Institutional Dawn and the End of Cycles: Decoding the 2026 Core Narratives and Divergences of Eight Leading Crypto Institutions

TechFlow Selected TechFlow Selected

Institutional Dawn and the End of Cycles: Decoding the 2026 Core Narratives and Divergences of Eight Leading Crypto Institutions

The simple model of "buy and hold while waiting for the halving" is now outdated.

Author: Bruce

Introduction: From the "Wild West" to a "Wall Street Branch"

2026 may be recorded as a watershed moment in cryptocurrency history. If previous bull and bear cycles were "Wild West" stories driven by retail sentiment and Bitcoin's halving mechanism (Halving), then the latest reports from eight top crypto institutions collectively point to a new narrative—the formal establishment of the institutional era.

Fidelity bluntly states in its report that the market is entering a "New Paradigm." With sovereign reserves (such as legislative attempts by Brazil and Kyrgyzstan) and traditional wealth management institutions entering, the purely historical-data-driven "four-year cycle theory" is failing. This article will cut through market noise to deeply unpack the certain opportunities and potential risks seen by these top-tier institutions.

I. Macro Tone-Setting: The Death of the Four-Year Cycle and New Asset Attributes

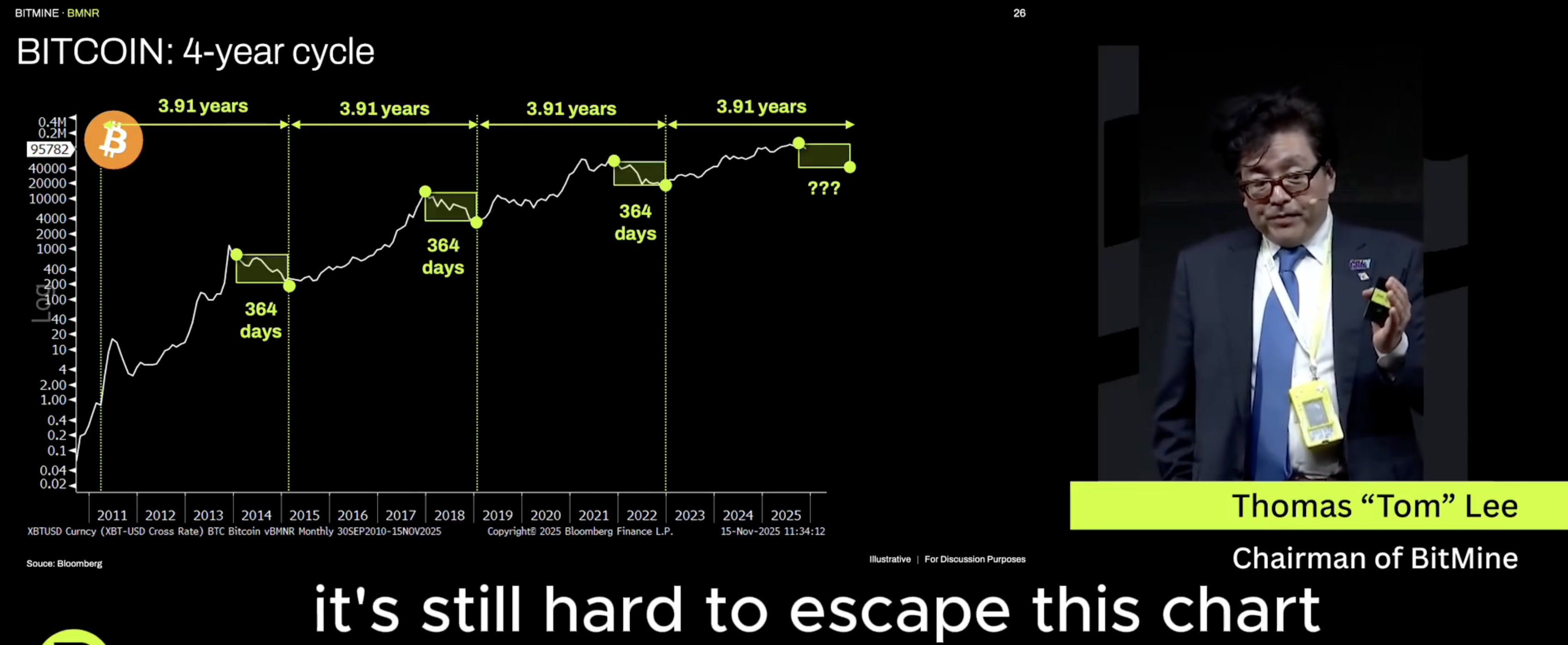

For a long time, the crypto market has been accustomed to linear extrapolation around Bitcoin’s four-year halving cycle. However, this logic has faced a collective "dimensional strike" in 2026 outlooks.

1. Cycle Law失效 (Broken Cycle)

Bitwise, Fidelity, and Grayscale agree: the halving effect is marginally diminishing.

21Shares uses even stronger language—"Bitcoin’s four-year cycle has broken (Broken)." Their data model shows that the introduction of ETFs has fundamentally changed demand structures; market drivers have completely shifted from supply-side (miner halvings) to demand-side (institutional allocation). When BlackRock and Fidelity clients begin quarterly BTC allocations, the once-every-four-years halving story no longer excites.

2. Asset Maturation: Volatility "Desensitization"

-

Bitwise's bold quantification: Bitwise makes a striking prediction—that by 2026, Bitcoin’s volatility will fall below that of Nvidia for the first time. This isn’t just a numbers game but signifies Bitcoin’s qualitative shift from a "high-beta tech stock" to a "mature safe-haven asset."

-

Fidelity's qualitative view: While not providing specific figures, Fidelity emphasizes that against a backdrop of high global debt and fiat depreciation, Bitcoin will shed its correlation with tech stocks and become an independent hedge against monetary inflation worldwide.

