TechFlow reports that on February 11, according to crypto blogger AB Kuai.Dong's analysis of Binance's Proof-of-Reserves data, from January to February 2025, Binance's BTC holdings dropped from 46,896 to 2,747 coins, a decline of 94.1%; ETH holdings decreased from 216,313 to 175 coins, a reduction of 99.9%. It should be noted that these assets primarily consisted of the platform’s historical revenue, not user funds.

Currently, most of these tokens have been reallocated into the stablecoin USDC, whose holdings increased from $805 million to $1.269 billion, up 57.5%. Judging by market conditions in January, prices for most of these tokens were at historical highs.

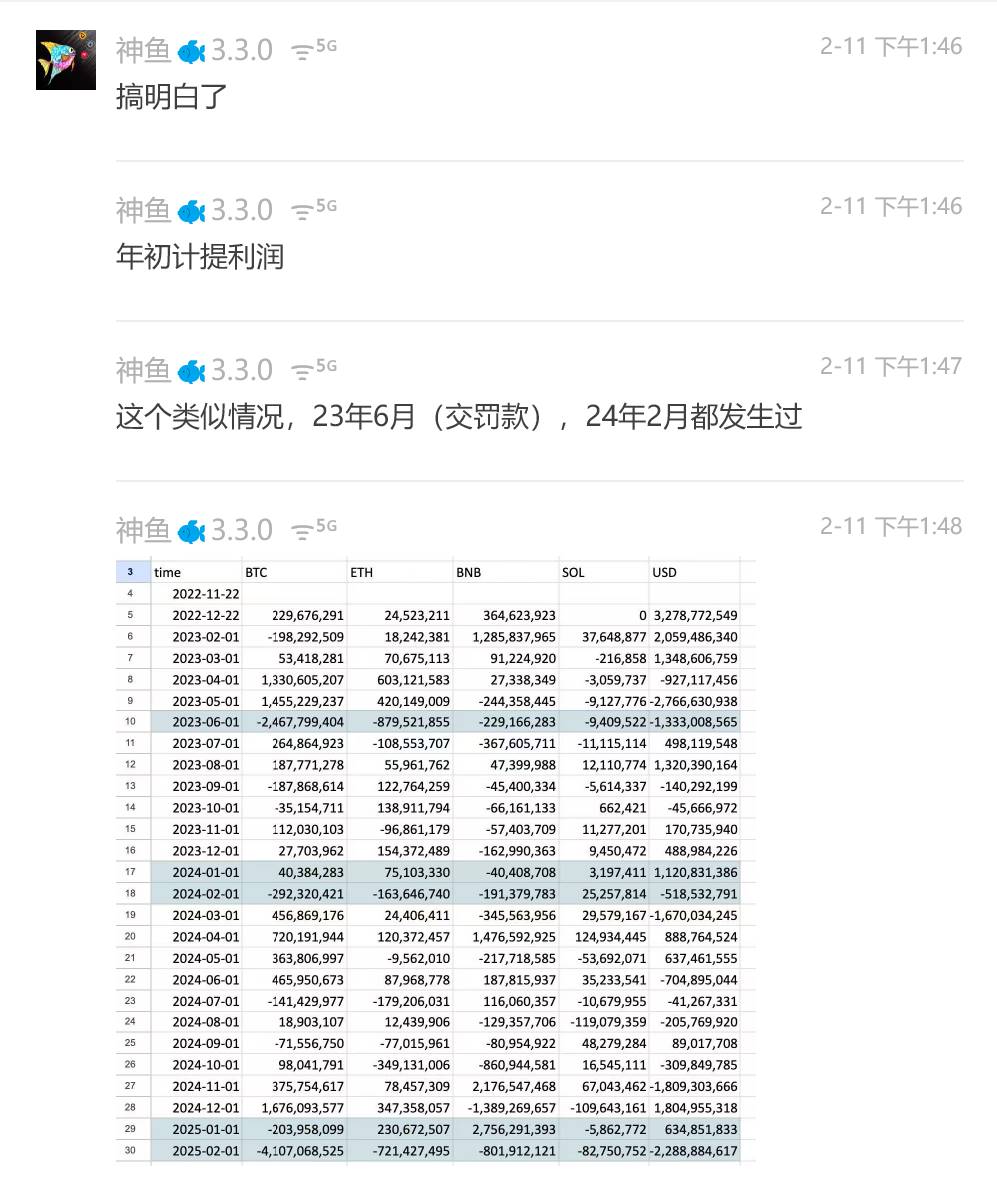

Shen Yu suggests that Binance's large-scale asset reallocation may be related to annual profit withdrawal at the beginning of the year. Historical data shows similar operations occurred in June 2023 (around the time of a fine payment) and February 2024.