The Paradox of the CLARITY Act

TechFlow Selected TechFlow Selected

The Paradox of the CLARITY Act

Opposition to the CLARITY Act should not be interpreted as opposition to regulation.

By Prathik Desai

Translated by Block unicorn

Historically, money has rarely been neutral; it has typically been value-generating. Long before modern banking emerged, people expected holding or lending money to yield returns.

As early as around 3000 BC, interest was charged on silver loans in ancient Mesopotamia. Since the 5th century BC, ancient Greece used maritime loans (nautikà) to finance high-risk sea trade. Under this system, lenders financed a merchant’s single voyage, bearing full loss if the ship sank, but demanding high interest—typically 22% to 30%—if the journey succeeded. In Rome, interest was so deeply embedded in economic life that it frequently triggered debt crises, making voluntary debt relief a political necessity.

Across these systems, the idea that money is more than just a passive store of value has remained consistent. Holding money without return has always been the exception. Even after the rise of modern finance, this view of money's nature became further entrenched. Bank deposits earn interest. It is widely believed that non-compounding money gradually loses economic value.

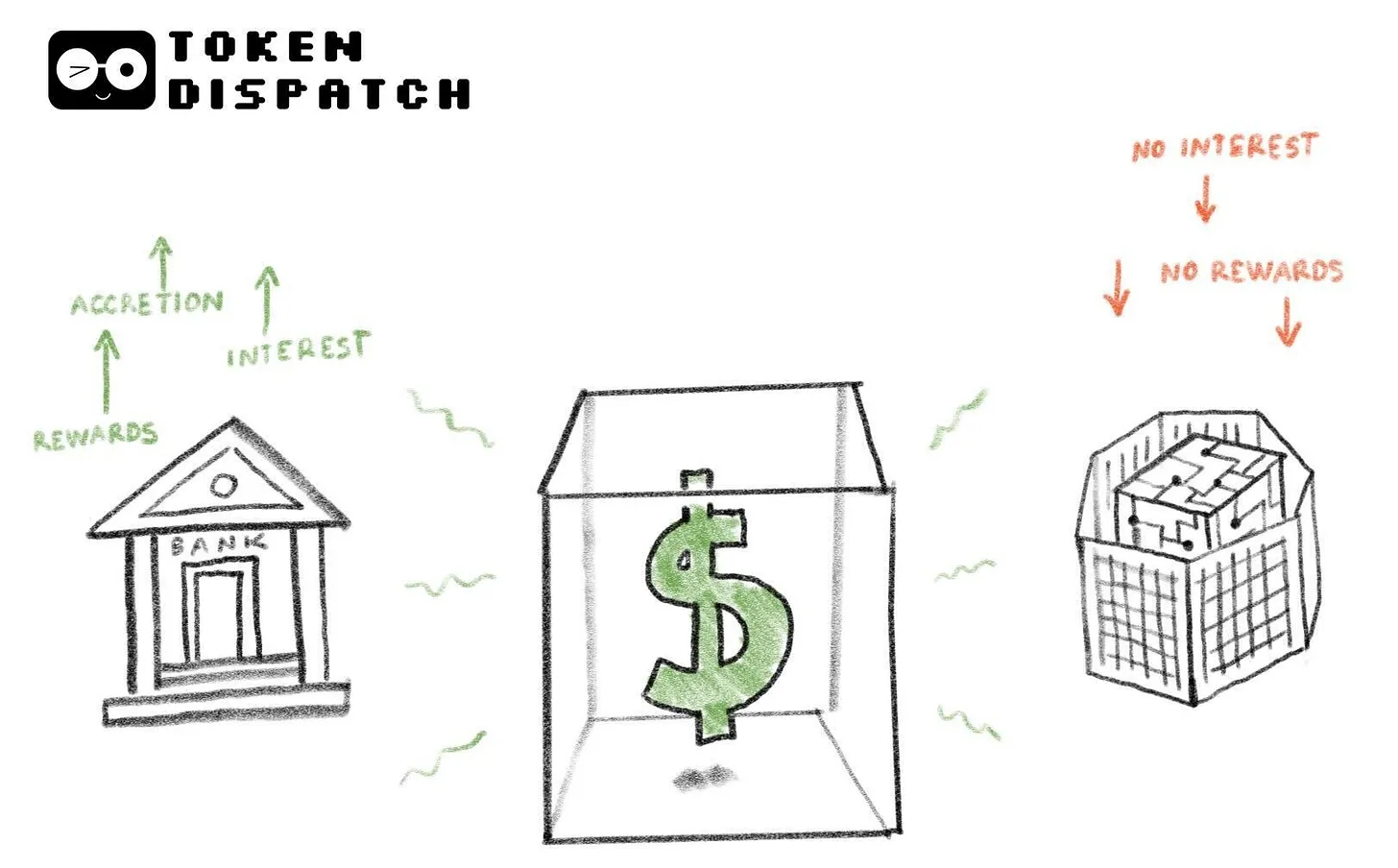

It is against this backdrop that stablecoins entered the financial system. Setting aside blockchain technology, they share little in common with cryptocurrencies or speculative assets. They claim to be digital dollars, designed for a blockchain-empowered world, blurring geographical boundaries and reducing costs. Stablecoins promise faster settlement, lower friction, and 24/7 availability. Yet U.S. law prohibits stablecoin issuers from paying yields—or interest—to holders.

