mental habits (mine or others’) and actual facts. I scrutinize the origins of every belief, perception, and conclusion I hold. And I learned to act based on factual reality—not on popular consensus, cognitive biases, or subjective desires.

Gradually, I dismantled the walls in my mind. The market began to reveal itself in strikingly simple patterns. That may sound exaggerated, but I often feel as though I can resonate with its breath, its heartbeat.

Why I went against the market and made 4 million

Now, I need to reflect on why I bet on a rally at a time when nearly everyone was bearish and waiting for “the final crash.”

It was actually very simple. I looked at just three indicators: macro liquidity, the relationship between the 2021 ETF application process and Bitcoin’s price cycles, and Bitcoin’s price chart.

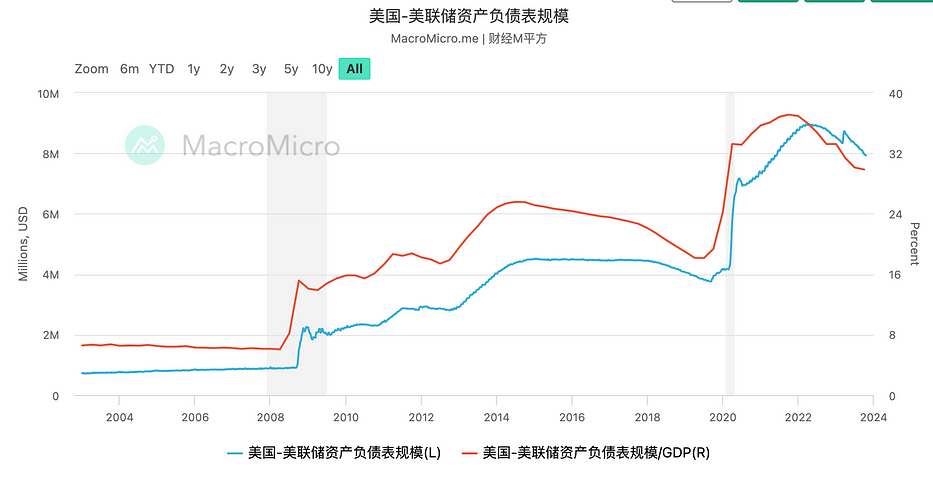

In July, I published an article thoroughly analyzing how much monetary liquidity had been reduced by central banks globally, particularly the Fed’s rate hikes and balance sheet contraction.

The conclusion: after over a year of aggressive rate hikes, the total money supply in the U.S. remained near peak levels. The eurozone’s money supply even returned to a ten-year high. The scale of the Fed’s quantitative tightening paled in comparison to its $8 trillion asset base and the over $1 trillion in new Treasury debt issued.

Moreover, the total liquidity in the crypto market today is far higher than during the same Bitcoin price levels in 2020.

I debunked the “liquidity crunch” narrative and found a relatively reasonable explanation for the rallies in both U.S. equities and crypto during the first half of the year.

Later, I investigated whether ETFs truly impact the crypto market. Though it was a rough comparison, I noticed something interesting—Bitcoin’s three vertical surges in 2021 corresponded precisely with institutional players collectively applying for Bitcoin futures ETFs, widespread rumors of ETF approval, and finally, the listing of ProShares’ ETF on the NYSE (when Bitcoin hit a new all-time high that month).

Finally, I studied Bitcoin’s long-term price chart. Volume-price data told me we were already in an uptrend. Then, on shorter timeframes, I noticed that despite frequent downside probes, minor support levels kept rising and real supply continued shrinking—classic signs of accumulation by large players shaking out weak hands. So I began building a small position. When I saw my position steadily generating profits and upward moves becoming easier than downward ones, I increased both position size and leverage, going all-in long.

Lessons learned from the market

If I could add one more thing, it would be this: I firmly believe wealth resides where most people least expect it. More precisely, failure lies on the side of conventional wisdom held by the majority (a quote from The Disciple of Wall Street).

Over the past two months, the quieter the market became and the less people cared to discuss it, the more certain I felt that opportunity had arrived.

