USDT negative premium, holding stablecoins still leads to losses, how exactly should we view and handle this?

TechFlow Selected TechFlow Selected

USDT negative premium, holding stablecoins still leads to losses, how exactly should we view and handle this?

The appreciation of the RMB stems from the need to attract foreign investment, boost consumption, and ease trade frictions, while the negative premium of USDT is the result of a downturn in the crypto market, concentrated year-end foreign exchange settlement demands, and tightening policies. Investors may consider hedging exchange rate risks through means such as Euro-pegged stablecoins.

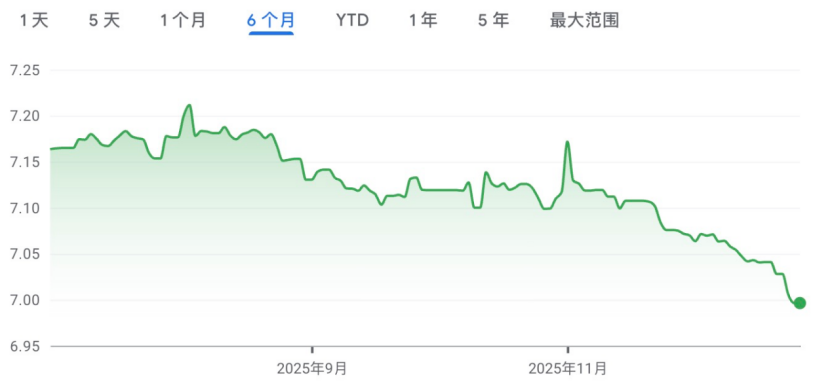

Why Has the RMB Entered an Appreciation Channel, and Why Does USDT Show Negative Premium?

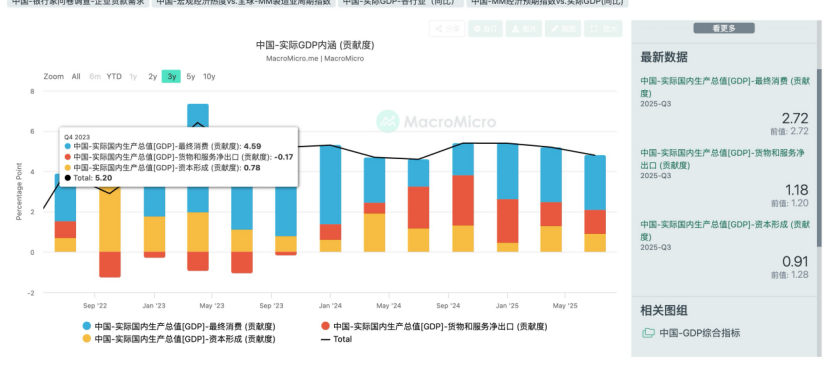

First, the author would like to discuss why the RMB has currently entered an appreciation channel. Regarding this point, let's return to a fundamental economic concept: GDP. Generally, we believe that although the GDP indicator has some shortcomings, it remains the simplest and most effective metric for assessing a country's overall economic condition. The composition of GDP is:

GDP = C + I + G + (X–M)

Where:

C: Consumption Expenditure: Total spending by households and individuals on final goods and services.

I: Investment Expenditure: Business capital formation (new equipment, factories, etc.) and residential construction spending.

G: Government Expenditure: Government spending on goods and services (excluding transfer payments).

X–M: Net Exports: Exports (X) minus Imports (M).

After clarifying this simple formula, the reasons for the RMB's appreciation become clearer, mainly due to three points:

1. Attracting Foreign Capital, Boosting Investment Expenditure

The first benefit of RMB appreciation is the rapid attraction of foreign capital inflows. We know that in the past period, both China and the US have faced the same issue—debt problems. The US manifests this in federal government explicit debt, i.e., the scale of national debt, while China's is reflected in local government implicit debt. Since US Treasury bonds are tradable and held by foreign investors in high proportions, the pressure to manage debt is greater because default risks quickly reflect in bond prices through the secondary market, affecting the US's refinancing ability. Therefore, only through dollar depreciation can the real value of dollar-denominated debt to foreign creditors decrease. Through this "inflation tax," the real value of nominal debt is reduced. The means are naturally interest rate cuts and quantitative easing. China's local debt, however, is more internal, mainly held by domestic commercial banks or domestic investors, with relatively more methods to manage debt, such as buying time through debt extensions, transfer payments, etc., to alleviate pressure. Therefore, relatively speaking, the RMB exchange rate does not face excessive pressure from debt issues. However, this debt problem has brought an impact to both China and the US: limited government borrowing capacity, meaning that stimulating domestic GDP by expanding government expenditure is not easily achievable. Therefore, at this stage, to boost the economy, RMB appreciation is beneficial for attracting capital back.

2. Boosting Consumption, Increasing Consumption Expenditure

Another benefit of RMB appreciation is making foreign goods cheaper for domestic consumers, mainly reflected in two aspects. First, it gives ordinary consumers more money for consumption and investment. This is especially evident in necessity consumer categories that account for the highest proportion of total consumption expenditure, such as food and energy. It is believed that in the near future, most people will see more and more imported goods on supermarket shelves at increasingly cheaper prices. Second, it lowers costs for enterprises importing foreign raw materials or key components, improving profit margins, thereby providing more capital for business expansion, profit distribution, etc.

3. Alleviating Political Friction from International Trade, Reducing Government Expenditure

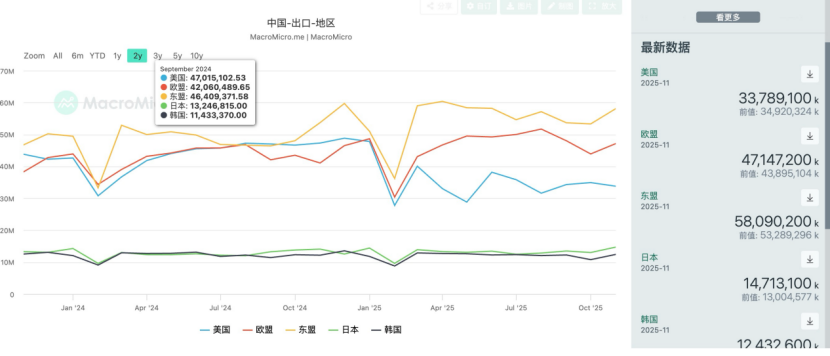

Since the announcement in November this year that China's trade surplus exceeded $1 trillion, there has been more international discussion about the undervaluation of the RMB. Friction in trade negotiations between China and major trading partners, especially major consumer countries in the EU, has increased. So why is this?

We know that theoretically, in accounting principles, the sum of global international trade current accounts must be 0, because one country's exports must be another's imports, and income/transfer payments are corresponding economic flows. Therefore, when the trade surplus hits a new high, it necessarily means that the deficits of some net-importing countries have also increased. In the current macroeconomic environment, where each country prioritizes economic growth, expanding trade deficits can drag down domestic GDP growth. This is particularly true for some developed countries already in low-growth modes, where minor data fluctuations have a larger impact on GDP growth. There are usually two means to alleviate trade deficits: first, tariff increases based on trade protectionism; second, adjusting exchange rate relationships. The former has temporarily paused with the ceasefire in the US-China tariff war, while orderly RMB appreciation helps quickly alleviate political conflicts arising from trade friction with other countries, thereby reducing associated government expenditure.

Although RMB appreciation has the above benefits, a core principle is that appreciation must be stable and orderly, not too rapid. However, the RMB's appreciation in the past month has been noticeably fast. This is also because, as the year-end approaches, the economic growth target for the first three quarters has reached 5.2%, which has basically achieved the annual target of "around 5%." Therefore, appropriately allowing appreciation helps lay the groundwork for next year's economic transformation, observing market developments, and identifying opportunities and risks in advance. Otherwise, with substantial foreign exchange reserves, the central bank could still relatively easily stabilize the exchange rate.

Next year, I believe the pace of exchange rate appreciation will significantly slow down. The reason is simple: although the contribution of net exports to China's GDP growth is showing a converging trend, it remains crucial. If the RMB appreciates too quickly, it will obviously cause net exports to shrink rapidly, thereby putting pressure on achieving next year's economic growth targets.

