Echoes of History: Each Bull and Bear Cycle is Slightly Different, but Overall Conditions Are Basically Similar

TechFlow Selected TechFlow Selected

Echoes of History: Each Bull and Bear Cycle is Slightly Different, but Overall Conditions Are Basically Similar

Now is the time to research and study, because when the fun begins, we need to be prepared.

Author: IGNAS | DEFI RESEARCH

Compiled by: TechFlow

It's widely believed that cryptocurrency needs to go through three crypto cycles to truly achieve its goals: the first cycle is for gaining knowledge and learning important lessons about how crypto works; the second cycle is for making some gains and feeling comfortable; the third cycle is for achieving financial freedom.

For me, this is my second bear market, and soon I’ll be entering my third bull run. I’m ready.

I feel like I've been through the current phase of the crypto market before—because I actually have, specifically during the 2019–2020 market cycle.

But I'm not just talking about the downward price trend. I mean the entire market sentiment: regulatory crackdowns from governments, general public apathy or accusations labeling crypto as a scam, and the PvP (player-versus-player) mode of profiting by rotating between different tokens.

If you joined the crypto space during or before the last bear market, you might feel the same way. This sense of familiarity is a huge advantage because your past experience in crypto lays the foundation for the next bull market ahead.

Every bull and bear market differs slightly, but overall conditions are fundamentally similar.

Based on my experience, this article will explore how the past has taught us to recognize when the next bull market begins.

A Familiar Market

First Bull Run and Crash

Deja vu is the feeling that you’ve already experienced the current situation. While this sensation usually lasts only seconds, the current crypto deja vu phase has lasted for years.

I entered the crypto market at the end of 2017 after reading a BBC article about Bitcoin continuously hitting new all-time highs. That was my first taste of FOMO.

I bought some Bitcoin, and its price quickly doubled. I felt extremely excited, thinking I was smart for getting into a new financial paradigm early. That excitement quickly turned into confidence—I believed I could make even more money by investing in newer, cheaper tokens.

