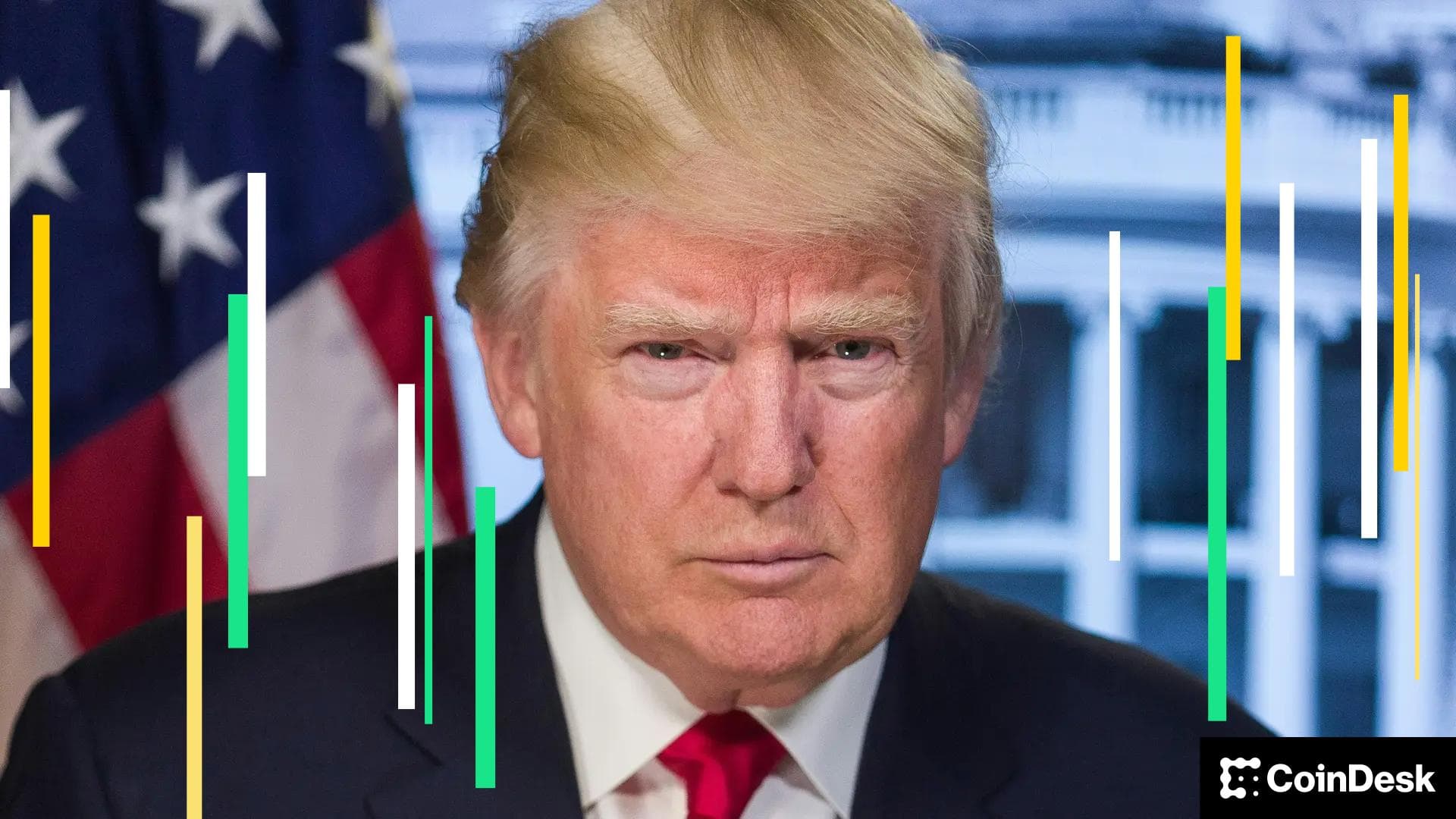

Buying Gold Like There's No Tomorrow: Tether, the Stablecoin King, Outpaces Central Banks in Gold Rush

TechFlow Selected TechFlow Selected

Buying Gold Like There's No Tomorrow: Tether, the Stablecoin King, Outpaces Central Banks in Gold Rush

Tether isn't just buying gold—he has much bigger ambitions.

By Liam, TechFlow

In 2025, central banks around the world are launching an unprecedented gold-buying surge.

