Everyone hates cryptocurrency, and we can only blame ourselves

TechFlow Selected TechFlow Selected

Everyone hates cryptocurrency, and we can only blame ourselves

While AI, robotics, and space technology are delivering more real and compelling narratives, cryptocurrency is venturing further down the dead-end path of ATMs.

Author: katexbt.hl

Translation: TechFlow

TechFlow Intro: If Evanss6’s article is about finding a way out within a rational investment framework, then katexbt’s long thread is a raw, unfiltered act of “in-crowd introspection.” He opens with a sharp (and somewhat vulgar) metaphor that cuts straight to the real sentiment shared by many in crypto today: embarrassment, shame, and the repetition of futile mistakes.

As we enter 2026, the crypto industry faces an unprecedented crisis of credibility. Kate points out that external sentiment toward cryptocurrency has shifted from “resistance” to outright “disgust,” while the inner circle has descended into a self-destructive “PVP” mudfight. While AI, robotics, and space technology offer more authentic and exciting narratives, crypto continues its descent down the dead-end alley of ATMs.

The full thread follows:

Tom and John were curious about a new thing called “group activity,” so they organized a gathering with about a dozen friends—mixed gender, though mostly women.

It was their first time—naturally, there was some nervousness. Understandable. They decided to turn off the lights to get started. It would make things easier, reduce performance anxiety.

Time came. Everyone stripped and began.

Bang! Bang! Bang!

A faint sobbing sound echoed in the dark.

“Is everyone okay?” Tom asked, turning the lights back on.

“Fine! Let’s keep going!” John said.

The lights went off again. Bang! Bang! Bang!

Lights back on.

John shouted, “Guys, come on—can you please focus? This is the second time I’ve accidentally ended up servicing Tom!”

If you think this story is just clickbait to trick you into reading further, you’re wrong—it perfectly captures how most people actually feel when participating in cryptocurrency:

- Group activity = shiny new thing (crypto)

- Turning off the lights = slight shame, but not enough to stop you

- Repeated attempts expecting different results = insanity

- Tom getting serviced by John = same outcome, more steps, and leaves you feeling even more humiliated when it’s over.

Over the past two years, nearly all camps have seen growing negative sentiment—even outright hostility—toward crypto enthusiasts.

Yes, crypto has always had haters. But in the past, there were always supporters and staunch defenders saying, “Wait and see, this time is different”—and for a while, they were right. Every four years, that narrative held.

Each wave brought in new “normies” and non-believers into Bitcoin or whatever hot Ponzi scheme was trending:

- 2017: ICOs and shitcoins.

- 2020: DeFi, smart contracts, NFTs, Ethereum/BSC/L1 trading, plus LUNA and Celsius.

- 2023/24: Memecoins, trenches.

Just look at the format and length of those terms—you can already sense that most meaningful action stopped around 2020. And that’s exactly why people don’t like us anymore.

Let’s just list some reasons why people now view crypto with hostility—no particular order:

1. It’s a game for old men

The people who started shilling Bitcoin in their early 20s are now solidly in “certified uncle” territory. As a 40-year-old man, pasting wallet addresses (CA) in chat groups full of kids and feeling superior isn’t heroic—even if you really are profiting off them.

The younger generation seems to care more about physical collectibles, vibes, nostalgia, and memories. They want yearning (Yearn), not earning (Earn).

2. Crypto’s terrible reputation

Even if they wanted to earn, the reasons listed below make it seem almost impossible: Crypto isn’t fun. Even if you’re tech-savvy, one moment of irrationality—one click, one signed approval—can cause irreversible, permanent damage to your net worth.

- Drank too much, clicked an airdrop ad on X, and got drained?

- Downloaded pirated Photoshop six months ago and forgot to delete it? Keylogger stole your private key?

- Too bad. No refunds.