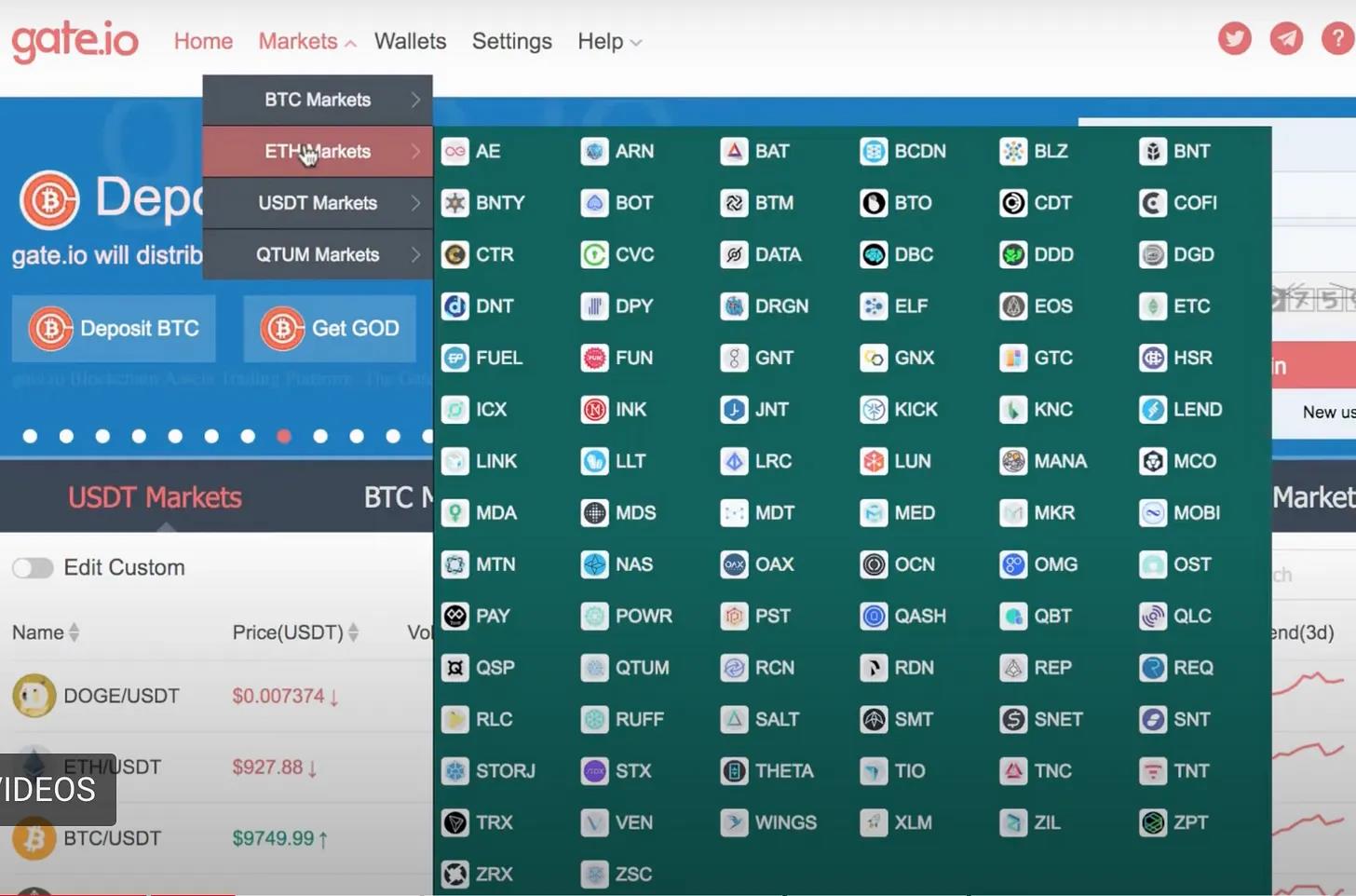

I Googled exchanges because my first exchange (Bitstamp) didn’t offer many altcoins, and somehow ended up on Gate.io CEX. I loved their old UI because I could clearly see all token symbols and, most importantly, their logos.

I did some “research” by reading project websites and whitepapers—all seemed revolutionary: decentralized supply chain management, decentralized storage, decentralized banking! The FOMO intensified.

I kept funneling my scholarship funds into these tokens, but eventually there were too many, and they all looked alike, so I decided to invest based solely on token logo colors—with little due diligence.

Long story short, I lost most of my money.

None of them built anything real—just websites and whitepapers.

This is a common story among newcomers to crypto. Greed, naive belief in new ideas, and lack of experience and knowledge about how the crypto market works lead to disaster. Many suffer heavy losses and ultimately give up on crypto. However, those who stay and learn from their mistakes have a better chance of success.

I was disappointed too, but curious about what went wrong.

That curiosity became the main motivation behind my continued writing about crypto.

Second Bull Run and Crash

Curiosity and greed are powerful morning motivators.

After the 2017–2018 Bitcoin crash, I remained interested in crypto and followed all news closely. By late 2018, my passion led me to land my first job at a Korean exchange, where I worked for about four years. It was a great experience—I learned how market makers operate, analyzed hundreds of tokens, communicated with their teams, and attended over a dozen conferences.

But the market was boring and quiet. This relative calm is just one similarity to the current market phase. Other similarities include:

-

Regulatory crackdowns on ICOs, especially in Asia back then, mirroring today’s Western regulatory pressures.

-

Crypto being labeled a scam, dead, or a Ponzi scheme—this has happened at least 385 times so far.

-

Waiting for institutional adoption: Bitcoin starting to be bought by institutions, just like today with spot Bitcoin ETFs.

-

Crypto profits shifting from one token to another without increasing the total size of the crypto market.

-

Waiting for mass crypto adoption.

There are many other parallels, but the widespread claim that crypto is now boring pales in comparison to the last bear market.

Back in 2018–2019, there really wasn’t much to do. No DeFi, no NFTs—my trading was limited to centralized exchanges. The most exciting things were IEOs (Initial Exchange Offerings), maybe the EOS token sale, which raised a record $4.2 billion but delivered almost nothing.

The market had almost nothing thrilling.

Yet, seemingly out of nowhere, things started changing. In early 2020, I discovered a new hot token called AMPL (Ampleforth), which completely reshaped my understanding of tokenomics. It was the first token with elastic supply.

