Numbers Tell the Story of Yuga Labs in May: The Darkest Hour for the NFT Leader?

TechFlow Selected TechFlow Selected

Numbers Tell the Story of Yuga Labs in May: The Darkest Hour for the NFT Leader?

NFTGo's ecosystem report on Yuga Labs, including data tracking for all collections, holder trading activities, whale profit alpha, BAYC pricing strategy, RSI trading signals, and Apecoin analysis.

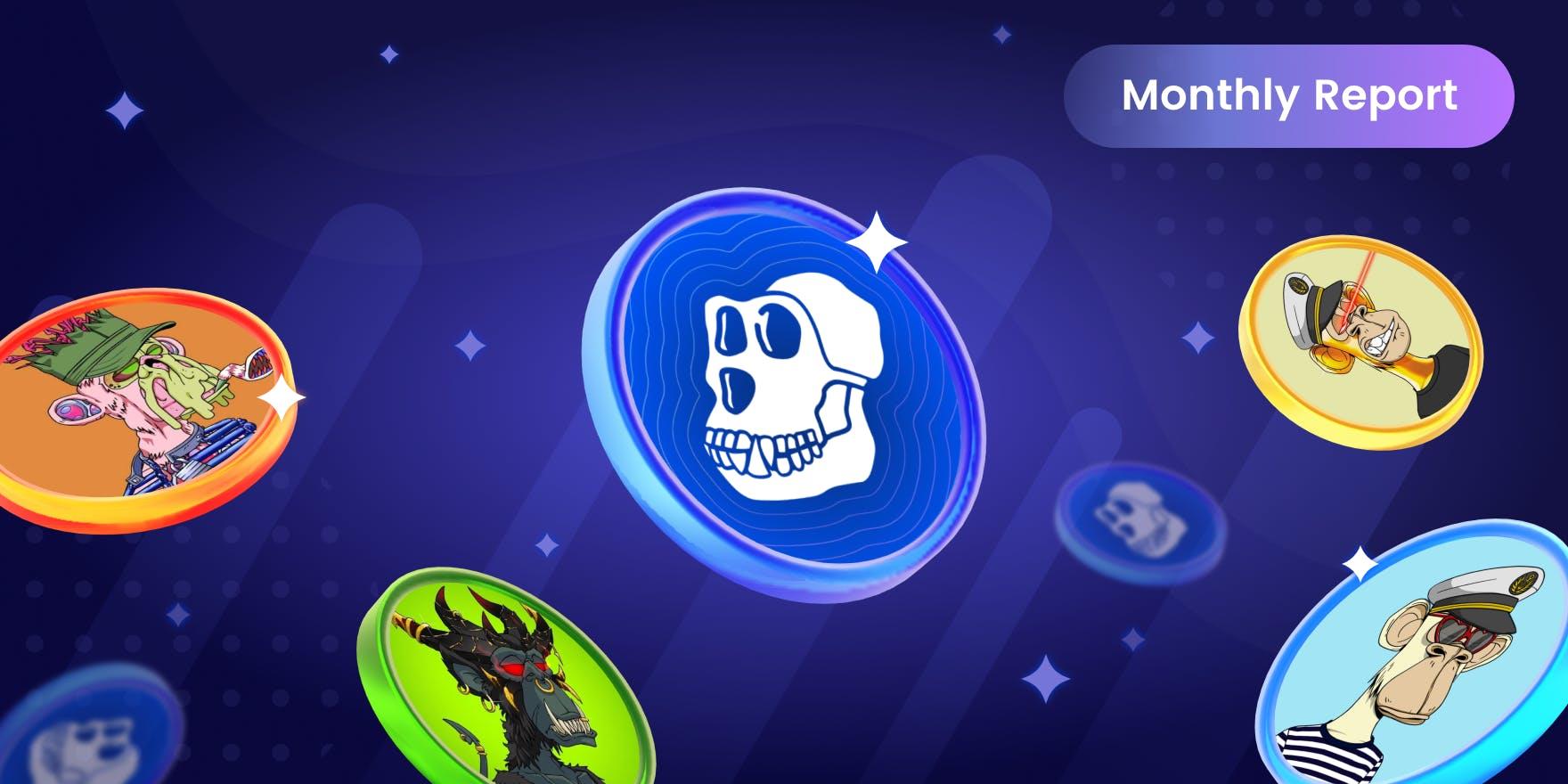

Over the past month, prices for Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Otherdeed for Otherside have dropped to their lowest levels of the year. On May 10, prices hit rock bottom, prompting a large number of traders to enter the market. Unexpectedly, among all NFTs created by Yuga Labs, MAYC recorded the highest monthly trading volume at approximately 44,480 ETH.