Central banks of China, India, Poland, Turkey and other countries have collectively purchased over 1,100 tons of gold in the past year—setting a new record since the collapse of the Bretton Woods system.

Yet amid this global return to gold, a "non-sovereign" buyer is quietly rising: Tether, the company behind the stablecoin king USDT.

According to Bloomberg, Tether has become one of the world’s largest gold buyers. Its latest reserve report shows that as of September 2025, the company holds gold worth more than $12.9 billion—surpassing the gold reserves of national central banks including Australia, the Czech Republic, and Denmark, ranking it among the top 30 globally.

Even more astonishing is its pace of accumulation. Over the past year through September, Tether added more than one ton of gold per week on average—a rate third only to Kazakhstan and Brazil among central banking institutions, outpacing even Turkey and China.

And this does not include the physical gold backing its gold-backed stablecoin (XAU₮), nor its private gold investments funded by billions in profits.

Tether isn’t buying paper gold or ETFs—it’s acquiring real gold bars.

Unlike most central banks that store gold at the Bank of England or the New York Fed, Tether has chosen to build and manage its own vaults. CEO Paolo Ardoino revealed in an interview that Tether has constructed one of “the world’s most secure vaults” in Switzerland, though he declined to disclose its exact location.

TechFlow has learned that Tether is also building a second vault in Singapore to support Asian reserve operations and expand its gold-backed stablecoin XAU₮.

A crypto firm is replicating central bank infrastructure, constructing proprietary vaults and a globally distributed reserve system.

Recently, Tether took an even bolder step—recruiting talent directly from the heart of the global gold market.

Bloomberg reported that Tether has poached two top-tier precious metals traders from HSBC: Vincent Domien, Global Head of Metals Trading, and Mathew O’Neill, EMEA Head of Precious Metals Financing. Both are currently serving their notice periods and are expected to join within months.

Domien also serves as a director at the London Bullion Market Association (LBMA), the de facto standard-setter for global gold markets. O’Neill has been with HSBC since 2008 and is a key figure in European precious metals financing.

Upon closer examination, it becomes clear that Tether’s ambitions go far beyond simply buying gold.

From Gold Bars to Mines: Building a Full-Chain Empire

If building its own vaults and stockpiling physical gold marks Tether’s first step toward mimicking central banks on the “asset side,” its true ambition extends well beyond passive ownership—to transform the entire gold industry into part of its financial empire.

This strategy unfolds across three layers: the base layer consists of mining rights and royalties, the middle layer is gold bars, and the top layer is tokenized, on-chain gold.

The most familiar piece is XAUT—the gold standard written into smart contracts. Tether Gold (XAU₮) is Tether’s gold-backed token, with each unit representing one troy ounce of physical gold stored in Swiss vaults and compliant with the London Bullion Market Association (LBMA) “Good Delivery” standards.

The latest official data reveals that XAU₮ is backed by approximately 370,000 ounces of physical gold—over 11 metric tons—all held in Swiss vaults. Fueled by rising gold prices, XAU₮’s circulating market cap has surpassed $2.1 billion.

This means Tether holds two distinct exposures to gold:

One layer lies in gold reserves listed on its own balance sheet—assets that can strengthen the credibility and risk resilience of its dollar-pegged stablecoin USDT;

The other layer backs the gold tokens (XAU₮), transforming physical gold into tradable, programmable financial instruments on blockchain.

For example, Tether launched Alloy by Tether, an open finance platform allowing users to use XAUT as collateral to mint a new synthetic dollar stablecoin, aUSDT.

But Tether isn’t stopping there. It aims to go further upstream—by investing directly in mining royalty firms and securing future gold output as part of its asset base.

In June 2025, Tether Investments, the investment arm of Tether, announced a stake in Canadian-listed Elemental Altus Royalties, a company focused on gold and precious metals royalties and streams, with revenue rights tied to multiple producing or near-production mines.

Public filings show that through a series of agreements and share purchases, Tether could acquire over one-third of Elemental Altus, becoming its cornerstone shareholder. It may also inject up to $100 million to support the merger between Elemental Altus and EMX Royalty, helping create a mid-sized gold royalty platform.

Tether isn’t just buying gold already unearthed—it’s securing claims on gold yet to be mined.

Tether’s ambitions extend beyond a single investment. According to the Financial Times, Tether is engaging with multiple gold mining and investment firms, seeking to deploy capital across mining, refining, trading, and royalty income streams to build its own “industrial matrix in gold.”

