Interpreting the Nansen Report: Solana's Past, Present, and Future

TechFlow Selected TechFlow Selected

Interpreting the Nansen Report: Solana's Past, Present, and Future

Is SOL still a worthwhile investment at this point?

Solana's price has continued to rise this year, and it appears that Solana is also emerging from the shadow of the FTX incident.

Is SOL still a worthwhile investment? What fundamental opportunities and challenges does Solana face?

Recently, Nansen released a research report titled "Solana: Past, Present, and Future," offering a comprehensive analysis of these questions from both data analytics and information integration perspectives, presenting a panoramic view of Solana’s development from past to present.

Given the length of the original report, TechFlow has summarized, translated, and extracted its core insights as follows.

Key Report Takeaways:

-

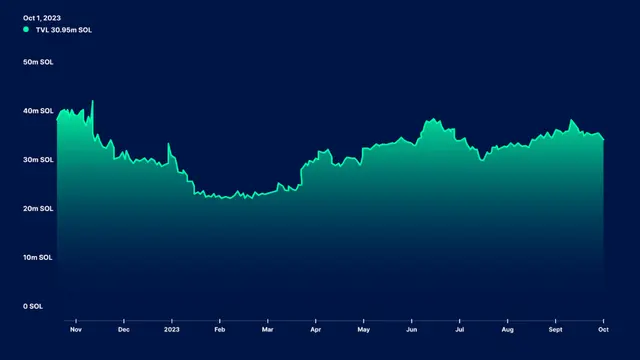

Since the beginning of the year, Solana’s TVL has nearly doubled, reaching 30.95M SOL. Despite past challenges such as network outages and the FTX/Alameda incident, Solana has achieved 100% uptime so far, demonstrating significant improvement and resilience.

-

Solana has proposed solutions like state compression and independent fee markets to address key issues in its tech stack. For example, state compression has reduced NFT minting costs on Solana by over 2,000x.

-

The liquid staking sector is growing rapidly, led by Marinade Finance, Lido, and Jito. Only 3–4% of staked SOL is locked in Solana’s liquid staking protocols, indicating clear growth potential.

-

Interest in enterprise adoption and payment channels is increasing, especially with Visa integrating USDC settlement on Solana, growth in liquid staking on Solana, and partnerships with entities like Shopify.

-

Solana’s catalysts include the successful execution of the Firedancer vision and consumer-facing applications that can leverage Solana’s strengths.

-

However, uncertainties around FTX/Alameda’s SOL holdings may pose temporary risks to its growth trajectory.

Catalysts & Risks Summary:

Catalysts:

-

Solana Virtual Machine (SVM) Gaining Enterprise Adoption:

-

Technical advantages: High TPS, low-cost on-chain storage. Transactions per second (TPS) ~3000, 30x higher than Ethereum and L2s.

-

Evidence: Visa selected Solana as the settlement layer for USDC cross-border payments; Solana Pay integrated into Shopify.

-

-

Execution of the Firedancer Vision:

-

The Firedancer upgrade will optimize Solana validator clients, improving efficiency.

-

-

Growth of Liquid Staking Tokens:

-

Jito Labs is Solana’s latest “success story” in the liquid staking space.

-

Achievement: Growth of JitoSOL, with over 2.4 million SOL staked within a year.

-

Comparison: Ethereum has 40% of staked ETH, while Solana has only 3–4% of staked SOL—indicating greater potential.

-

Even a small increase in the share of staked SOL within LSDs could significantly boost the total TVL of the Solana ecosystem. Currently, Solana’s staking yield is double that of Ethereum.

-

-

Consumer Applications Recognizing Solana’s Advantages:

-

Solana’s cNFTs enable large-scale NFT minting at minimal cost, while native fee markets aim to eliminate unnecessary network congestion.

-

-

Native Token Launches by Solana-Centric Protocols:

-

Most Solana DeFi applications have not yet launched their native tokens.

-

Reason: Protocols typically wait until user base and activity reach certain thresholds before launching tokens.

-

Premature token launches risk dumping and inflation, which harms long-term development.

-

Risks:

-

SOL Price Volatility:

-

Trigger: A full and rapid liquidation of SOL holdings by Galaxy could cause a price drop.

-

-

Network Downtime Damaging Reputation:

-

Current record: 100% uptime. Future outages could undermine confidence.

-

Past incidents of network downtime have already made users skeptical.

-

-

Lack of Bridging Infrastructure and Native Assets:

-

Issue: Insufficient on-chain liquidity, limited native asset support, and underdeveloped cross-chain bridge infrastructure.

-

Past bridge vulnerabilities leading to losses remain fresh in memory.

-

Macro Data Overview:

-

Total Value Locked (TVL):

-

Solana’s TVL increased from 25.12M SOL at the beginning of the year to 30.95M SOL now, nearly doubling. The USD value also shows a consistent upward trend.