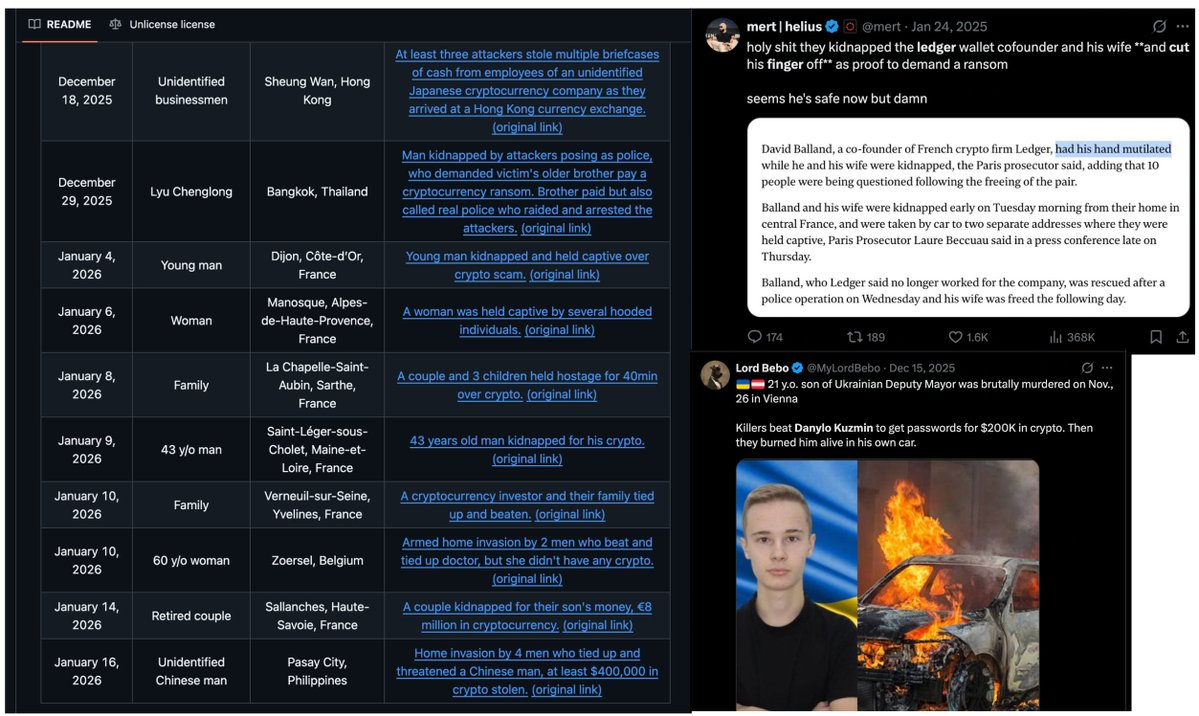

Even if your devices are clean, you could still be caught in a Ledger data breach or have your identity exposed via Celsius’ doxxing. Your name will forever be tied to “internet funny money gambling.” And if you flex even slightly, you risk kidnapping, torture, or simply universal social contempt.

Caption: Look, I’m having so much fun here (sarcastic)

3. Crypto’s terrible reputation – Presidential ATM

With the introduction of tokens like TRUMP, MELANIA, and WLF, the Overton window has shifted. Ironically, all these coins crashed—they became the funeral bell for the previous “AI + Solana” hype cycle.

Caption: Thanks, Obama (meme)

The issue isn’t whether this marks a top, but who did it and what the consequences are. Given that the TRUMP token launched two days before inauguration, and others were created by people “associated but technically not him,” good luck getting your money back.

Before this spectacle, “extraction” had already become the name of the game. We often say crypto is a zero-sum game—for me to gain $50, someone else must lose $50. Many got burned in 2021/22, becoming exit liquidity for savvy “on-chain predators,” then returned in 2023 with revenge—to start extracting themselves.

Herein lies the problem: There’s no pure interest left.

Now, no new speculators are willing to be “extracted” because in 2021/22, joining the “party” was at least positive expected value (+EV), fun, and alive. Today, better alternatives exist.

4. Crypto is no longer the most interesting game in town

- AI

- Vibe Coding (building apps solo in hours instead of leading teams for weeks)

- Robotics

All of these are far more interesting than crypto because we can clearly see their impact. Their stories aren’t just “you’ll get rich because it goes up.” If there’s a bubble now, it’s in AI—not crypto.

