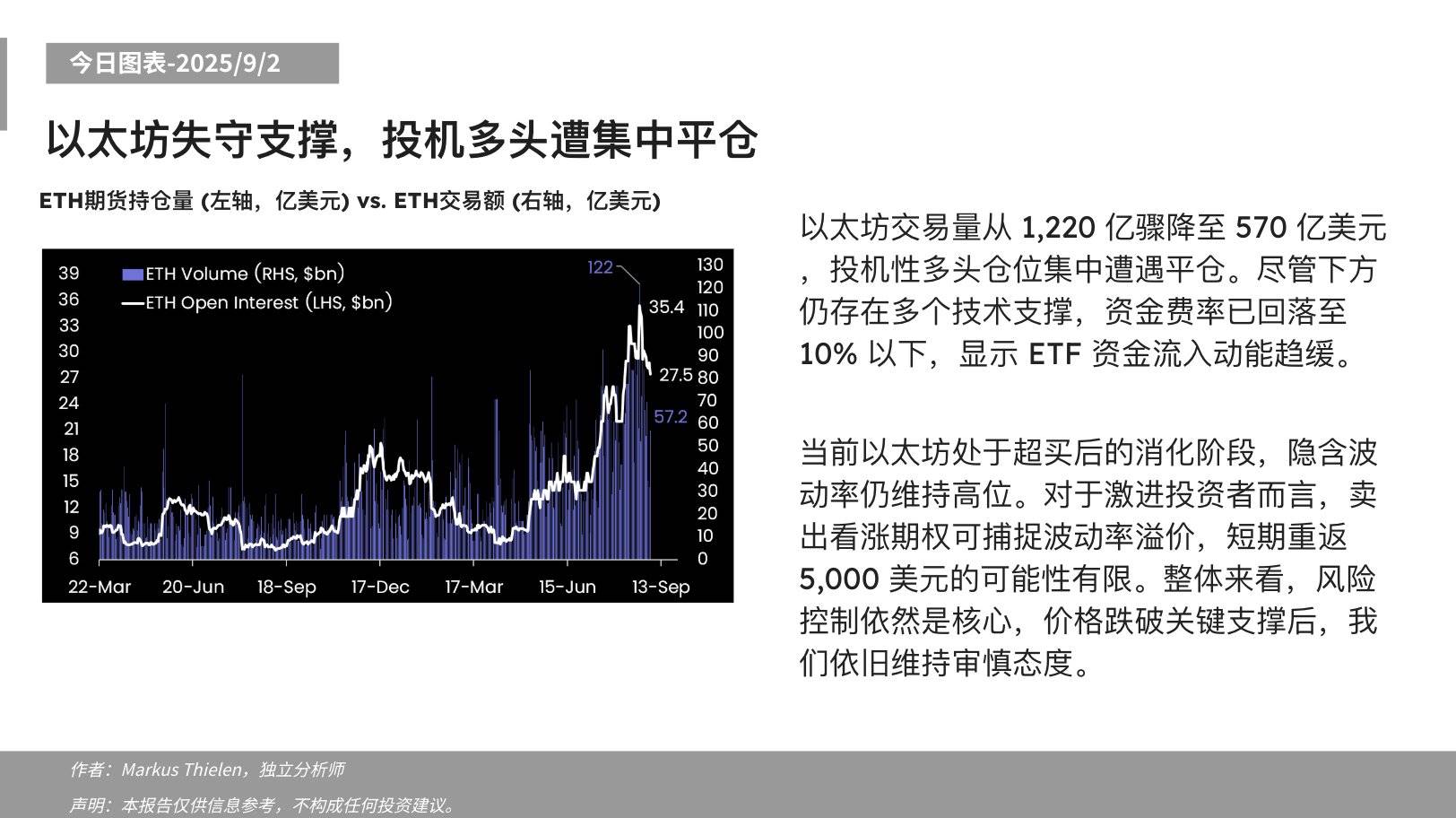

TechFlow, September 2 — Matrixport released a chart today stating, "Ethereum trading volume has sharply dropped from $122 billion to $57 billion, with concentrated speculative long positions being liquidated. Although multiple technical supports remain below, funding rates have fallen back below 10%, indicating weakening momentum in ETF capital inflows.

Currently, Ethereum is in a digestion phase following an overbought condition, with implied volatility remaining high. For aggressive investors, selling call options could capture volatility premium, while a short-term rebound to $5,000 remains unlikely. Overall, risk management remains key, and we maintain a cautious stance after the price broke below critical support levels."