After clarifying the reasons for the short-term RMB appreciation, let's discuss why USDT shows a negative premium. The main reasons, I believe, are the following three:

1. The crypto market remains sluggish, lacking sufficiently attractive investment targets, leading investors to reallocate their portfolios.

2. Year-end often sees concentrated foreign exchange settlement by many international trade enterprises, increasing demand to convert USD to RMB. We know there are significant restrictions on onshore RMB exchange quotas. Therefore, many small and medium-sized enterprise owners engaged in international trade or overseas operations choose to settle through USDT, avoiding quota limits while being more convenient and cost-effective.

3. The Chinese government has recently noticeably tightened policies on stablecoins, increasing the risk premium for cryptocurrency investments, thus triggering capital flight to safety.

In summary, the author believes the negative premium on USDT will not last too long. This situation is more influenced by short-term changes in supply and demand. However, the short-to-medium-term strong appreciation of the RMB will inevitably cause RMB-denominated investors to bear some exchange rate losses.

Should We Convert USD Stablecoins Back to RMB?

Now that the RMB has entered an appreciation channel, do we need to convert USD stablecoins back to RMB to avoid exchange rate losses? The author believes that unless USD stablecoins constitute an excessively high proportion of your investment portfolio, adjustments can be made appropriately. Otherwise, maintaining a certain proportion of asset allocation is advisable. There are three reasons:

1. Exchange Losses from Short-term USDT Negative Premium: The analysis above indicates that the author believes the current negative premium on USDT is due to short-term factors, not structural risks. Rashly exchanging now might incur significant exchange losses. Therefore, even if portfolio adjustments are needed, it's better to wait for the negative premium to mean revert before acting.

2. Opportunity Cost: Although China's overall economic fundamentals show resilience, significant challenges remain, primarily the lack of wealth effect at the societal level due to declining real estate prices. In this context, economic policies focus on stability, with debt management, industrial structure adjustment, and optimized redistribution being the most realistic strategies. Therefore, although we see a general rally in the Chinese stock market, the author views it as valuation repair or speculation, not indicative of a clearly favorable environment for long-term development. Moreover, declining interest rates on RMB government bonds amplify the opportunity cost of this operation. Holding stablecoin assets, however, offers relative flexibility, facilitating global asset allocation, especially as the US enters an interest rate cut cycle with ample liquidity.

3. Uncertainty of RMB Appreciation: The tariff game between China and the US is not permanently resolved, only paused for a year. The US cannot immediately counter the rare earth card and is about to enter a midterm election cycle, forcing a retreat to focus on internal strengthening. However, this doesn't mean the tariff war won't reignite. Past articles have systematically analyzed Trump administration policies. Therefore, before achieving the goal of key manufacturing回流 (return), the possibility of the tariff war resuming remains high. At that time, the RMB exchange rate will inevitably be affected.

How to Hedge Exchange Rate Losses via On-chain Strategies: Gold and Euro Stablecoins

Based on this strategy, how can we appropriately hedge against exchange rate losses caused by RMB appreciation? Naturally, we first think of using currency derivatives to hedge against RMB appreciation. However, this is very difficult to achieve in an on-chain environment. Early last year, the author considered building a decentralized currency derivatives platform to anticipate this demand, but research showed that related competitors' developments were unsatisfactory. Taking DYDX's Foreign derivatives section as an example, order book depth is very shallow, and liquidity is noticeably insufficient, indicating market makers' lack of interest. The reason lies in regulatory pressure. We know exchange rate control has always been a crucial tool for manufacturing countries like China and South Korea. Therefore, compared to cryptocurrency investments, currency derivatives face higher levels of regulation. Investors needing currency hedging are mostly from these countries, so the resistance is可想而知 (imaginable).

