Focusing on Long-term Value: How Should Crypto Projects Navigate Narrative Shifts?

TechFlow Selected TechFlow Selected

Focusing on Long-term Value: How Should Crypto Projects Navigate Narrative Shifts?

As the industry matures, the focus should shift from short-term price movements to long-term value creation.

Author: Kyrian Alex

Compiled by: TechFlow

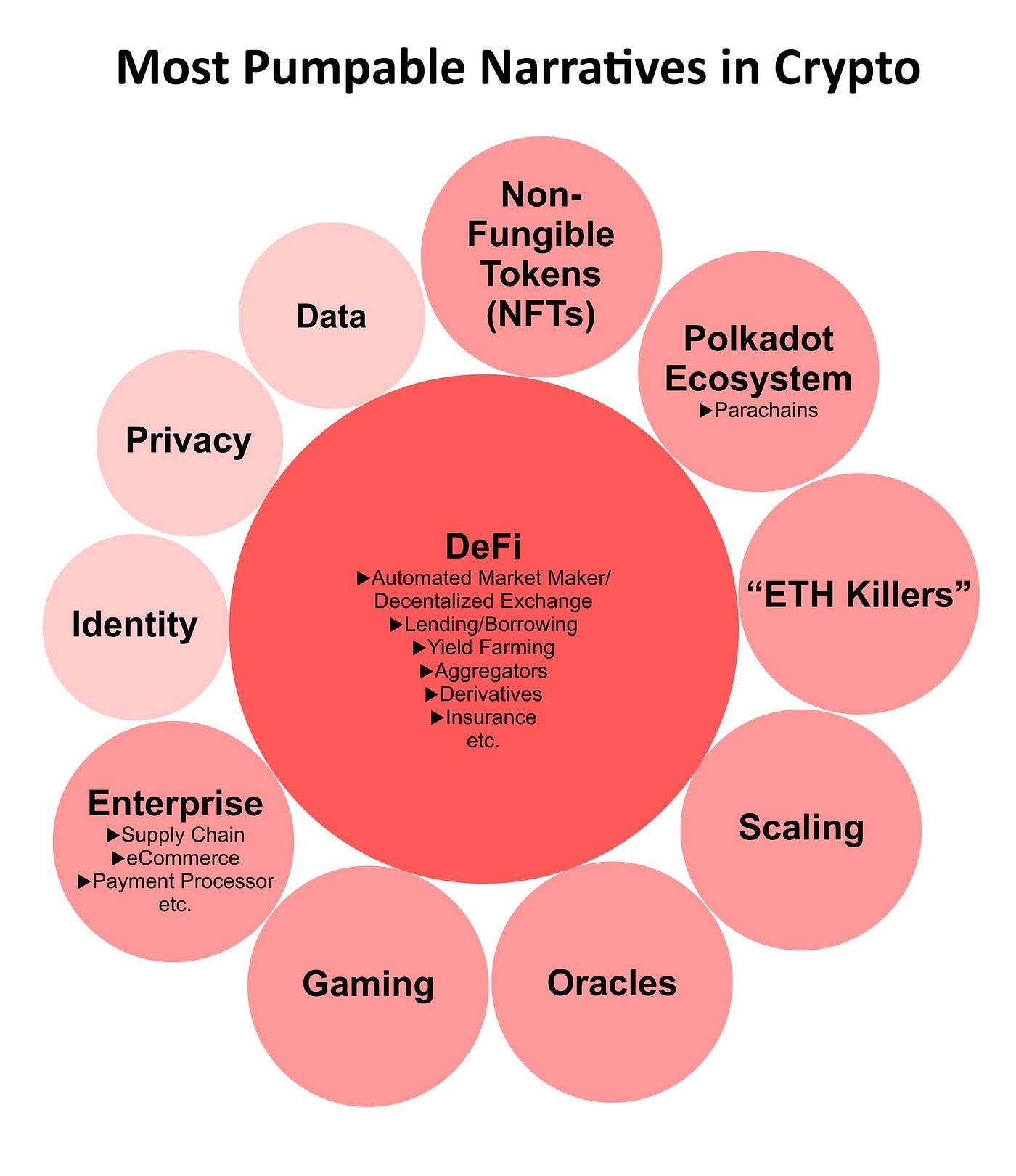

In the blockchain space, narratives have consistently proven to be powerful drivers of attention, investment, and growth. The ever-shifting landscape has witnessed the rise and fall of various themes—from ICOs to DeFi and NFTs—leaving behind critical lessons for investors, founders, and enthusiasts alike.

The evolution of narratives can be observed through the transition from initial coin offerings (ICOs) to launchpads. The 2017 ICO boom promised a revolution in venture investing, but many projects failed to sustain momentum. As the industry matured, attention shifted toward more sophisticated investment mechanisms, with exchanges leading the trend of launchpad platforms. These narrative shifts highlight the dynamic nature of the Web3 space, where trends emerge rapidly, peak quickly, and then gradually fade.

Narratives sweep across the crypto domain like tides, elevating once-obscure concepts to the forefront of attention. Let’s examine some recent cases that illustrate this phenomenon.

First came Bitcoin DeFi. Bitcoin is typically not associated with experimentation, but the introduction of Ordinals—assigning unique identifiers to individual satoshis—opened the door to complex DeFi applications on Bitcoin. BRC-20 tokens, built atop Ordinals, aim to replicate the fungibility of ERC-20 tokens while introducing distinct characteristics, potentially paving the way for DeFi on Bitcoin, including fractional ownership, smart contracts, decentralized exchanges, lending platforms, and insurance protocols. But as we often say, the crypto community’s attention span lasts less than two months. Only the earliest users and developers truly profited.

