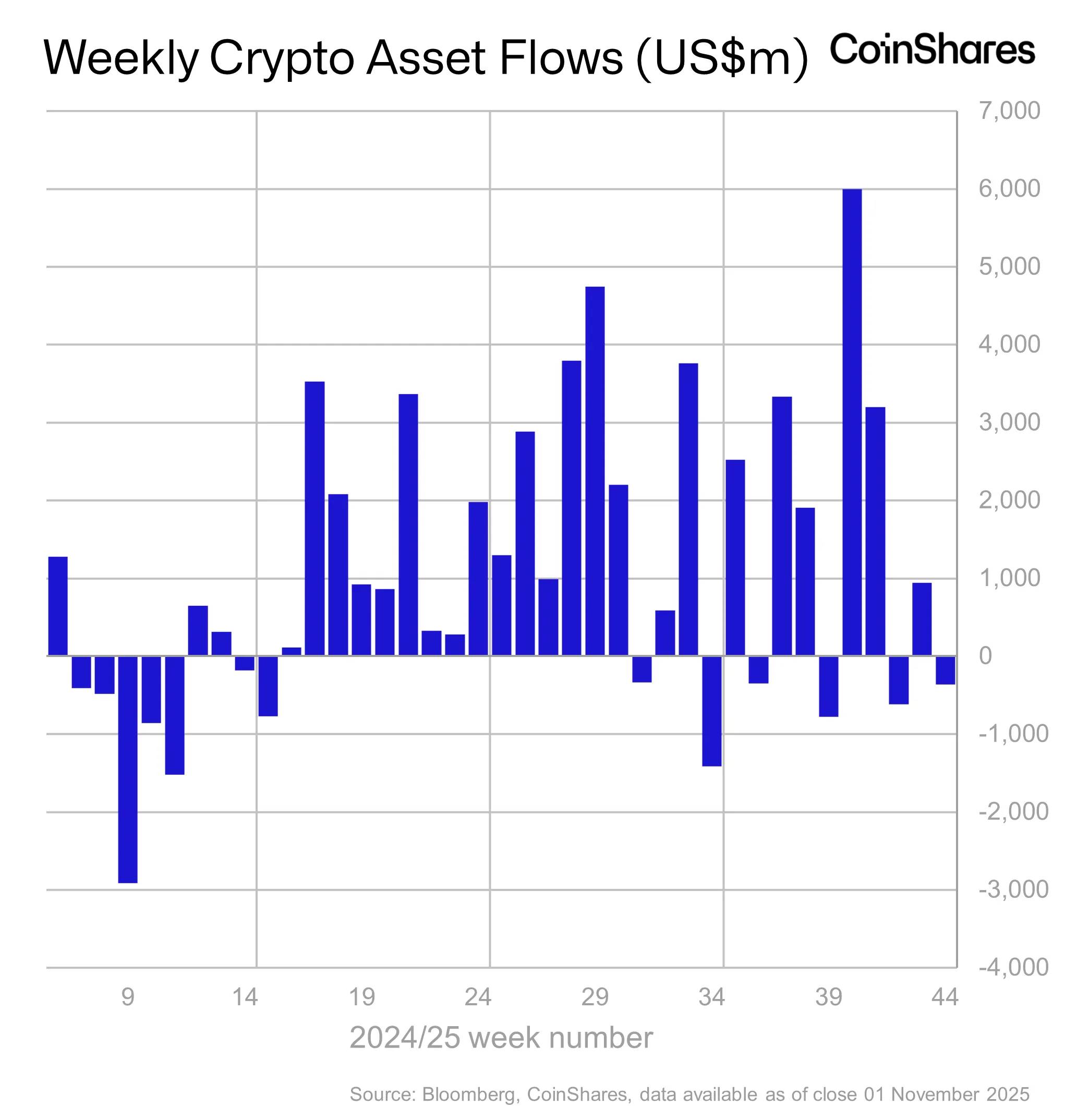

TechFlow news, November 3 — According to a CoinShares report, last week saw a total net outflow of $360 million from digital asset investment products, primarily due to investors interpreting Federal Reserve Chair Powell's comments on a potential December rate cut as hawkish, leading markets into a state of uncertainty.

The U.S. led the outflows with a net outflow of $439 million, while Germany and Switzerland recorded modest net inflows of $32 million and $30.8 million respectively, partially offsetting the U.S. outflows.

Bitcoin experienced outflows amounting to $946 million. In contrast, Solana attracted $421 million in net inflows, marking its second-highest record, driven largely by capital flowing into newly launched U.S. ETFs, bringing its year-to-date net inflows to $3.3 billion. Ethereum also recorded $57.6 million in net inflows.