BAYC Data Performance

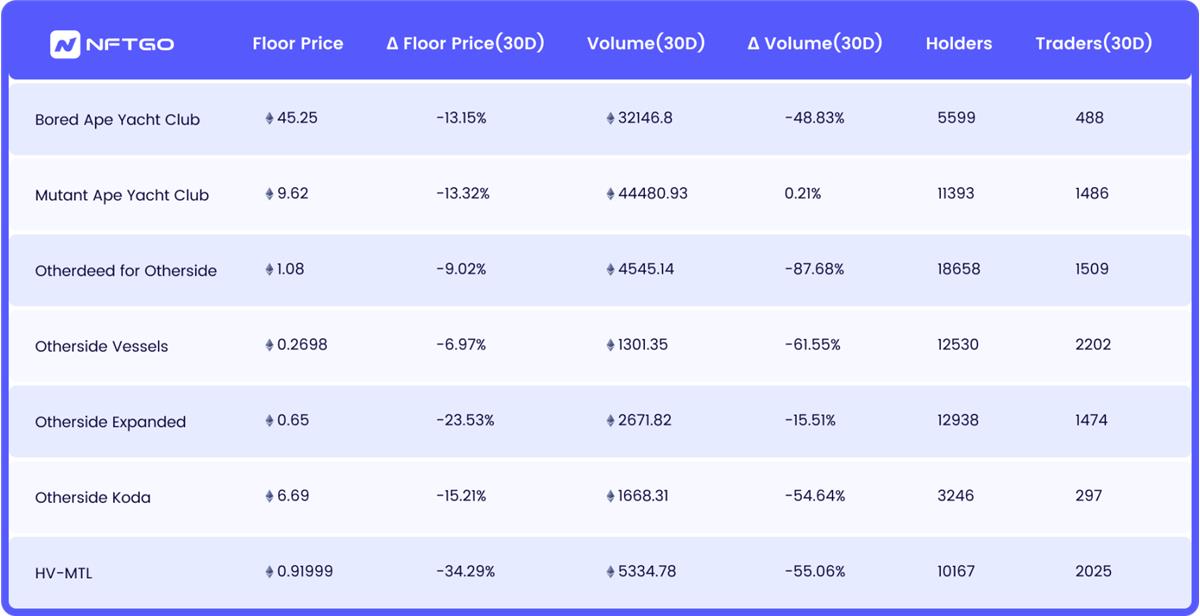

Hit Year-to-Date Low on May 10

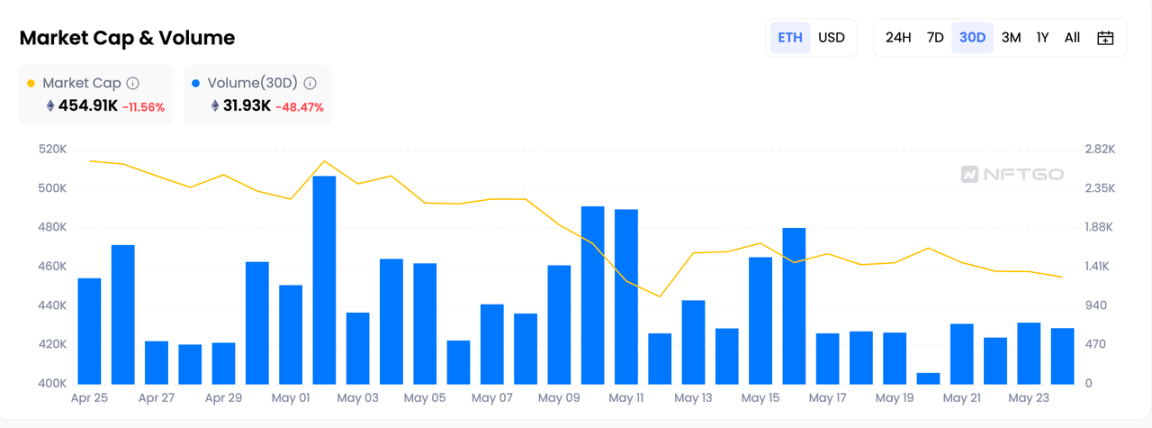

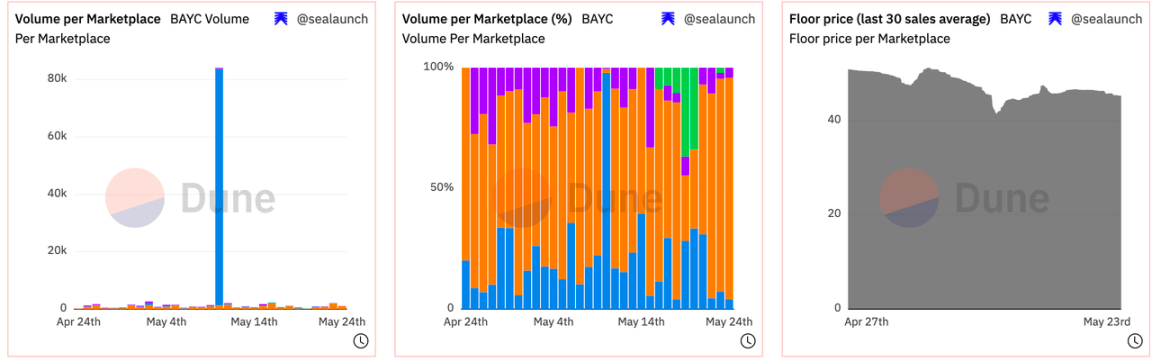

On May 10, BAYC's floor price fell to its lowest point in a year—40.95 ETH. Despite the declining floor price, trading volume on that day was the second-highest of the month, after which BAYC prices began steadily rebounding.