This is why the CLARITY Act, currently under review in the U.S. Congress, has become a controversial piece of legislation. Read alongside its sister bill—the GENIUS Act, passed in July 2025—the CLARITY Act bans stablecoin issuers from paying interest to holders, while permitting “activity-based rewards.”

This has sparked strong opposition from the banking sector toward the current proposed legislative form. Several amendments pushed by banking lobbyists aim to eliminate stablecoin reward mechanisms entirely.

In today’s deep dive, I’ll explain what impact the current version of the CLARITY Act could have on the crypto industry, and why the crypto industry is visibly upset about this proposed legislation.

Let’s get into it…

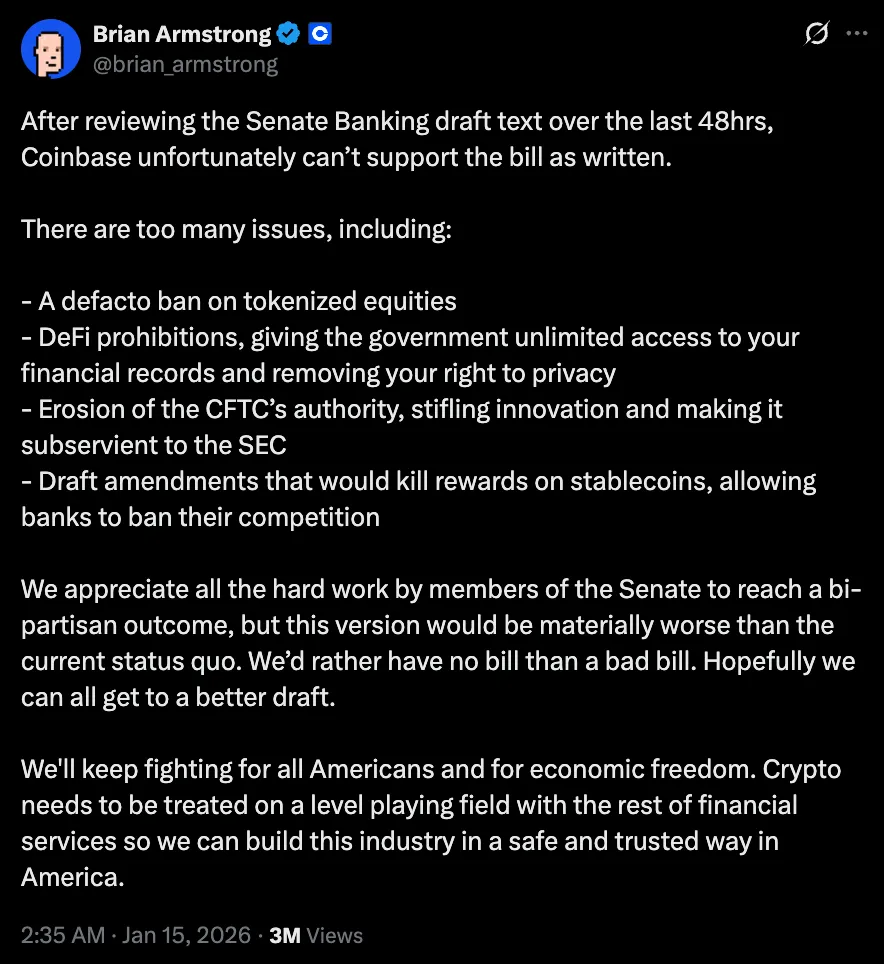

Within less than 48 hours of reviewing the Senate Banking Committee’s draft, Coinbase publicly withdrew its support. CEO Brian Armstrong tweeted: “We’d rather have no bill than a bad one.” He argued that a proposal claiming to bring regulatory clarity would actually leave the entire industry worse off than the status quo.

Just hours after the largest publicly traded U.S. crypto company pulled its backing, the Senate Banking Committee postponed deliberations, with a closed-door meeting scheduled to discuss amendments to the bill.

The core objection to this legislation is clear: it seeks to treat stablecoins purely as payment tools, not as any form of monetary equivalent. This point is crucial—and most disappointing—for anyone hoping stablecoins would fundamentally transform payments.

The legislation reduces stablecoins to mere conduits for funds, rather than assets capable of capital optimization. As I’ve noted earlier, that’s not how money functions. By banning both interest generation and activity-based rewards at the stablecoin layer, the bill restricts stablecoins from achieving the very yield optimization they claim to excel at.

This also raises concerns about competition. If banks can pay deposit interest and offer rewards for debit/credit card spending, why should stablecoin issuers be prohibited from doing the same? This tilts the competitive landscape in favor of incumbent institutions and undermines many of the long-term benefits promised by stablecoins.

Brian’s criticism extends beyond yield and rewards—it touches on how the legislation does more harm than good to the industry. He also pointed out issues with the DeFi ban.