But this doesn't mean there's no way to alleviate it appropriately. The author believes the following three asset categories are most worth attention:

l HKD, JPY, KRW Stablecoins: Mid-year, following the US passing stablecoin-related legislation, various countries掀起 (initiated)热潮 (enthusiasm) for issuing their own stablecoins. The特殊性 (special nature) of the Hong Kong dollar and the重叠性 (overlap) in industrial structures among East Asian countries势必 (inevitably) lead to趋同 (convergence) in exchange rate development trends. Therefore, investing in such stablecoins can to some extent hedge against exchange rate losses from RMB appreciation. However, recently we clearly see that countries,出于 (due to) concerns about exchange rate control, have tightened exploration of stablecoin issuance. So, we can only say to keep关注 (attention) and configure after mature products emerge.

l On-chain Gold RWA: Gold's price increase over the past few years has been staggering. Geopolitical uncertainty and expectations of USD depreciation have made gold assets highly sought-after. For on-chain investors, purchasing gold RWA tokens is relatively easy, with ample liquidity, such as Tether Gold and Pax Gold. However, discussions about whether gold is in a bubble have never stopped. From the recent剧烈波动 (sharp fluctuations) in precious metals, we see this market has entered a微妙 (delicate)博弈 (game)格局 (situation). For risk-averse investors who haven't positioned提前 (in advance),保持观望 (maintaining a wait-and-see approach) is safer now.

l Euro Stablecoins: The author believes Euro stablecoins are the most值得关注 (noteworthy) asset category among these three. First, the compliant Euro stablecoin EURC issued by Circle has sufficient issuance volume and good liquidity. Second, the author personally believes the exchange rate fluctuation of EUR against RMB will be more moderate compared to USD. Reasons are as follows:

Looking at China's export data, the top three by export share are currently ASEAN, the EU, and the US. Influenced by the trade war, China's exports to the US show a clear declining trend (we won't discuss转口 (re-export) issues here). The most significant contributors to增量 (incremental) growth are still the EU and ASEAN.

We know ASEAN consists mainly of developing countries with higher economic growth rates, meaning the impact of net exports will be缩小 (reduced) by带动 (driving) from other indicators. Moreover, ASEAN承接 (undertakes) a large amount of mid-to-low-end product转移 (transfer) and investment from China, and a significant portion of imports also comes from machinery equipment and industrial products necessary for产业升级 (industrial upgrading), so the overall economic impact is偏向正面 (biased positive). Politically, the崛起 (rise) of China's military power also forms certain constraints. Therefore, we see政治摩擦 (political friction) between China and ASEAN呈现 (showing)收敛态势 (converging trend).

However, regarding the EU, the story is different. The proportion of industrial manufactured goods in China's exports to the EU is higher, so profit margins are also higher compared to markets like ASEAN. Therefore, Europe naturally is an important market for China's stable trade surplus. Trade settlements between China and Europe are mainly in Euros. To enhance the influence of Chinese goods in this market, there is reason to maintain a lower level for the RMB against the Euro.