II. High-Conviction Narratives: Where Is the Money Flowing?

After eliminating cyclical noise, although details differ, the institutions’ logic on capital flows strongly converges.

1. Stablecoins: Challenging Traditional Financial Infrastructure (ACH)

If Bitcoin is digital gold, stablecoins are digital dollars. Multiple institutions believe stablecoins will move beyond crypto circles to directly challenge traditional financial pipelines.

-

21Shares prediction: The total market cap of stablecoins will surpass $1 trillion by 2026.

-

Galaxy Digital prediction: On-chain transaction volume of stablecoins will officially exceed that of the U.S. ACH (Automated Clearing House) network. This means stablecoins will replace traditional interbank clearing systems as more efficient financial highways.

-

Coinbase outlook: Predicts stablecoin market cap will reach $1.2 trillion by 2028.

-

a16z view: Stablecoins are evolving into the internet’s "base settlement layer," fueling the rise of PayFi (Payment Finance), making cross-border payments as cheap and instant as sending emails.

2. AI Payments & KYA: A New Commercial Civilization

This is the biggest technological variable favored by both a16z and Coinbase, who paint the same picture from different angles.

-

Google AP2 and Coinbase x402: The Coinbase report highlights Google’s Agentic Payments Protocol (AP2) standard, noting that its developed x402 protocol will serve as an AP2 payment extension. This enables AI agents to conduct instant micropayments via HTTP ("HTTP Payment Required"), closing the commercial loop between AIs.

-

From KYC to KYA: a16z creatively introduces the concept of "KYA" (Know Your Agent). They point out that on-chain transaction participants now consist of 96% non-human versus 4% human. Traditional KYC (Know Your Customer) will evolve into KYA. AI agents don’t have bank accounts but can own crypto wallets, tirelessly purchasing data, compute power, and storage via micropayments 24/7.

3. Prediction Markets: A New Carrier of Free Information

This is a true "institutional consensus sector," with multiple institutions listing it as a breakout point for 2026.

-

Bitwise: Predicts open interest on decentralized prediction markets (e.g., Polymarket) will hit record highs, becoming a parallel "source of truth" alongside traditional news media.

-

21Shares: Provides a concrete figure, forecasting annual trading volume in prediction markets will exceed $100 billion.

