10.96% burned, price up 38%: JST charts a sustainable deflationary path through protocol-generated real yield

TechFlow Selected TechFlow Selected

10.96% burned, price up 38%: JST charts a sustainable deflationary path through protocol-generated real yield

As the quarterly burn mechanism continues to operate, market expectations of JST’s deflationary nature are continually reinforced, creating an accelerating cycle of rising prices and increasing scarcity.

Facing the sustainability challenge of DeFi’s value model, JST is delivering a clear and forceful answer through a series of real, cash-backed buyback-and-burn actions.

Market data provides the most direct validation: since the first buyback-and-burn was launched on October 21, 2025, JST’s price has followed a steady upward trajectory. Momentum further strengthened after the second large-scale burn was completed on January 15, 2026. As of January 22, 2026, JST reached a high of $0.0458—up 38.2% from its price at the mechanism’s inception, with a 7-day gain of 13.55% and a 24-hour trading volume climbing to $43 million. This sustained and pronounced price performance is a direct market response to the fundamental restructuring of JST’s underlying value logic—transforming it from a governance token into a scarce asset driven by genuine protocol revenue.

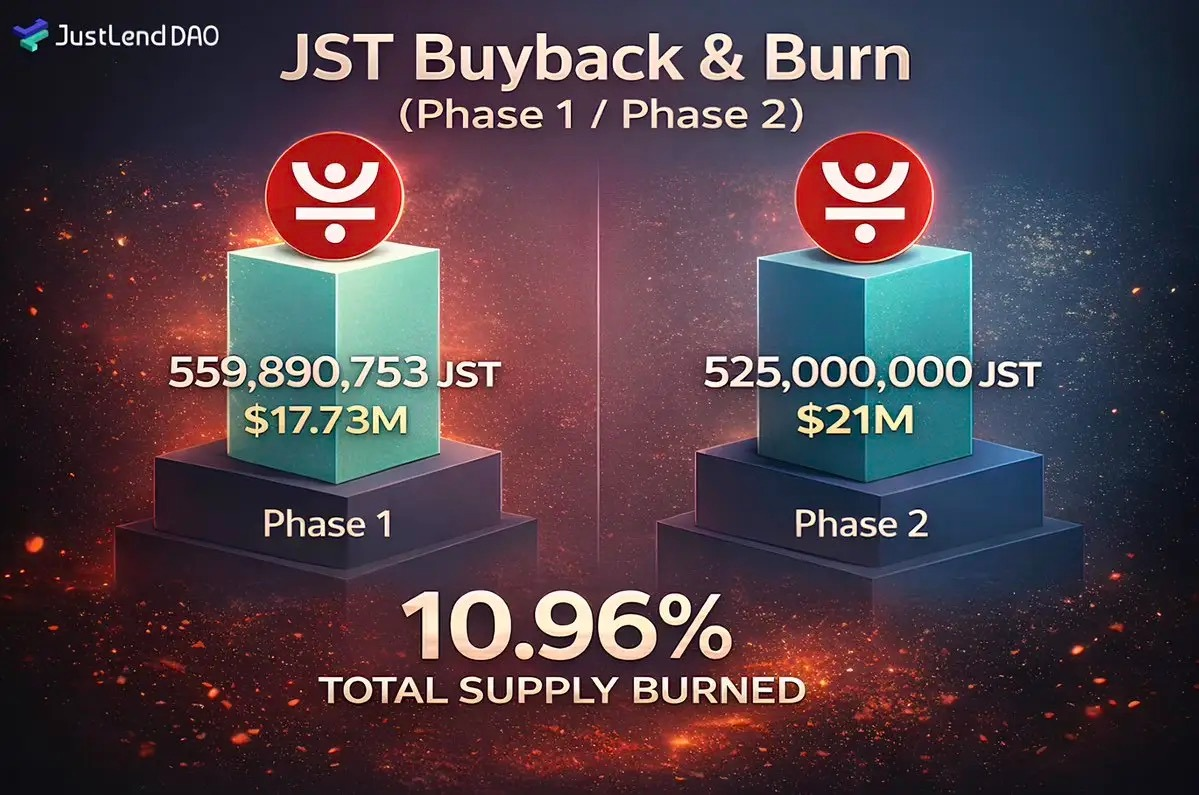

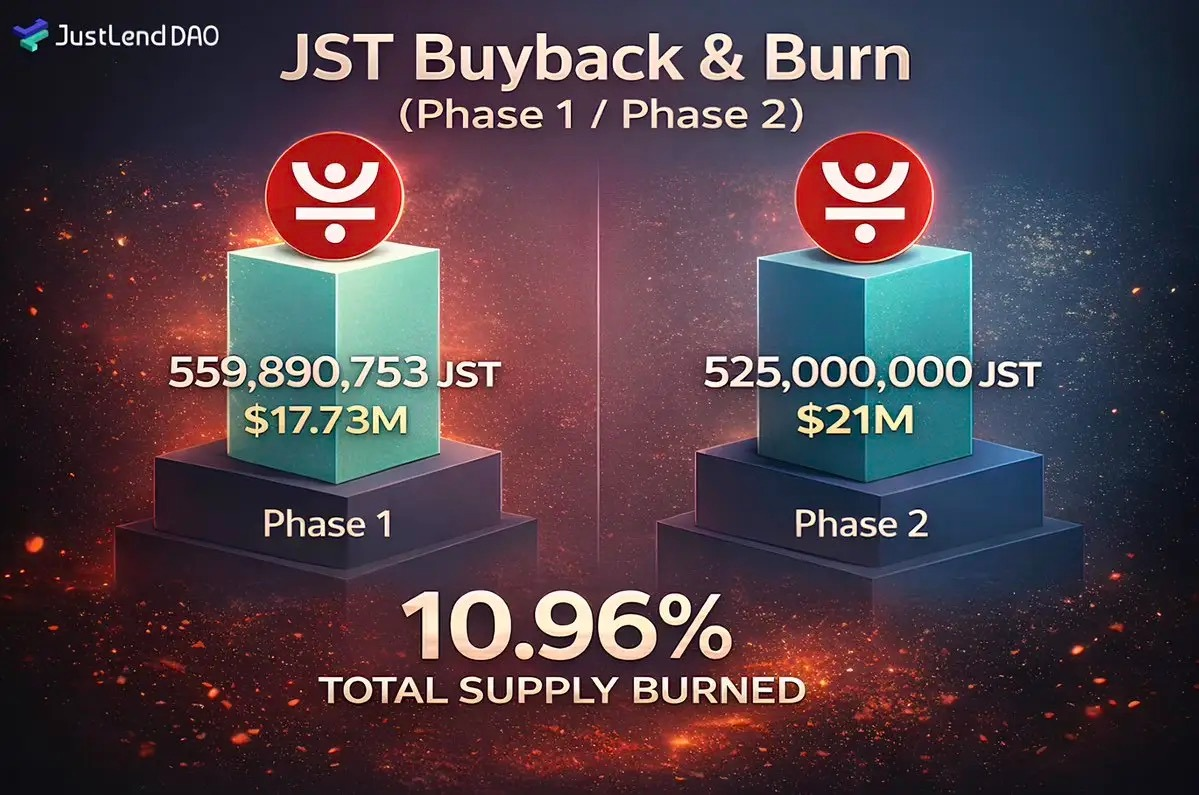

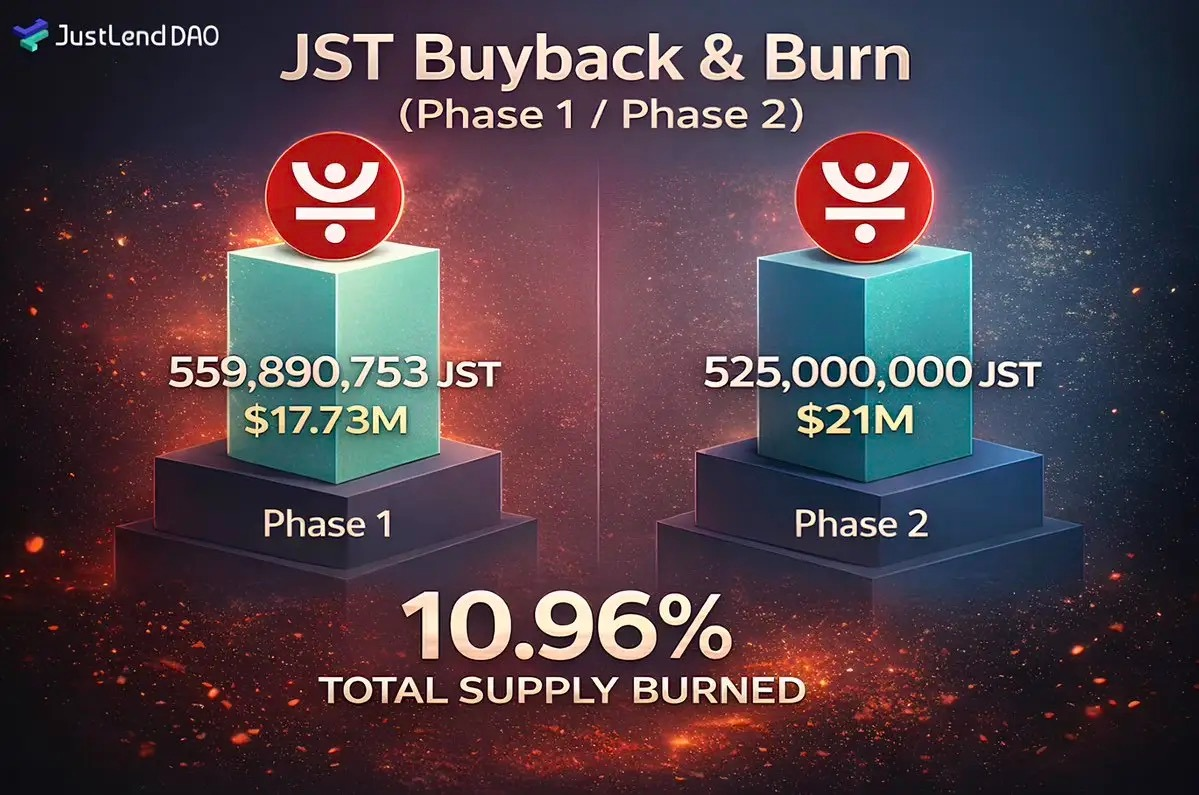

This value redefinition is underpinned by two robust buyback-and-burn actions executed by the JUST ecosystem. The first burn removed 560 million JST tokens—5.66% of the total supply. The second burned 525 million JST, representing 5.3% of the total token supply. Cumulatively, JST’s total burned supply now accounts for 10.96% of its initial issuance, significantly accelerating its deflationary trajectory.

The core driver behind all this is Proposal #37 of JustLend DAO—a finely tuned “economic gear” that converts core protocol profits within the JUST ecosystem into continuous market-driven JST buybacks. It directly ties token value to the financial health of the ecosystem. This is analogous to a publicly listed company systematically using quarterly profits to repurchase and retire its own shares—directly converting operational results into enhanced shareholder value. JST’s steadily rising price curve reflects the market’s positive endorsement of this mechanism—and of the virtuous “value generation → value return” cycle it represents. It signals that a token economic model grounded in real revenue, transparent execution, and long-term sustainability is now operating at full speed within the JST ecosystem.

JST Deflation Milestone: From Proposal to Sustainable Deflation in Practice

The fourth quarter of 2025 marked a pivotal turning point in JST’s foundational value proposition. At the heart of this transformation lies JustLend DAO’s Proposal #37, which passed with overwhelming community support on October 21. This landmark proposal established an innovative value-return mechanism: net income generated by the JustLend DAO protocol—and excess revenue from the USDD multichain ecosystem—would be continuously used to buy back JST on the open market and permanently burn it. This marks JST’s formal transition—from a utility token primarily focused on governance—to a “value token” backed by real cash flow.

Subsequently, JustLend DAO initiated its first round of buyback-and-burn per the pre-defined schedule, deploying 30% of accumulated earnings to permanently remove 559,890,753 JST tokens from circulation—approximately 5.66% of the total supply. The remaining 70% of accumulated earnings were deposited into JustLend DAO’s SBM USDT money market to generate yield. This “seed capital” and its future returns are earmarked for phased burns over the next four quarters—demonstrating the project’s commitment to long-term, sustainable development.