Market Sentiment Influences Trading Volume

Data shows that BAYC’s market cap has been in continuous decline, dropping from 820,000 ETH to 460,000 ETH—a 44% decrease. In broader terms, May’s trading volume was only half of April’s, reflecting an overall market sentiment dominated by meme-driven activity.

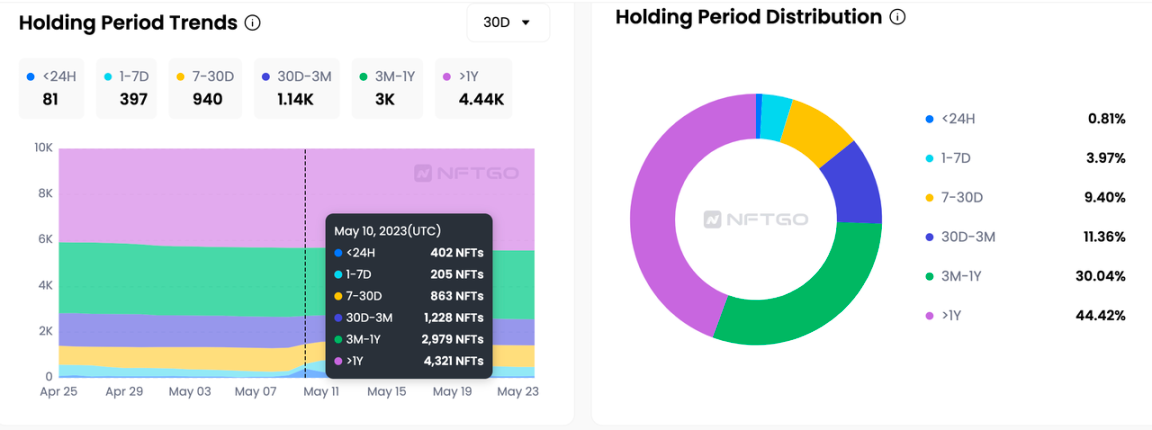

On May 10, there was a slight shift in holder holding periods, with some owners holding their NFTs for less than 24 hours. This suggests potential new users entering the market seeking short-term profits.

Notably, nearly 44.5% of holders have owned their NFTs for over one year, and this percentage continues to grow steadily. Additionally, 10.51% of holders have not sold since minting.

Holder Count Begins to Rebound

According to NFTGo data, the peak trading volume this month occurred on May 2, followed by May 10, averaging around 50 transactions per day, while hitting its lowest point on May 20.

Since last month, the number of BAYC holders had been on a downward trend. However, this trend appeared to reverse on May 10, as the number of holders began increasing again.

Analysis of BAYC Holder Trading Activity

Blur Is the Most Frequently Used Platform by Holders

According to Sealanuch data, over 90% of BAYC trading activity takes place on Blur, while OpenSea currently accounts for only 4.2%.

NFTs Most Purchased by BAYC Holders

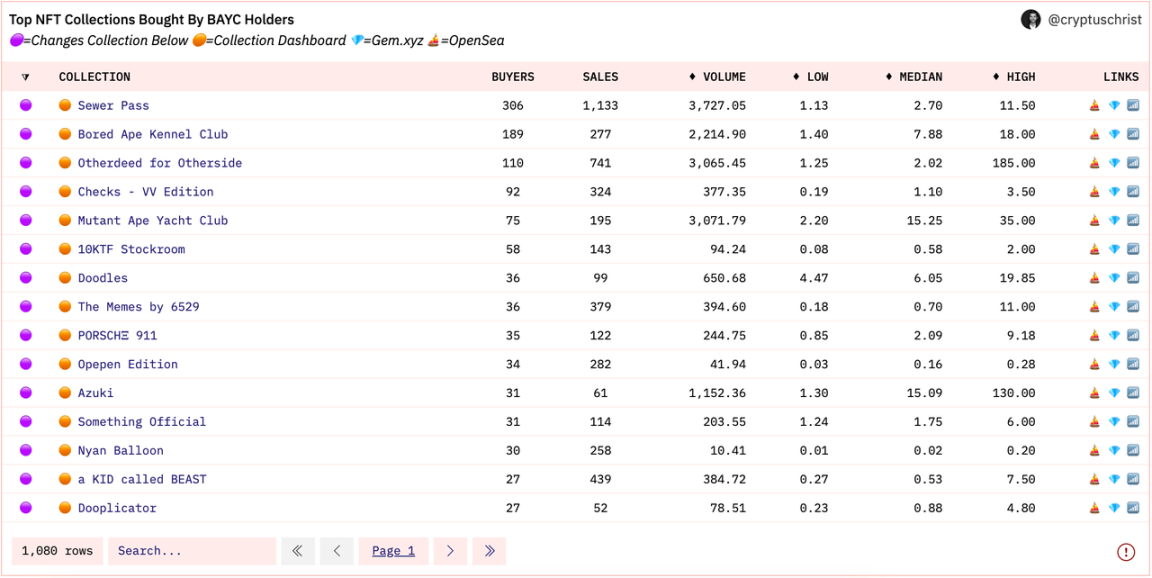

Currently, the top five NFTs held by BAYC holders are Sewer Pass, BAYC, Otherdeed, Checks, and MAYC. Notably, three of these collections belong to Yuga Labs. Additionally, some BAYC holders have invested in other popular NFTs this year, such as the Checks-VV edition and open edition.