This means opportunity lies elsewhere, not in crypto.

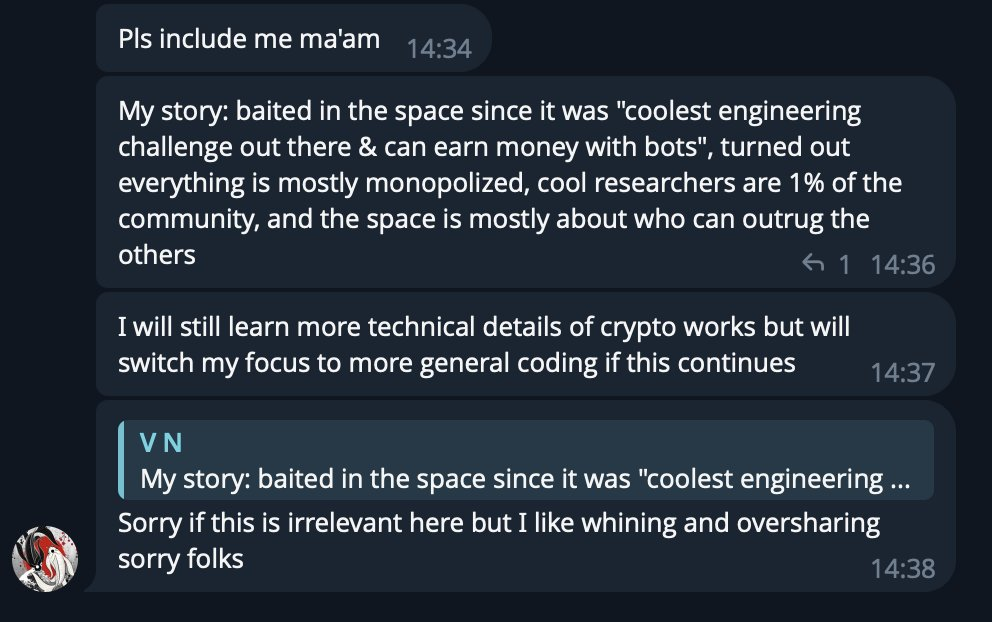

As “a friend on my TG” put it, his origin story (and many others):

The logic here: If you enter with pure intentions, trying to create value and tokenize it, you’ll eventually face a truckload of fools complaining about price (which was designed to drop due to team-biased tokenomics).

So people just chose the brute-force route—they designed systems (varying flavors of Ponzi based on skill level) whose sole purpose was to take money. More direct, more efficient.