On January 15, 2026, the JUST ecosystem successfully executed its second large-scale buyback-and-burn: 525 million JST (valued at approximately $21 million) were permanently removed from circulation, representing 5.3% of the total supply. Funding for this burn came from two sources: $10.19 million in net income generated during Q4 operations, and $10.34 million in carried-forward income.

Within less than one quarter, JST’s cumulative burn has exceeded 10.96% of its total supply. This figure is more than just a milestone—it clearly charts an accelerating deflationary path, sending a strong market signal that JST’s scarcity narrative has entered a stage of tangible, real-world fulfillment.

At the price level, the market has responded positively to JST’s value-logic overhaul. Since the completion of its first burn, JST’s price has entered a steady upward channel. According to CoinMarketCap data, one week after the first burn, its price rose approximately 4.62%; one month later, the gain expanded to 13.04%. Prices continued climbing thereafter, reaching a near-term high of ~$0.0458 on January 22, 2026—up over 38.2% from the price at the time of the first burn. This reflects not only deep market confidence in JST’s buyback-and-burn mechanism but also signals investors’ ongoing revaluation of JST—from a single-purpose governance token to a “scarce asset” underpinned by predictable cash flows and a firm deflationary outlook.

From governance proposal to economic model design, to reserve-funded burn initiation, to protocol-generated income powering the second large-scale execution, JST completed a full value leap—from theory to practice, from launch to self-reinforcement—during Q4 2025. This has laid a credible and robust operational foundation for its long-term scarcity narrative.

Performance-Driven: Real Revenue Forging JST’s Value Bedrock

JST’s two large-scale buyback-and-burn events in Q4 2025 were fundamentally powered by JustLend DAO’s solid operational performance and strategic execution. The protocol not only demonstrates consistent revenue-generating capacity but has also built a resilient financial system capable of self-funding and strategic reserves.

Specifically, JustLend DAO’s Q4 2025 performance can be summarized as “stable core, breakthrough innovation”—with its key contribution being the establishment of a diversified and healthy revenue structure.

First, as the ecosystem’s core lending market, JustLend DAO maintained its Total Value Locked (TVL) above $7 billion, consistently ranking among the world’s top-tier lending protocols—providing a stable, predictable revenue base.