-

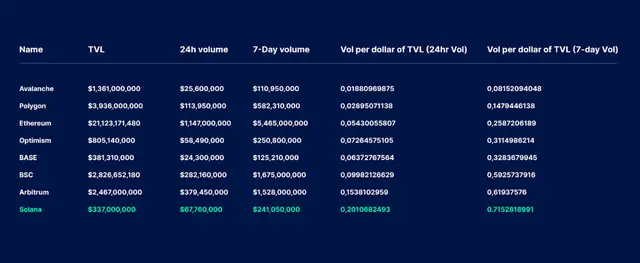

DeFi Velocity (TVL Utilization):

-

DeFi Velocity—measured by trading volume per dollar of TVL—is a more persuasive metric for gauging chain activity and adoption than TVL alone.

-

Over the past 7 days, Solana’s DeFi Velocity ratio was 0.71, meaning each dollar of liquidity generated nearly $0.71 in weekly trading volume. Compared to chains like Arbitrum, Binance, Base, Optimism, and Ethereum, Solana has shown the highest TVL utilization over both the last 24 hours and past 7 days.

-

Daily Trading Volume:

-

Solana’s daily trading volume has remained relatively stable this year, with an increase in vote transactions.

-

Transactions consist of vote and non-vote transactions; vote transactions are associated with validators’ voting accounts.

-

Decentralization Level:

-

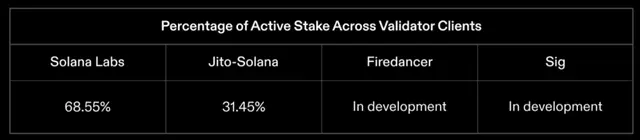

Client Diversity:

-

Beyond Solana Labs, over four different validator client implementations are in development. Usage of the Jito-Solana Client is rising, accounting for nearly one-third of total market share.

-

-

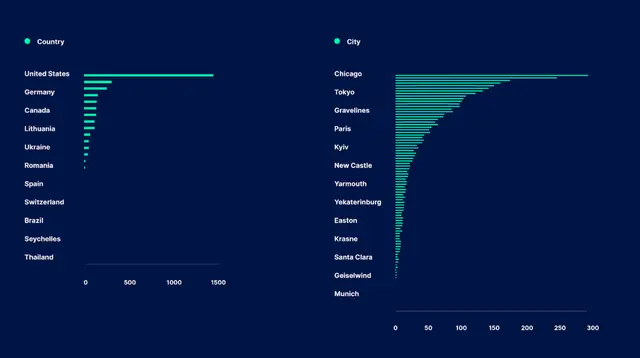

By Region:

-

Globally, 2,919 nodes are distributed across 31 countries and 211 cities. The U.S. leads, followed by Germany, Canada, and Lithuania. The U.S. hosts 1,370 nodes—nearly half of the total.

-

-

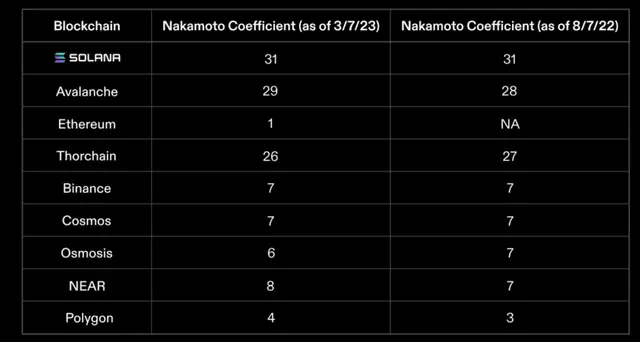

Nakamoto Coefficient:

-

Explanation: The Nakamoto coefficient measures the degree of centralization in a blockchain network.

-

It calculates the minimum number of independent entities required to control or shut down the network. It is a key indicator of a blockchain’s resistance to single points of failure. Ideally, a highly decentralized network would have a high Nakamoto coefficient, meaning no single entity or small group can dominate the network.

-

Solana’s Nakamoto coefficient has remained relatively stable at 30–31% over the past year. Notably, the Solana Foundation controls about 20% of stake, delegating it to small- and mid-sized validators.

-

Catalysts / Drivers / Risks

-

Alameda / FTX SOL Sales:

-

FTX’s largest holding is SOL, over 71.8M SOL (~$1.16B), representing about 17% of circulating supply and 13% of total supply.

-

Total assets held by FTX and Alameda amount to ~$1.3B, including SOL, BTC, ETH, APT, etc.

-

Total SOL in hot wallets: 6.98M SOL, split across three addresses:

-

Staking wallets: Three main ones, with total staked balance of 61M SOL, 52M SOL locked, and 3.8M SOL unlocked.