5. Price is the best marketing—but current ads suck

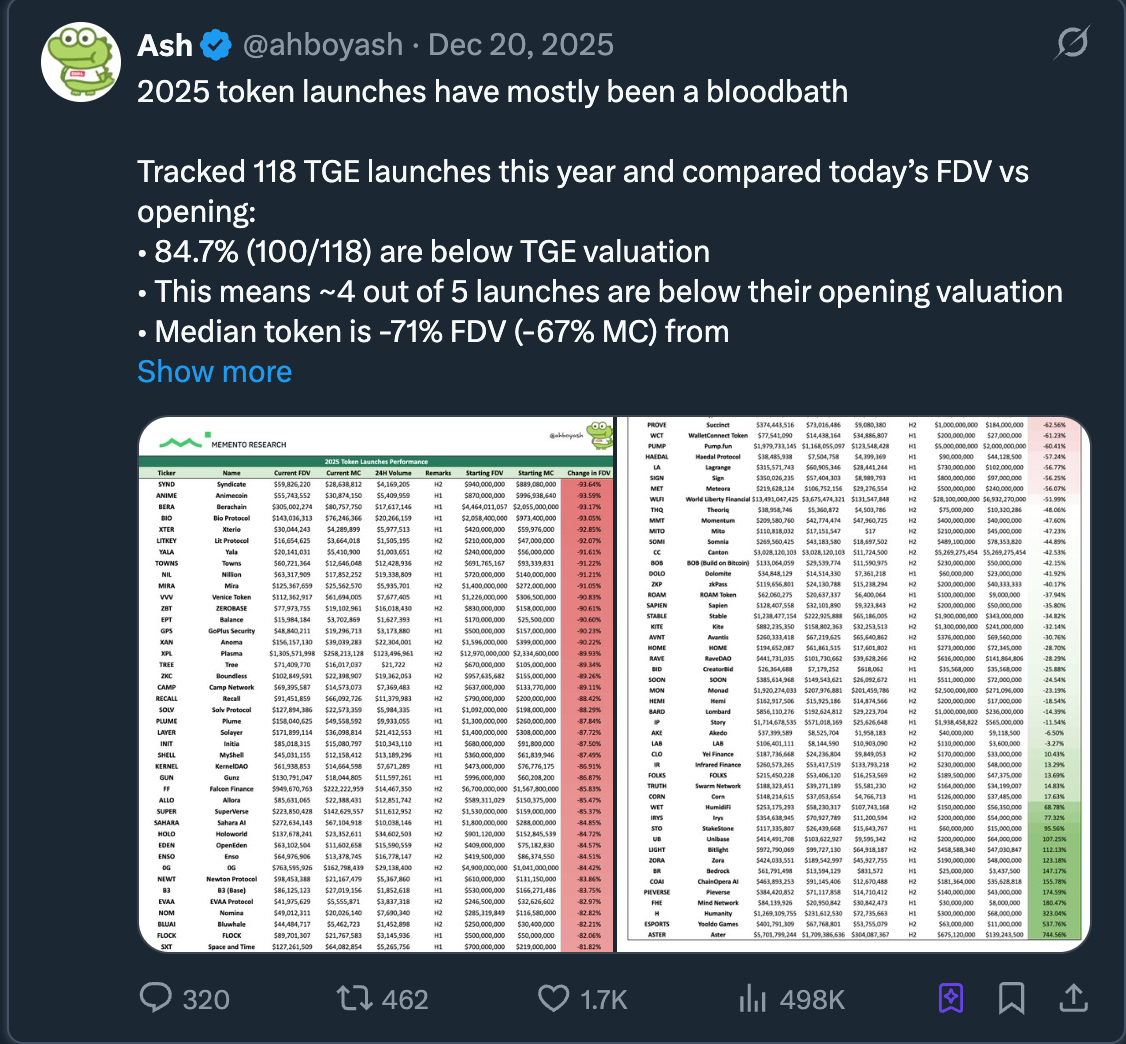

So far, these “ads” have performed terribly. Since Solana (SOL) 10xed and Hyperliquid (HYPE) 5xed, crypto returns have been pathetic compared to public markets.

Legendary crypto trader GCR once remarked:

“When macro is in risk-on mode, bet on the fastest horse—and right now, that horse is crypto.” (Roughly this meaning—I can’t find the screenshot.)

But guess what? The Dow Jones hit record highs. The Nikkei hit record highs. Gold and silver prices—you guessed it—also hit record highs. And crypto? Stuck. This is unlike anything we’ve seen before, and it’s precisely what frustrates so many.