AMPL’s smart contract automatically increases or decreases the total supply based on a target price range between $1.06 and $0.96—a process known as “Rebase.” If the price exceeds $1.06, even at 2 a.m., the protocol mints more AMPL to bring the price down. If it drops below $0.96, excess tokens are burned. In short, instead of holding a fixed number of AMPL, you hold a percentage of the supply. Investors see their AMPL balance grow or shrink—unlike any traditional currency.

It was novel, exciting, and profitable. I didn’t fully grasp its implications (guessing others’ moves during rebases was the main game), but I loved watching my wallet’s AMPL count grow. At the time, it was the new hot thing.

Soon, more new hot things emerged, the most exciting being liquidity mining with BAL and COMP tokens. These protocols rewarded users with free tokens proportional to the amount deposited into their smart contracts.

It was mind-blowing. And when such moments happen, you should pay extra attention!

Because occasionally, an astonishing token model emerges that can shift the entire industry’s trajectory. The ingenuity of new tokenomic models drives progress and can spark a new bull market—here are my picks for the five most innovative tokens from DeFi Summer.

Why were they giving away free tokens? Initially, it made little sense—previously you either bought new tokens via ICO/IEO or completed endless tasks for a $5 airdrop.

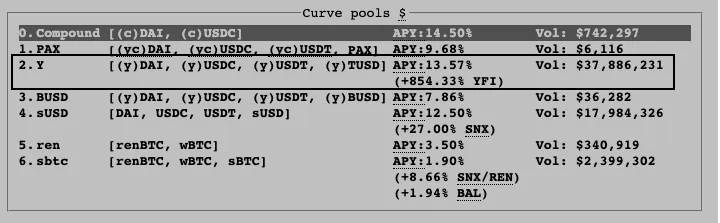

The craziest was Yearn Finance’s YFI token launch. Simply depositing my stablecoins into Curve earned me free YFI tokens with over 1000% APY.

Things got even stranger and wilder with SushiSwap’s liquidity mining. Its mechanism allowed users to deposit ETH/USDT to earn SUSHI, or buy SUSHI and stake it in ETH/SUSHI LP pools to earn more SUSHI.

This two-pool token mechanism was essentially a real Ponzi scheme—the SUSHI price rose only as long as more people joined.

Dozens of such two-pool schemes launched and collapsed daily. The game theory to win was simple: get in first, mine as many tokens as possible, and dump when incoming capital falls below token issuance and outflows.

Eventually, the constant flood of new hot pools distracted users, reducing inflows of ETH/USDT. As token prices dropped, APYs fell, and TVL flowed toward higher-yielding opportunities—until all these pools collapsed.

But this crash was an important lesson—and a recurring pattern in crypto that ultimately offers the best opportunities. As long as you know when to exit in time.