-

Addresses listed here: https://twitter.com/solanobahn/status/1696270047491277143

-

-

Galaxy Digital is handling the sale of Alameda/FTX holdings, but the timeline remains unclear. Weekly sales capped at $100M to limit price volatility.

-

-

Ecosystem Highlights:

-

September 2023: Visa introduced USDC settlement on Solana, a significant step for future public blockchain interactions with financial institutions in payments and other use cases.

-

September 2023: MakerDAO’s founder considered using Solana SVM as Maker’s new native chain—a part of Maker’s “Endgame” upgrade plan expected to span 2–3 years across five phases.

-

August 2023: Solana Pay integrated with Shopify.

-

June 2023: Tensor NFT launched its compressed NFT marketplace, capturing most of Solana’s NFT market share. Together, Tensor and Magic Eden account for nearly 90% of Solana’s NFT trading volume.

-

Starting April 2023, Backpack wallet on Solana gained traction due to smoother user experience with wallet infrastructure. Backpack includes plugins like Jito Staking, Solend, and Drift Protocol, plus games accessible directly from the wallet interface.

-

-

Development & Partnerships

-

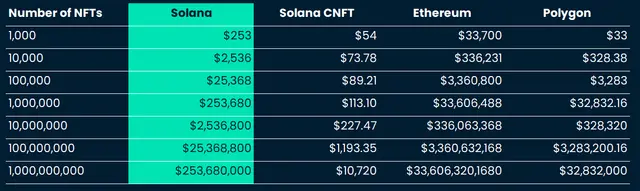

Solana’s State Compression Technology:

-

State compression is an on-chain solution that significantly reduces storage costs by storing most data (e.g., NFT metadata) off-chain while keeping a cryptographic “footprint” on-chain via Merkle trees. This compression-friendly structure allows developers to store minimal data on-chain and update it directly within the Solana ledger, reducing storage needs while preserving Solana’s base layer integrity.

-

Comparing NFT minting costs: With state compression, minting 1M NFTs costs $113 vs. $253K without. On Ethereum and Polygon, the same operation would cost $33.6M and $32.8K respectively.

-

State compression gives Solana a significant edge, drastically lowering NFT minting and trading costs across its ecosystem.

-

-

Use Cases of State Compression Technology:

-

DRiP: Recently hit a milestone—minting its 1 millionth Solana NFT, making it the largest NFT collection across all chains. DRiP provides free weekly NFTs to users, a scale only feasible through Solana’s state compression.

-

Mad Lads: The first xNFT (executable NFT) collection, where a new token standard enables tokenization of code. xNFTs can represent dApps, allowing users to access them directly from their wallets. Mad Lads NFTs were initially minted and managed via Backpack wallet and platform, which also provides the execution environment for xNFTs.

-

Crossmint: NFT infrastructure enabling developers to seamlessly build NFT applications.

-

Dialect: A messaging platform leveraging Solana’s compression capabilities, allowing creators to mint and distribute NFTs to users. State compression reduces infrastructure costs (e.g., NFT provisioning, storage, and merchandising) to near zero.

-

-

DePIN Narrative:

-

DePIN benefits from Solana’s state compression technology, with applications spanning maps, energy, logistics, and more, offering gig-economy-like opportunities. Kuleen Nimkar, Solana Foundation’s DePIN lead, notes that individuals can earn extra income by contributing hardware to DePIN protocols.

-

Helium Network:

-

Helium uses Solana’s state compression to mint hotspots as NFTs at lower cost. Helium is the first DePIN example, partnering with Hivemapper to verify each driver’s location.

-

-

Hivemapper:

-

By distributing camera hardware, Hivemapper built a decentralized mapping network, rewarding drivers who install “dashboard cameras” with tokens and collecting map data during drives.

-

-

Render Network:

-

Render Network expanded from Polygon to Solana blockchain, enabling individuals to contribute unused GPU power to render motion graphics and visual effects.

-

-

-

QUIC Protocol:

-

QUIC is a transport protocol replacing UDP (User Datagram Protocol), designed for fast asynchronous communication while incorporating TCP (Transmission Control Protocol) session and stream control features.

-

With QUIC implementation, Solana resolved previous network outage issues, achieving 100% annual uptime. QUIC offers better flow control to prevent spam, optimizes data ingestion, and enhances network traffic management.

-

-

Native Fee Market:

-

The native fee market is a new fee structure on Solana allowing users to send priority fees to validators for transaction prioritization, solving past congestion caused by spamming transactions to secure priority.

-

By introducing priority fees and dynamic fee adjustments based on transaction type, Solana improves network efficiency and economic cost. For instance, during NFT launches or DeFi events, priority fees can dynamically adjust to reflect processing demands, reducing spam costs and optimizing resource allocation.