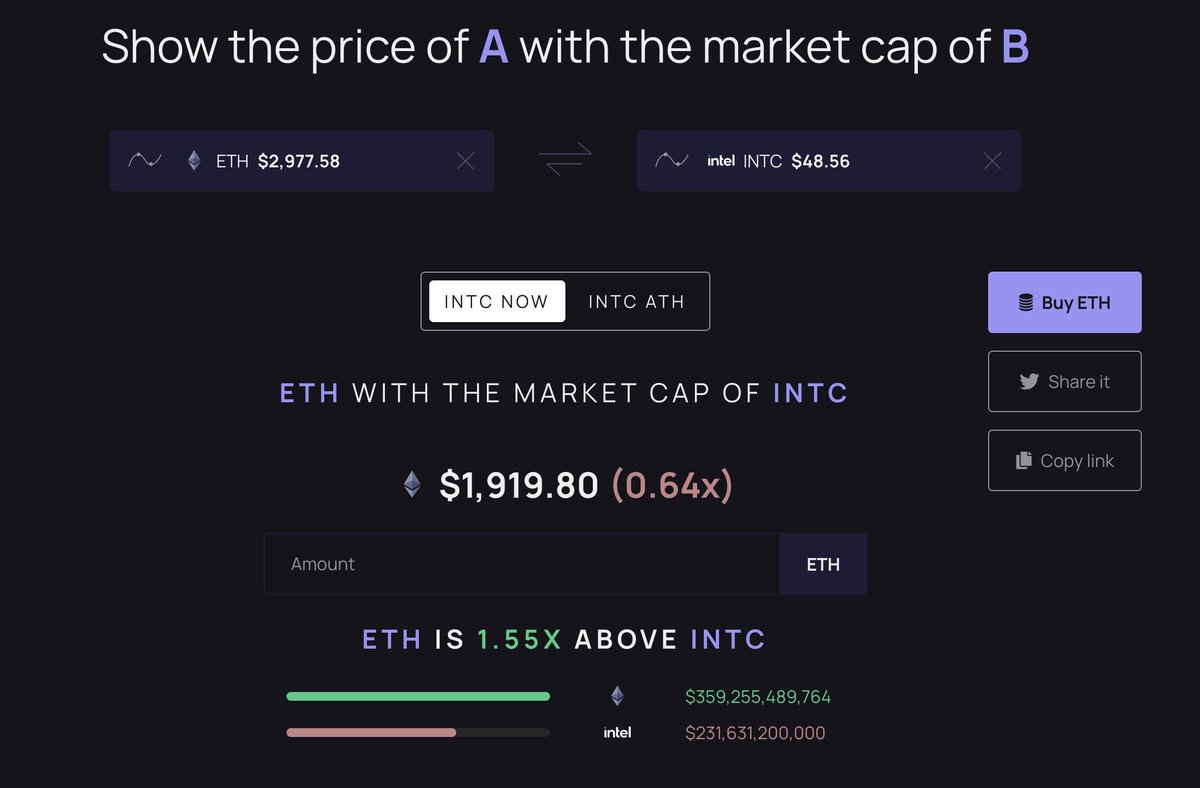

Asset prices (valuations) are also completely detached from functionality. Does the “world computer” really need a $360 billion market cap? Is it truly worth twice Intel?

That’s a company that’s manufactured processors for nearly half a century. Could Ethereum (ETH) secure the network at $400? Probably yes.

6. Normies hate our “culture”

One difference today versus 2021: nobody drinks the Coolaid anymore. Nobody believes you become rich, famous, or successful just by being in crypto. If that were true, we’d see more success stories, not constant losses—or worse, violent incidents (like finger-chopping).

Instead, when someone with social capital encounters a crypto project or hears about it, they might humor it briefly—maybe a few hours—because entering and exiting with a bag of cash now takes only that long. On this site (X/Twitter), everything is pseudonymous or anonymous, meaning consequences are equally negligible—almost nonexistent.

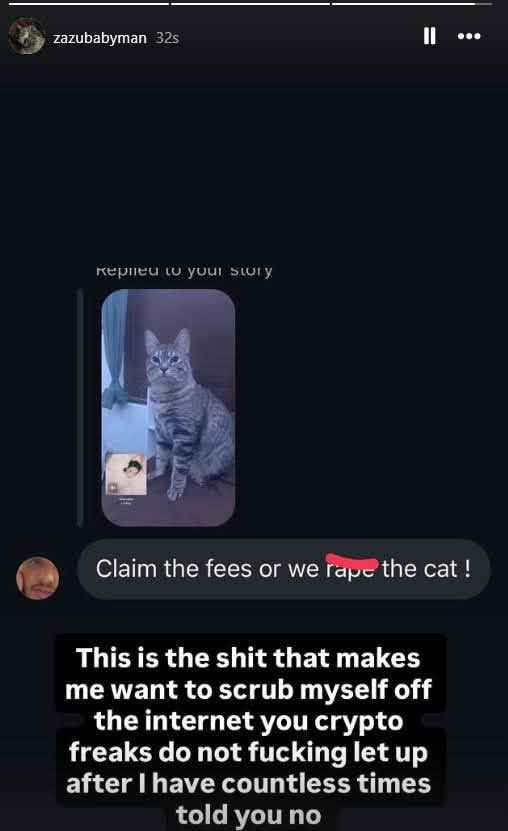

We’ve been playing with this garbage called “creator coins” for nearly three years. Except for a few barely functional cases, every version turned into “Extraction Central.” In economics, this is called “adverse selection”:

- Real creators don’t want a swarm of disgusting, beetle-like speculators bothering them all day.