How Bull Markets Begin and End

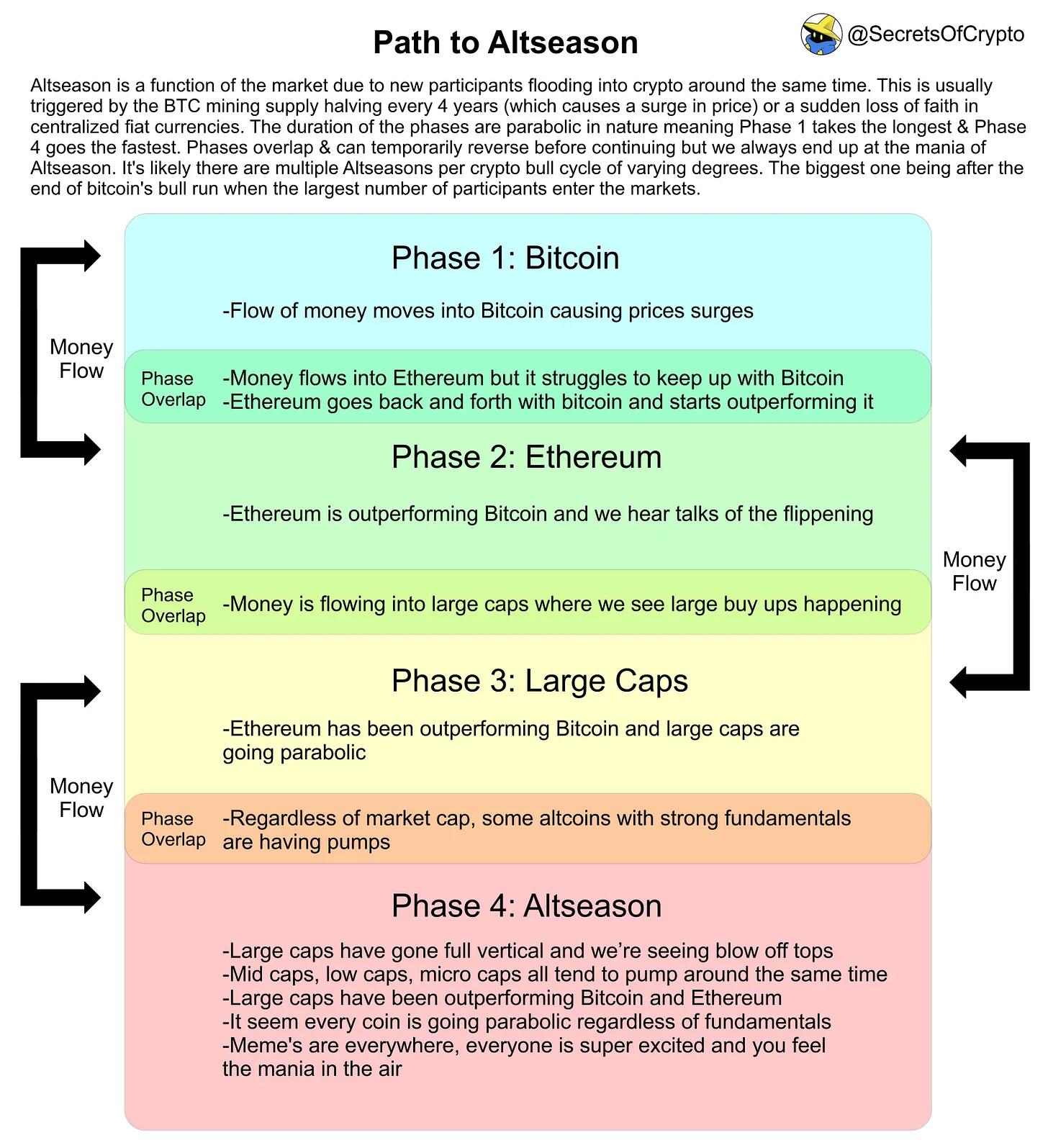

Below is a summary of SecretsOfCrypto’s “Road to Altseason,” which nicely captures how capital flows from Bitcoin into the broader crypto ecosystem and gradually spreads into altseason.

But I believe there’s a crucial missing element in the bull market narrative: innovative money printing.

I’m not referring to central bank money printing—which certainly benefits crypto prices—but rather to crypto-native money printers.

In crypto, we criticize central governments for printing money because it dilutes fiat purchasing power, increases inequality, and eventually leads to collapse.

Yet, the crypto industry itself is the master of money printing.

Imagine: years passed after Bitcoin’s launch before significant competitors emerged. Litecoin, the first altcoin, launched in 2011. Then Ethereum arrived in 2015. The following years featured Bitcoin forks like Bitcoin Cash, Bitcoin SV, and Bitcoin Gold. This was the original Layer 1 season.

These Bitcoin forks were also crypto’s original money printers—Bitcoin holders received new tokens, and if sold on launch day, generated instant profits.

However, launching new coins was expensive due to PoW mechanisms requiring electricity to secure networks.

ERC-20 tokens on Ethereum made issuing new tokens easier and cheaper. Now anyone could launch a token at low cost. Thousands of new tokens could be created with just a website, whitepaper, and big promises.

Yet, the most significant impact of Ethereum and ERC-20 wasn’t technical—it was social. Before ERC-20, tokens were mainly seen as payment methods or stores of value. But with ERC-20, tokenization became ubiquitous. As crypto prices rose, use cases expanded rapidly.

Then, suddenly, prices crashed.