-

-

Liquid Staking on Solana:

-

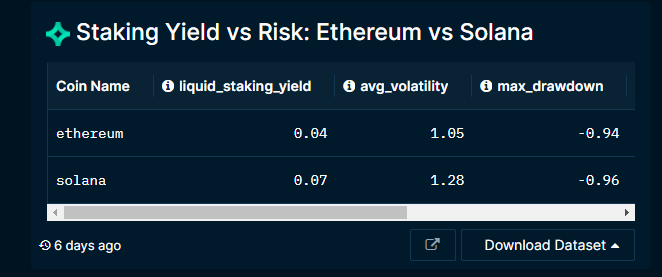

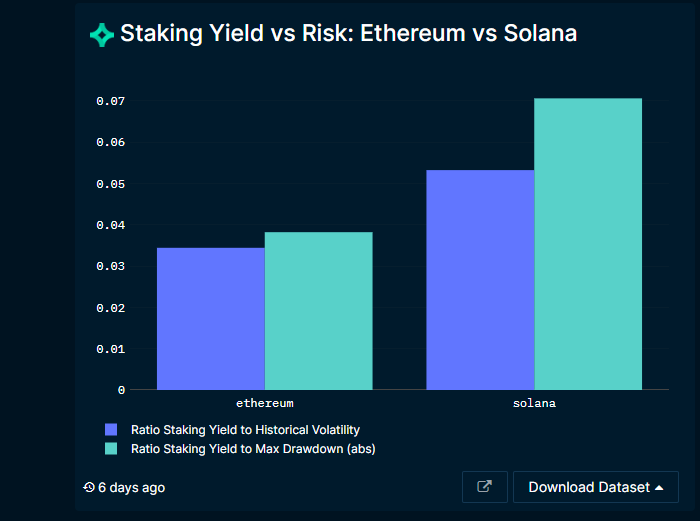

Ethereum vs. Solana Comparison:

-

Compared to Ethereum’s ~$20.22B in liquid staking, only ~3–4% of SOL is liquid staked, showing substantial room for growth.

-

Risk profiles are similar, but yields differ: Under comparable risk conditions, Solana’s staking yield is nearly double Ethereum’s.

-

-

Current State of Liquid Staking:

-

A total of 295.7M SOL is staked on the network, but usage of liquid staking derivatives remains very limited.

-

During the FTX event, liquid staking TVL dropped from a peak of 12.8M SOL to a low of 5M SOL, but has since fully recovered to pre-FTX levels (~12M+ SOL).

-

-

Emergence of New Liquid Staking Protocols:

-

Jito is a recently launched staking provider that, since its launch at the end of November last year, has accumulated over $44.86M (2.3M SOL) in TVL. Cross-LSD and DeFi use cases have also grown significantly.

-

-

Main Liquid Staking Protocols:

-

Marinade Finance still dominates Solana’s liquid staking market, with over 5.47M SOL staked, followed by Lido and Jito. More liquid staking protocols are emerging—Marinade, Socean, Lido, BlazeStake, Jito—offering various reward programs to attract more users to stake SOL.

-

-

Reward Programs & New Initiatives:

-

Marinade launched Marinade Native, allowing users to delegate staking rights seamlessly while retaining withdrawal rights.

-

Marinade also announced its Marinade Earn rewards program, running from October 1, 2023, to January 1, 2024. Participants will receive 1 MNDE/SOL during the program period.

-

A referral system is also available—referrers earn 1 MNDE/SOL via their unique referral link.

-

-

Jito Performance & MEV Rewards:

-

Jito recently hit a new all-time high in total TVL on October 2, 2023, reaching $57.5M, with 2.4M SOL currently staked—showing consistent growth since launch.

-

Jito is Solana’s first liquid staking product including MEV rewards. Users stake SOL to receive JitoSOL, which entitles them to additional rewards from MEV transactions on Solana, while being staked with validators running performance-optimized software.

-

Upcoming Catalysts

-

Emerging Solana DeFi Applications:

-

AlphaVybe and Phoenix: Phoenix is a decentralized limit order book on Solana supporting spot markets, built by Ellipsis Labs. It recently completed a $3.3M funding round led by Electric Capital.

-

Drift Protocol: A derivatives exchange on Solana, with total trading volume exceeding $1B, open interest at $4.9M, and TVL up over 50% in the past month.

-

Squads Protocol: A newly launched comprehensive multisig platform protecting $6M in assets and processing $9.5M in total transaction volume.

-

Kamino Finance: An automated liquidity solution enabling users to earn yield by providing liquidity to concentrated liquidity pools. In Q3, Kamino’s trading volume exceeded $1B, generating $1.25M in fees for depositors.

-

-

DeFi Protocol Point Systems:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News