-

Coinbase’s "Tax-Driven Thesis": Offers a unique perspective—that new U.S. tax laws (limiting gambling loss deductions) will unexpectedly push users toward prediction markets. Because prediction markets may be classified as "derivatives" rather than "gambling" for tax purposes, they offer a fiscal advantage.

III. Key Disagreements: Alpha Often Lies in Controversy

Consensus often means prices are already priced in, while disagreement implies either excess returns (Alpha) or potential risk.

1. Digital Asset Treasuries (DAT): "Great Cleansing" vs "Red Herring"

On MicroStrategy’s "public company Bitcoin hoarding" model, institutional views are sharply divided.

-

The Great Cleansing Camp (Galaxy Digital & 21Shares):

-

21Shares predicts DAT total size will grow to $250 billion but stresses “only a few will survive.” Small DAT companies trading persistently below net asset value (NAV) will face forced liquidation.

-

Galaxy Digital goes further: “At least five DAT companies will be forced to sell assets, get acquired, or shut down.” They argue that blind bandwagoning in 2025 brought in many companies lacking capital strategy, making 2026 the market’s “cleansing moment.”

-

-

The Ignore Camp (Grayscale):

-

Maintains its “Red Herring” stance, arguing that despite media attention, DATs—constrained by accounting rules and vanishing premiums—won’t be a core pricing driver in 2026.

-

2. Quantum Computing: Need for Vigilance vs Alarmism

-

Vigilant Camp (Coinbase): Dedicates a section titled "The Quantum Threat" in its report, warning that migration to post-quantum cryptography standards must start now, and underlying signature algorithms must begin upgrading to quantum-resistant solutions—a necessary step for infrastructure security.

-

Calm Camp (Grayscale): Labels the "quantum threat" a "red herring." They argue that within the 2026 investment horizon, the probability of quantum computers breaking elliptic curve cryptography is zero, and investors should not pay a "panic premium."

3. L2’s "Great Cleansing" (The Zombie Chain Apocalypse)

This is one of 21Shares’ sharpest predictions. They believe most Ethereum Layer 2 chains won’t survive past 2026, becoming "zombie chains."

-

Reason: Liquidity and developer resources exhibit strong Matthew effects, eventually concentrating toward leaders (e.g., Base, Arbitrum, Optimism) and high-performance chains (e.g., Solana).

-

Data support: Galaxy Digital forecasts that “the ratio of application-layer revenue to L1/L2 network-layer revenue will double by 2026,” validating the “Fat App Thesis”—value is shifting from infrastructure layers to super-apps with real users.

IV. Non-Consensus Predictions: Overlooked Corners

Beyond mainstream views, some institutions offer unique "niche" predictions worth noting:

-

Privacy Sector Resurgence (Galaxy Digital & Grayscale): Both Galaxy Digital and Grayscale favor the privacy sector. Galaxy Digital predicts total market cap of privacy tokens will exceed $100 billion. They specifically mention Zcash ($ZEC)'s rebound, believing privacy will be repriced from a "tool for crime" to an "institutional necessity" (Privacy as a Service).

-

Revival of Compliant ICOs (21Shares): 21Shares believes that with regulatory frameworks (e.g., U.S. Digital Asset Market Structure Act) taking shape, "regulated ICOs" (Regulated Initial Coin Offerings) will return as legitimate capital market financing tools.