The crash occurred because capital flowing into the crypto system couldn’t sustain the exponential growth of newly issued tokens each day. We ended up printing too many tokens. Additionally, as circulating tokens increased, attention fragmented, causing confusion about where to invest.

Then, during DeFi Summer, a similar pattern repeated.

Protocols distributed free tokens via airdrops to liquidity providers or users. This time, the stated purpose was more humble and ethical: aligning with crypto ideals of decentralization and protocol ownership.

Looking back at 2017, after the ICO bubble burst, it seemed every project needed a utility token. Now in DeFi, protocols need governance tokens. We’re still mostly in this phase, but disappointment with DeFi governance is growing rapidly.

Yet, the real motivation behind these tokens remains—and always has been—to bootstrap liquidity. Without liquidity, protocols like Aave, Uniswap, or Curve have no value.

Just like in 2017, when daily token issuance exceeded incoming capital, the DeFi market crashed. It’s a different story, but the root cause is identical.

Interestingly, NFTs also crashed for the same reason. CryptoPunks and BAYC triggered FOMO among those who missed out, leading to a surge of new NFT projects. But when attention and new NFT issuance couldn’t sustain price levels, the market eventually collapsed.

Currently, only a few NFT collections have survived, which makes me believe the NFT market may be nearing its bottom.

New Bull Market: New Stories, Same Mechanisms

Let’s briefly revisit SecretsOfCrypto’s “Road to Altseason.” The idea is that bull markets start with new fiat money entering Bitcoin, then capital flows into lower-market-cap tokens.

But I believe that before new capital enters, innovative leverage and reuse of existing crypto capital pave the way for profit-making opportunities in the next bull market.

DeFi Summer is a perfect example: before ETH and BTC prices surged, DeFi tokens were already volatile. Native crypto users deposited ETH and stablecoins to mine brand-new tokens telling compelling stories about a new financial system. Some dumped the tokens, but many believed in the DeFi narrative and held on.

The pre-bull market DeFi bubble and the wealth it generated were enough to convince newcomers to enter crypto and buy ETH/BTC. Of course, the impact of low interest rate environments was far greater than our relatively small-scale money printing.

What fascinates me most is that DeFi infrastructure was already built before DeFi Summer—but few paid attention until liquidity mining took off.

I believe we’re currently in a similar pre-DeFi-bull phase, laying the groundwork for innovative money printing and compelling narratives. With that in mind, I want to highlight top opportunities with potential to create bubbles larger than the short-lived narratives we’ve seen in this bear market.

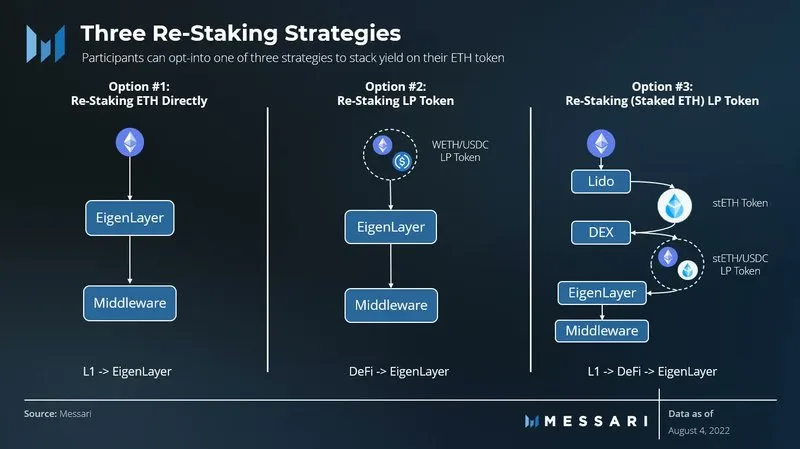

Restaking

EigenLayer is at the forefront of this narrative.

Simply put, Ethereum’s security can be “rented out” by allowing ETH stakers to “restake” their ETH, securing multiple networks simultaneously. However, this introduces additional risk, compensated by higher returns. You guessed it—you’ll receive a new virtual currency promising to change our world.

Many liquidity-mining-style scam tokenomics will be invented, each more creative in trying to prevent you from selling. Our focus should be on identifying tokens that create flywheel effects—where dApp adoption grows alongside token inflation.