- Scammers dive in for two hours, make money, then laugh at how degenerate we gamblers are.

- Most high-net-worth individuals (HNWI) ignore it entirely—costs far outweigh benefits.

- Degenerates (truly degenerate) gamble until they’re broke, then complain inside their echo chambers.

Wow, the Zora creator economy powered by Base and Solana capital markets is so cool, I love it, I’m rushing to get all my friends involved! (Note: sarcasm)

7. Technologists also hate this culture—because crypto has no substance

Five years ago, I’d go to Hacker News to see how anti-crypto they were, or read acidic comments on Gematsu, only to later watch those people become top-level bagholders. But now, I don’t even think they hate actively anymore—they just feel utter disgust and wish it would all end quickly.

They want it over because—whether founder or thinker, pro- or anti-crypto—the only significant use cases they see are “zero-sum money games” and “scams.” Aside from rare life-changing airdrops (like Jito, Hyperliquid, or some dead infra projects), almost every so-called “opportunity” is a minefield.

In my view:

- Despite technical feasibility, Web3 wallet connect hasn’t been implemented in any major Web2 app.

- Stablecoin adoption in real life isn’t as impressive as claimed—and increases regulatory and opsec risks.

- Smarter investors find better returns elsewhere.

- New project valuations are universally insane. Regardless of price tag, we now have over eight years of strong data proving underperformance.

- Even projects like Privy, hailed over the past four years as the biggest winner due to broad appeal, haven’t driven any app anyone could call a “crypto success story.”

If, as a collective, you’re given ten full years to build something, and the best you can come up with is “a better wallet,” “a better blockchain explorer,” or “a cheaper, easier way to gamble”—can you blame people for thinking crypto is worthless and a failed experiment?

8. Yield compression

Since I entered in 2020, what kept me engaged and investing was DeFi protocols. In traditional finance, USD yields max out at 3–4%, and banks demand endless KYC/AML paperwork just for basic operations. In countries like Japan or China, even that yield is hard to access.

DeFi offered a new way to earn yield—somewhat safe (usually less so, lol)—and especially attractive when factoring in potential airdrops. But as the saying goes in the hood, “hitting a lick in the bando” is now far less likely.

Not because of AI advances or people suddenly getting smarter—but due to a collapsing ratio: Newcomers willing to endure the mess and risk / seasoned players who know the rules… this ratio is plummeting.

For deeper insight, check @rami_poker’s old threads—everything worth saying has already been said.

I’d also argue Pendle made this worse. Despite being brilliant, the innovation of YT (yield tokens) opened doors for unethical teams to accelerate speculative fraud at the expense of those who thought they were clever—but were merely average (like me, lol).

Yield compression reflects my earlier point: the fast-rotating ball of hot money isn’t so hot anymore—it now looks like cold leftovers. From personal experience, only three people in my circle are actual DeFi fans who genuinely care:

- One guy who constantly hates it and wants out—he feels too old for this nonsense.

- Another from Singapore who cares deeply, but he’s only 20 and can pivot anytime.

- And me—I’ve transitioned to writing on X for a living because I don’t have time, between work, travel, and life management, to properly vet whether someone will rug-pull, steal my yield, or just waste my time.

9. We trust no one anymore

All “narratives” (metas) seem to evolve faster, yet each specific narrative faces greater resistance spreading. We no longer trust companies or centralized exchanges (CEXes)…

- We don’t trust CZ or Binance.

- We don’t trust Coinbase, Brian, or the Base/Zora crew.

- We absolutely don’t trust Ledger.