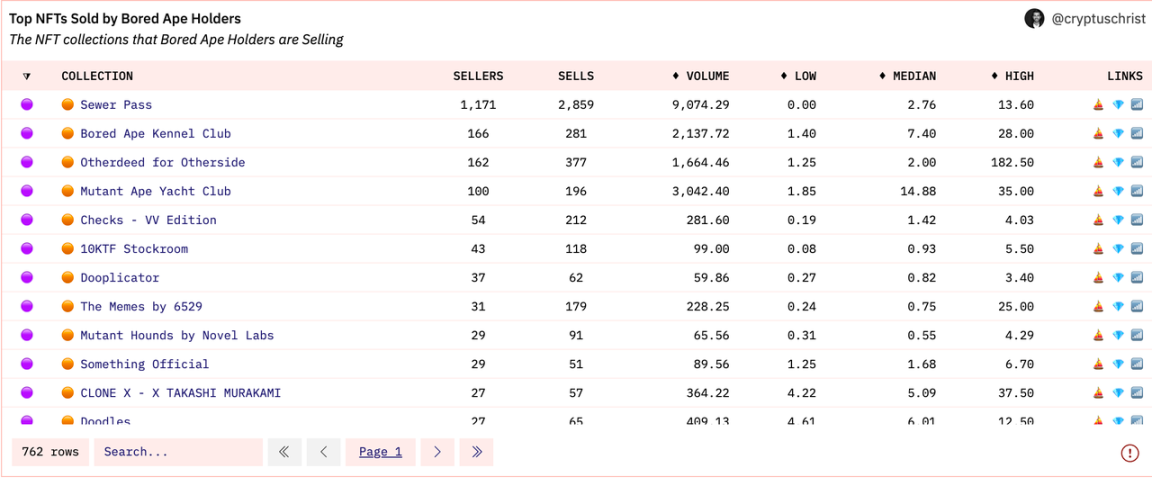

NFTs Most Sold by BAYC Holders

Similarly, the top five NFTs sold by BAYC holders are also Sewer Pass, BAYC, Otherdeed, MAYC, and Checks. Therefore, we can infer that these NFTs exhibit strong liquidity.

Whale Reversal

machibrother.eth has consistently been an active trader in the market, and their recent on-chain activity provides valuable insights for investors. Last month, machibrother.eth was among the most active traders, conducting 89 buys and 106 sells. Analysis of trading trends reveals that May 10 marked the lowest BAYC floor price at just 40 ETH, potentially representing a buying opportunity for interested parties.

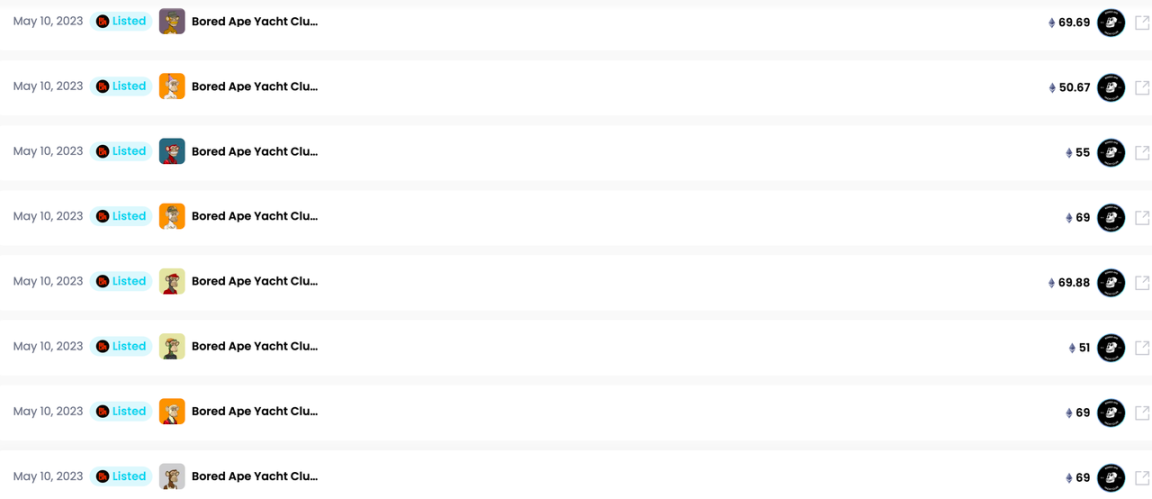

Additionally, on May 10, machibrother listed over ten BAYC and MAYC NFTs on Blur. This move may have been aimed at earning Blur rewards. However, it is important to consider historical market reversals and trends before making any investment decisions.