And it’s already begun—Stader’s rsETH is a liquid restaking token.

But restaking is a broader narrative beyond Ethereum. Cosmos launched Replicated Security, where ATOM stakers lend their security to other blockchains—the first being Neutron. I expect more blockchains to adopt restaking, just as they embraced liquidity mining rewards during DeFi Summer.

Our task is to understand how restaking works before the bubble starts—because once it does, timing is everything.

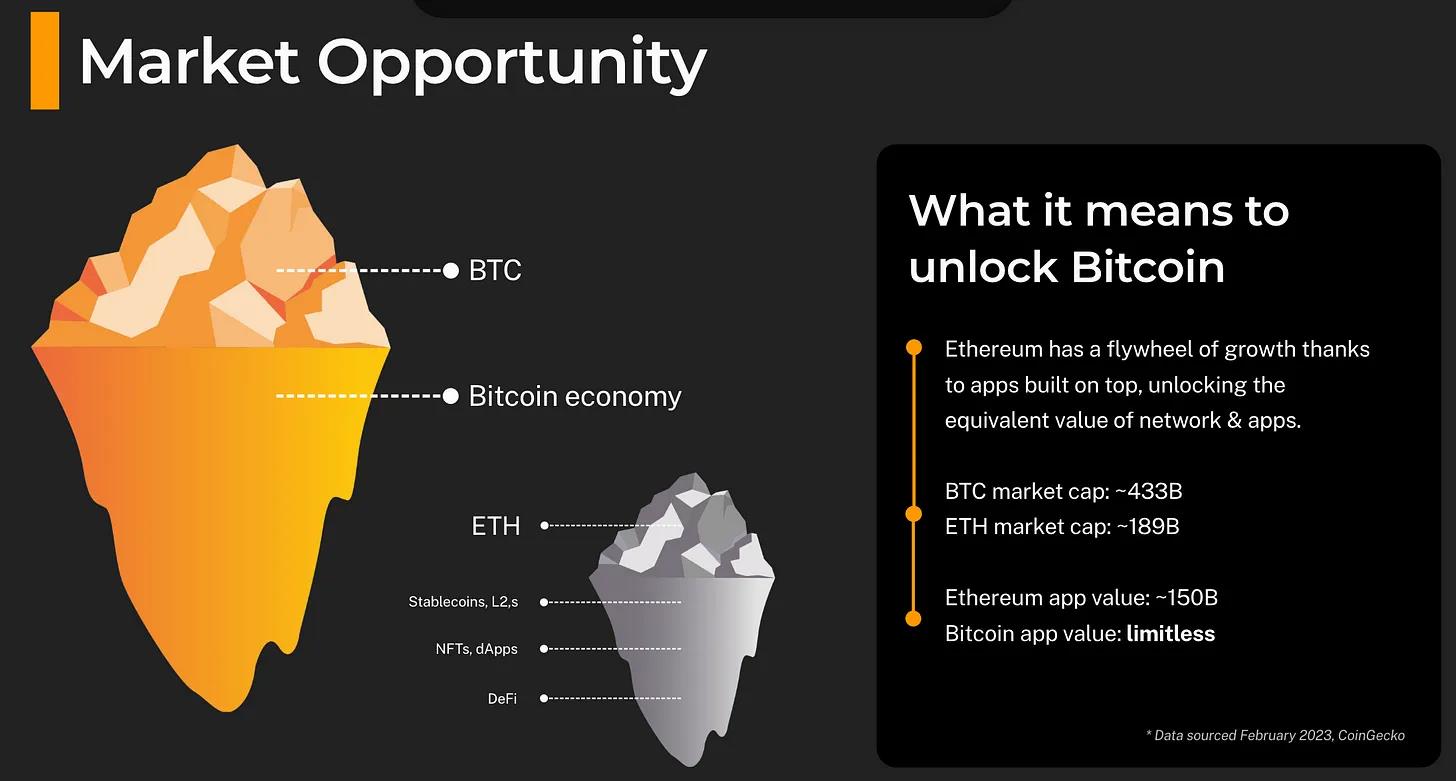

Bitcoin DeFi

This is a completely new narrative that hasn’t yet gained traction even among Ethereum Virtual Machine (EVM) DeFi enthusiasts.