It's not that I enjoy opposing the crowd, but after years of introspection, I can instantly recognize ideas that don’t serve people’s pursuit of a better life—especially those widely accepted societal norms and “common sense” assumptions that people treat as unchangeable realities.

For example, people love using “bull market” and “bear market” to describe conditions, but in reality, bull and bear are definitions—opinions, perspectives, not facts. Such labels lead people to assume the market will behave consistently as “bullish” or “bearish” over long periods. But in fact, even during so-called “bear markets,” I frequently find excellent investment opportunities.

That’s the magic: recognizing the beliefs you take for granted, questioning them, and realizing that once your mindset shifts, your range of options expands dramatically.

My growth hasn’t been smooth or happy. But I’m glad I’ve become who I am today.

Through navigating life’s hardships and learning to read the market, I’ve gained profound insights.

One is: always maintain a sense of order in life (and when necessary, let goals serve as tools).

From October 2021 through all of 2022, I was lost and unfocused, and that’s when I made my worst investments and trading mistakes. After repeated setbacks, I believed my life would never improve—until one morning at 5 a.m., I inexplicably got out of bed and did a 60-minute HIIT workout.

Drenched in sweat, heart racing, I turned on music, leisurely stretched and relaxed, then took a hot shower and applied thick body lotion. I made myself a cup of coffee and sat down at my desk to tackle work I’d postponed for two weeks.

At that moment, all the darkness vanished. My good mood told me I was ready to face any difficulty.

I realized then that it’s emotions and feelings—not events themselves—that trap us. Since then, I’ve maintained this disciplined routine for a full year. Never before has my life been so consistently light, joyful, and fulfilling.

The second lesson: never stop learning voraciously while pursuing your goals.

After mastering basic economics, technical analysis, various trading theories, strategies, and risk management techniques, I realized how many so-called “professionals” in this space occupy expert roles without possessing real expertise. Most participants lack fundamental knowledge, yet these concepts are essential—without them, we cannot interpret market signals or think like major players.

Also, I realized that achieving most goals begins with asking the right questions—and that most problems can be solved through learning, practical testing, and refining objectives based on feedback. This loop works exceptionally well in trading and language learning; I’m not sure how applicable it is elsewhere, but I plan to test it in areas I’m less skilled at.

Lastly: learn to understand your own mind, recognize the roots of cognitive biases and desires, and never be enslaved by them.

Anyone who has seriously studied trading knows that a trader’s greatest enemy is never the market or manipulators—it’s himself. More precisely, it’s his own thinking patterns, emotions, and feelings.

Driven by delusion, disturbed by fear, ruled by impulse, weighed down by inertia—these lead directly to poor decisions.

But strangely, I only experienced this occasionally when I first started trading.

Trading is my training ground

It helped me identify my greed, fear, complacency, and all my deep-rooted beliefs and desires. One by one, I removed them. Interestingly, once I quieted my internal mental noise, I became remarkably emotionally stable—a tremendous advantage in financial markets. I don’t fully understand how it happened, but I simply learned to do the right thing at the right time.

Earning four million during a bear market when everyone else was pessimistic came down to understanding my own mind.

Of course, four million is a small sum for many, and compared to what I made blindly in 2020 and 2021, it’s insignificant in terms of performance. But unlike back then, I value this money more—it validated something important. The market became a lab, proving my hypotheses could rise to the level of reliable principles. Now I have a system that truly works.

During the violent bull market of 2020, I didn’t understand how I made much of that money. I often feared that without certain environments or information sources, I’d never be profitable again.

But this time, I’m crystal clear about the methodology that allowed me to move mountains with a small capital base.

I understand exactly why I make each decision, and how I arrived at those reasons. More importantly, if I ever need to make decisions in the future, I know precisely where to find those reasons.

This means I can use this framework to master anything I choose, achieve any goal I set, and navigate every future low.

I may completely lose this four million—or even all my savings—in a future investment. But I’ve already gained something far more valuable than profit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News