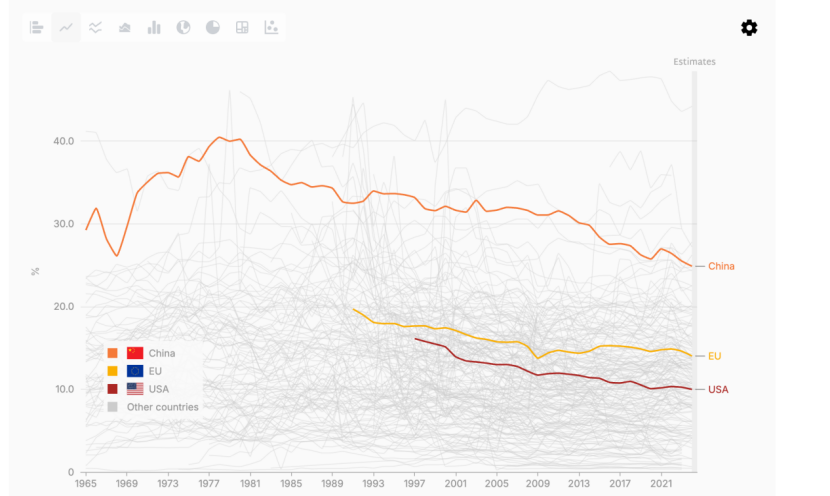

Exchange rate risk also lies in how to resolve political friction with the EU. Since most EU countries are developed, and manufacturing's share in GDP is much higher than in the US (European manufacturing accounts for about 15% of GDP, while the US is less than 10%), this means wage income constitutes a higher proportion of the main income for ordinary Europeans compared to capital gains from investments. In the past period, the EU, having lost cheap energy supply from Russia, faced rising costs, significantly impacting manufacturing. Particularly, China's industrial upgrading has greatly冲击 (impacted) one of Europe's pillar industries, automotive products. This means declining overall industrial profits in Europe. Two impacts of declining corporate profits are reduced government tax revenue and slowed wage growth. The former, through fiscal tightening, affects the maintenance of Europe's original high福利 (welfare). Both will reduce居民 (residents')财富效应 (wealth effect), thereby affecting consumption. In terms of investment, due to the lack of优质标的 (quality targets) in AI, Europe has lost capital competitiveness in the AI field, with most European capital flowing to the US AI market seeking higher expected returns. Therefore, investment is also not optimistic. On this basis, the impact of net exports on the economy is amplified, so European governments' attitudes towards trade deficits are more激烈 (intense).

However, the author believes the EU currently lacks the博弈资本 (bargaining capital) the US demonstrated in the tariff war with China. Moreover, EU countries' attitudes towards China are不一致 (inconsistent), e.g., Hungary, Spain, etc., making it difficult to gain more利益 (benefits) in negotiations. Therefore, the author believes the final trade rebalancing between China and Europe will not be based on大幅调整汇率 (significant exchange rate adjustments) but rather on欧元利润在地投资协议 (Euro profit on-site investment agreements) as the final cooperation framework. On one hand, compared to other emerging markets like India, Vietnam, Brazil, etc., European capital market systems are more健全 (sound), offering相对较好 (relatively better) capital protection. China currently has ample foreign exchange reserves, so it can improve profit margins through reinvestment. On the other hand, stabilizing exchange rate relations also helps Chinese goods maintain sufficient competitiveness in Europe.

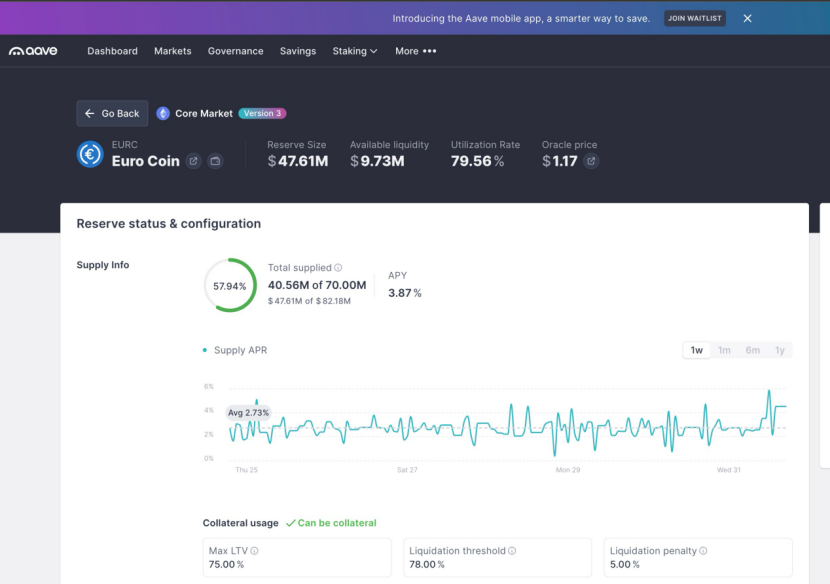

Returning to exchange rate hedging strategies, the author believes a practical strategy is to exchange USD stablecoins for EURC, then optionally deposit them on leading platforms like AAVE to earn interest. Based on current utilization rates, lending rates can reach 3.87%, which is quite attractive. If wanting to maintain positions in risk assets like BTC while hedging exchange rate risk, one can use EURC as collateral to borrow USD stablecoins, then proceed with asset allocation, such as purchasing BTC.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News