I’m optimistic about the potential of Ordinals and Inscriptions, but currently they lack the scam tokenomics needed to sustain inflation from newly issued tokens.

For clarity: Bitcoin Ordinals refer to satoshis (sats)—the smallest units of Bitcoin—that have been inscribed with unique data, making individual sats distinct and granting them identities similar to basic non-fungible tokens.

However, I believe this will change. Ordinals and Inscriptions have already demonstrated strong demand for NFTs, fungible tokens, and DeFi within the Bitcoin ecosystem. Stacks, with its enhanced functionality and deep Bitcoin integration, is well-positioned to meet this demand.

Stacks is a smart contract layer built on Bitcoin, where DeFi apps execute on Stacks and settle on Bitcoin. Stacks is preparing for a major rollout of sBTC.

sBTC is a decentralized Bitcoin peg system enabling seamless Bitcoin transfers between Bitcoin and Stacks. Bitcoin sent to Stacks becomes sBTC at a 1:1 ratio. Converting back to Bitcoin involves trust assumptions, making it minimally trusted—not fully trustless. Unlike wBTC or RBTC, sBTC avoids centralized custodians by using an open network of users, enhancing Bitcoin liquidity for DeFi and NFTs on Stacks.

I’m bullish on Stacks because Bitcoin will soon flow into its ecosystem, and currently there aren’t many places to deploy Bitcoin. This is good—capital and attention will concentrate on the first few applications to launch.

One of them is Alex. ALEX is steadily expanding its lead in the Stacks DeFi space, focusing on Bitcoin-settled crypto trading and lending. At its core is an AMM protocol powering its issuance platform and order book. It’s also building a BSC/Ethereum USDT bridge on the Stacks Chain.

Importantly, Alex has also launched an on-chain BRC20 token indexer (wrapper), allowing you to trade BRC20 tokens on Stacks and attach any scam tokenomics you desire.

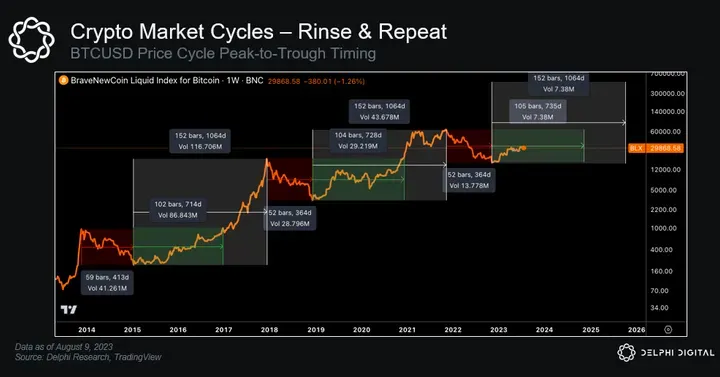

When Will the Bull Market Arrive?

The two narratives mentioned above stand out due to their ability to issue new tokens while managing inflation, driven by compelling stories (Bitcoin shared security and DeFi) and innovative tokenomics.

That said, new capital inflows are crucial for sustainability and bubble longevity. Currently, narratives emerge and fade due to lack of fresh capital. However, I believe these specific narratives have the potential to attract external capital into the broader crypto market—especially buyers purchasing ETH for restaking and Bitcoin for Bitcoin DeFi narratives.

But remember, both narratives will eventually collapse. Too many tokens will be minted to keep up with demand and attention. Don’t blindly believe the stories they sell you—so plan your exit strategy before it’s too late.

Timing is key, and macro conditions remain the most critical factor—and those are improving. For the past few years, we’ve been hit by three major forces: the Fed’s liquidity cycle, war, and new government policies. Recently, however, we’re seeing a shift: regulatory crackdowns are slowing, China is entering deflation, and inflation and interest rates appear to have peaked.

If we trust the crypto cycle, we expect Bitcoin to reach a $69,000 ATH by Q4 2024, followed by a wild bull run peaking at a new ATH by Q4 2025.

If true, these two money-printing Ponzi-like phases will begin before the new ATH. Now is the time to study and learn, because when the fun starts, we need to be ready.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News