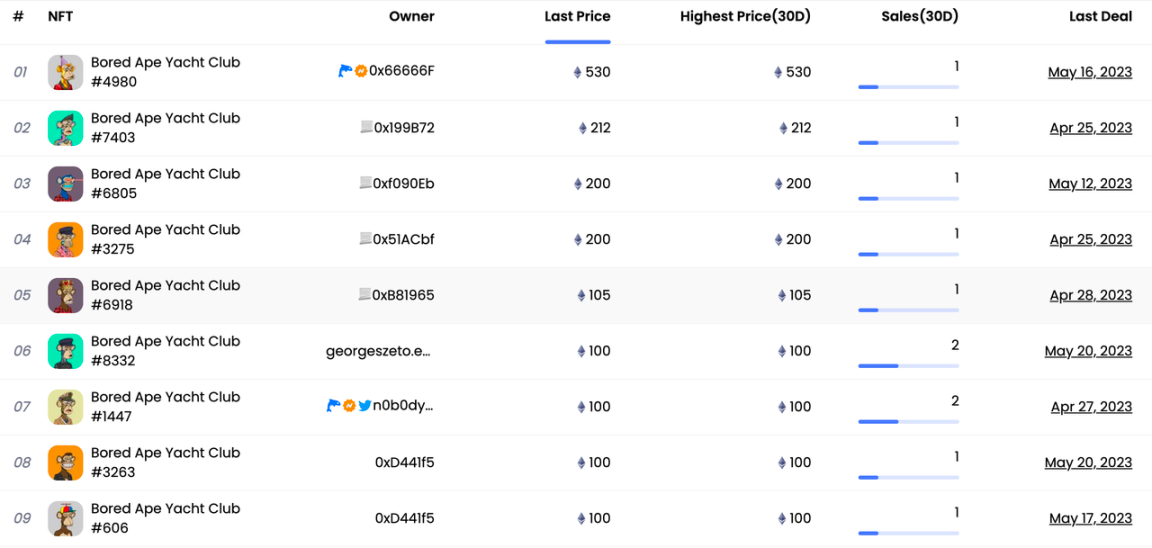

Highest Sale Price

Over the past 30 days, the highest-selling BAYC was #4980, fetching 530 ETH. The owner of this BAYC is 0x66666F, whose portfolio value reaches as high as 743.91 ETH. Aside from #4980, the next highest-sale BAYCs were #7403 and #6805.

Yuga Pricing and Predictions

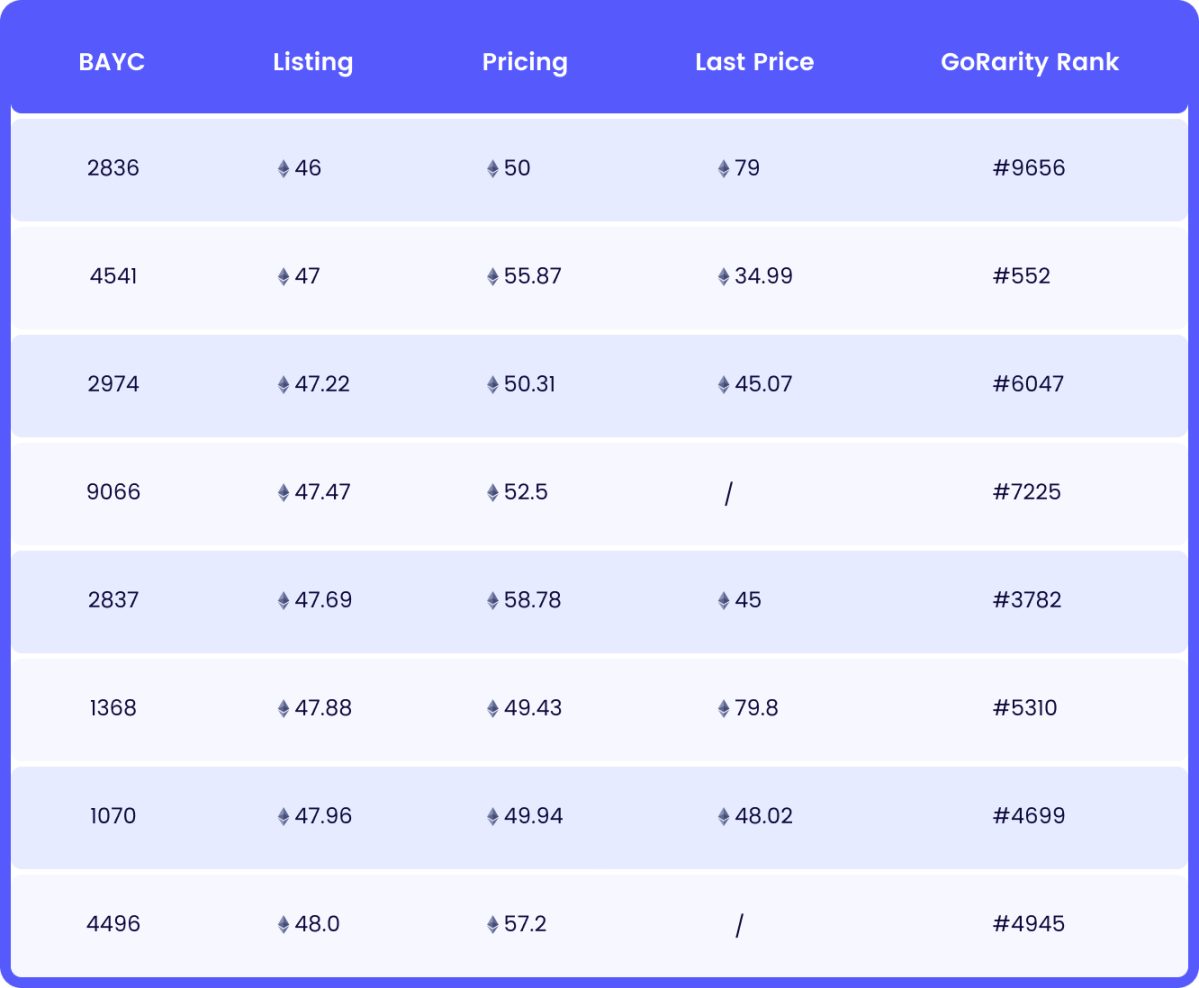

Bored Ape NFT Listings and Prices

NFTGo offers a beta version of its NFT pricing tool covering most mainstream NFTs. If you wish to evaluate more NFTs, you can obtain an API key by filling out this form.