-

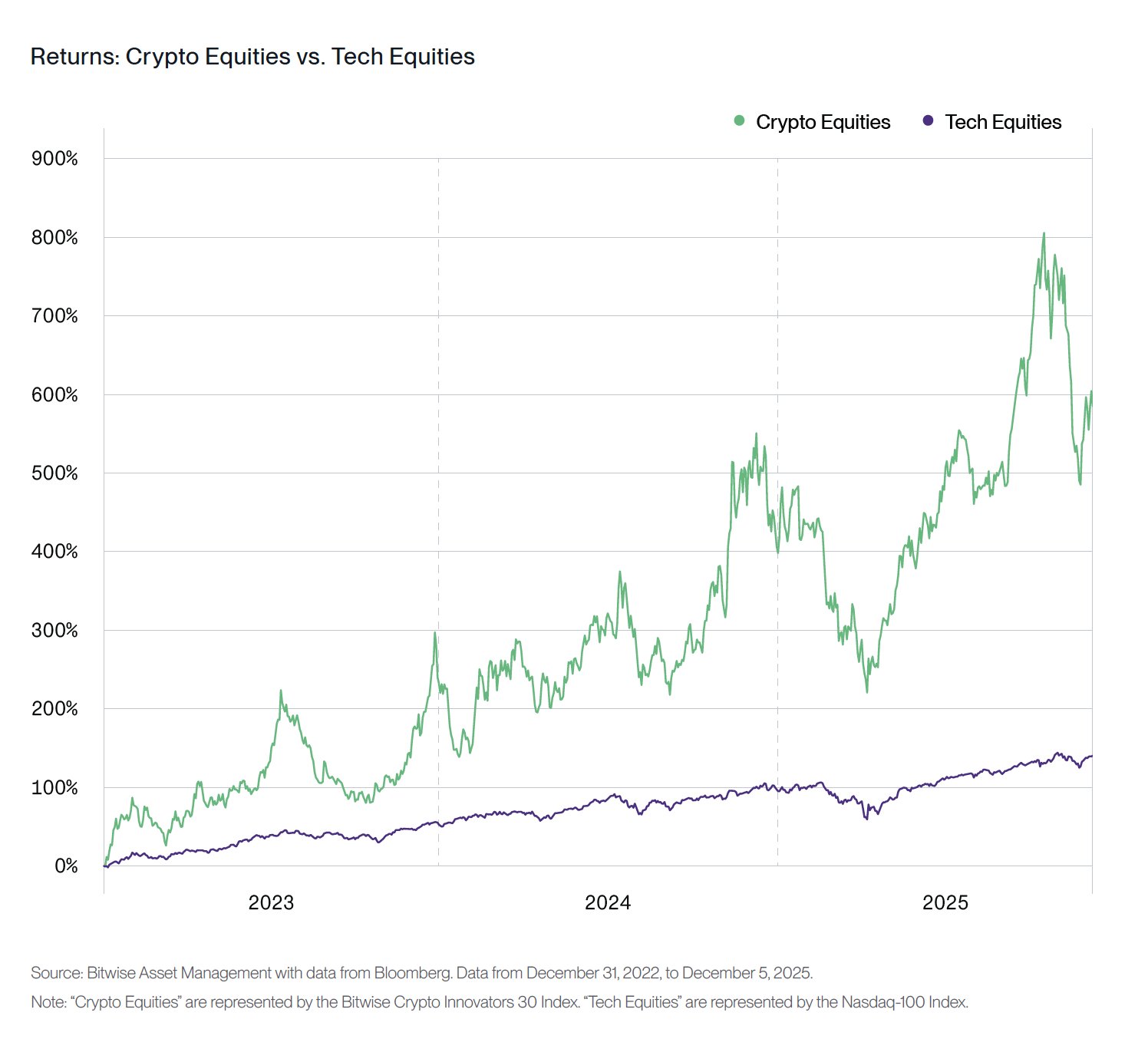

Outperformance of Crypto Stocks (Bitwise): Predicts crypto-related equities (e.g., miners, Coinbase, Galaxy) will outperform the Magnificent 7 traditional tech giants.

Conclusion: Survival Rules for 2026 Investors

In aggregate, the outlooks from eight institutions show that the market logic for 2026 has fundamentally changed. The simple model of "blindly buying and waiting for halving" is over.

For investors, the new survival rules can be summarized in three dimensions:

-

Embrace leaders and real yield: Amid the brutal cleansing of L2s and DATs, liquidity and capital structure are survival indicators; focus on protocols generating positive cash flow.

-

Understand the "tech content": From Google’s AP2 standard to KYA, upgrades in technical infrastructure will bring new Alpha; closely watch the implementation of new protocols like x402.

-

Beware of false narratives: In institutional eyes, there are golden opportunities but also "red herrings." Distinguishing long-term trends (e.g., stablecoins replacing ACH) from short-term hype will be key to winning in 2026.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News