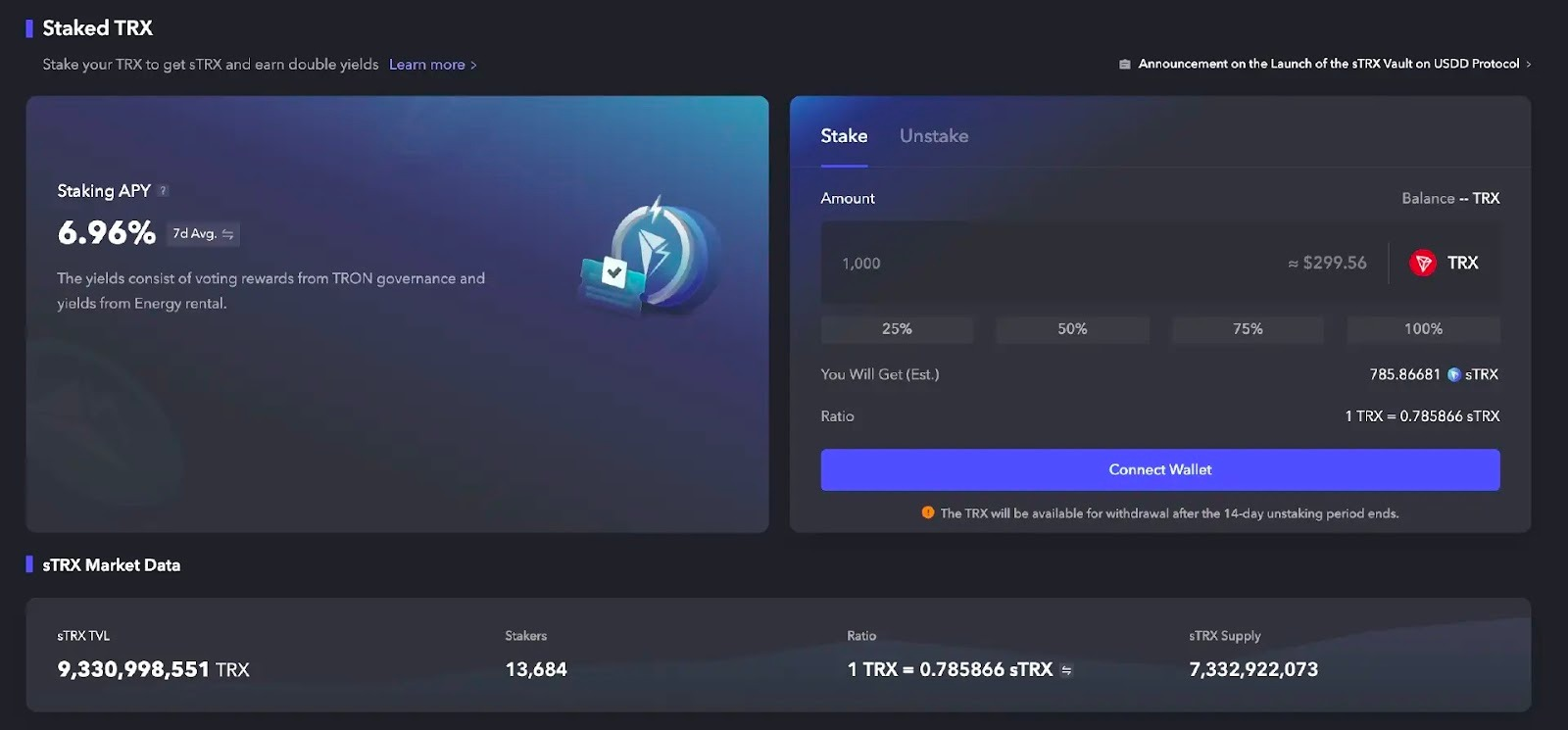

Second, the protocol broadened its value-capture boundaries through product innovation. Notably, the sTRX service offers an elegant solution to the inherent tension between staking rights and asset liquidity. It allows users to convert staked TRX into tradable sTRX tokens, enabling them to continue earning native TRX staking rewards while simultaneously deploying sTRX as liquid capital—seamlessly participating in JustLend DAO’s lending markets or providing liquidity on SUN.io, among other DeFi use cases.

This mechanism is, in essence, a revolutionary upgrade to users’ capital efficiency—transforming “idle” staked assets into “productive” circulating capital. As of January 22, 2026, TRX staking volume exceeded 9.3 billion tokens, with an annualized staking yield holding steady around 6.96%. This not only locks in massive core assets for the protocol—building a deep moat—but also generates steadily growing cash flow via associated service fees.

Another key innovation—the “Energy Leasing” service—focuses on lowering on-chain interaction barriers for everyday users, directly stimulating ecosystem activity through market strategy. In September 2025, the service underwent a critical strategic fee adjustment, slashing its base service fee from 15% down to a far more competitive 8%. This “price-for-volume” strategy quickly ignited demand, making smaller-value, higher-frequency on-chain interactions economically viable. The fee optimization directly drove significant increases in transaction frequency and overall leasing volume—ultimately generating substantial incremental revenue atop a much larger business base.

Together, these two innovations form a reinforcing loop: sTRX attracts and anchors core assets, boosting ecosystem-wide value; Energy Leasing lowers interaction costs, fueling ecosystem activity and transaction volume. Complementary and synergistic, they not only opened new revenue streams but also fundamentally elevated the overall vitality and appeal of the JustLend DAO ecosystem—injecting powerful growth resilience into its financial foundation.

In summary, JustLend DAO’s Q4 2025 contributions extend far beyond mere financial growth. Through disciplined operations, it achieved two vital proofs: first, the protocol possesses sustained capacity to generate real, diversified revenue; second, that revenue is both able and already committed—per predefined rules—to directly and transparently power JST’s deflationary engine. The first buyback-and-burn served as the mechanism’s “ignition switch”; the second serves as definitive proof of its “sustainability”—providing the essential performance foundation needed to elevate “buyback-and-burn” from a one-off event into a long-term, reliably anticipated value cycle.