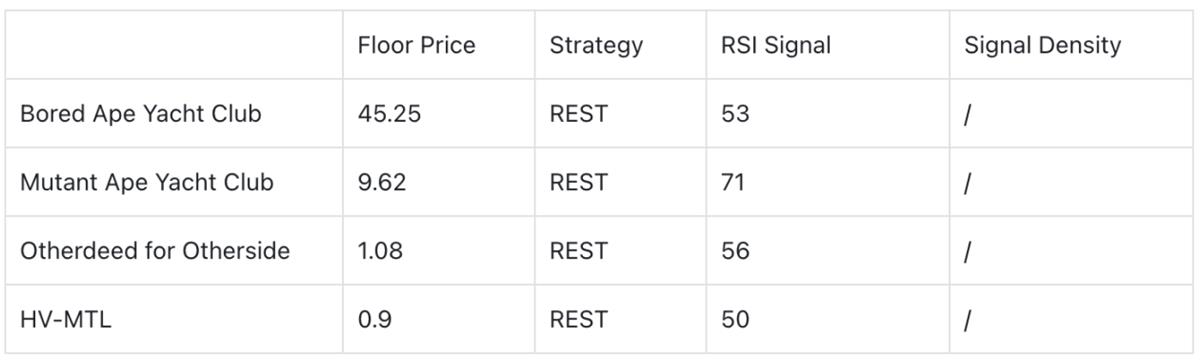

Trading Signals for Yuga NFTs

Possibility of Upswing and Downturn (NFA)

RSI Strategy: Trading signals designed based on the RSI’s buy/sell strength characteristics. Below the volatility range indicates a buy signal, while above the range indicates a sell signal. The greater the deviation, the stronger the signal.

