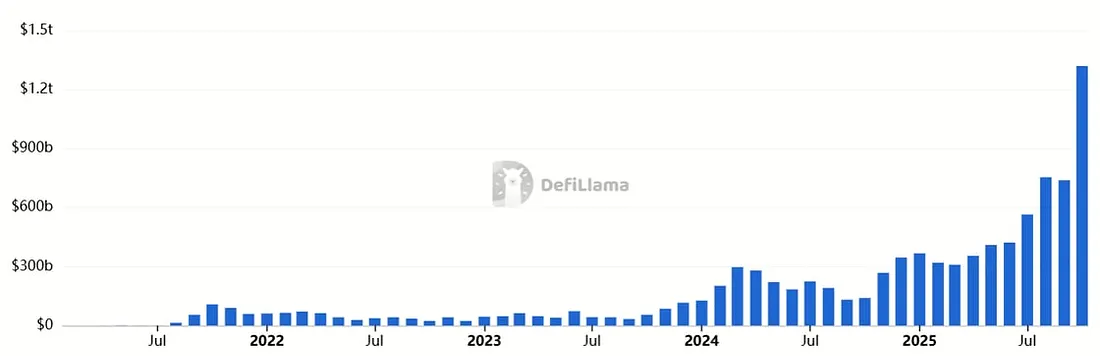

TechFlow news, November 1 — According to a Sentora analysis report and DefiLlama data, monthly trading volume for decentralized cryptocurrency perpetual contracts has surpassed $1 trillion for the first time. The current 30-day rolling trading volume stands at approximately $1.3 trillion, with open interest around $17.9 billion, marking a structural breakthrough in the on-chain derivatives market.

Sentora analysis states that the surge in perpetual contract trading volume is primarily driven by three factors: centralized exchanges tightening risk management, prompting capital migration to on-chain platforms; lower base interest rates increasing collateral value; and improved protocol maturity reducing tail-risk premiums. The analysis highlights that perpetual contracts have become the main vehicle for on-chain leverage, and the transmission effects of macro events on funding rates and open interest will further strengthen.