Sources indicate Tether has held talks with Terranova Resources, a gold mining investment vehicle, although no deal was finalized. The signal, however, is unmistakable:

Tether is not interested in mere financial investments—it seeks systematic control over the entire gold supply chain.

Put these pieces together, and Tether’s gold strategy reveals a dual-pronged, top-down and bottom-up approach:

Top-down: Starting from financial products, it created XAU₮ as a tokenized gateway to capture global demand for gold—a “gold traffic入口”;

Bottom-up: Through gold bar reserves, mine royalties, and potential mining investments, it is gradually bringing the supply-side assets of the gold industry under its control via equity and investment.

Where Does This Faith in Gold Come From?

On the surface, Tether’s bet on gold might seem like simple “FOMO”—following central banks into safe-haven assets.

But if you trace back the company’s leadership statements and asset shifts over the past two years, a deeper, worldview-driven philosophy emerges:

Using Bitcoin and gold to build a dual-pillar foundation for the balance sheet of a “stateless central bank.”

Tether CEO Paolo Ardoino has repeatedly said he dislikes the phrase “Bitcoin is digital gold.” He prefers to flip it: gold is the “natural Bitcoin”—equally scarce, equally battle-tested over time, one existing in the physical world, the other in the digital realm.

In September 2025, Ardoino stated: “As the world grows darker, Tether will continue investing portions of its profits into safe-haven assets like Bitcoin, gold, and land.” In his view, Bitcoin and gold will “outlast any fiat currency” as ultimate stores of value across cycles.

As stated in XAU₮’s promotional material: For over five thousand years, gold has symbolized power, stability, and truth—measured by weight, not words.

Underpinning this vision are a series of strategic moves Tether has made on the asset front over the past two years:

On one hand, quarterly audit reports reveal that Tether’s reserves are heavily concentrated in U.S. Treasuries—its holdings exceeding $120 billion, making it one of the largest single institutional holders globally;

On the other hand, starting in 2023, Tether has consistently emphasized using a portion of its quarterly profits to acquire “long-term value positions”—first Bitcoin, then gold—not to fully back USDT one-to-one, but to strengthen the “hard asset” nature of its overall balance sheet against interest rate, credit, and geopolitical risks.

Thus, Tether’s gold strategy reflects several clear motivations:

First, the most straightforward: turning profits into something “no central bank can print into existence.”

During the high-interest-rate cycle, Tether earned over $100 billion annually from massive Treasury holdings—projected to exceed $150 billion in 2025. But Ardoino knows this “interest feast” is cyclical, while sovereign debt expansion is structural.

Over the past year, he has frequently referenced the so-called “debasement trade”—investors shifting assets from government bonds and fiat currencies to hard assets like gold due to long-term concerns about sovereign debt and currency depreciation.

Second, hedging against extreme risks within the dollar system.

USDT’s scale now rivals that of small national currencies or regional banking systems, forcing Tether to consider worst-case scenarios: what if U.S. regulators or banks freeze its assets? Or what if the entire dollar system faces systemic collapse? Relying solely on Treasuries and bank deposits would leave it too vulnerable.

Gold, being outside any sovereign credit framework, can be fully detached from traditional custodial systems when stored in self-owned vaults—that’s why Tether is building vaults in Zurich and Singapore instead of leaving gold indefinitely at the Bank of England or NY Fed like many central banks.

Third, in the RWA era, gold is the most widely accepted off-chain asset.

In its Q1 2025 announcement, Tether explicitly described XAU₮ as “one of the largest and most compliant tokenized gold products,” emphasizing that every token is 100% backed by physical bars in Swiss vaults.

This creates a powerful closed loop:

On one side, Tether secures both spot and long-term gold supply through direct purchases and stakes in royalty firms like Elemental Altus; on the other, it “slices” this gold into tokens and places them on-chain, turning them into globally tradable, composable DeFi collateral and settlement assets.

From a business perspective, this is a re-financialization of the gold industry’s cash flows and valuations through DeFi.

Every asset decision Tether makes resembles those of a company learning how to act like a central bank.

It’s not merely chasing returns, but constructing a new order bounded by code, anchored in Bitcoin and gold.

If the world truly shifts toward a multipolar monetary system, then “Treasuries + Bitcoin + Gold” will no longer be just an investment portfolio—but the cyclical-resilient balance sheet of this “stateless central bank.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News