Ecosystem Synergy: Expanding JST’s Value-Capture Boundaries

The funding sources for JST’s buyback-and-burn mechanism reflect its open, forward-looking design. Beyond JustLend DAO’s protocol revenue, incremental earnings from the USDD multichain ecosystem constitute another critical—and often overlooked—value channel. Per the mechanism’s design, once USDD ecosystem revenue covers mining subsidies and excess profits exceed the $10 million threshold, JST buybacks and burns are triggered. This expands JST’s buyback-and-burn mechanism beyond the confines of a single protocol—and deeply couples it with the growth and profitability of TRON’s core decentralized stablecoin ecosystem.

As TRON’s core decentralized stablecoin, USDD’s multichain expansion strategy has delivered notable success. By deploying successfully on major public blockchains—including Ethereum and BNB Chain—USDD has effectively broadened its application scope and user reach. USDD’s Total Value Locked (TVL) and total supply continue rising steadily: as of January 22, 2026, its TVL surpassed $1.3 billion—a >100% increase in under two months—while its total supply likewise crossed the $1.1 billion mark. This rapid growth rate and deepening market adoption vividly reflect the stablecoin’s swift acceptance and asset appeal across multichain environments.

USDD’s rapid expansion directly enhances its potential contribution to JST’s buyback-and-burn program. As the USDD ecosystem continues flourishing, this external value channel will provide increasingly substantial—and predictable—funding for JST’s future quarterly burns, further strengthening JST’s value foundation.

The closed-loop value design within the JUST ecosystem establishes a collaborative, multi-party reinforcing cycle. JustLend DAO functions as the core revenue-generation engine: its business growth directly powers JST’s buyback-and-burn. Meanwhile, the USDD multichain ecosystem acts as a critical external value input channel: its expansion-driven surplus revenue supplies additional, scalable fuel for JST’s deflation. Simultaneously, JST’s increasing scarcity and appreciating value—driven by continuous burns—feeds back into and strengthens the entire TRON DeFi ecosystem’s asset appeal and capital cohesion, attracting more users and assets to JustLend DAO and reinforcing USDD’s use-case expansion.

Within this loop, JST plays the pivotal role of “value hub”—efficiently coupling and transforming two major growth engines: internal protocol operations and external ecosystem expansion. As a result, the ecosystem’s collective prosperity is continuously and verifiably converted into JST’s deterministic deflation and long-term value accumulation.

Notably, to ensure the credibility of the core “buyback-and-burn” value mechanism, JustLend DAO officially launched its dedicated “Transparency” section in Q4. This section serves as an authoritative information hub, publishing—in real time and in structured format—key on-chain data for each buyback-and-burn event, including exact amounts, number of tokens burned, and execution dates. Institutionalizing transparency fundamentally eliminates trust issues arising from information asymmetry—providing the community and external observers with a credible source for evaluating protocol execution.

From a governance perspective, the quarterly burn mechanism is quietly executing a “concentration of power” for JST. As the circulating supply irreversibly shrinks, the governance weight represented by each unburned JST token passively increases. This means long-term holders not only benefit from potential value appreciation due to deflation—but also see their voting power on critical matters—such as JustLend DAO’s future direction—grow in tandem. This tightly binds the most loyal community members to the protocol’s long-term success, forming an exceptionally stable alliance of shared interests.

In summary, JST is undergoing a profound paradigm shift—built upon dual pillars: “multi-protocol value inputs” and “endogenous deflation-driven scarcity.” It is evolving from a functional governance tool into a composite asset characterized by clear cash-flow backing, dynamically intensifying scarcity over time, and deep integration into a vast, thriving ecosystem.

Its buyback-and-burn mechanism is more than just a price-support tool—it is a sophisticated, transparent infrastructure for cross-ecosystem value aggregation and redistribution. This infrastructure has charted a clear, predictable long-term value trajectory for JST, where every periodic burn event becomes a repeated validation—and reinforcement—of its underlying value logic. This marks the arrival of a sustainable, verifiable DeFi value-generation model into a new phase of mature operation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News