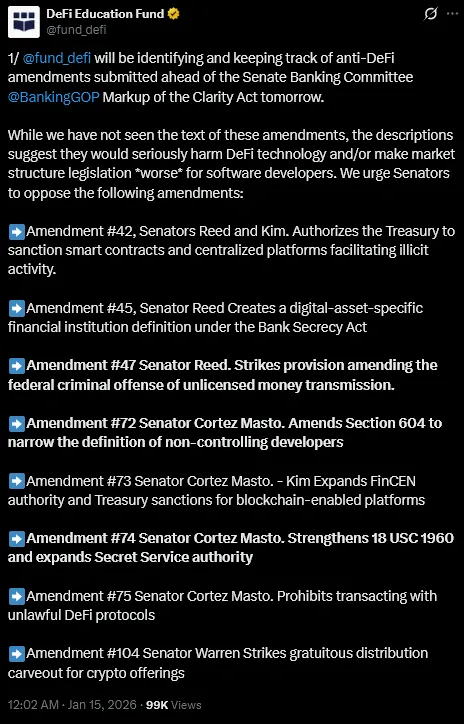

The DeFi Education Fund—a DeFi policy and advocacy group—also urged senators to oppose the proposed amendments, calling them “anti-DeFi.”

The group posted on X: “While we haven’t yet seen the text of these amendments, descriptions suggest they would severely harm DeFi technology and/or make market structure legislation even more hostile to software developers.”

Although the CLARITY Act formally recognizes decentralization, it comes with a narrow definition. Protocols under “common control” or retaining the ability to modify rules or restrict transactions could face bank-like compliance obligations.

Regulation aims to introduce oversight and accountability. However, decentralization is not a fixed state but a dynamic process requiring evolving governance and emergency controls to enhance resilience—not to achieve monopoly. These rigid definitions impose additional uncertainty on developers and users.

Then there’s tokenization, where a significant gap exists between promise and policy. Tokenized stocks and funds could enable faster settlement, lower counterparty risk, and more continuous price discovery. Ultimately, they could create more efficient markets by shortening clearing cycles and reducing capital tied up in post-trade processes.

Yet the current draft of the CLARITY Act leaves the regulatory status of tokenized securities uncertain. While not explicitly banned, the wording introduces enough ambiguity around custody of tokenized stocks.

If stablecoins are framed solely as payment tools and tokenized assets are restricted to issuance only, the path toward more efficient capital markets becomes significantly narrower.

Some argue stablecoins can continue as payment tools while yield is provided via tokenized money market funds, DeFi vaults, or traditional banks. Technically, this isn’t wrong. But market participants will always seek more efficient ways to optimize capital. Innovation drives workarounds. These often involve shifting capital offshore. Sometimes, such shifts may be so subtle that regulators later regret not anticipating the capital flight.

However, one overarching argument against the legislation outweighs all others: it’s hard not to see how, in its current form, the bill structurally entrenches banks, weakens innovation prospects, and imposes serious barriers on an industry that could help optimize today’s markets.

Worse still, this legislation may come at two extremely high costs. First, it kills any hope of healthy competition between banks and the crypto industry, while allowing banks to earn even more. Second, it leaves customers entirely dependent on these banks, unable to maximize returns within regulated markets.

These are steep prices—and precisely why critics refuse to support the bill.

What’s troubling is that while the legislation claims to protect consumers, provide regulatory certainty, and bring crypto under oversight, its provisions subtly imply the opposite.

Its terms predetermine which parts of the financial system can compete for value. Banks can keep operating within familiar frameworks, while stablecoin issuers are forced to survive and operate in a much narrower economic space.

But money dislikes sitting idle—it flows toward areas of higher efficiency. History shows that whenever capital is constrained in one channel, it finds another. Ironically, this is exactly what regulation aims to prevent.

The good news for the crypto industry is that opposition to the bill extends beyond crypto itself.

The bill still lacks sufficient support in Congress. Some Democratic lawmakers are unwilling to vote yes without first discussing and debating certain proposed amendments. Without their backing, the bill cannot pass—even if it treats crypto industry opposition as mere noise. Even if all 53 Republican senators vote in favor, the bill would still need support from at least seven Democratic senators to achieve a supermajority and overcome a filibuster.

I don’t expect the U.S. to produce a bill that satisfies everyone. I don’t even think that’s possible or desirable. The issue is that the U.S. isn’t merely regulating a new asset class—it’s attempting to legislate a form of money whose inherent properties make it highly competitive. This raises the stakes, forcing lawmakers to confront competition directly and craft provisions that might challenge existing institutions—in this case, banks.

The urge to tighten definitions, limit permitted activities, and preserve existing structures is understandable. But doing so risks turning regulation into a defensive tool—one that repels capital instead of attracting it.

Therefore, it’s critical that opposition to the CLARITY Act not be misread as opposition to regulation. If the goal is to integrate crypto into the financial system—not simply quarantine it—then the U.S. must establish rules allowing new forms of money to compete, fail, and evolve within a clear regulatory framework. That would force incumbent institutions to raise their game.

Ultimately, legislation that harms the very groups it claims to protect is worse than no legislation at all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News