Then came the LSD-Fi frenzy. With Ethereum's transition to PoS, liquid staking derivatives (LSDs) dominated the DeFi landscape. They offered staking rewards without locking up assets, and LSDfi protocols like Lybra Finance and Pendle Finance expanded on this concept by enhancing liquidity and reducing risk. Annualized yields skyrocketed. But guess what? After early speculators entered, yields plummeted, followed by a rapid decline in hype.

We saw the same pattern during the memecoin craze. Tokens like $PEPE and $BEN surged, fueled by social media buzz, NFT popularity, and the desire for quick profits. Despite knowing these tokens were risky and highly volatile, people simply wanted 100x returns in the shortest time possible. The appeal lay in easy access and the potential for strong gains amid a stagnant market. Well, just like all meme seasons known to humanity, the hype abruptly ended—accompanied by scandals, frauds, hacks, and pump-and-dumps.

Oh, how could we forget the AI token hype sparked by the recent popularity of ChatGPT? What drove the speculation? Was it anticipation of progress? Belief in transformative potential? Or merely speculative rebranding?

Or can we forget the so-called virtual reality revolution? Rumors around Apple’s VR headset and Meta’s rebranding reignited interest and speculation about the metaverse. Tokens such as Decentraland (MANA), The Sandbox (SAND), Axie Infinity (AXS), and Render Network (RNDR) multiplied in value amid the buzz. Early participants cashed out; newcomers bore the losses.

Narratives have their limitations.

They can propel a theme into the spotlight, but they do not guarantee long-term success. Thus, founders often face a dilemma: the challenge of timing within volatile narrative cycles.

Note that most of the projects I mentioned earlier are actually solid initiatives. However, the narratives that drove their price surges and popularity ultimately harmed them. Founders must therefore come to terms with securing sufficient revenue or profit to cover operational costs during market downturns. Because even bear markets expose the fragility of projects caught up in attention-driven frenzies, resulting in shrinking user bases and weakened market prospects.

The Web3 investment landscape resembles uncharted territory, where pioneers must rely on a blend of vision and calculated risk-taking.

For founders navigating the Web3 space, several survival strategies have emerged:

-

Understand the narrative: It’s crucial to distinguish between investor-driven narratives and themes with deep underlying potential. Founders should determine whether they’re entering a narrative early or riding an existing wave.

-

Act early: First-mover advantage often means months of investor education and persuasion. This double-edged sword is both a blessing and a challenge for founders seeking support and funding.

-

Survive flexibly: In an environment where many peers may fail, survival itself is an impressive achievement. Prudent financial management designed to weather storms may be the key to long-term success.

-

Consumer focus over capital: Prioritizing user engagement and iterating products based on consumer feedback—before chasing investor capital—is a wise strategy. Meeting real user needs fosters more sustainable organic growth.

-

Discern the right timing: Timing is critical; entering a collapsing theme or mistaking short-term price increases for genuine demand can lead to difficulties securing follow-on funding.

The Duality of DeFi

Once hailed as a beacon of innovation, DeFi has now transitioned from exaggerated expectations to a more pragmatic phase of enlightenment. While attention and usage have declined, the underlying user base remains relatively stable, indicating that many users remain actively engaged in the space.

This duality raises a key question: Can DeFi maintain its relevance beyond the fluctuations of market narratives?

The answer depends on DeFi’s ability to address challenges revealed during its initial hype phase—such as high transaction fees, network congestion, and security vulnerabilities.

Next, the focus must shift toward tangible utility and real-world use cases.

DeFi projects that demonstrate concrete value propositions, solve practical problems, and offer sustainable financial products are more likely to find stable footing. A balance between innovation and compliance is essential. The transition must move from speculative token trading toward products delivering genuine financial services.

Currently, the Web3 ecosystem’s emphasis on ownership and exclusivity can be contrasted with the early internet’s ethos of free content access. The shift toward ownership comes at a cost—both in monetary investment and user engagement.

Emerging themes like DeFi, NFTs, and Web3 gaming remain unfolding stories, each following its own development trajectory. The shift from relying solely on investor capital to fostering consumer participation is a critical transformation founders must embrace. Chasing trends is no longer enough; founders must build products that address real needs and deliver actual value.

In balancing value creation with user retention, hybrid models combining “free” experiences with ownership—like Reddit—offer a potential path forward.

Within the Web3 investment landscape, a new paradigm is emerging—one that places higher value on sustainability, user engagement, and meaningful differentiation. Unlike the wild ICO era, investors today scrutinize a project’s long-term viability and resilience against market volatility—driven by rising interest rates and drying-up liquidity. The concept of “survival of the fittest” applies not only to projects but also to investors and entrepreneurs who adapt and evolve with changing currents.

As the Web3 investment landscape continues to evolve, the challenge lies in striking a delicate balance between risk and reward. Successfully timing investments within narrative cycles, understanding a project’s intrinsic value beyond speculative hype, and fostering user engagement are foundational to success. Investors, founders, and enthusiasts alike must navigate this complex terrain with an eye toward long-term potential, guided by lessons from past experiences and a commitment to a more sustainable future.

Conclusion

The Web3 investment landscape is a complex tapestry woven from narratives, attention, capital, and survival. It is a realm where trends rise and fall, and hype can both propel and extinguish projects. Success is defined by a combination of foresight and adaptability. As the industry matures, the focus should shift from short-term price movements to long-term value creation. The road ahead demands a strategic approach. Therefore, builders, creators, and users alike must understand the evolving dynamics and remain steadfast in their commitment to innovations that stand the test of time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News