- We distrust “tourist founders”—if you spent ten years in the space before launching a token, what were you doing for those ten years?

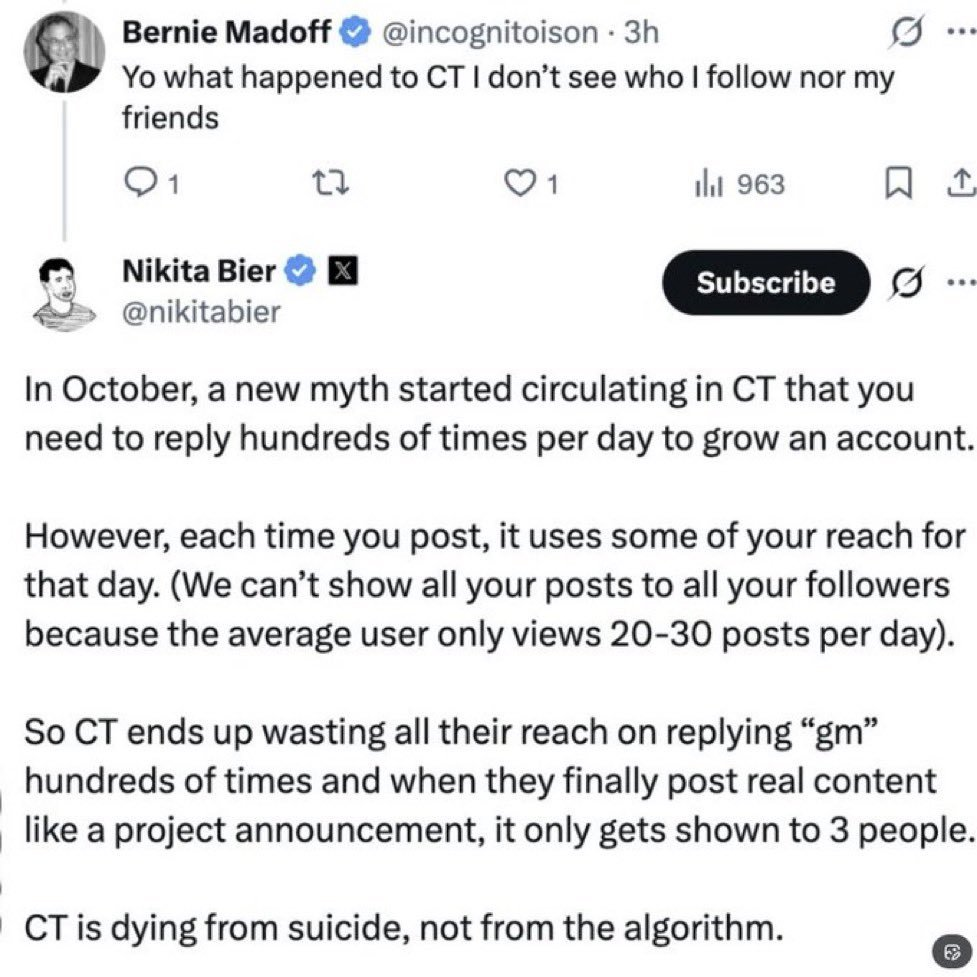

10. In-fighting within the circle

Since late 2022, the term “PVP market” has become ubiquitous. Originally referring to on-chain metric battles, this “hatred” has now spread internally across crypto.

- Crypto Yelp-style corpse dragging: People tearing each other apart on social media—well-intentioned, but far too late.

- Rising fame through roasting: Many accounts recently gained massive followings by producing nothing but two-liner jokes or mocking screenshots of other CT (Crypto Twitter) influencers or projects.

- Sexist and unpleasant community vibes: Groups of self-proclaimed cool kids gatekeeping their own “sewage tanks” (NFT or token communities). When market caps crash 90% a year later, they turn on each other viciously.

Imagine having to explain to your future grandchildren that your achievements between ages 20 and 30 were these pathetic antics. How utterly disgusting.

Whether love or hate, it was this “ignorant optimism” that once propped up our altcoin prices. Now, the lights are on. The party is over.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News