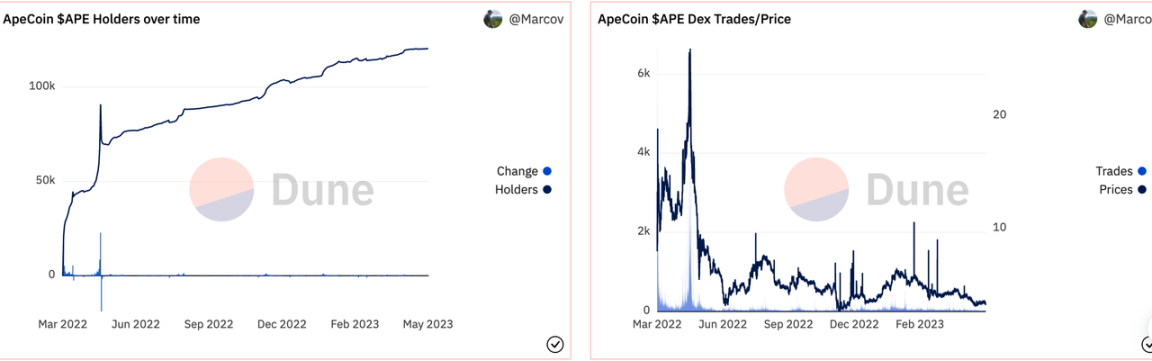

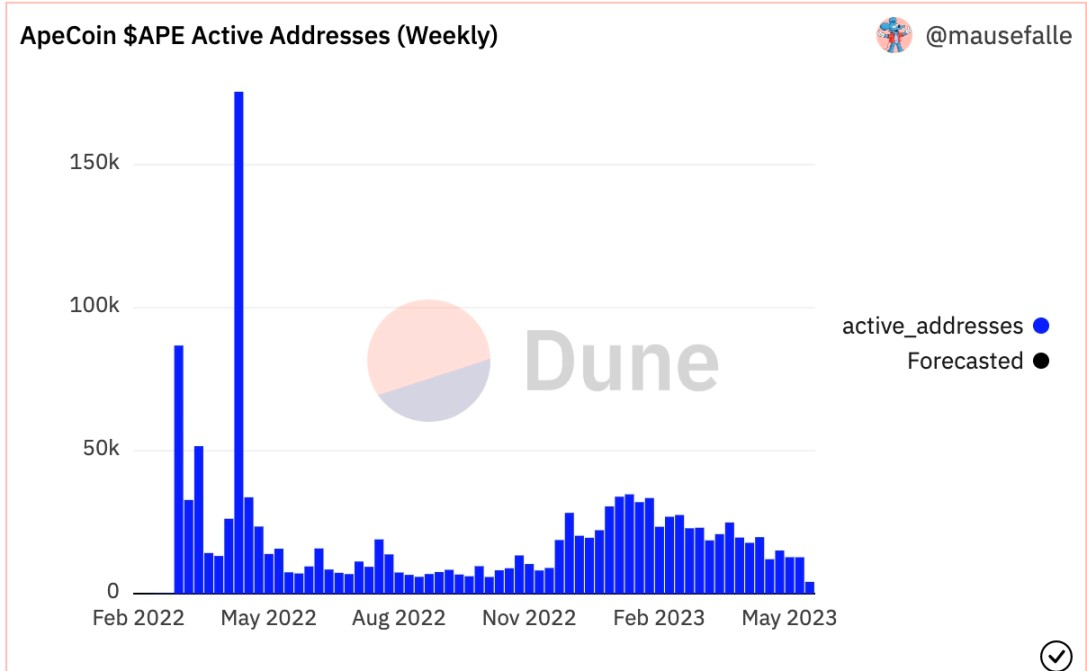

Apecoin Analysis

Currently, $APE is priced at $3.47 (note: approximately $3.1 at time of publication). Its last peak was in February 2023, coinciding with the launch of Otherside’s second trip and Dookey Dash. Despite the cooling market, the number of $APE holders has continued to grow over recent months.

Currently, there are over 120,000 addresses holding $APE. However, since February 2021, the number of active $APE addresses has been declining and is now below 10,000.

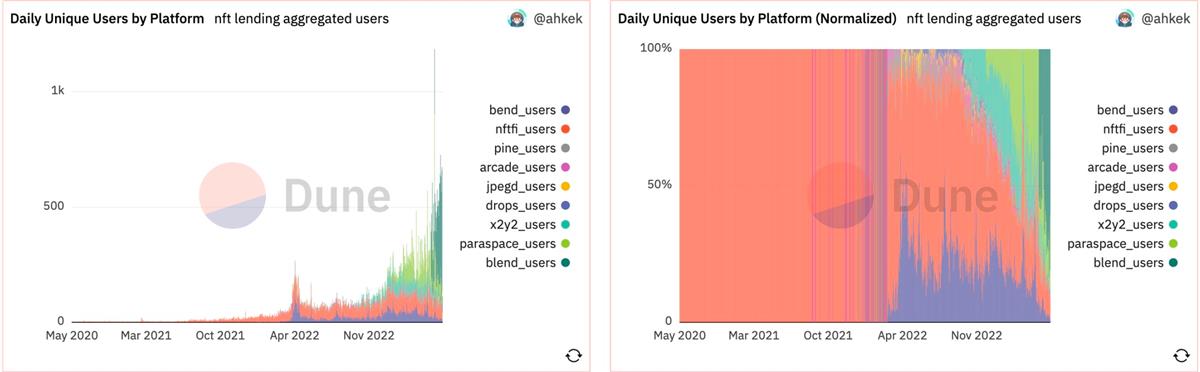

Yuga’s NFTFi Ecosystem

In terms of loan volume and daily users, Blend has become the leading NFT lending platform. To date, Blend sees between 300 and 400 daily active users—equivalent to the combined user base of all other lending platforms.

More than 6,000 apes have been borrowed across these platforms, with 88 liquidated. Among all platforms, MAYC remains the most frequently collateralized NFT.

NFTs and Game Economics

Legends of the Mara offers a complex gameplay mechanism with numerous strategic choices, each leading to different outcomes.

Otherside Vessels

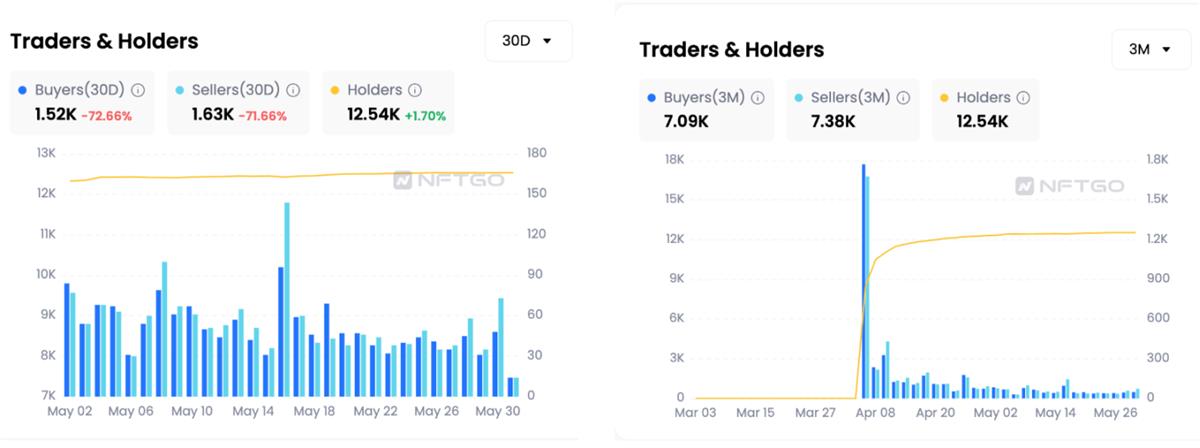

At initial release, the market was seller-dominated, with sales significantly exceeding purchases. However, this trend changed markedly after the first update. Both buying and selling activities dropped by about 70%, indicating a shift from initial hype-driven trading to a more stable and mature market environment.

Despite reduced trading activity, the number of holders saw a modest 1.7% increase. This trend suggests that many loyal fans may be steadily accumulating Vessels NFTs, focusing on strategic aspects of the game.

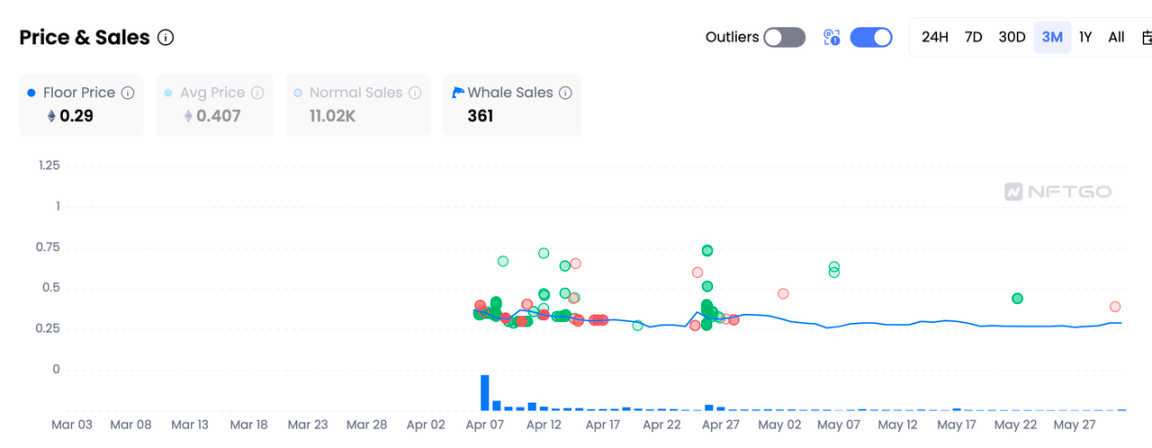

From launch to the second update, Vessels NFT floor prices and average sale prices showed a steady but slightly declining trend. Specifically, the floor price decreased from 0.35 ETH at launch to 0.29 ETH at the second update, while trading volume dropped sharply from 1.37K ETH at launch to 86.15 ETH at the second update. Essentially, these trends indicate that the collection is maturing beyond its initial hype phase.

Otherside Koda

Within the strategic ecosystem of Legends of the Mara, Otherside Koda plays a pivotal role. As primary guardians of Otherside, they excel in farming, spellcasting, and hunting, differentiating them functionally and in value from Vessels.

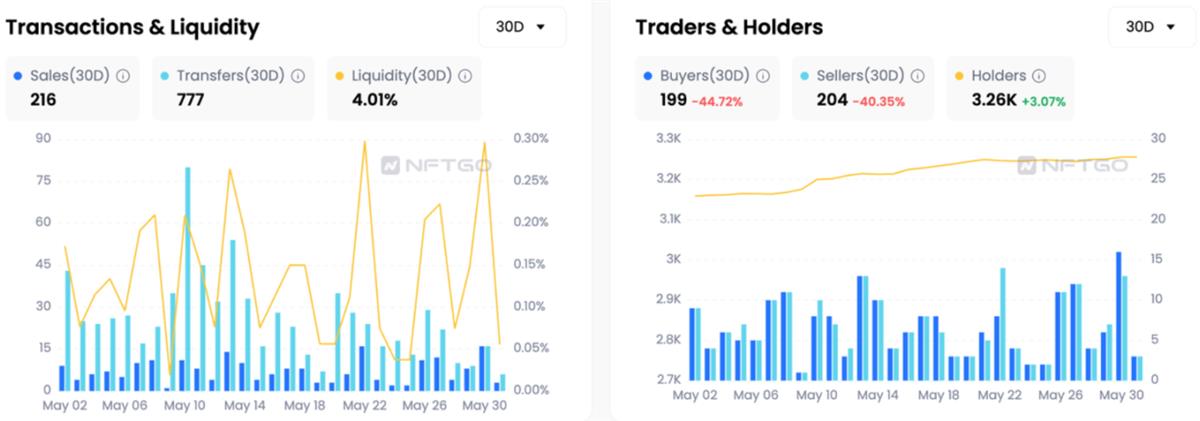

The trading data for Otherside Koda presents an interesting contrast to that of Vessels. Unlike Vessels, Koda’s trading data appears more balanced, with roughly equal demand on both sides. Moreover, Koda holder count increased by 3.07%, a larger growth rate than Vessels. This may be due to enhanced utility of Kodas within the game, attracting either a broader or more dedicated player base.

Both the floor price and average sale price of Koda NFTs have declined, though starting from much higher levels. From an initial floor of 10.48 ETH and average price of 10.85 ETH at launch, they dropped to 6.8 ETH and 7.34 ETH respectively following the second update.

Legends of the Mara holds significant potential in the NFT gaming market. Developers and players alike are striving to balance economic incentives with gameplay enjoyment. Introducing in-game tutorials or comprehensive guides could help new players better understand the game mechanics.

[Disclaimer] The market involves risks; investing requires caution. This article does not constitute investment advice. Readers should consider whether any opinions, viewpoints, or conclusions presented herein are suitable for their specific circumstances. Investment decisions made based on this information are at the user’s own risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News